China’s chief Xi Jinping just lately laid out the aim of reaching the per capita revenue of “a mid-level developed nation by 2035.” Is that this aim more likely to be achieved? Not in our view. Continued speedy development faces mounting headwinds from inhabitants getting old and from diminishing returns to China’s investment-centered development mannequin. Further impediments to development look like constructing, together with a flip towards elevated state administration of the economic system, the crystallization of legacy credit score points in actual property and different sectors, and limits on entry to key overseas applied sciences. Even given beneficiant assumptions regarding future development fundamentals, China seems more likely to shut solely a fraction of the hole with high-income nations within the years forward.

Some Disagreeable Development Arithmetic

Whereas it’s not clear precisely what peer group Xi had in thoughts in referring to developed nations, these labeled as “Superior Economies” by the IMF appear a pure alternative. This group consists of thirty-two economies, with 2022 per capita incomes starting from $36,900 on the backside (Greece) to $127,600 on the prime (Singapore) measured at buying energy parity. (Changing greenback incomes to PPP phrases corrects for cost-of-living variations throughout nations.) We outline “mid-level” as starting on the twenty fifth percentile for this group, akin to a per capita revenue of $49,300.

China is presently a middle-income nation, with a per capita revenue of $21,400, inserting it simply above the sixtieth percentile of the worldwide revenue distribution. China has an extended strategy to go to satisfy our revenue threshold. Per capita revenue would wish to rise by an element of two.3, akin to a mean development price of 6.6 p.c to achieve the brink by 2035. Annual revenue development must be 4.3 p.c to match the present stage in Greece by that 12 months.

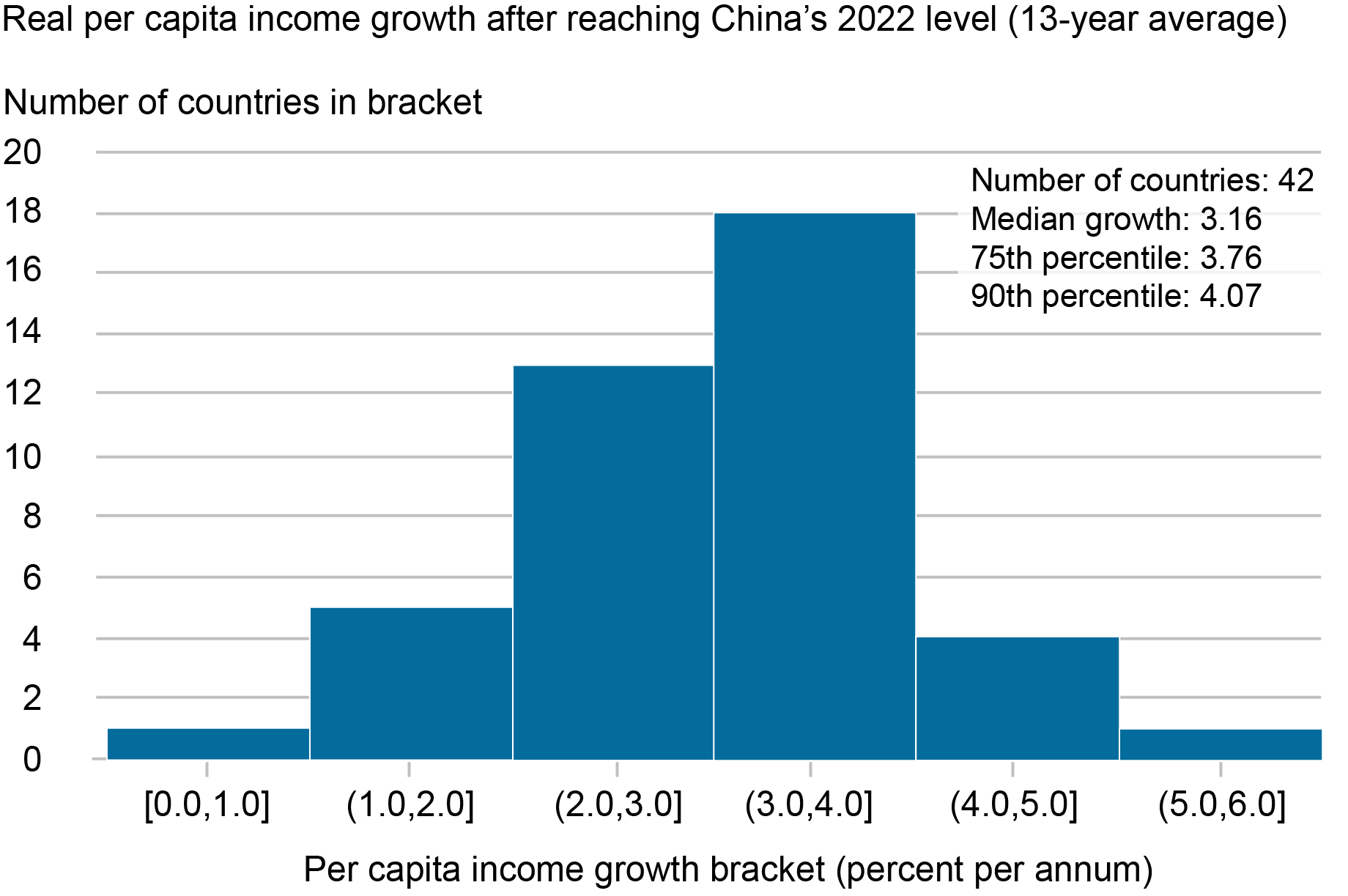

A have a look at historical past underscores the daunting nature of this job. Of the forty-three nations that had reached China’s present revenue stage by 2009, not one managed to realize the expansion price wanted to push China to the Superior Financial system twenty fifth percentile over the following 13 years (see chart beneath). Certainly, the median thirteen-year revenue development price for this group comes to three.1 p.c, with solely 5 seeing development above 4 p.c. And for the twenty-four nations with incomes above $49,300, it took a mean of thirty-two years to make the climb from China’s present revenue stage. Solely two did so in lower than twenty years.

Excessive-Revenue Standing by 2035 Requires Unprecedented Development

Sources: Penn World Desk, model 10.01; IMF WEO database, April 2023; authors’ calculations.

Observe: Per capita revenue development is GDP development much less inhabitants development.

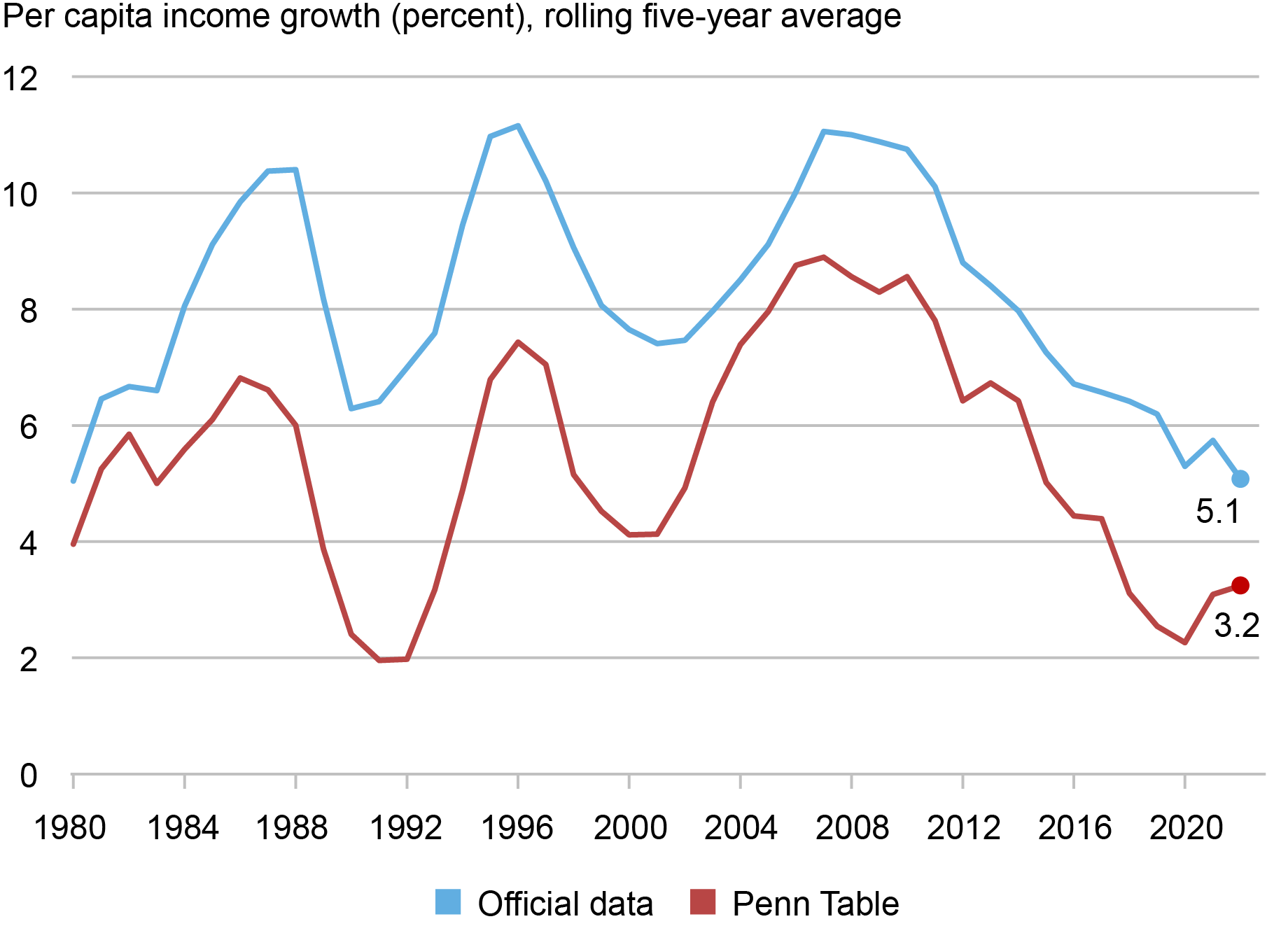

A development optimist will little question level to China’s sturdy development trajectory since market reforms have been initiated within the early Eighties. Per capita revenue development got here to six.5 p.c from 2009 to 2022 and was even quicker through the two prior thirteen-year intervals (9.4 p.c throughout 1996-2009 and eight.8 p.c throughout 1983—1996). Remarkably, China was the worldwide revenue development chief throughout all three intervals.

China’s previous development efficiency is certainly spectacular. Even so, the official knowledge present pattern revenue development slowing because the mid-2000s (see the blue line within the chart beneath, which reveals five-year development charges). The authorities’ revenue targets contain reversing or a minimum of arresting this pattern.

Chinese language Actual Revenue Development Has Been Slowing

Sources: China Nationwide Bureau of Statistics; Penn World Desk, model 10.01; Complete Financial system Database (Convention Board).

Notes: Per capita revenue development is GDP development much less inhabitants development. *Development knowledge for 2020 via 2022 (as a part of five-year averages) taken from Complete Financial system Database.

Furthermore, these figures take China’s official development statistics at face worth. There has lengthy been skepticism over the accuracy of China’s statistics, which we now have mentioned in earlier work, and lots of analysts imagine that development has been systematically overstated. Economist Harry Wu has given substance to the view, proposing a variety of changes to the official knowledge. These changes present the idea for different collection printed in main worldwide datasets such because the Penn World Desk and the Convention Board’s Complete Financial system Database. China’s revenue development efficiency stays distinctive even given these changes, inserting within the prime decile of the worldwide distribution throughout every of the three current thirteen-year intervals. However these knowledge present development already slowing to “solely” at 4.4 p.c from 2009 to 2022—barely quick sufficient to climb to the underside of the Superior Financial system ranks by 2035—and to a nonetheless slower tempo for the final 5 years (the purple line within the chart above).

The talk over China’s true development price stays unsettled. Fortuitously, we don’t must settle it. As we’ll see, a have a look at the evolving sources of development in China suggests that it’s going to fall beneath our benchmarks even when the official knowledge are right.

Classes from the Neoclassical Development Mannequin

The usual neoclassical development mannequin supplies a helpful framework for assessing China’s development prospects. Beneath the mannequin, financial development comes from two primary sources: will increase in labor and capital inputs, and enhancements in expertise. Development contributions from labor and capital are equal to the expansion charges of those inputs, weighted by their shares within the worth of manufacturing. The expansion contribution from expertise (termed “complete issue productiveness” or TFP) is calculated as a residual, as the rise in output not defined by increased inputs.

A neoclassical perspective reveals two elementary constraints on China’s future development efficiency. Labor inputs are set to say no beneath the burden of inhabitants getting old. In keeping with projections from the United Nations, China’s working age (20-64) inhabitants will fall by 6 p.c by 2035. In precept, will increase in labor power participation or hours per employee might offset a few of the decline within the working age inhabitants. However China already ranks excessive on each these measures. At greatest, strikes increased might offset solely a fraction of the demographic drag.

China’s excessive share of funding spending in GDP—persistently above 40 p.c because the mid 2000s—has supported a speedy buildup within the nation’s capital inventory. Certainly, China’s capital-output ratio is now among the many highest on the planet in PPP phrases. However capital accumulation is topic to diminishing returns: A given increment makes a smaller contribution to development when capital is considerable than it does when capital is scarce. Furthermore, because the capital inventory rises relative to output, a better share of recent funding should go to offset ongoing depreciation. The affect of diminishing returns is already in proof. In keeping with our estimates, elevated capital inputs contributed a mean of three.4 share factors to GDP development in 2018-22, versus 4.3 share factors for 2013-17.

In earlier work based mostly on the neoclassical framework, we discovered that the expansion contribution from capital will proceed to fade within the years forward, even given favorable assumptions. Up to date projections taking in new knowledge reinforce this conclusion, implying a contribution of 1.4-1.9 share factors for the interval via 2035. (For particulars, see our appendix on China development eventualities.) Taken collectively, we count on decreased contributions from labor and capital to carry revenue development beneath 4 p.c absent an offsetting acceleration in TFP development.

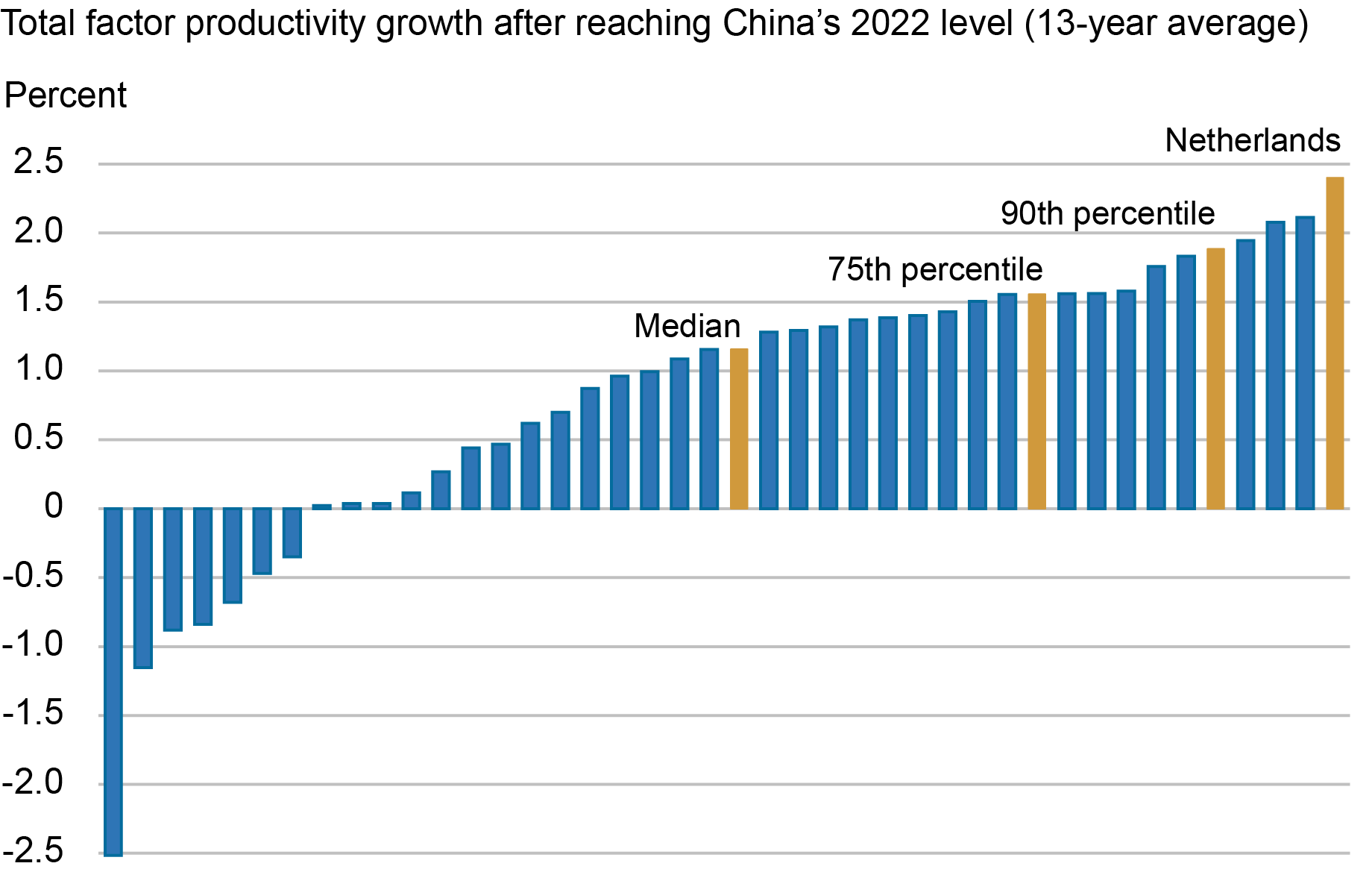

A surge in TFP development, nonetheless, appears unlikely, since productiveness development in China is already fairly excessive, averaging 1.8 p.c since 2009. Solely 5 of the forty-three nations that reached China’s present revenue stage previously noticed TFP development that prime over the following 13 years (see chart beneath). Not one managed to exceed this tempo by quite a lot of tenths of a share level. In brief, China might want to obtain TFP development in extra of the quickest historic precedents to satisfy official revenue targets. Furthermore, these estimates assume that the official development figures are correct. If the decrease development charges of Wu’s work are right, TFP development has already fallen to about zero.

Productiveness Development of two P.c Is Uncommon

Sources: Penn World Desk, model 10.01; IMF WEO database, April 2023; authors’ calculations.

Notes: Nation pattern measurement: 42. The TFP development spurt for the Netherlands covers 1964-77.

Structural Headwinds

In our view, nonetheless, a mixture of longstanding and rising structural headwinds will make it troublesome for China to match its previous productiveness efficiency, not to mention exceed it. The longstanding headwinds have been extensively mentioned elsewhere, together with in our personal work, and we’ll merely record them right here:

- Pervasive state and Communist Get together administration of the economic system, a bent that has grown extra pronounced beneath President Xi’s tenure.

- Lagging institutional improvement, mirrored for instance in low scores on survey-based measures such because the World Financial institution’s Worldwide Governance Indicators.

- The necessity to rebalance the economic system away from an extreme reliance on funding spending and towards consumption-led development.

- Excessive non-public sector and authorities debt ranges, constructed up in financing investment-led development.

New headwinds have emerged alongside these longstanding ones. China’s development has lengthy been depending on property sector exercise. (By some measures, actual property accounts for one quarter of financial exercise.) Chinese language authorities have historically relied on enjoyable or tightening credit score and regulation for the sector to clean out cycles in GDP development. Over the past two years, nonetheless, actual property exercise has gone into an prolonged decline, seemingly unresponsive to official efforts to help exercise.

Present strains within the property sector serve for instance of the broader problem of managing a rotation away from credit- and investment-centered development. However these strains have their very own dynamic. Shifting away from investment-led development will entail a considerable reallocation of presidency expenditure from funding to consumption and family switch funds. On the identical time, although, general authorities deficits and debt are already very giant. Any such shift in expenditure priorities will likely be intertwined with the politically thorny challenge of presidency debt restructuring.

A second rising headwind includes the transfer by China’s buying and selling companions towards onshoring and derisking. The pandemic revealed the fragility of nations’ international provide chains, many centered on China. As well as, geopolitical tensions between China and key buying and selling companions have mounted in recent times. These forces have prompted strikes to convey provide chains nearer to residence, and the place they continue to be worldwide in character, to find them in nations with whom relations are much less fraught—insurance policies that U.S. and European officers have known as “derisking.”

As well as, elevated geopolitical tensions have prompted the U.S. and its safety companions to impose new limits on China’s entry to essential overseas applied sciences. For instance, final October the U.S. authorities issued main export controls that considerably blocked Chinese language entry to key applied sciences for manufacturing or buying cutting-edge built-in circuits, and even merchandise containing such built-in circuits. This U.S. motion was later joined by main safety companions, notably together with Japan and the Netherlands. These controls in essence are designed to roll again Chinese language chipmaking applied sciences to pre-2014 ranges. Extra just lately, the U.S. issued an Government Order that locations focused restrictions on sure outward investments in China by U.S. entities.

We have no idea but how severely property and derisking headwinds will crimp China’s future development. However they clearly restrict the prospects for sustaining previous productiveness efficiency.

Conclusion

China has many compelling strengths: a well-educated inhabitants, together with half the world’s skilled engineers; high-quality and still-improving infrastructure and an environment friendly distribution system; excessive if uneven state capability; and clear leads in necessary new applied sciences, together with solar energy, battery manufacturing, and electrical automobiles. China might shock us and obtain Xi’s lofty revenue development goal. However that wager comes with stiff odds.

Hunter L. Clark is a world coverage advisor in Worldwide Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Matthew Higgins is an financial analysis advisor in Worldwide Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Learn how to cite this publish:

Hunter L. Clark and Matthew Higgins, “Can China Catch Up with Greece?,” Federal Reserve Financial institution of New York Liberty Road Economics, October 19, 2023, https://libertystreeteconomics.newyorkfed.org/2023/10/can-china-catch-up-with-greece/.

Disclaimer

The views expressed on this publish are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).