Most staff anticipate sure office advantages, comparable to medical health insurance or retirement plans. However developing with distinctive and interesting perks, like commuter advantages, can additional your possibilities of attracting and retaining high expertise.

Commuter advantages aren’t simply in style in large cities with prevalent public transportation programs. Any employer may give staff the reward of a commuter tax profit. Be taught extra about providing commuter advantages under.

What are commuter advantages?

Commuter advantages are fringe advantages that cowl an worker’s transportation-related bills with pre-tax {dollars}. Transportation advantages are exempt from revenue tax withholding, Social Safety and Medicare (FICA) taxes, and federal unemployment tax. Staff can use the funds on qualifying bills, comparable to public transportation and parking charges.

Providing these advantages decreases worker transportation prices and encourages your workforce to make use of public transportation, which is very useful in congested cities.

Employers and staff can contribute to an worker’s commuter advantages plan. Nevertheless, your mixed contribution should be under the IRS contribution limits, defined later.

Certified transportation fringe advantages

Staff can use funds to cowl transportation bills and parking bills.

Transportation bills: Staff can use their commuter profit funds to purchase transit passes (e.g., passes, tokens, vouchers, and so forth.) for public transportation. Public transportation contains buses, trains, subways, ferries, or freeway automobiles with a minimum of six passenger seats.

Parking bills: Commuter profit funds can even go in the direction of parking bills. Staff can use pre-tax {dollars} to pay for parking at or close to work. Staff can even use funds to pay for parking on or close to mass transit premises.

Not all transportation-related bills are included beneath commuter advantages. For instance, an worker can’t use transit profit funds to pay for issues like gasoline or automobile insurance coverage.

IRS contribution limits

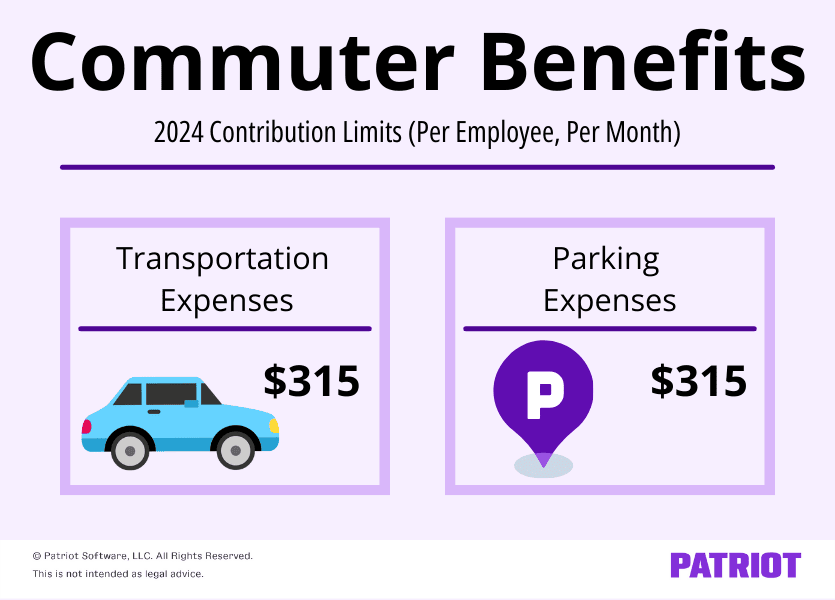

The IRS units contribution limits for each transportation bills and parking bills. For 2024, each limits are the identical:

- $315 per worker monthly for transportation bills

- $315 per worker monthly for parking bills

These 2024 limits are every up $15 from the 2023 transportation expense and parking expense restrict of $300. Once more, you and your worker’s mixed contributions can’t exceed $315 monthly in 2024. Nevertheless, your worker can elect to enroll in each commuter profit plans (transportation and parking), if relevant.

Previous to the Tax Reduce and Jobs Act of 2017, staff may additionally use pre-tax {dollars} to cowl as much as $20 monthly for biking-related bills. Staff can not use commuter advantages for biking-related bills.

Are employers required to supply commuter advantages?

In most cities, providing commuter advantages to staff is your determination.

However some cities, comparable to San Francisco, New York Metropolis, and Washington D.C., require you to supply transit advantages when you make use of a sure variety of full-time staff.

For those who should provide commuter advantages, discuss along with your native transit authorities. They may also help you arrange and administer your commuter advantages program.

Commuter advantages and tax financial savings

As a result of commuter advantages are pre-tax deductions, they’ll scale back the quantity your staff pay in payroll and revenue taxes. When staff contribute to their commuter advantages plan, they owe much less in federal revenue, Medicare, and Social Safety taxes.

Providing commuter advantages gives tax financial savings for employers, too. Social Safety and Medicare taxes are employer and worker taxes, which means you and the worker must contribute an identical 7.65% of the worker’s wages. When an worker owes much less in Social Safety and Medicare taxes, you owe much less too.

Let’s say an worker earns gross wages of $2,000 monthly. Their FICA legal responsibility is $153 monthly ($2,000 X 0.0765). And, your FICA legal responsibility is $153 monthly for that worker.

Now let’s say the worker contributes $200 a month to their commuter advantages plan. As a result of their taxable wages are actually $1,800 ($2,000 – $200), you and the worker will solely owe $137.70 every.

This reduces your FICA tax legal responsibility for that worker by $183.60 per 12 months [($153 – $137.70) X 12).

If you have more than one employee, your year-end FICA tax savings can add up.

Transit deduction for employers

In the past, businesses have been able to claim a federal income tax deduction on the amount they contributed to the commuter benefits program.

However, the Tax Cut and Jobs Act of 2017 eliminated the transit deduction for employers. You can no longer deduct commuter benefit contributions.

Although you cannot claim a transit deduction, you can still enjoy the payroll tax savings that come with offering commuter benefits.

Setting up a commuter benefits program

If you decide to offer a commuter benefits program, or if your business is located in a city that requires it, you need to know your employer responsibilities.

You can use a third-party administrator to set up your program. Generally, you will need to pay a fee per employee. Or, you may be able to create and manage your account through your local transit agency.

After you set up the program, employees must enroll to receive benefits. Educate your employees on the program and thoroughly discuss the program rules. Make information accessible on how they can enroll, what the funds can be used for, how much they can contribute, and whether you are also contributing to their plans.

Employees need to tell you how much they will contribute to their plan. Remember, you and your employee can only contribute up to a combined total of $315 per program per month.

When employees enroll, you need to adjust your payroll. If you are using payroll software, enter the employee’s contribution amounts as a pre-tax deduction. That way, you can withhold the correct amount of taxes, pay the employee, and add their contribution to their commuter benefits plan.

Looking to simplify how you run payroll? Patriot’s online payroll services provide an affordable, accurate, and reliable option for managing payroll. Our online software is made for busy small business owners. Get your free trial today!

This article has been updated from its original publication date of September 12, 2018.

This is not intended as legal advice; for more information, please click here.