The S&P 500 has fallen from 4,598 on July 27th of this yr to 4,117 on October 28th for a decline of 10.5%, whereas yields on the ten-year Treasury have risen from 4.01% to 4.85% for an increase of 20.9%. The Constancy Intermediate Treasury Bond Index (FUAMX) has had a value decline of 4% throughout this three-month interval. I anticipated a bigger decline within the S&P 500 and a decrease rise in yields. Cash market yields are hovering round 5%, and “money is king.”

Financial progress is strong, together with comparatively secure employment, whereas inflation has moderated. Nonetheless, pandemic-era financial savings are being depleted, delinquency charges are rising, bankruptcies amongst small companies are rising, and banks are tightening lending requirements. The yield curve remains to be inverted. A attainable recession has been pushed into early or mid-2024, the Federal Reserve has peaked its charge hikes or quickly will, and hypothesis is that the Federal Reserve will start decreasing charges in mid-2024. How ought to we make investments now?

I’ve targeting constructing fixed-income ladders for the previous yr, and as they mature, I’ve rolled them over into bond funds with longer durations. I’ve additionally employed wealth administration providers at Constancy and Vanguard for longer horizon buckets. This month, I up to date my spreadsheet that tracks the efficiency of over 600 funds out there at both Constancy or Vanguard. I created a rating system to replicate short-term efficiency and sentiment at this inflection level utilizing 1) a three-month exponential shifting common, 2) cash stream, and three) returns throughout September and October.

This text is split into the next sections:

TRENDING LIPPER CATEGORIES

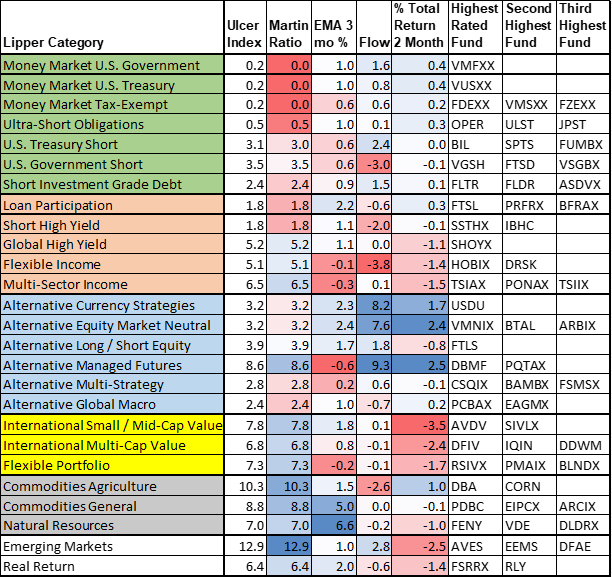

Desk #1 comprises the top-performing Lipper Classes for the 635 funds that I presently observe. The primary group of funds is cash markets and short-term high quality fastened earnings. Money is king. Ulcer Index measures the depth and length of drawdowns over the previous two years, whereas Martin Ratio measures the risk-adjusted efficiency over the previous two years. The following group of classes doing nicely is higher-risk fastened earnings. The third class performing nicely is “Alternate options”, a few of which I’ve written about over the previous yr. Worldwide small and multi-cap funds that I observe are performing higher than home large-cap funds.

A balanced, low-volatility portfolio will comprise funds that transfer in several instructions at totally different instances. The ultimate part seems to be at how among the uncorrelated [to the S&P 500] funds that I personal evaluate through the previous few months.

Desk #1: Trending Lipper Classes – Ulcer & Martin Stats – Two Years

FIXED INCOME FUNDS

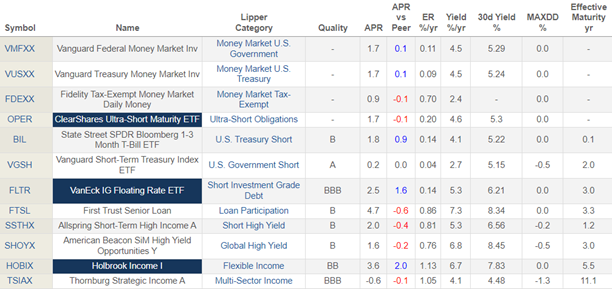

Desk #2 comprises the cash market and short-term fixed-income funds which have completed nicely over the previous few months. The standard funds ought to proceed to do nicely over the subsequent yr whereas the Federal Reserve is holding charges increased for longer. Decrease-quality bond funds are more likely to come beneath strain if a recession turns into extra doubtless. My present technique is to spend money on longer-duration funds of high quality bonds whereas rates of interest are excessive.

Desk #2: Trending Mounted Earnings Funds (Metrics -4 Months)

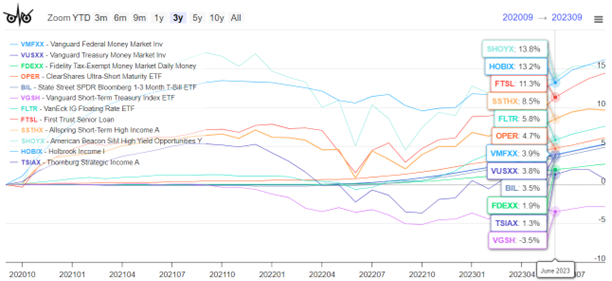

Determine #1: Trending Mounted Earnings Funds (Metrics -4 Months)

ALTERNATIVES AND EQUITY FUNDS

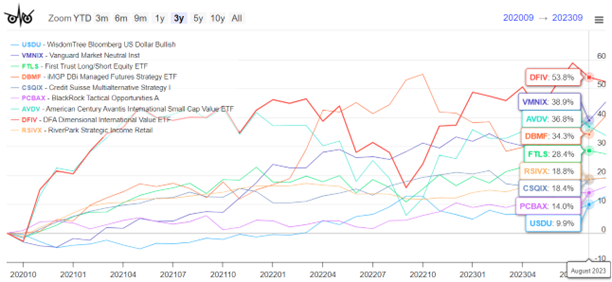

The varieties of different fund classes proven in Desk #3 usually are inclined to do nicely throughout instances of uncertainty. As I’ve written, I personal a number of of those and can proceed to take action till the U.S. financial system enters its subsequent progress stage. I plan to take care of low allocations to fairness for the subsequent six months due to excessive geopolitical dangers and recession dangers.

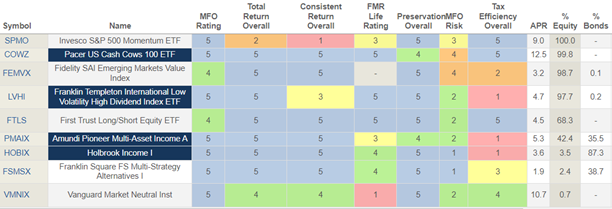

Desk #3: Trending Different and Fairness Funds (Metrics -4 Months)

Observe that the 2 worldwide worth funds (AVDV, DFIV) have been trending increased currently.

Determine #2: Trending Different and Fairness Funds (Metrics -4 Months)

SHORT LIST OF TOP PERFORMING FUNDS

This part covers funds that carried out comparatively nicely over the previous a number of months. These funds had been chosen by particular person funds as a substitute of focusing first on the Lipper Class.

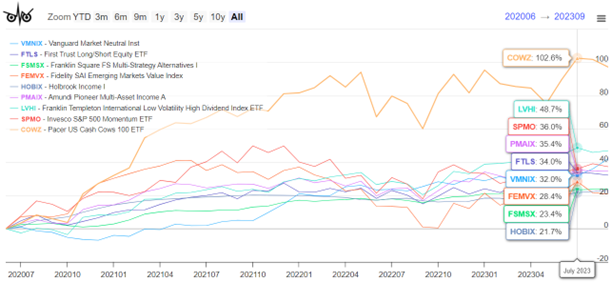

Desk #4: Brief Record of Trending Funds (Metrics -4 Months)

Pacer US Money Cows (COWS) has completed nicely over the previous few years. Within the subsequent part, I add the Pacer Trendpilot 100 Fund (PTNQ) for comparability.

Determine #3: Brief Record of Trending Funds (Metrics -4 Months)

COMPARISON TO AUTHOR’S FUNDS

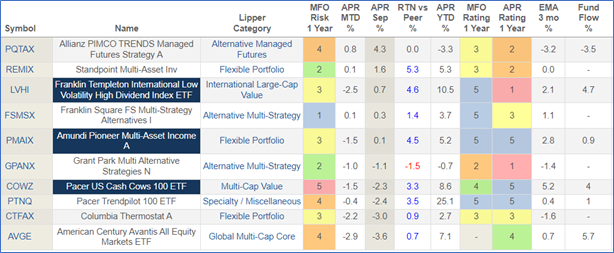

On this part, I chosen among the extra conservative funds from the earlier part and in contrast them to among the funds that I personal (PQTAX, REMIX, GPANX, CTFAX). I need to take a better have a look at the 2 Different Multi-Technique funds (FSMSX and GPANX) and the 2 Versatile Portfolio Funds (PMAIX and CTFAX) to see if I need to make a commerce.

“APR MTD” returns are October returns by the 24th. I personal a small starter place in American Century Avantis All Fairness Markets (AVGE) and plan so as to add to it on main pullbacks.

Desk #5: Comparability to Writer’s Funds

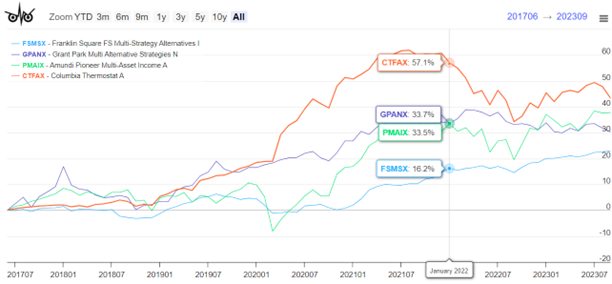

Whereas I’m a bit disenchanted with the short-term efficiency of GPANX and CTFAX, I’m glad with their longer-term efficiency and never able to make a commerce right now.

Determine #4: Comparability of Writer’s Funds to Related Classes

Closing Ideas

October is often a poor-performing month for shares, and final month, shares supported this pattern. I initiated a Roth Conversion in a managed account, which could have a small influence on rising allocations to equities. For the subsequent few months, I’ll proceed to increase the length of bond funds. I count on that shares will probably be decrease subsequent yr because the financial system slows, and I plan one other Roth Conversion subsequent yr. If shares do fall as I count on (hope), I’ll swap from shopping for longer-duration bond funds to equities.