Methods to Navigate the Surge in Excessive-Web-Value Owners Insurance coverage Charges

Navigating the complicated high-net-worth home-owner insurance coverage market is proving to be tougher than ever. This sector, normally identified for its stability and safety, is now grappling with unprecedented volatility. Based on David W. Clausen, CEO of Coastal Insurance coverage Options, “We at the moment are dealing with the toughest market in a long time. It’s an ideal storm of things.”

- Inflation and Regulatory Challenges: The Ripple Impact on Excessive-Web-Value Markets

- Extra and Surplus: The Shift Towards the Non-Admitted Market

- Tackling Water Harm Dangers in Excessive Worth Houses

- Searching for Stability within the Excessive-Web-Value Insurance coverage Market

Inflation and Regulatory Challenges: The Ripple Impact on Excessive-Web-Value Markets

On this planet of insurance coverage, it’s not unusual for premiums to path inflation by a considerable interval, usually years. Insurers should produce in depth knowledge to regulatory our bodies, demonstrating the justification for price will increase. By the point new charges are issued, they usually mirror the financial situations of years prior, slightly than the fact of the present state.

In extra to inflationary strain, numerous different components have contributed to the rising ranges of market instability. These embrace hovering prices of reinsurance, skyrocketing development bills, and an array of regulatory hurdles. The tightening grip of regulatory constraints on insurance coverage price hikes is placing immense strain on insurance coverage carriers. As well as, the focus of high-value properties in catastrophic inclined areas exacerbates the problem. As reinsurance charges improve with out corresponding price reduction for the carriers, the result’s fewer selections for protection and better premium for the buyer.

Extra and Surplus: The Shift Towards the Non-Admitted Market

With strain to seek out protection choices for shoppers, brokers have been more and more pressured into the non-admitted, or extra and surplus strains market. Conventional (admitted) high-net-worth insurance policies are sure by state rules and should obtain state approval for price will increase, nevertheless within the non-admitted market, carriers usually are not required to file charges, affording them better flexibility.

Clausen has seen a serious shift, stating, “In previous years, we solely approached the non-admitted marketplace for high-risk properties with a historical past of claims, or poorly maintained beachfront houses. Now, we discover ourselves putting even probably the most pristine, claim-free excessive web value account within the non-admitted market when admitted carriers usually are not prepared to supply phrases.”

A current strategic transfer by AIG, one of many largest high-net-worth insurers, exemplifies the mounting challenges available in the market. AIG and personal fairness companion Stone Level Capital have created Non-public Shopper Choose Insurance coverage Providers (PCS), an impartial Managing Basic Company (MGA) to serve Excessive Web Value and Extremely Excessive Web Value markets. In doing so, AIG has moved its high-net-worth house insurance coverage enterprise out of the admitted market.

Tackling Water Harm Dangers in Excessive Worth Houses: The Essential Position of Prevention Measures and Exact Coverage Language

Excessive worth houses are usually constructed to resist wind, significantly newer houses that adhere to fashionable constructing codes. Nevertheless, water harm usually proves extra problematic. Water coming into via broken roofs and home windows, or pipe bursts can result in important harm. It may possibly foster mildew progress on costly constructing supplies and break worthwhile contents, typically even exceeding the worth of the house’s construction.

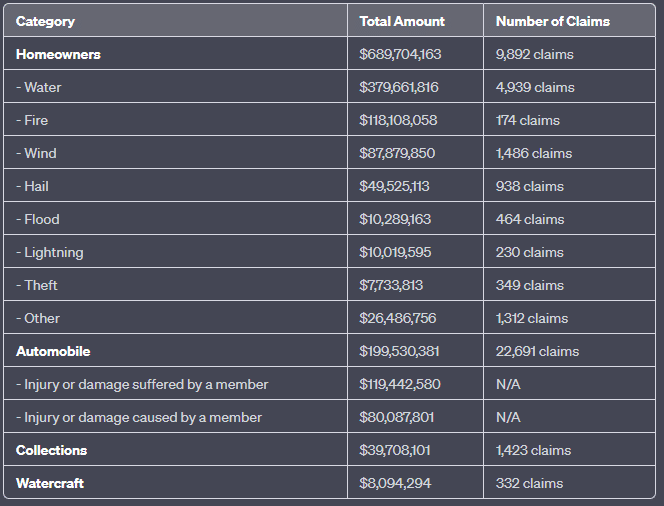

Water harm, the loss chief within the high-net-worth insurance coverage section, is underneath intense scrutiny. Pure Insurance coverage reported in 2021 that that greater than half of its house insurance coverage losses got here from water harm, most of which have been incurred throughout Hurricane Ida and Winter Storm Uri. In contrast to in the usual property market the place water losses are usually sub-limited, within the high-net-worth house, there’s usually no such restrict.

Excessive worth house insurance coverage insurance policies cowl costlier supplies and specialised labor than that of an ordinary insurance coverage coverage, prompting insurers to reassess property valuations extra usually whereas additionally providing incentives for shopper threat participation akin to increased deductibles or deductibles written as a proportion of the dwelling protection.

One other rising development sees insurers urging shoppers to put in computerized water shut-off units. These units monitor water movement inside a property, sound an alarm when a leak is detected, and shut down the water provide to forestall additional harm. Shoppers that do set up an permitted gadget are normally eligible for a reduction to offset the price of the gadget and set up.

Brokers Bear the Brunt: Fee Cuts and Shopper Discontent Influence HNW Insurance coverage Advisors

The scenario has develop into troublesome for each shoppers and brokers, who for years navigated a market the place a single insurer usually took on the total restrict of an account. “In comparison with 5 years in the past, when insurers eagerly competed for a brand new account, we now see extra rejections than approvals,” mentioned Coastal CEO David W. Clausen. The development has developed over the previous 2 years. Chubb, PURE, Cincinnati, and AIG proceed to be main figures within the high-net-worth insurance coverage market, with Nationwide Non-public Shopper and Berkley One following the path.

The rising charges and property valuations within the high-net-worth insurance coverage market have an effect on extra than simply owners; they’re additionally reverberating via the personal shopper dealer neighborhood. As insurance coverage carriers grapple with the difficult circumstances, brokers are discovering their commissions being squeezed.

Nevertheless, the diminishing commissions are solely a part of the brokers’ challenges. As premiums proceed to rise in response to elevated development and reinsurance prices, shoppers’ satisfaction ranges are inevitably dropping. The once-stable panorama of the high-net-worth insurance coverage market has grown more and more tumultuous, with price will increase and property revaluations sparking frustration and concern amongst policyholders.

Brokers, appearing as intermediaries between insurance coverage corporations and policyholders, discover themselves caught within the crossfire. They’re those usually delivering the unwelcome information of price hikes and elevated property valuations to shoppers. This information is troublesome for a lot of policyholders, who usually are not accustomed to double-digit rises in premium in consecutive years.

“As a shopper advisor and advocate, it’s the brokers accountability to verify their shoppers are getting the very best worth. After that, efficient communication about market dynamics and what to anticipate shifting ahead is crucial,” says Clausen.

Searching for Stability within the Excessive-Web-Value Insurance coverage Market

Carriers, reinsurers, brokers, and trade leaders all agree that the trail to equilibrium within the high-net-worth insurance coverage market might be lengthy and troublesome. The components disrupting this market echo these affecting many different aggressive markets, however options are delayed due from the regulatory nature of the insurance coverage trade. A number of parts have to stabilize earlier than any semblance of stability can emerge.

“We’re within the midst of an ideal storm. Development prices have soared, inflation continues, reinsurance charges are climbing, and we’re witnessing file weather-related declare payouts…all with no commensurate response in price,” explains Clausen. He continues, “The high-net-worth insurance coverage sector is strong, however earlier than it will possibly regain its capability, carriers want acceptable price changes to meet up with the compounding reinsurance and development bills that they’ve already incurred. It’s going to take just a few years,” Clausen concludes.

Evaluate Excessive Web Value Insurance coverage Bundle

To fight a tightened market and elevating charges, it’s extra vital than ever to companion with a dealer who entry to a full suite of carriers suited to your distinctive wants. The group at Coastal Insurance coverage works with excessive worth owners throughout the nation to supply protection options, even in a tough market. Attain out to our skilled advisors to entry our unique suite of carriers and examine custom-made quotes. Our group of state licensed insurance coverage advisors will make it easier to examine charges from the best insurance coverage excessive web value insurance coverage corporations like Chubb, Pure, Cincinnati, AIG, and Nationwide Basic.

Evaluate Quotes With Coastal