The housing market is damaged. Affordability is as unhealthy because it’s ever been. Mortgage charges are excessive. Costs are excessive. There isn’t a provide available on the market. It’s a multitude. So who’s accountable? In a latest piece at Fortune I went via the suspects to determine how we bought right here.

*******

The housing market feels damaged in the meanwhile.

Costs skyrocketed 50% nationally over the course of the pandemic. Then mortgage charges went from sub-3% to greater than 7.5% in a rush because the Fed aggressively raised rates of interest. And now provide is severely constrained as a result of affordability is so poor and owners don’t need to surrender their 3% mortgage. Housing affordability is as unhealthy because it’s been in many years, and it’s arduous to see what fixes issues.

So who’s accountable for this mess of a housing market?

It’s the newborn boomers, in line with economists at Barclays. In a latest notice titled “Blame the Boomers,” housing strategists at Barclays wrote: “The U.S. housing sector is on the upswing once more, even with mortgage charges at multi-decade highs. Though a lot has been attributed to shortages of present properties and mortgage lock-in results, we predict robust demand is a symptom of the growing older inhabitants.”

The gist of the argument right here is the baby-boomer technology is a lot bigger than earlier older generations, and as soon as the youngsters are out of the home, they’re now crowding out the housing provide.

There may be some credence to this argument. Practically 40% of all mortgages on this nation are paid off free and clear. That’s principally owing to child boomers. They’ve substantial fairness constructed up of their properties so that they aren’t almost as apprehensive about excessive mortgage charges as younger individuals.

Child boomers are in a much better place than most potential homebuyers. In line with Redfin, almost one-third of all homebuyers are paying money.

Nonetheless, there are far greater culprits than child boomers for the damaged housing market. Right here they’re in no explicit order:

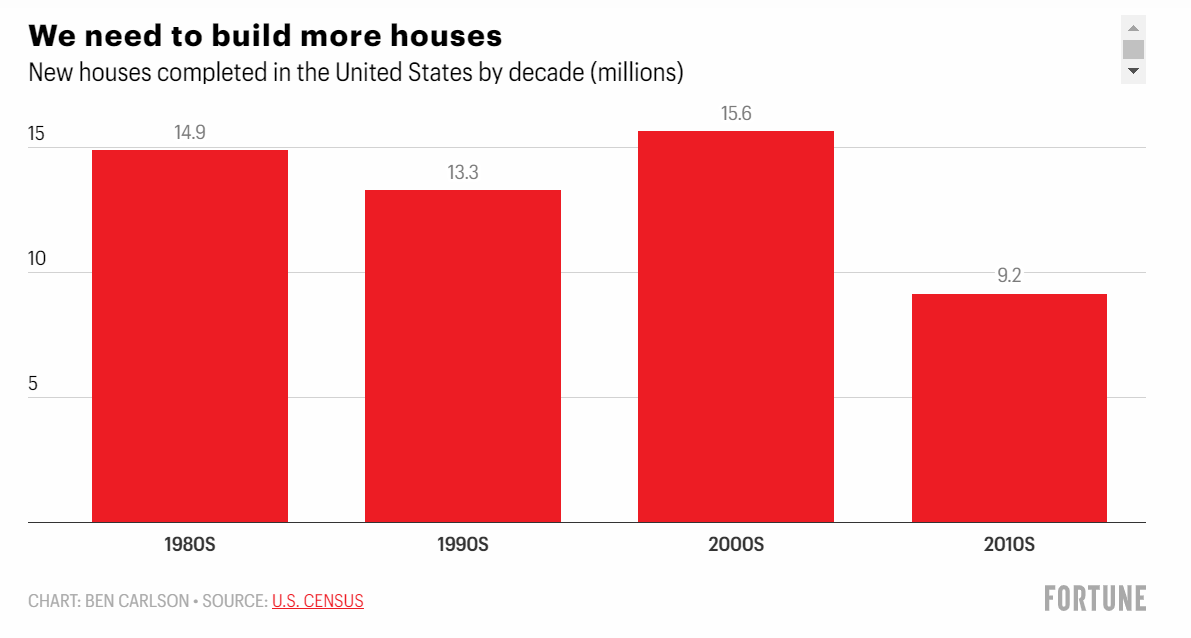

We have to construct extra housing

We merely haven’t constructed sufficient homes on this nation to maintain up with demand. The next chart exhibits what number of hundreds of thousands of properties we’ve got accomplished on this nation by decade, going again to the Seventies:

There was an enormous drop-off within the 2010s. Clearly, properties accomplished within the ’70s, ’80s, and ’90s can nonetheless be lived in, however our inhabitants has grown on this time as nicely. In 1970, the U.S. inhabitants was roughly 200 million individuals. It’s now closing in on 340 million residents.

The excellent news is 4 million properties have already been accomplished within the 2020-22 interval, so we’re off to a greater begin this decade. Nonetheless, we nonetheless have plenty of work to do.

Zillow estimates we’re 4.3 million homes brief of the present demand.

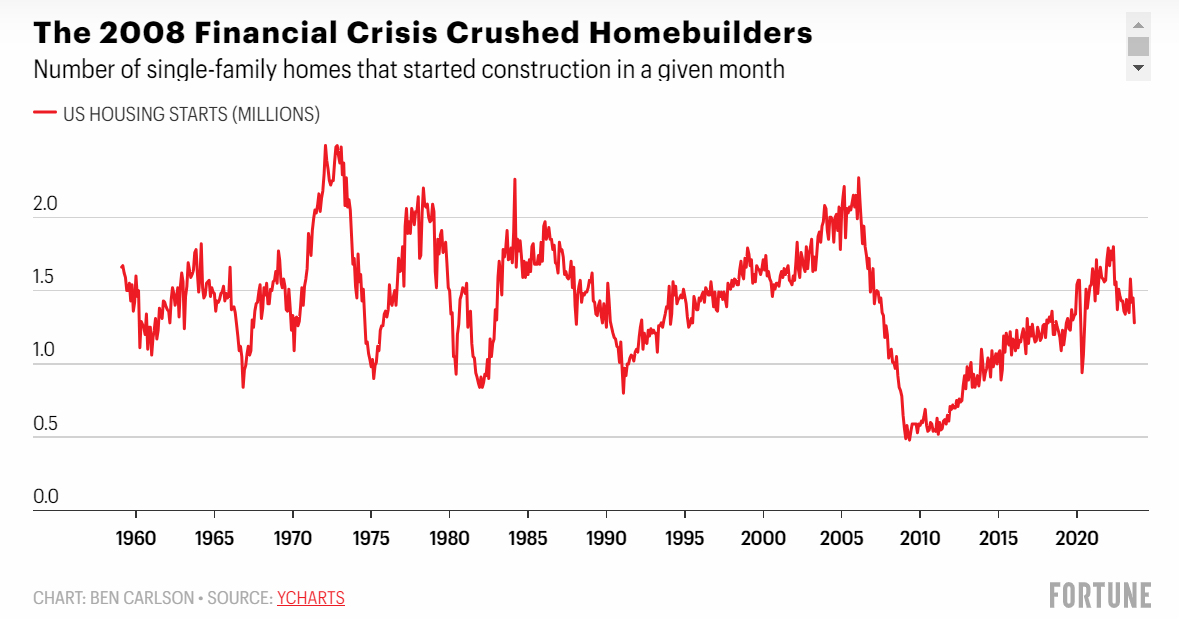

The Nice Monetary Disaster

One of many largest causes for the drastic drop-off within the variety of new properties accomplished within the 2010s was the 2008 monetary disaster.

Homebuilders went loopy constructing new properties throughout the housing bubble of the early-to-mid-2000s. However the housing bubble burst, and the variety of new properties beneath building fell off a cliff:

We went from an setting with an excessive amount of provide to not sufficient, as housing costs crashed and homebuilders pulled again.

Homebuilders are nonetheless scarred from that boom-bust cycle and have been gradual to develop as they did within the 2000s for concern of one other downturn.

Until the federal government incentivizes residence building, it’s arduous to see us attending to the purpose the place we construct sufficient homes.

The Pandemic

Housing costs had been comparatively inexpensive for the complete decade of the 2010s from a mix of worth declines from the housing bust and low mortgage charges. From 2010-19, nationwide housing costs, in line with the Case-Shiller U.S. Nationwide House Value Index, had been up 44% in complete or 3.7% per 12 months.

Since 2020, housing costs are up 44% in complete or almost 11% per 12 months. We principally squeezed a decade’s value of residence worth good points into rather less than 4 years.

The pandemic brought on individuals to reassess their way of life. Distant work grew to become an choice for hundreds of thousands of white-collar employees. Individuals who lived in high-cost-of-living areas might relocate to cheaper cities and work from anyplace.

Sprinkle within the highest inflation in 4 many years (housing costs have a tendency to trace the price of constructing) and we’ve skilled the most important housing bull market in historical past.

Demographics

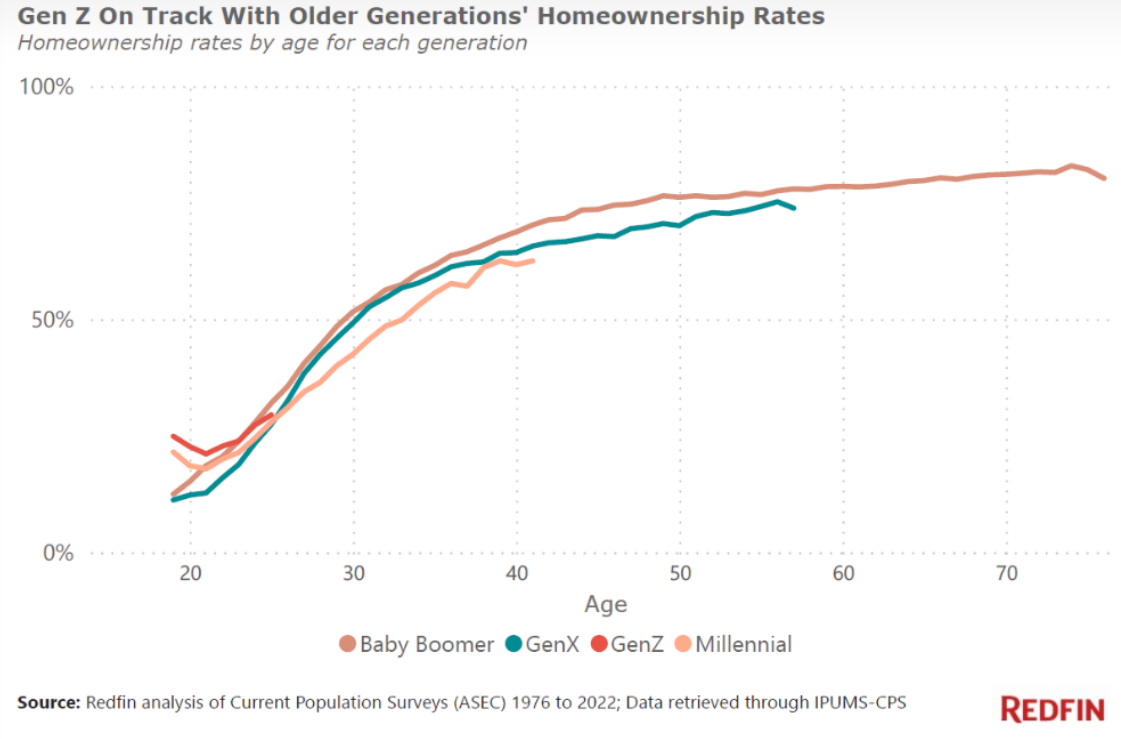

Child boomers may need the higher hand in housing wealth, however family formation by the most important demographic on this nation, millennials, can be inflicting the imbalance in provide and demand.

I do know it could look like younger individuals are fully boxed out of the housing market, however Gen Z and millennials are kind of on observe relating to proudly owning a house (through Redfin):

The homeownership charge for millennials is nicely over 50% and trending increased. That is what occurs when individuals grow old. They calm down, have children, and transfer out of Mother and Dad’s basement.

And since there are greater than 70 million millennials who are actually in or approaching their prime family formation years, this quantity will proceed to extend.

The issue for younger individuals nowadays is there isn’t a lot hope for a fast repair within the housing market. It’s potential 8% mortgage charges will deliver down housing costs ultimately, however it’s definitely not assured. And if mortgage charges do fall as a result of the Fed cuts charges or the economic system slows, it’s potential demand will really choose up once more as a result of so many individuals have been ready to purchase a home.

The one excellent news for younger individuals is ultimately the newborn boomer technology will move down their properties or be pressured to promote as they age.

The unhealthy information is you may have to attend for the 2030s for this to occur in a significant method.

This piece was initially revealed at Fortune.