Right this moment’s submit was cowritten by Peter Essele, vp of funding administration and analysis.

Within the huge image, the inflation we’re now seeing may very well be a brief phenomenon, pushed by a a lot quicker restoration from the pandemic than anticipated, mixed with the standard snafus because the world economic system tries to spin up rapidly. Certainly, these results are actual.

However earlier than we discover that concept additional, my colleague Pete Essele instructed we first ask a greater query: is that scary inflation print actually as unhealthy because it appears? In different phrases, earlier than we begin in search of causes for the issue, maybe we need to first make sure that the issue is actual. And if you break down the numbers? The inflation menace doesn’t look so unhealthy in any case.

Pete’s Take

Final week’s inflation print (Client Value Index or CPI) got here in at 4.2 p.c year-over-year, the biggest improve since 2008. Buyers at the moment are questioning if maybe it is sensible to start shopping for inflation-sensitive belongings like TIPS (U.S. Treasury inflation-protected securities), commodities, and valuable metals. Earlier than doing so, it’s necessary to grasp the numbers as a result of, like many financial knowledge factors, the satan’s within the particulars. Let’s take a look.

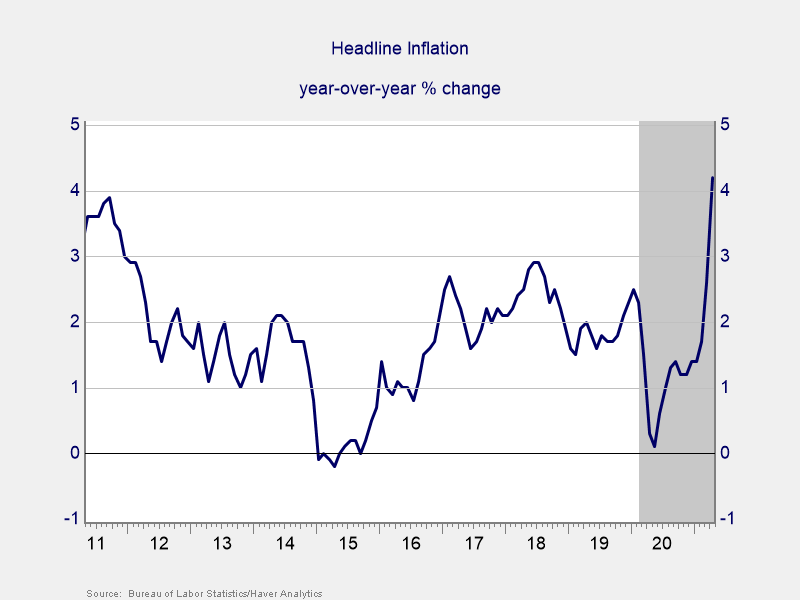

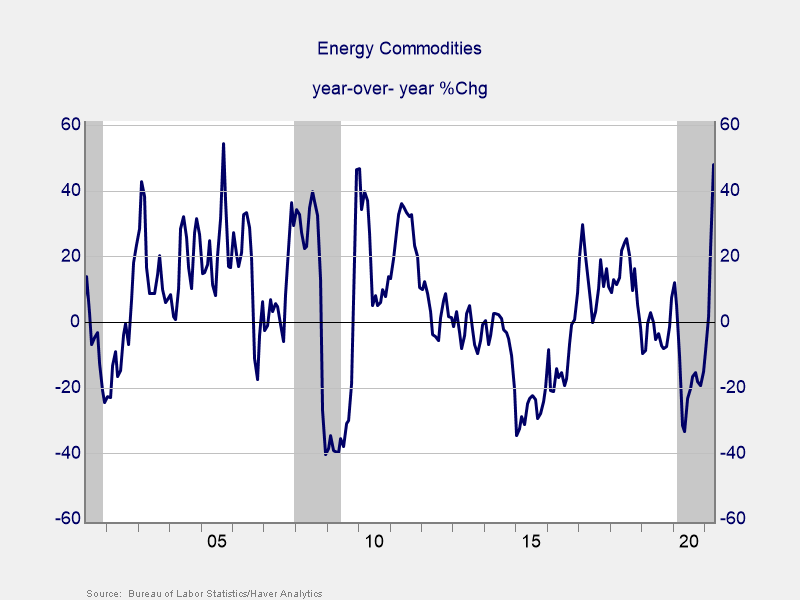

Headline inflation. Though the 4.2 p.c rise in costs over the previous 12 months was a noteworthy print, the numbers counsel that it wasn’t a broad-based improve throughout all items and providers. In reality, of the foremost expenditure classes used to calculate the headline quantity, just a few got here in above 4.2 p.c. Power commodities, used vehicles and vehicles, and transportation providers (particularly, airfare and automobile insurance coverage) stood out, which noticed yearly worth will increase of 47.9 p.c, 21 p.c, and 5.6 p.c, respectively. All different main expenditures had been in keeping with long-term averages. The three aforementioned classes account for less than 12 p.c of the CPI basket of products and providers. As a result of they skilled such important will increase, the general headline quantity was pulled greater, touchdown above latest averages. The biggest element of CPI (shelter) got here in at 2.1 p.c, in contrast with a 10-year common of two.76 p.c.

Power commodities. What additionally must be thought of within the numbers, particularly for power commodities, is that present costs are being in contrast with a very low base, which makes year-over-year values look important. As an example, the value of oil at present stands at pre-COVID ranges ($62 per barrel) after plunging to low double digits in April 2020 because the economic system got here grinding to a halt. With enhancements within the financial atmosphere as of late, costs have began to normalize from historic lows. Due to this fact, a prudent investor ought to assess present worth ranges in contrast with long-term averages and never take the year-over-year will increase at face worth.

Brad Breaks It Down

Thanks, Pete. For many who received misplaced within the numbers, most objects within the CPI got here in underneath, in lots of circumstances properly underneath, the 4.2 p.c headline quantity. That scary print was largely resulting from a handful of classes that spiked, notably power, after collapsing final 12 months. In different phrases, that scary quantity was a one-off.

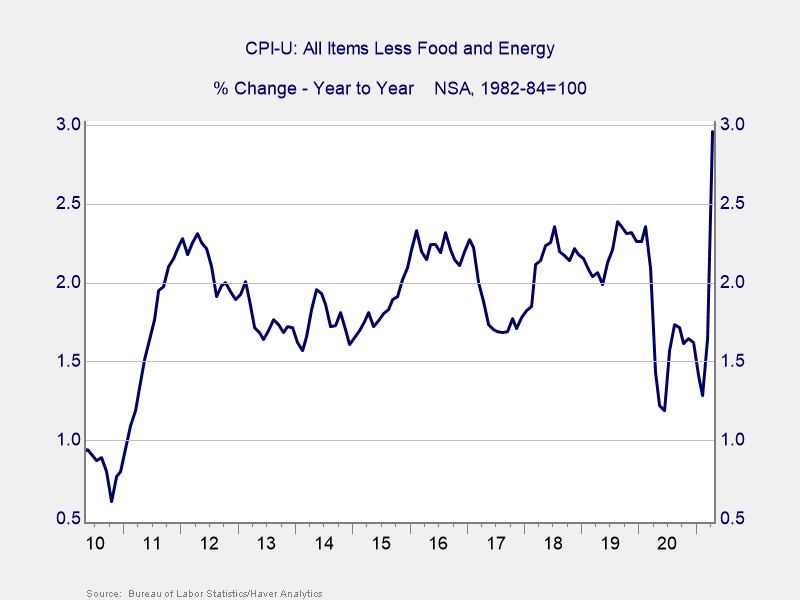

Core inflation. A less complicated method to have a look at it’s to take out meals and power from the headline quantity, which will get us to what’s known as core inflation. If we have a look at that, the 4.2 p.c turns into 2.96 p.c, which remains to be not nice however is significantly much less scary than the preliminary headline quantity. Power alone accounts for quite a lot of the rise, and that’s because of the collapse and rebound in costs over the previous 12 months.

Total change in worth. All properly and good, I hear you say, however I have to warmth my dwelling and gas my automobile. I can’t take out power! Truthful sufficient. So let’s take out the power worth plunge final 12 months and the restoration this 12 months by going again and seeing what the general change in costs has been over the previous two years. And what we see, within the chart under, is that costs are up about 4 p.c total since two years in the past, which is about the identical as we noticed in 2018 and 2019. If you happen to take out the pandemic results, inflation appears very similar to it did in 2019. This isn’t a surge in inflation; moderately, it’s a return to regular. Pete was fairly proper to ask the query as a result of after we dig into the small print, inflation isn’t practically as scary because the headline quantity would counsel.

Inflation Not That Scorching

Now there are indicators that inflation may rise within the coming years. The infrastructure issues are actual and can want time to appropriate. Labor shortages may turn into extra frequent, which may drive up inflation. And as globalization slows or reverses, inflation will even doubtless rise. These are actual issues to look at for over the subsequent couple of years.

However that isn’t what is occurring now. If you dig into the numbers, inflation merely isn’t that scorching. If you look over an extended interval than the trough to peak of the previous 12 months, once more, inflation merely isn’t that scorching. And when you think about the true issues the worldwide economic system is coping with, the shock is that inflation isn’t greater.

As soon as once more, stay calm and keep it up.

Editor’s Word: The unique model of this text appeared on the Unbiased Market Observer.