One of the crucial attention-grabbing findings from our newly launched 2023 Herbers & Firm Service Market Progress Research is that the everyday advisory agency is challenged in relation to changing prospects to shoppers.

In our survey of greater than 700 advisory corporations, the typical respondent reported that they shut simply 33% of their prospects. That pales compared to the 73% shut fee for corporations that we choose to be prime natural growers.

Our research didn’t search to search out explanation why common corporations let so many prospects slip away. However Herbers & Firm consulting engagements over greater than twenty years gives us insights about what separates the best-organic rising corporations from those who battle at closing.

When working with advisory corporations to increase their development, we ask shoppers for information. One important piece of natural development information is shut ratios. Usually, we discover that corporations haven’t tracked the information, haven’t thought of how the consumer expertise correlates with shut ratios and customarily aren’t targeted on the metric.

Most frequently, agency leaders are primarily involved with driving results in their enterprise after which hiring sufficient expertise to accommodate any ensuing consumer development. That leaves a giant hole, although: You possibly can drive plenty of leads, and have ample advisory capability, however are these relationships leading to new shoppers?

Why Corporations Neglect to Concentrate on Shut Ratios

Earlier than I’m going on, it’s price trying on the three explanation why so many corporations fail to trace shut ratios. First, in my expertise, most corporations don’t contemplate shut charges as some of the necessary drivers of income. Advisory agency leaders typically give attention to the variety of leads coming in, the variety of new shoppers, shoppers which can be being served, and whole property being managed. Their logic is that bringing in additional leads will lead to extra shoppers and property. However they have an inclination to overlook that extra leads would not essentially equate to extra new shoppers with property. Certainly, in some circumstances, corporations develop quicker regardless of having fewer leads, just because they obtain greater shut ratios.

Second, many corporations don’t have a constant manner of monitoring the shut ratio. By technical definition, the variety of new shoppers divided by the variety of gross sales proposals represents the shut ratio. However every advisory agency has a special consumer expertise and differing definitions of when the “gross sales proposal” occurs.

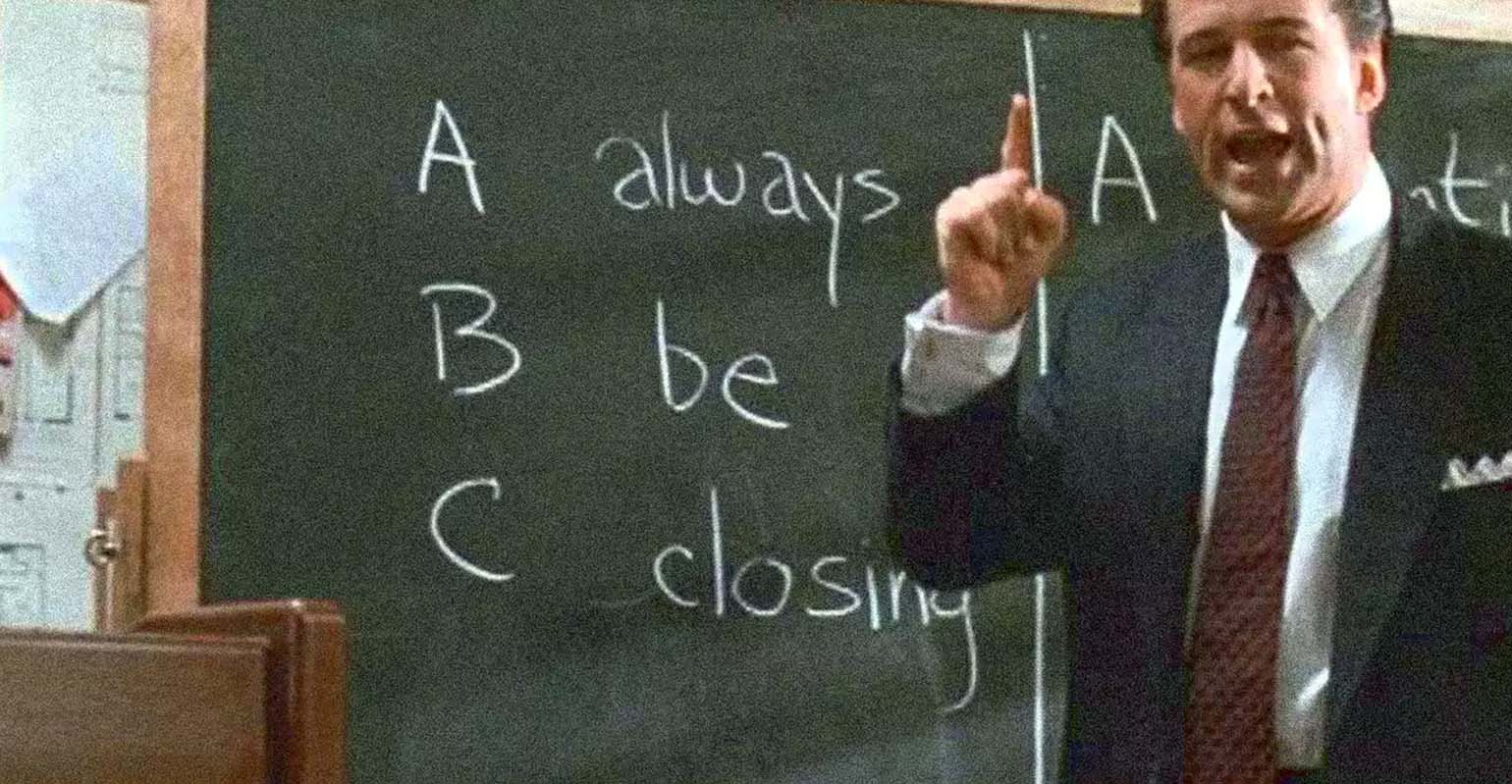

And eventually, there’s the aversion to “gross sales” amongst monetary advisory practices. Once I began within the enterprise 20-plus years in the past, most unbiased advisors had rejected the gross sales cultures of their former dealer employers. “Gross sales” was virtually a unclean phrase. The composition of the trade has modified lots over the previous twenty years, however a stigma round “promoting” stays. Thus, a propensity to not give attention to the gross sales course of stays.

The Do-Present-Inform Gross sales Strategies

All advisory companies search to transform prospects, also called promoting. There are three gross sales approaches, that are generally described as Do, Present and Inform. 20 years in the past, most prospect to consumer conversions had been performed through the “Do” course of: Preliminary conferences passed off, info was gathered and work began—earlier than the prospect had signed on, they acquired free recommendation. Advisors usually create monetary plans or funding allocations, constructing belief by “doing” work with none pay, and hopefully impressing the prospect to turn into a consumer and switch their property.

The “Do” gross sales course of is a loss-leader, spending advisor capability and time with out fee to transform prospects, and it really works. The method is within the monetary advisors’ consolation zone and doesn’t require a lot promoting. It’s simply doing the work. Advisors are usually assured placing collectively monetary or funding plans and explaining them to shoppers. Asking the potential consumer to maneuver their property is a comparatively straightforward ultimate step to gaining a brand new consumer.

However, as advisory companies bought larger through the years, managing the capability of their advisors grew to become a problem. The end result: advisors had been managing a full consumer load whereas nonetheless doing free loss-leader work with the prospects. All that work earlier than gaining a brand new consumer overwhelmed capability.

That’s when the “Present” strategy began to turn into extra frequent. As an alternative of making monetary plans or asset allocations, advisors “confirmed” prospects their agency’s expertise and/or a pattern monetary plan, as an illustration. It was defined to the prospect that they may get their very own custom-made plan in the event that they grew to become a consumer. “Displaying” the prospect the tangible deliverables with out “doing” free work is a approach to reduce up-front-work and handle advisor capability. It weeded out prospects who took the free monetary plan within the “do” course of and by no means transferred property, and guess what, it additionally labored to shut new shoppers.

Then got here the “Inform” course of typically extra frequent in mid-size or bigger, more-established corporations who’ve a recognizable model that may afford extra an “it’s as much as you” strategy. The advisor sits down with the prospect, walks them by means of the agency’s client-service course of, then communicates that when the consumer settlement is signed, they’ll get occurring the work. The “inform” course of is gross sales, with out the used automobile salesman really feel.

The “Do, Present and Inform” processes all work. Some work higher for various corporations relying on their consumer service mannequin. However they’ll all be efficient in changing results in shoppers. Nonetheless, and this can be a huge nonetheless, the profitable use of any of those approaches’ hinges on advisor coaching. And, from our expertise, that is the place the place corporations run into hassle on shut ratios.

The Resolution to Greater Shut Ratios Is Higher Coaching Applications

There’s a widespread assumption all through the trade that solely rainmakers or devoted gross sales specialists can shut enterprise. That’s simply not true: All advisors can convert shoppers. I do know this as a result of I’ve seen all kinds of non-sales-oriented advisors’ shut enterprise. However, to extend shut ratios requires coaching, and I’m not speaking about gross sales coaching right here. I’m speaking about studying higher communication … and practising.

When a brand new advisor sits in entrance of a potential consumer for the primary time, they’re seemingly to not shut that consumer. However with extra expertise and follow speaking to potential shoppers comes polish and confidence, which results in greater and better closing charges. Many advisory corporations make the error of pulling advisors off the gross sales course of after they fail to shut the primary few prospects.

Ahead-looking corporations permit for failure, however extra importantly, they practice the advisor talk with a consumer and follow with them repeatedly. Whereas they might lose a number of potential shoppers at first, the longer term conversions will usually far outweigh these early setbacks. Nobody ought to perceive this higher than agency founders. Tales of founding entrepreneurs whiffing repeatedly earlier than hitting their stride are legion. Good leaders go away room for his or her expertise to fail and study.

Equally necessary for sustaining a excessive shut ratio is to select one strategy—Do, Present or Inform. Many small corporations begin with the loss-leader “Do” strategy as a result of they’re determined to create a sustainable e-book of enterprise. “Doing” the free work within the forefront offers them an edge with out the stress of “promoting” to a prospect. As they develop larger, they could proceed to supply free up-front monetary planning for the largest prospects. However they could additionally cost others a flat charge for a monetary plan, utilizing the “Present” strategy. Lastly, a “Inform” course of could be used for prospects which can be much less fascinating.

Using a number of gross sales approaches is a recipe for having very low shut ratios, as a result of it signifies that advisors should be skilled and proficient in three completely different communication strategies moderately than turning into an professional in only one. Once more, our research didn’t establish the explanations that so many corporations have low shut ratios. However primarily based on our consulting expertise, I can say that the low ratios are virtually all the time the results of a scarcity of coaching. Advisory corporations can start by first, monitoring the shut ratio, and second, figuring out which advisors want a bit of extra assist with communication coaching.

Angie Herbers is founder and managing associate of Herbers & Firm, a follow administration and development fidelity for monetary advisory corporations. She will be reached at [email protected].