Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

When the UK issued its first index-linked gilt in 1981, critics warned {that a} profligate authorities might retailer up issues for future generations.

That day may need come. Forward of the Autumn Assertion this week, persistently excessive inflation is predicted to drive the Workplace for Finances Duty to lift its March forecast for curiosity funds alone on these kind of bonds by a 3rd to £92bn over the following 5 years, in accordance with the Institute for Fiscal Research.

This comes on high of the £89bn additional the OBR calculated in March that the federal government had spent on curiosity funds on these devices over the earlier two years, equal to three.4 per cent of GDP.

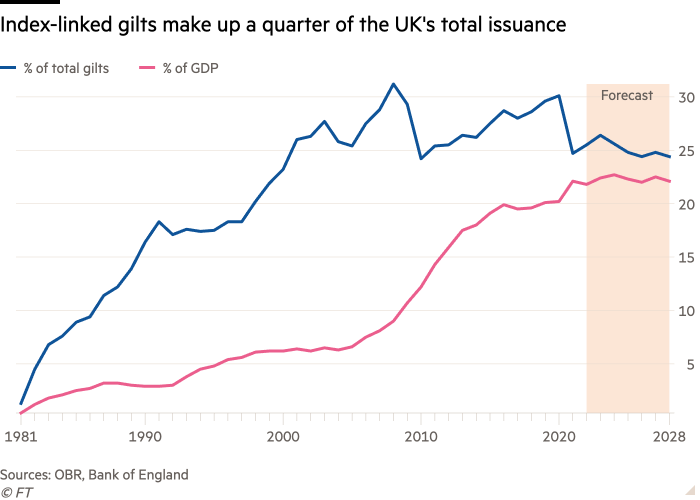

The UK now has a few quarter of its debt repayments linked to inflation, greater than double the quantity of Italy, which has the second highest proportion of any giant financial system at 12 per cent.

“This was the debt that folks wished,” mentioned Lord Terry Burns, who was serving as chief financial adviser to the Treasury when the choice was taken to start index-linked issuance.

Britain began down this path — beforehand seen because the protect of crisis-prone rising economies — greater than 40 years in the past out of desperation. Rising from a extreme inflation shock within the Nineteen Seventies, the Treasury was quaking below so-called gilt “strikes” — repeatedly discovering itself unable to borrow except it raised rates of interest sharply to lure traders again.

The then-Conservative authorities urgently wanted to shore up confidence and set up its inflation-busting credentials. The considering within the Treasury, led by chancellor Geoffrey Howe, was that traders could be interested in bonds providing curiosity funds linked to rising costs as a result of it could take away the motivation for the federal government to inflate down its debt.

Over time, so-called “linkers” grew to become a a lot larger a part of the UK market than initially supposed, because the Treasury grew to become swamped with demand from outlined profit pension schemes keen to purchase belongings that might match their have to pay members in keeping with inflation. Britain’s giant pensions sector has the next proportion of those schemes than many different giant economies.

“Individuals had been glad to pay up for them,” mentioned David Web page, an economist at Axa Funding Managers and a former official on the UK’s Debt Administration Workplace, arguing that the way in which the UK regulated pensions “created a requirement that couldn’t be fulfilled in different elements of the market”.

To an extent, officers took the view that it made sense to situation index-linked debt as a result of there was a pure hedge in larger tax revenues when inflation was excessive.

When Labour got here to energy within the late Nineteen Nineties, then chancellor Gordon Brown pursued a coverage of ultra-long-term debt issuance by launching 50-year gilts, and making certain a big chunk of these had been listed was in all probability needed to persuade traders.

Alistair Darling, Brown’s successor, informed the Monetary Instances the Labour authorities felt vindicated in that method because it meant that through the monetary disaster in 2008 the UK had much less debt to roll over than many different European nations.

Darling acknowledged “that panorama ha[d] modified dramatically” however added it was “troublesome to say” if a surge of inflation was foreseeable.

Linkers have been significantly costly in recent times as a result of they observe the flawed retail value index, which has constantly run not less than 1 share level larger than the patron value index. RPI peaked at greater than 14 per cent final 12 months and continues to be multiples above goal at 6.1 per cent for the 12 months to October.

“Issues don’t all the time prove the way in which that you really want. The actual fact is that we held long-dated gilts and we had been dwelling in a low-interest price surroundings and that meant that it was not a priority on the time,” Darling mentioned.

However in 2017, after the OBR questioned the extent of publicity, the federal government determined to restrict the quantity of latest linker issuance, which had been operating about 25 per cent per 12 months of whole new debt within the earlier 5 years. This 12 months, about 11 per cent of the issuance programmes are in index-linked debt.

The Debt Administration Workplace has mentioned it has no plans to cut back the proportion of index-linked issuance additional however would as a substitute assessment the state of affairs yearly taking into consideration market circumstances. In absolute phrases, it nonetheless plans to situation extra index-linked debt this 12 months than it did in 2022-23.

This coverage displays a view shared by economists and officers that the UK’s method has in all probability paid off over time, regardless of the prices incurred as inflation soared.

Furthermore, debt specialists argue that had been the federal government to cut back the proportion of linker issuance dramatically in response to the excessive value surroundings, it could undermine the inflation-fighting credentials that the usage of the instrument was meant to determine.

Additionally they level out that if inflation is introduced again below management, the longer common maturity of linkers — about 18 years in contrast with 13 years for typical gilts — would mitigate the additional price over the lifetime of the bond. “What seems like a painful bout now could be only a blip within the 50-year lifetime of one of many actually lengthy ones,” a Treasury official mentioned.

However it’s unattainable to show conclusively whether or not the UK’s resolution to undertake index-linked gilts has paid off, though on steadiness, John Kay, one of many UK’s main economists, believes it has.

“Over more often than not, inflation has been decrease than individuals anticipated,” he mentioned. “I think trying again since 1981 — the reply is it was cheaper to have issued index-linked gilts.”