Public Provident Fund or PPF is without doubt one of the greatest and hottest debt devices out there to us. Nonetheless, it doesn’t imply it’s risk-free. What are the dangers of investing in a Public Provident Fund or PPF?

No asset class on this earth is totally risk-free. In a technique or one other means, they carry a certain quantity of dangers. Solely nature or color could change. Therefore, understanding the dangers of investing in a Public Provident Fund is most vital.

Earlier than continuing additional, allow us to recap the options of the Public Provident Fund.

Options of Public Provident Fund or PPF

Who can open it?

(i) a single grownup by a resident Indian.

(ii) a guardian on behalf of a minor/ individual of unsound thoughts. ?

Word:- Just one account could be opened all throughout the nation both within the Publish Workplace or any Financial institution.

How a lot to deposit?

(i) Minimal deposit of Rs. 500 in a Monetary Yr and Most deposit is Rs. 1.50 lakh in an FY

(ii) Most restrict of Rs. 1.50 lakh shall be inclusive of the deposits made in his/her personal account and within the account opened on behalf of a minor.

(iii) Quantity could be deposited in any variety of installments in an FY in a number of of Rs. 50 and a most as much as Rs. 1.50 lakh.

(iv) The Account could be opened by money/cheque and within the case of the cheque the date of realization of the cheque in Govt. the account shall be the date of opening of account/subsequent deposit within the account.

(v) Deposits qualify for deduction beneath part 80C of the Earnings Tax Act.

What if you happen to discontinue the account?

(i) If in any monetary 12 months, a minimal deposit of Rs.500/- isn’t made, the mentioned PPF account shall change into discontinued.

(ii) Mortgage/withdrawal facility isn’t out there on discontinued accounts.

(iii) Discontinued account could be revived by the depositor earlier than maturity of the account by deposit minimal subscription (i.e. Rs. 500) + Rs. 50 default payment for every defaulted 12 months.

(iv) The entire deposit in a 12 months, shall be inclusive of deposits made in respect of years of default of earlier monetary years.

What’s the rate of interest?

(i) Curiosity shall be relevant as notified by the Ministry of Finance on a quarterly foundation. The present rate of interest is 7.1%.

(ii) The curiosity shall be calculated for the calendar month on the bottom stability within the account between the shut of the fifth day and the top of the month.

(iii) Curiosity shall be credited to the account on the finish of every Monetary 12 months.

(iv) Curiosity shall be credited to the account on the finish of every FY the place the account stands on the finish of FY. (i.e. in case of switch of account from Financial institution to PO or vice versa)

(v) Curiosity earned is tax-free beneath the Earnings Tax Act.

Can we avail a mortgage?

(i) Mortgage could be taken after the expiry of 1 12 months from the top of the FY by which the preliminary subscription was made. (i.e. A/c open throughout 2010-11, mortgage could be taken in 2012-13).

(ii) Mortgage could be taken earlier than the expiry of 5 years from the top of the 12 months by which the preliminary subscription was made.

(iii) Mortgage could be taken as much as 25% of the stability to his credit score on the finish of the second 12 months instantly previous the 12 months by which the mortgage is utilized. (i.e. if the mortgage was taken throughout 2012-13, 25% of the stability credit score on 31.03.2011)

(iv) Just one mortgage could be taken in a Monetary Yr.

(v) A Second mortgage shall not be offered until the primary mortgage was not repaid.

(vi) If the mortgage is repaid inside 36 months of the mortgage taken, a mortgage rate of interest @ 1% every year shall be relevant.

(vii) If the mortgage is repaid after 36 months of the mortgage taken mortgage rate of interest @ 6% every year shall be relevant from the date of mortgage disbursement.

How a lot withdrawal is allowed? ?

(i) A subscriber can take 1 withdrawal throughout a monetary after 5 years excluding the 12 months of account opening. (if the account was opened throughout 2010-11 the withdrawal could be taken throughout or after 2016-17)

(ii) Quantity of withdrawal could be taken as much as 50% of the stability on the credit score on the finish of the 4th previous 12 months or on the finish of the previous 12 months, whichever is decrease. (i.e. withdrawal could be taken in 2016-17, as much as 50% of stability as on 31.03.2013 or 31.03.2016 whichever is decrease).

When it is going to mature?

(i) Account can be maturity after 15 F.Y. years excluding FY of account opening.

(ii) On maturity depositor has the next choices:-

# Can take maturity fee by submitting account closure type together with passbook at involved Publish Workplace.

# Can retain maturity worth in his/her account additional with out deposit, the PPF rate of interest can be relevant and fee could be taken any time or can take 1 withdrawal in every FY.

# Can prolong his/her account for an additional block of 5 years and so forth (inside one 12 months of maturity) by submitting a prescribed extension type on the involved Publish Workplace. (Discontinued account can’t be prolonged).

# In an prolonged account with deposits, 1 withdrawal could be taken in every FY topic to a most restrict of 60% of stability credit score on the time of maturity within the block of 5 years.

Whether or not untimely closure allowed?

(i) Untimely closure shall be allowed after 5 years from the top of the 12 months by which the account was opened topic to the next circumstances.-> In case of life-threatening illness of account holder, partner, or dependent youngsters.-> In case of upper schooling of account holders or dependent youngsters.-> In case of a change of resident standing of the account holder ( i.e. grew to become NRI).?(ii) On the time of untimely closure 1% curiosity shall be deducted from the date of account opening/date of extension because the case could also be.

(iii) The Account could be closed on the above circumstances by submitting the prescribed type together with the e book on the involved Publish Workplace.

What is going to occur if the account holder dies?

(i) In case of the demise of the account holder, the account shall be closed and the nominee or authorized inheritor(s) shall not be allowed to proceed deposits within the account.

(ii) On the time of closure on account of demise PPF price of curiosity shall be paid until the top of the previous month by which the account is closed.

Dangers Of Investing in Public Provident Fund (PPF)

Allow us to now attempt to perceive the dangers of investing in public provident fund (PPF).

# Liquidity Danger

One of many largest danger related to Public Provident Fund (PPF) is the liquidity danger. Regardless that mortgage and withdrawal facility is out there, however they arrive with their very own algorithm and rules. You may’t withdraw as per your individual necessities. Therefore, understanding this danger earlier than blind funding is a should for all buyers.

This danger will ease after a 12 months (to avail mortgage) and particularly after fiver years (to avail withdrawal). Nonetheless, the true liquidity danger will vanish to sure extent put up 15 years completion. As a result of after 15 years completion, 1 withdrawal could be taken in every FY topic to most restrict 60% of stability credit score on the time of maturity within the block of 5 years.

Refer my earlier put up on this regard – “PPF-Mortgage And Withdrawal” and “PPF Withdrawal Guidelines & Choices After 15 Years Maturity“.

# Curiosity Fee Danger

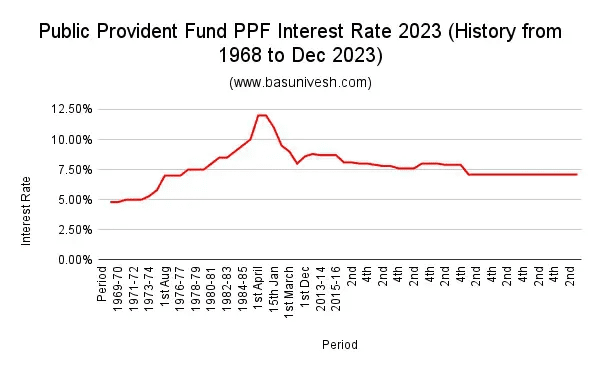

As I discussed above, PPF rate of interest will change as soon as in 1 / 4. Have a look at under chart to grasp the historical past of the PPF rate of interest.

You discover that in preliminary years, it was round 5%, then touched the height of round 12% in round 2000 and now at 7.1%. Therefore, in case you are investing and assuming the identical present 7.1% curiosity you’re going to get all through your funding cycle is an entire MYTH. Refer my put up on this regard “Public Provident Fund PPF Curiosity Fee 2023 (Historical past From 1968 To Current)“.

# Aim Mismatch Danger

Many individuals blindly spend money on PPF with out understanding their precise want. When you want the cash inside 15 years, then obiviously PPF isn’t an acceptable product for you. Be sure that your monetary aim ought to match your PPF maturity date. In any other case, although you invested in PPF, on account of its liquidity danger, you might not fund in direction of your aim totally.

Therefore, by no means make investments blindly. As an alternative perceive your requirement after which make investments.

# Coverage Danger

The key motive for PPF buyers is security and tax free nature of curiosity and maturity. Nonetheless, when the policymakers change the foundations is unknown to us. When you invested right now with an assumption that it’ll stay tax free however afterward if the foundations modified, then you need to undergo in a giant means. The basic instance is of EPF. Earlier no matter you earn as curiosity in your contribution (worker contribution) and your employer contribution was tax free. Nonetheless, now the restrict set to your contribution (Rs.2,50,000) a 12 months. When you contribute past this, then regardless of the curiosity earned by such extra contribution can be taxable earnings for the worker on yearly foundation. Refer my earlier put up “Taxation Of EPF Contribution Above Rs.2.5 Lakh – CBDT Clarification“.

Therefore, by no means be in a unsuitable perception that the tax guidelines or the advantages of PPF will proceed ceaselessly like how they’re right now.

# Inflation Danger

PPF is the perfect debt instrument. Little question in that. Nonetheless, PPF alone isn’t sufficeint to fullfill your future long run monetary targets. Therefore, by no means make investments full quantity in PPF. As an alternative, you want the fairness half additionally to generate inflation adjusted return.

Sadly many individuals not perceive this. As an alternative, blindly they fill the Rs.1.5 lakh hole with out fail. As an alternative, primarily based in your targets, you have to do the asset allocation and a part of your debt must be invested in PPF. In reality in case you are following the aim primarily based investing, and PPF is a debt a part of your portfoio, then by no means make investments all debt half in PPF. Primarily as a result of in case of rebalancing, you may’t partially withdraw (as per your phrases) to stability the portfolio. In such a state of affairs, debt funds can be helpful for you.

Conclusion – The concept behind this put up is to not convey the negativity of a product. Nonetheless, the thought is to counsel that DON’T INVEST BLIDNLY simply because PPF affords tax advantages and security of cash. As an alternative, suppose past this and if you happen to understood the above talked about dangers of investing in public provident fund (PPF), then go forward. BLIND EMPTIONAL INVESTMENT IS ALWAYS RISKY.