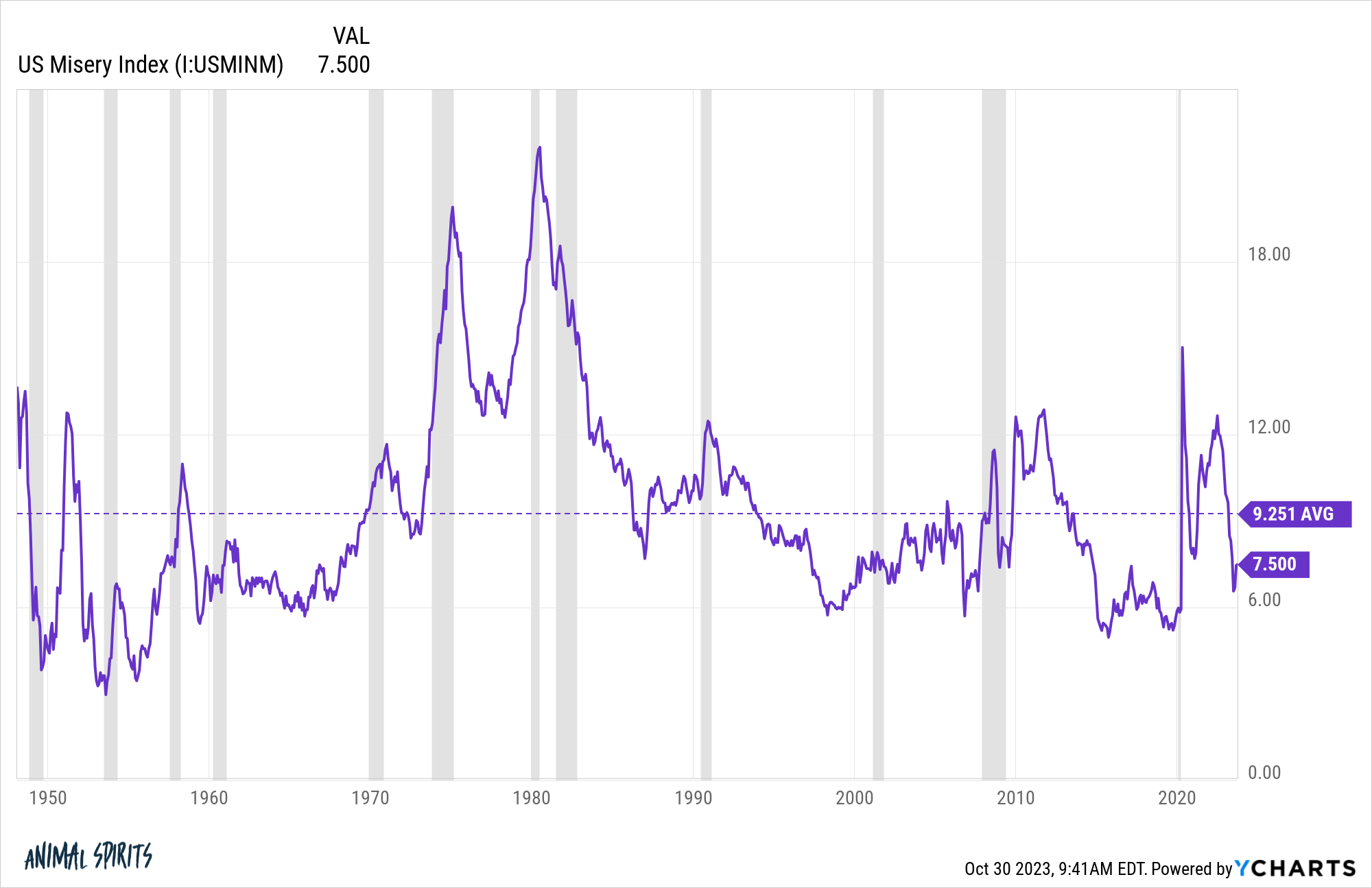

The Distress Index was created by Arthur Oken, an economist who labored for the Johnson administration within the Nineteen Sixties.

It’s purported to measure how residents are doing economically by including up the unemployment charge and the inflation charge. Right here’s the info going again to the late-Nineteen Forties:

It could come as a shock to some those that we’re really under common proper now.

Actually, a sub-4% unemployment charge helps however the inflation charge has additionally come down.

We’re in a bizarre place in terms of how folks really feel and what the financial knowledge are exhibiting.

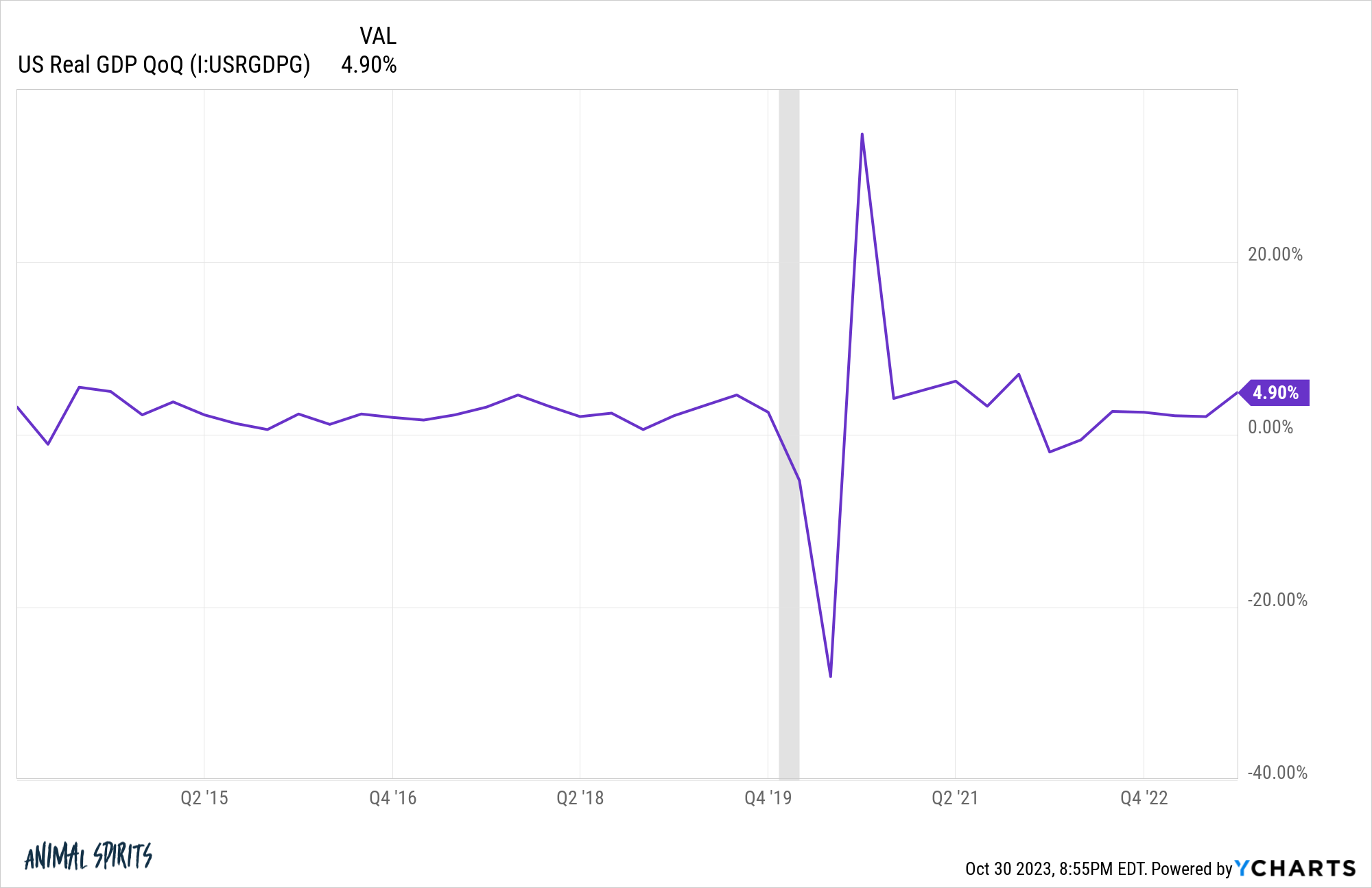

The newest GDP report final week confirmed financial development within the third quarter was 4.9%. Taking out the whipsaw from the pandemic, that was the very best financial development we’ve skilled since 2014.

Going again to 1948, the unemployment charge has been greater than the present 3.8% in 90% of all readings. That’s fairly good.

Issues might all the time be higher and will worsen any day now however, objectively, we’ve been in a robust economic system for a while now. Many individuals assumed we have been already in a recession final 12 months but development has solely accelerated in 2023.

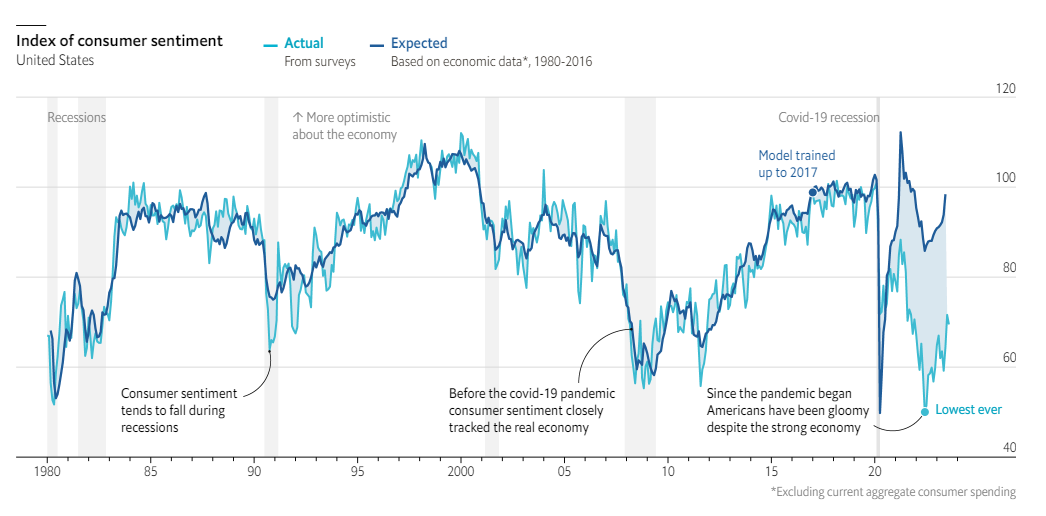

The divergence between sentiment and financial knowledge needs to be as broad because it’s ever been.

The Economist created this glorious chart that tracks sentiment and financial knowledge over time:

The 2 measures tracked each other intently for 40 years proper up till the pandemic. Since then, the vibes don’t agree with the info.

Inflation is the apparent offender however there needs to be extra to it than that. The inflation charge averaged 5.6% within the Eighties. Since 2021 it’s averaged 5.7%. We’re nonetheless a great distance off from the Nineteen Seventies when the annual inflation charge averaged greater than 7%.

It doesn’t assist that the media has been telling everybody a recession is imminent for the previous 24 months.

The pandemic actually screwed with our collective psyche as properly.

However I wish to deal with the financial aspect of the equation right here to indicate why the psychology of sentiment is out of whack proper now.

The entire thought of “the economic system” continues to be a comparatively new phenomenon. Gross home product didn’t actually even exist in the best way we give it some thought till the aftermath of the Nice Despair when economists determined it might be a good suggestion to trace financial development.

“The economic system” for most individuals was kind of private. Your private economic system nonetheless issues an important deal in terms of gauging financial sentiment, however now we’re crushed over the pinnacle each single day with scary headlines and tick-by-tick modifications to every thing.

Nobody acquired breaking information or alerts up to now when GDP or inflation got here in 0.1% off the estimates. For many of human historical past folks mainly needed to guess how the economic system was doing.

And though folks weren’t listening to these things on a regular basis up to now, they have been most conditioned to take care of financial volatility as a result of the economic system was extra unstable.

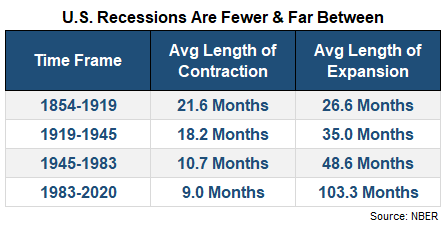

The Nationwide Bureau of Financial Analysis has a listing of financial expansions and contractions for the U.S. economic system going again to the 1850s. Check out how the typical size of each the recessions and the expansions has modified over time.

The expansions are getting longer. The recessions are getting shorter.

Not solely have been the recessions longer up to now however the magnitude of the declines have been way more vital.

From 1854-1945, the typical GDP contraction throughout a recession was -23%. Since 1945, we’ve seen GDP fall by a mean of simply 3.7% (and that features the 19.2% decline within the short-lived 2020 pandemic-induced recession).

Within the 1870s, the aptly titled Lengthy Despair lasted for 65 months with GDP falling a shocking 34%.

The enlargement following that godawful downturn lasted lower than three years earlier than one other melancholy hit that lasted greater than three years. The U.S. economic system was in a recession roughly three-quarters of the time for greater than a decade.

Are you able to think about if that occurred immediately?! Folks would lose their minds.

Now we’ve decade-long financial expansions.

Earlier than the transient 2020 downturn, it had been over a decade for the reason that final recession resulted in June 2009. There have been six years between the 2001 recession and the beginning of the Nice Monetary Disaster in 2007. It was a decade between the tip of the recession in 1991 and the beginning of the following one in 2001. There was practically a decade between the tip of the 1982 recession and the beginning of the recession in 1990.

Since 1983, there was a grand whole of 4 recessions or one each ten years or so.

It is a good factor however it additionally means we’re not used to financial volatility the best way folks have been up to now.

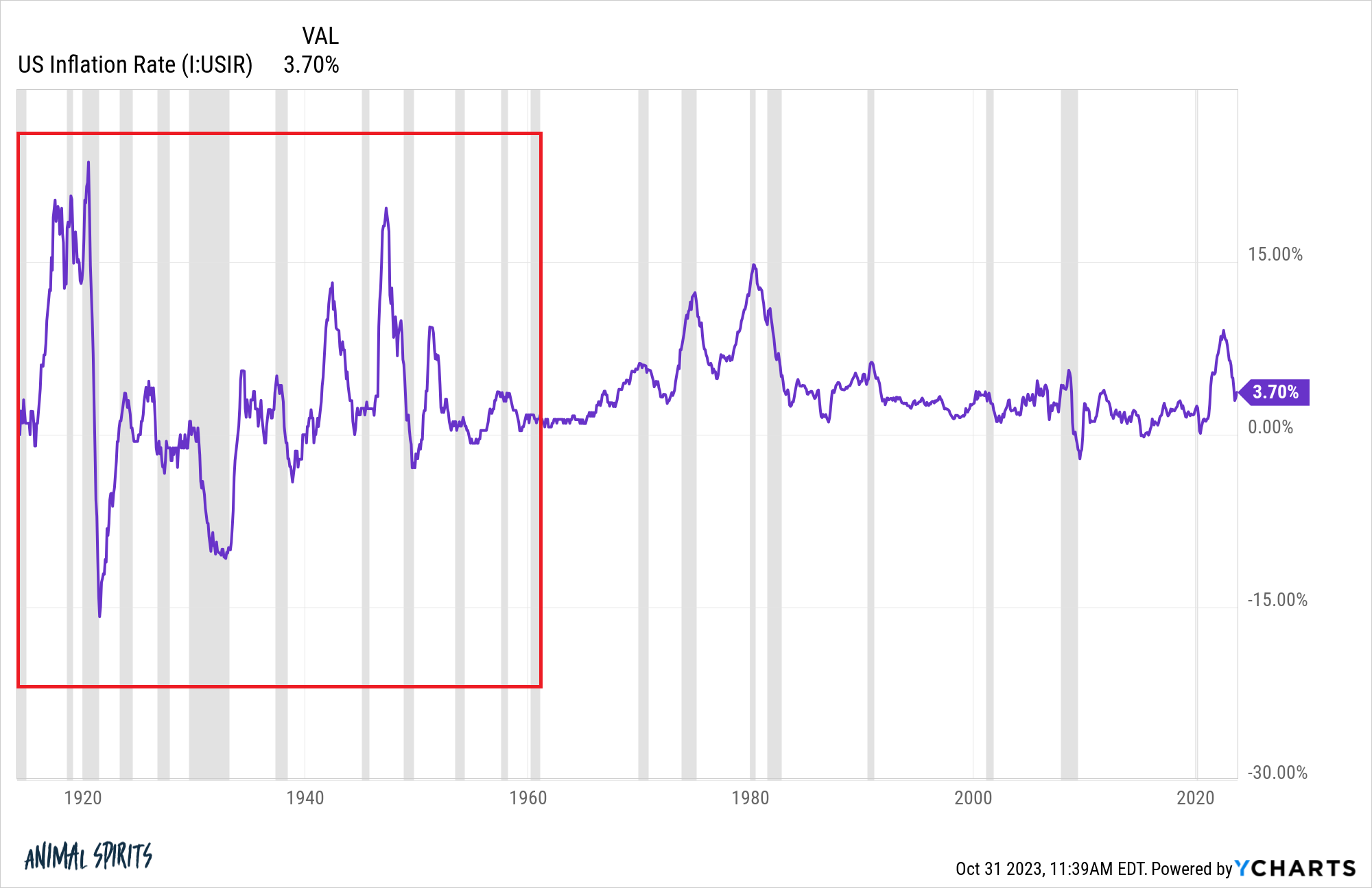

Have a look at how way more unstable the inflation charge was within the pre-Nineteen Sixties period:

It was a relentless back-and-forth between massively excessive inflation and bone-crushing deflation from all the wars, recessions and depressions.

I do know folks like to complain concerning the Fed and authorities spending however our economic system actually is way more secure today than it was up to now.

Each previous technology thinks the younger generations are comfortable. Once I was your age…

Most individuals don’t understand that is really an indication of progress. Future generations must be softer than earlier generations as innovation and onerous work make our lives simpler than they have been up to now.

Perhaps we’ve change into just a little complacent as a result of there hasn’t been practically as a lot financial volatility in trendy instances as earlier generations have been compelled to take care of.1

And that’s a very good factor!

I hope the pandemic-induced financial volatility is the outlier and financial volatility settles down going ahead.

Everybody and their brother has been predicting a recession for the previous 24 months and complaining concerning the state of the economic system.

Perhaps the silver lining of the financial volatility we’ve skilled and the divergence between sentiment and financial knowledge is extra households will probably be ready when that subsequent downturn really hits for actual.

Additional Studying:

Individuals Have By no means Been Wealthier & No One Is Blissful

1I’m positive lots of people are going to disagree with me right here however it’s true.