On this submit, we comply with up on the earlier Liberty Avenue Economics submit on this collection by learning different impacts of maximum climate on the true sector. Information from the Federal Reserve’s Small Enterprise Credit score Survey (SBCS) make clear how small companies within the Second District are impacted by pure disasters (resembling hurricanes, floods, wildfires, droughts, and winter storms). Amongst our findings are that rising shares of small enterprise corporations within the area maintain losses from pure disasters, with minority-owned corporations struggling losses at a disproportionately larger charge than white-owned corporations. For a lot of minority-owned corporations, these losses make up a bigger portion of their complete revenues. In a companion submit, we’ll discover the post-disaster restoration of small corporations within the Second District: how lengthy do they continue to be closed and what are their sources of catastrophe aid?

Vulnerability to Catastrophe-Associated Losses

For this examine, we think about small companies in three states within the Fed’s Second District: New York, New Jersey, and Connecticut (we omit Puerto Rico and the U.S. Virgin Islands as a result of restricted information availability). To start out with, we evaluate their exposures to disaster-related losses with small companies in different states, utilizing information from the SBCS for the interval 2021-22. (Earlier Liberty Avenue Economics posts [see here and here] examine catastrophe vulnerabilities of small companies nationally for the interval 2019-21.) The annual survey offers detailed info on the operations and monetary circumstances of small companies with fewer than 500 workers and data the demographics of agency house owners. There have been 18,190 and 13,910 respondents within the 2021 and 2022 surveys, respectively.

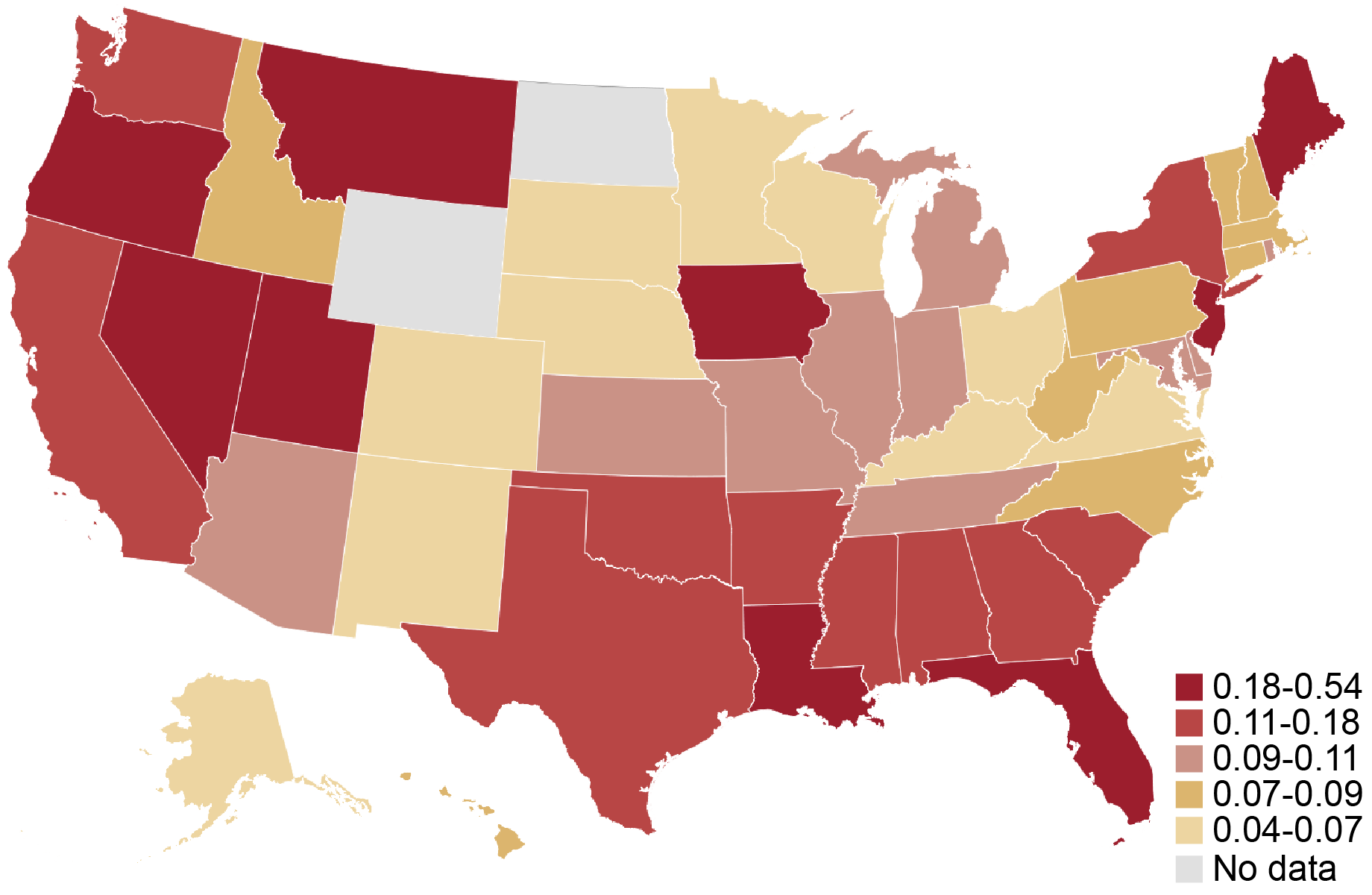

The pure catastrophe module of the survey asks respondents whether or not their enterprise sustained any direct or oblique losses from a pure catastrophe inside the previous twelve months. Because the chart under reveals, the fraction of corporations reporting pure disaster-related losses in 2021-22 is particularly excessive within the states in our pattern, suggesting {that a} discovering of huge disparities in catastrophe vulnerabilities for the area is consequential. Moreover, states alongside the Gulf Coast and on the West Coast have a excessive fraction of small companies reporting disaster-related losses relative to the heartland.

Fraction of Companies Reporting Catastrophe-Associated Losses by State, 2021-22

Notes: The warmth map reveals the fraction of corporations in a given state that answered sure to the query “Inside the previous 12 months, did your small business maintain direct or oblique losses from a pure catastrophe aside from COVID-19 (e.g., hurricane, wildfire, earthquake, and so forth.)?” All observations which can be lacking a response to the query are excluded from the pattern. The pattern swimming pools employer and nonemployer corporations. Responses by employer and nonemployer corporations are weighted individually on a wide range of agency traits to match the nationwide inhabitants of employer and nonemployer corporations, respectively. To assemble a pooled weight, we use the employer (nonemployer) weight for the pattern yr if the agency is an employer (nonemployer). The surveys have been fielded between September and November of 2021 and 2022.

Are Minority-Owned Small Companies within the Area Extra Prone to Report Catastrophe-Associated Losses?

Pure disasters might have a detrimental affect on small companies and significantly these owned by minorities, that are usually extra resource-constrained and thus much less resilient. A agency is outlined as minority-owned if at the least 51 p.c of the agency’s fairness stake is held by a minority (that’s, an Asian, Black, Native American, or Hispanic) proprietor. A agency is outlined as white-owned if at the least 50 p.c of its fairness stake is held by non-Hispanic white house owners. Race/ethnicity classes will not be mutually unique. Disparities within the affect of pure disasters can come up as a result of, for instance, low-income and minority People are extra seemingly to reside in high-risk flood zones. Conditional on publicity, disparities within the affect of pure disasters are additionally associated to current inequalities induced by historic practices like redlining.

We report the fraction of corporations experiencing disaster-related losses within the Second District states, extending the info again to 2019. For corporations general, this fraction rose from 2 p.c in 2019 to 18 p.c in 2021 earlier than stabilizing (see the left panel of the chart under). By race and ethnicity, we see disparities rising repeatedly after 2019 (a yr during which no minority corporations within the three states in our pattern reported experiencing pure disasters). In 2020, 4 p.c of white-owned corporations and 9 p.c of minority-owned corporations reported disaster-related losses; each of these percentages rose in 2021 and additional once more in 2022 to 12 p.c and 29 p.c, respectively (see the fitting panel within the chart under).

Qualitatively comparable outcomes receive for the nationwide pattern though, by comparability, the disparity was decrease in all years since 2020 (not pictured). The fraction of corporations reporting disasters grew from about 7 p.c in 2019 to about 15 p.c in 2022 and disparities additionally rose alongside. For instance, in 2022, 22 p.c of minority-owned companies confronted disaster-related losses nationally versus 12 p.c of white-owned companies.

The Fraction of Companies within the Area with Losses and Disparities in Losses Have Each Elevated since 2019

Supply: Federal Reserve Banks, 2022, 2021, 2020, and 2019 Small Enterprise Credit score Surveys. Notes: For respondents in annually and race/ethnicity class, the strains present the share of corporations within the pattern that answered sure to the query “Inside the previous 12 months, did your small business maintain direct or oblique losses from a pure catastrophe aside from COVID-19 (e.g., hurricane, wildfire, earthquake, and so forth.)?” A agency is outlined as minority-owned if at the least 51 p.c of the agency’s fairness stake is held by a minority (that’s, an Asian, Black, Native American, or Hispanic) proprietor. A agency is outlined as white-owned if at the least 50 p.c of its fairness stake is held by non-Hispanic white house owners. Race/ethnicity classes will not be mutually unique. An statement is excluded from the pattern whether it is lacking a response to the query or if the proprietor’s race is just not noticed. The pattern swimming pools employer and nonemployer corporations. Responses by employer and nonemployer corporations are weighted individually on a wide range of agency traits to match the nationwide inhabitants of employer and nonemployer corporations, respectively. To assemble a pooled weight, we use the employer (nonemployer) weight for the pattern yr if the agency is an employer (nonemployer). The surveys have been fielded between September and November of every calendar yr.

Amongst these small companies situated in disaster-affected areas within the pattern, extra minority-owned corporations confronted damages than white-owned corporations. We present this by specializing in the subsample of small companies situated in counties designated as disaster-affected by the Federal Emergency Administration Company (FEMA) within the interval of the survey. We discover that 29 p.c of minority-owned corporations reported disaster-related losses in 2021 and 2022, in comparison with 12 p.c of white-owned corporations.

Do Minority-Owned Companies within the Area Undergo Bigger Catastrophe-Associated Losses?

The 2021 and 2022 surveys ask corporations reporting disaster-related losses to estimate the worth of losses ensuing from pure catastrophe(s) and their revenues within the yr prior. We normalize these losses as a proportion of a agency’s complete income within the yr prior.

Minority-owned companies within the three states are disproportionately more likely to expertise disaster-related losses that have been a big share of their revenues (see the chart under). For instance, 38 p.c of minority-owned companies reported losses that quantity to over 60 p.c of 2019 income whereas simply 18 p.c of white-owned corporations reported comparable losses. In distinction, white-owned companies have been extra more likely to undergo reasonable disaster-related losses. For instance, 65 p.c of white-owned corporations skilled disaster-related losses of lower than 30 p.c whereas about 50 p.c of minority-owned corporations had comparable losses. Qualitatively comparable outcomes receive for the nationwide pattern (not pictured). For instance, the share of minority-owned corporations experiencing normalized losses of over 60 p.c was about 30 p.c as in comparison with 22 p.c of white-owned corporations.

Extra Minority-Owned Companies within the Area Have Excessive Income Shares of Catastrophe-Associated Losses

Notes: Amongst corporations that reported disaster-related losses, the 2021 and 2022 SBCS asks “What’s the estimated worth of your small business’s losses because of the pure catastrophe?” Respondents can choose from six classes. Companies are additionally requested to report their complete revenues from 2019 by deciding on from eight ranges. To compute the normalized income loss, we divide the midpoint of the disaster-related losses vary by the midpoint of the agency’s income vary. The normalized losses are grouped into 4 bins, that are proven on the x-axis. The bars present the share of corporations in every race/ethnicity class with normalized disaster-related losses in a given bin. A agency is outlined as minority-owned if at the least 51 p.c of the agency’s fairness stake is held by a minority (that’s, an Asian, Black, Native American, or Hispanic) proprietor. A agency is outlined as white-owned if at the least 50 p.c of its fairness stake is held by non-Hispanic white house owners. Race/ethnicity classes will not be mutually unique. An statement is excluded from the pattern whether it is lacking a response to the query or if proprietor race is just not noticed. The pattern swimming pools employer and nonemployer corporations. Responses by employer and nonemployer corporations are weighted individually on a wide range of agency traits to match the nationwide inhabitants of employer and nonemployer corporations, respectively. To assemble a pooled weight, we use the employer (nonemployer) weight for the pattern yr if the agency is an employer (nonemployer). The surveys have been fielded between September and November of 2021 and 2022.

The distribution of normalized losses is generally pushed by decrease revenues of minority-owned corporations, suggesting that pure disasters are a better burden for minority-owned corporations as a result of they amplify current racial disparities (associated to, for instance, tougher entry to start-up capital and credit score) which have a detrimental impact on small enterprise revenues.

A priority could be that, for 2021, our outcomes are pushed by better income losses of minority-owned corporations through the COVID-19 pandemic of 2020. To handle this concern, we examine normalized losses for 2022 alone and discover a comparable sample. The outcomes are additionally in keeping with the distribution of normalized losses in 2020.

Wanting Forward

Our findings counsel that small companies owned by minorities within the area have been extra weak to pure disasters than white-owned corporations. Minority-owned small companies nationally face challenges in accessing credit score and are situated in areas with underinvestment in local weather infrastructure, and these challenges stay salient for the Second District. Within the following submit, we look at the assets that small companies can depend on to deal with losses following disasters, resembling entry to catastrophe aid.

Asani Sarkar is a monetary analysis advisor in Non-Financial institution Monetary Establishment Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

How one can cite this submit:

Asani Sarkar, “How Do Pure Disasters Have an effect on Small Enterprise Homeowners within the Fed’s Second District?,” Federal Reserve Financial institution of New York Liberty Avenue Economics, November 15, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/how-do-natural-disasters-affect-small-business-owners-in-the-feds-second-district/.

Disclaimer

The views expressed on this submit are these of the writer(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the writer(s).