You’ve completed distributing Kinds W-2. Simply whenever you suppose you’re executed, an worker comes as much as you, arms you their type, and asks, Why are my W-2 Field 1 earnings lower than my Field 3 and Field 5 earnings?

Panicked, you look over the W-2. That doesn’t assist.

You do a fast search of Type W-2 on the internet, however you’re too overwhelmed to get a fast, particular reply to your worker’s query.

Have been you incorrect? Do you might want to challenge a corrected W-2? Most certainly, no. However, you might want to perceive why Type W-2 Field 1 values are increased or decrease than different values on the shape.

About Type W-2 Field 1

You doubtless know that you could report an worker’s wages and withheld taxes from the earlier yr on Type W-2. However, Type W-2 particulars stump many employers and staff.

Field 1

In case you imported data out of your payroll software program or used a tax preparer, chances are you’ll not know the ins and outs of Field 1.

Nonetheless, understanding W-2 type fundamentals is essential to fielding worker questions. So, what’s Field 1?

Field 1—wages, ideas, different compensation—comprises an worker’s whole wages topic to federal revenue tax. Don’t embody pre-tax advantages in Field 1.

Per the IRS, record the next taxable wages, ideas, and different compensation in Field 1:

- Complete wages, bonuses, prizes, and awards you paid an worker

- Noncash funds

- Ideas the worker reported

- Sure worker enterprise expense reimbursements

- Accident and medical health insurance premiums for two%-or-more shareholder-employees (if in case you have an S Corp)

- Taxable money advantages from a Part 125 cafeteria plan

- Worker and employer contributions to an Archer MSA

- Employer contributions for certified long-term care providers, if protection is supplied by an FSA

- Taxable price of group-term life insurance coverage in extra of $50,000

- Non-excludable instructional help funds

- Quantity you paid for an worker’s share of Social Safety and Medicare taxes, if relevant

- Designated Roth contributions

- Distributions to an worker’s nonqualified deferred compensation plan or nongovernmental Part 457(b) plan

- Qualifying Part 457(f) quantities

- Funds to statutory staff who’re topic to Social Safety and Medicare taxes however not federal revenue tax withholding

- Insurance coverage safety beneath a compensatory split-dollar life insurance coverage association

- Worker and employer contributions to an HSA, if includible

- NQDC plan quantities includible in revenue as a result of Part 409A

- Nonqualified transferring bills and reimbursements

- Funds made to former staff who’re on army responsibility

- All different compensation (e.g., scholarships and fellowship grants)

Associated bins

Field 2 exhibits how a lot federal revenue tax you withheld from Field 1 wages all year long. The numbers in Field 1 and Field 2 assist decide an worker’s tax refund or legal responsibility.

Most advantages which might be exempt from federal revenue tax should not exempt from Social Safety tax. Field 3 reviews how a lot cash an worker earned that was topic to Social Safety taxes in the course of the yr.

As a result of some advantages should not topic to federal revenue tax, Packing containers 1 and three (in addition to Field 5) can have totally different values. Likewise, you might even see W-2 Field 1 and Field 16 differ. And, the values in Field 1 and Field 18 may additionally differ.

Causes for W-2 type Field 1 wage variations

Listed below are a couple of frequent causes for variations between Field 1 wages vs. Social Safety wages, Medicare wages, and state and native revenue wages:

1. The worker elected to contribute to a retirement plan

If an worker elected to contribute to a pre-tax retirement plan, their W-2 Field 1 wages are doubtless decrease than their Field 3 wages.

An worker’s elected retirement plan contributions should not topic to federal revenue taxes. Nonetheless, these contributions are topic to Social Safety and Medicare taxes.

Report the quantity of an worker’s retirement plan contributions on Type W-2. Use code “D” in Field 12 and verify the field under “Retirement plan” in Field 13.

Do you contribute to an worker’s retirement plan? If that’s the case, don’t embody your contributions on the worker’s Type W-2.

An worker’s elected contributions to a Roth retirement account are topic to federal revenue tax, Social Safety, and Medicare taxes.

Let’s say an worker incomes $50,000 contributed $2,000 to their 401(ok) in the course of the yr. The worker’s taxable wages in Field 1 are $48,000. The worker’s taxable wages in Packing containers 3 and 5 are $50,000.

Retirement plan contributions is likely to be topic to state revenue tax, relying on the state. Some states observe federal guidelines relating to tax-exempt retirement contributions. Different states tax contributions on the state degree.

If retirement contributions are exempt from state revenue tax, Packing containers 1 and 16 stands out as the identical. If contributions are topic to state revenue tax, Field 16 could also be increased than Field 1.

For instance, Pennsylvania requires staff to pay state revenue tax on retirement contributions. Then again, Ohio aligns itself with federal necessities and exempts retirement contributions from state revenue tax. Test together with your state for extra data.

2. The worker participated in your adoption help program

When you have an adoption expense program at your small enterprise, you pay or reimburse staff for qualifying bills. Some adoption-related bills embody adoption charges, court docket prices and legal professional charges, and journey bills.

Once you pay or reimburse an worker for qualifying adoption bills, the worker’s W-2 Field 1 is probably going increased than Field 3.

Adoption expense funds and reimbursements are exempt from federal revenue tax withholding however are topic to Social Safety and Medicare taxes.

Report the quantity of adoption help bills on Type W-2 in Field 12. Use code “T” for adoption expense funds or reimbursements.

For instance, you present a reimbursement of $1,100 to cowl an worker’s adoption bills. The worker’s gross revenue is $65,000. Report $63,900 in Field 1 and $65,000 in Packing containers 3 and 5.

3. The worker earned above the SS wage base

In some cases, Field 1 could be increased than Field 3. After an worker earns above the Social Safety wage base, they not have to pay Social Safety tax.

As a result of earnings above the Social Safety wage base aren’t topic to SS tax, don’t report them in Field 3.

The 2023 Social Safety wage base is $160,200.

Wages above the SS wage base are topic to federal revenue tax. Consequently, proceed itemizing the wages in Field 1.

Let’s say you pay an worker $170,000 in taxable wages in 2023. You’ll enter “$170,000” in Field 1 and “$160,200” in Field 3. As a result of there is no such thing as a Medicare wage base, you could additionally report “$170,000” in Field 5.

Heads up! The 2024 Social Safety wage base is growing to $168,600 in 2024.

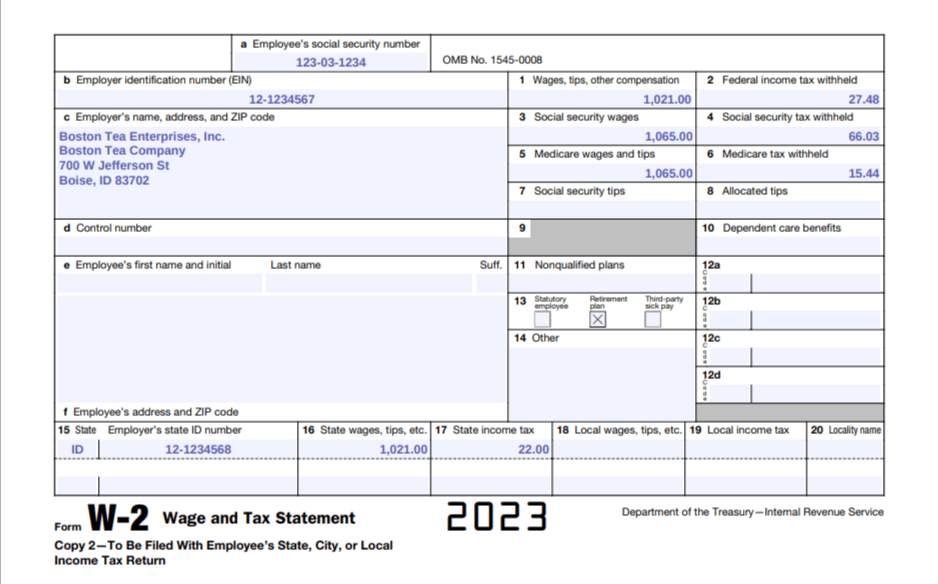

Instance Type W-2 Field 1 “discrepancy”

Check out this instance Type W-2.

The worth in Field 1 is decrease than the values in Packing containers 3 and 5. You may as well see that there’s a checkmark in Field 13.

This instance Type W-2 exhibits that the worker contributed to a pre-tax retirement plan, decreasing their taxable wages. Nonetheless, the retirement contribution continues to be topic to Social Safety and Medicare taxes.

In search of a dependable supplier to file Kinds W-2 for you? Patriot Software program’s Full Service payroll providers will file Kinds W-2 in your behalf. All you must do is print out the worker copies for distribution. Get your free trial now!

This isn’t meant as authorized recommendation; for extra data, please click on right here.

This text has been up to date from its authentic publication date of March 4, 2019.