The disinflation course of has not been as constant as one might have hoped, new information from the Bureau of Financial Evaluation present. The Private Consumption Expenditures Value Index (PCEPI), which is the Federal Reserve’s most popular measure of inflation, grew at a repeatedly compounding annual charge of three.4 p.c over the twelve-month interval ending in September 2023—down from 6.4 p.c over the twelve-month interval ending in September 2022. That’s the excellent news. However there’s additionally unhealthy information.

Though inflation has declined during the last 12 months, it has rebounded in current months. Over the three-month interval ending September 2023, costs grew at an annualized charge of three.7 p.c, in contrast with 2.3 p.c over the three-month interval ending June 2023. The uptick is very pronounced within the final two months. In August 2023, lowered vitality provides brought about costs to develop at an annualized charge of 4.4 p.c, up from 2.5 p.c within the prior month. In September, costs grew at an annualized charge of 4.3 p.c.

There are two distinct causes to be involved concerning the current rise in inflation. First, one would possibly fear about an inflation resurgence, with costs rising as quick as they did in late 2021 and 2022—or, no less than sooner than they had been rising only a few months in the past.

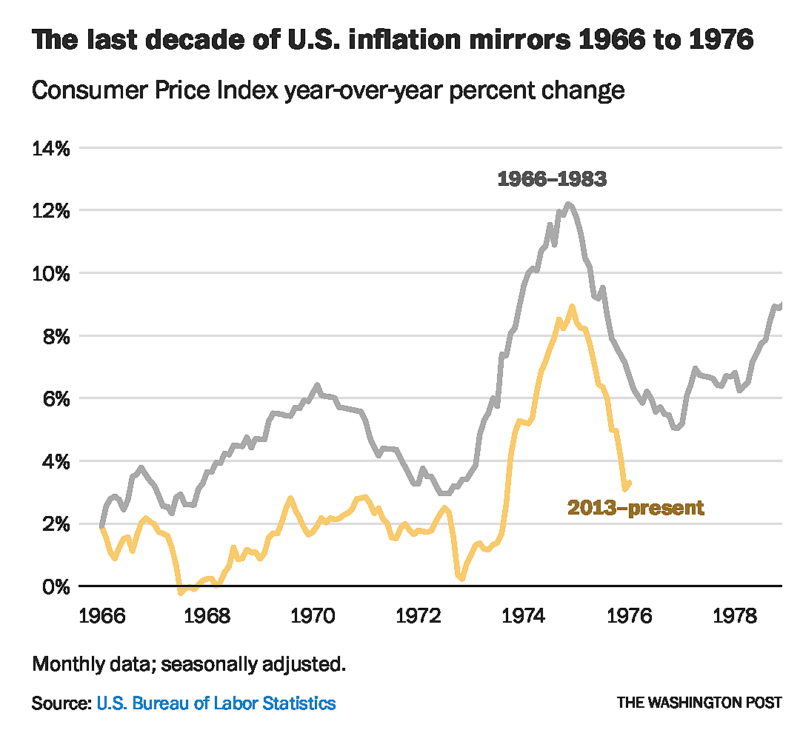

Some level to the 2 waves of inflation skilled within the Seventies. “It’s sobering to recall,” former Treasury Secretary Lawrence Summers wrote in August, “that the form of the previous decade’s inflation curve nearly completely shadows its path from 1966 to 1976 earlier than it accelerated within the late Seventies.”

One needs to be very skeptical when offered with a supposed sample in macroeconomic information. There is no such thing as a motive to suppose costs will inevitably evolve at this time as they did then. At most, the prior episode signifies that it can occur. If one believes that it will occur, one ought to determine the causal elements.

Maybe one of the best argument that inflation will rise once more pertains to fiscal coverage. Brief-term rates of interest are greater than they’ve been at any level within the final twenty years. Consequently, the federal authorities’s curiosity expense has exploded. To cope with the extra expense, the federal government should (1) enhance revenues, (2) cut back expenditures, or (3) situation extra debt. There appears to be little urge for food in DC for elevating taxes or slicing spending. The probably final result is that the federal government will situation extra debt.

Further authorities borrowing would put upward strain on the pure charge of curiosity. To forestall inflation, the Fed would want to offset the fiscal enlargement by elevating its rate of interest goal. In any other case, the unfold between the pure charge and the Fed’s goal will shrink, passively loosening financial coverage. Therefore, inflation may rise once more if the Fed fails to offset expansionary fiscal coverage.

Another excuse to be involved concerning the current rise in inflation is that it will increase the percentages that the Fed will overtighten.

The (nominal) federal funds charge goal vary is at the moment set at 5.25 to five.5 p.c. With core PCEPI inflation at 3.6 p.c in September, the true federal funds charge goal might be someplace between 1.65 and 1.9 p.c. For comparability, the New York Fed at the moment estimates the pure charge of curiosity at 0.57 to 1.14 p.c. Financial coverage seems to be sufficiently tight.

Nonetheless, on the September assembly of the Federal Open Market Committee, twelve members projected a further charge hike in 2023. If something, the inflation information launched in September and October makes further charge hikes extra probably.

The Fed ought to hold financial coverage tight as inflation returns to its 2-percent goal. But when it tightens an excessive amount of, it would push the economic system into an pointless and painful recession.

As I’ve written earlier than, it’s tough to find out what the Fed ought to do when it hasn’t carried out what it ought to have carried out. It will have been higher had it averted this example altogether. Clearly, it’s too late for that now. We’re the place we’re. One can solely hope that the Fed will navigate this slim move safely this time—and avoid such risks sooner or later.