The impacts of hurricanes analyzed within the earlier put up on this collection could also be far-reaching within the Second District. In a brand new Employees Report, we examine how banks in Puerto Rico fared after Hurricane Maria struck the island on September 17, 2017. Maria makes a worst case in some respects as a result of the financial system and banks there have been susceptible beforehand, and since Maria struck simply two weeks after Hurricane Irma flooded the island. Regardless of the immense destruction and disruption Maria brought on, we discover that the island’s financial system and banks recovered surprisingly shortly. We talk about the assorted protections—together with owners’ insurance coverage, federal support, and mortgage ensures—that helped buttress the island’s financial system and banks.

Double Strike

Puerto Rico’s location within the Caribbean leaves it extremely uncovered to all method of extreme climate, together with floods, droughts, tropical storms, and winter swells. Since 1955, FEMA has declared forty-five disasters there, twenty-eight of which had been hurricanes or extreme storms.

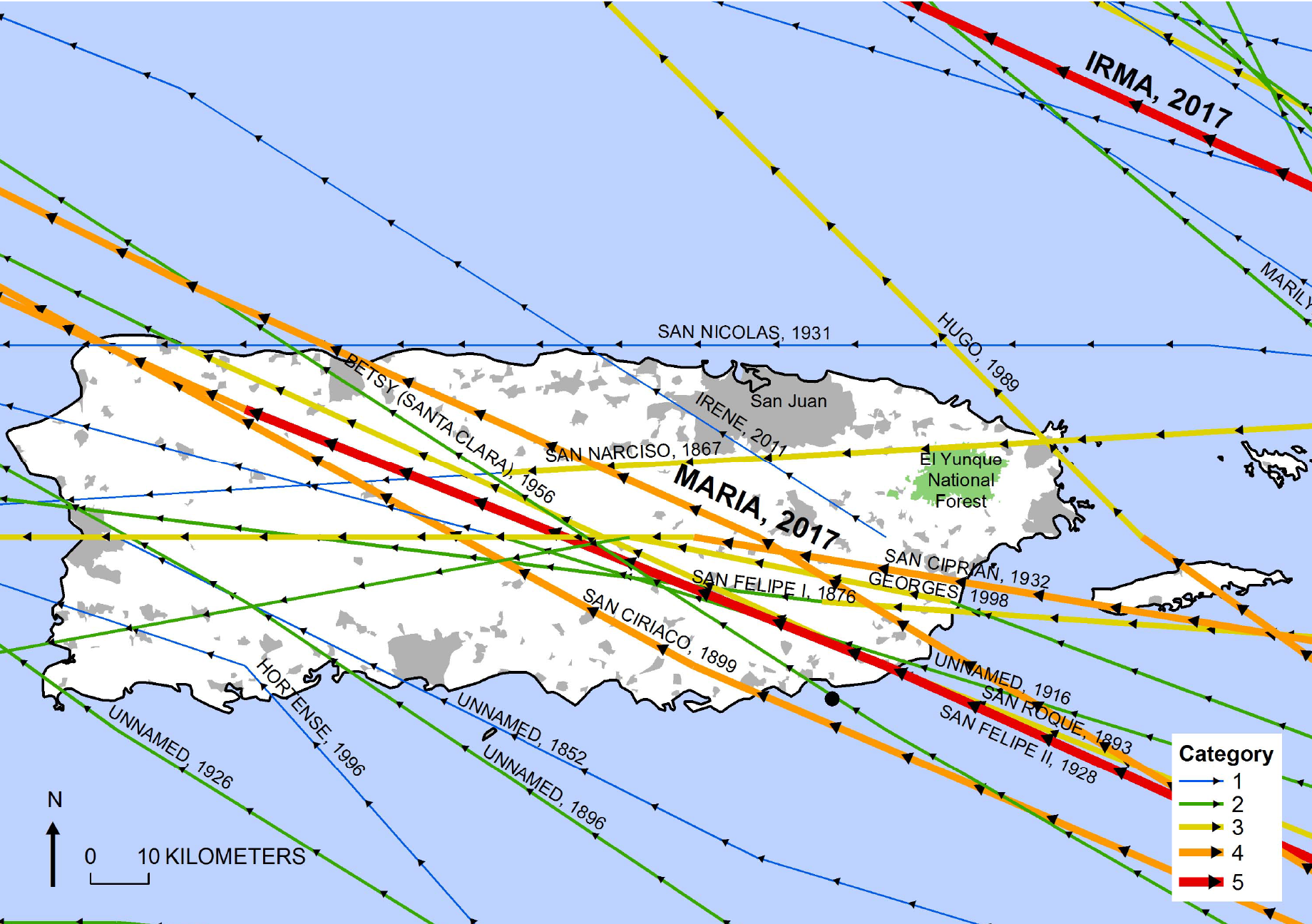

The Paths of Hurricanes Maria and Irma

Supply: U.S. Geological Survey.

The total fury of Irma (the attention) handed thirty miles north of the primary island of Puerto Rico on September 6, however the island was nonetheless buffeted by 55 mph winds and a foot of rain in locations. Culebra and Vieques, smaller islands off the primary island, had been particularly onerous hit. The island was nonetheless reeling from Irma when Maria struck full power on September 17, with winds of 155 mph and most rainfall of 38 inches in 48 hours. Maria destroyed 80 p.c of the island’s electrical grid and blacked out most of Puerto Rico’s 3.4 million residents for months. 1000’s of properties had been broken or destroyed. Flash floods brought on landslides and destroyed many bridges. FEMA estimated damages from Maria at $90 billion, making it the third costliest hurricane in U.S. historical past. The mixed damages from Maria and Irma practically exceeded the island’s $104 billion GDP in 2016.

Financial Influence

The chart under tracks employment in Puerto Rico utilizing August 2017 because the benchmark (100). The development was flat or downward earlier than Maria struck, reflecting longer-term financial difficulties which can be mentioned in our paper. Employment fell sharply, about 7 p.c, after Maria however had absolutely recovered by July 2018. Apparently, employment grew sooner afterwards than earlier than Maria, in keeping with this latest examine documenting optimistic medium-term results of climate disasters on native employment and revenue.

Puerto Rico’s Employment Fell Sharply after Maria however Recovered Rapidly

Notes: Chart plots whole personal employment in Puerto Rico relative to August 2017.

Financial institution Influence

There have been three banks headquartered in Puerto Rico when Maria struck, establishments that collectively held 75 p.c of all home deposits on the island. In our evaluation, we evaluate these banks’ efficiency to a management group of U.S. banks that weren’t uncovered to any kind of climate disasters over the post-hurricane comparability interval.

The primary signal of bother at banks is often mounting mortgage delinquencies. The left panel under exhibits that delinquencies at Puerto Rico banks rose after Maria, significantly in comparison with the management, however the deterioration was modest and pretty short-lived. Financial institution revenue additionally fell sharply afterward, as proven in the fitting panel, however rebounded inside two quarters.

Puerto Rico Banks’ Efficiency Deteriorated after Maria however Rebounded Rapidly

Sources: Financial institution name reviews and Y9-C filings.

Notes: Panels present means for every interval for 3 Puerto Rico-headquartered banks and a management group of U.S. banks that weren’t uncovered to any (FEMA-declared) climate catastrophe between 2017:Q3 and 2019:Q3. The vertical line signifies when Maria struck. Delinquency fee = 90 days+ late. Earnings is measured in log phrases.

We confirmed these results extra rigorously in our paper, the place we management for particular person financial institution traits and financial situations. We additionally take a look at different financial institution efficiency measures, comparable to capital and default danger, however don’t discover important adjustments. The modest (or null) impacts we discover for Puerto Rico banks, although probably shocking, are in keeping with the outcomes of different latest research (Blickle et al., 2022; Brei et al., 2016; Gallagher and Hartley, 2017).

Mitigated Disasters

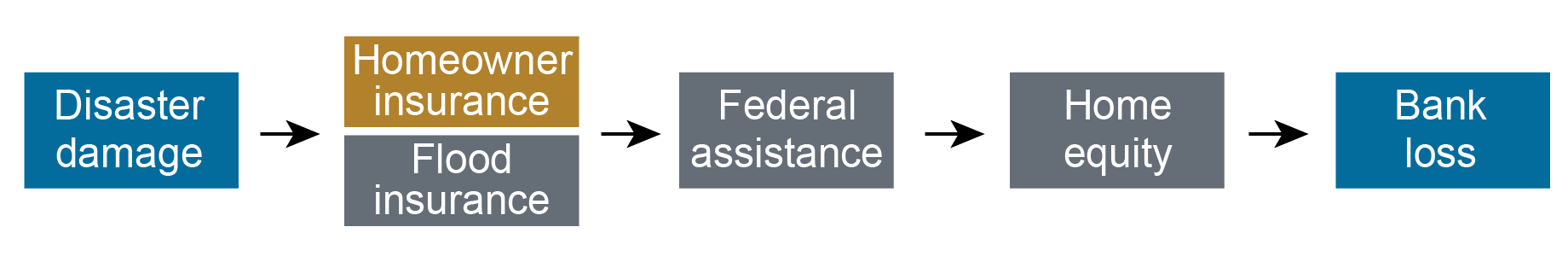

Regardless of the combination catastrophic impacts of Irma-Maria, a number of layers of safety helped mitigate the affect (see chart under).

Layers of Catastrophe Safety

The primary mitigant is home-owner’s and flood insurance coverage. By enabling owners to restore broken property, relatively than abandon it, insurance coverage protects lenders not directly.

Federal catastrophe help can also present oblique safety. Puerto Rico acquired $20.6 billion in FEMA support after Irma-Maria, $19.3 billion in public help for rebuilding infrastructure, and $1.4 billion in particular person help to assist uninsured households and people. By supporting employment and restoration, this support might have benefited banks not directly, however the profit is troublesome to quantify.

Mortgage insurance coverage by means of the Veteran’s Administration and Federal Housing Administration offered direct safety to banks. These companies assure mortgage reimbursement within the occasion of default because of harm to the house or unemployment (amongst different occasions). Utilizing McDash information, we discovered that over 30 p.c of mortgages in Puerto Rico had been lined by one or the opposite assure when Irma-Maria hit. Loss charges on these mortgages by means of November 2019 had been simply 0.1 to 0.2 p.c, in comparison with 1 p.c on standard mortgages with out personal or authorities mortgage insurance coverage.

Borrower’s house fairness is one other layer of direct safety to banks, one they management although their underwriting. In Puerto Rico, nevertheless, house fairness had been declining for years earlier than 2017, because the lengthy financial downturn depreciated house costs. Thus, house fairness ranges probably didn’t present sturdy help to banks holding these mortgages.

Takeaways

Puerto Rico banks had been surprisingly resilient towards the back-to-back hurricanes that wracked the island in September 2017, due to the mitigating results of property insurance coverage, federal mortgage insurance coverage and catastrophe help, and, to a lesser extent, their very own underwriting. This discovering is reassuring from a monetary stability perspective, but in addition for households which may want extra credit score to rebuild and get well from climate disasters. We warning, nevertheless, that these mitigants might themselves be threatened by local weather change if personal and federal insurers withdraw from catastrophe zones or enhance protection prices prohibitively or if federal catastrophe help turns into scarcer.

Peter Anagnostakos is a high quality administration supervising examiner within the Federal Reserve Financial institution of New York’s Supervision Group.

Jason Bram was a analysis officer within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Benjamin Chan is an institutional supervision program supervisor within the Federal Reserve Financial institution of New York’s Supervision Group.

Natalia Fischl-Lanzoni is a analysis analyst in Monetary Intermediation within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Hasan Latif is an institutional supervision supervising examiner within the Federal Reserve Financial institution of New York’s Supervision Group.

James M. Mahoney is an institutional supervision program director within the Federal Reserve Financial institution of New York’s Supervision Group.

Donald P. Morgan is a monetary analysis advisor on Banking Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Ladd Morgan is a capital markets danger supervising examiner within the Federal Reserve Financial institution of New York’s Supervision Group.

Ivelisse Suarez is an institutional supervision supervising examiner within the Federal Reserve Financial institution of New York’s Supervision Group.

Tips on how to cite this put up:

Peter Anagnostakos, Jason Bram, Benjamin Chan, Natalia Fischl-Lanzoni, Hasan Latif, James M. Mahoney, Don Morgan, Ladd Morgan, and Ivelisse Suarez, “Banks versus Hurricanes,” Federal Reserve Financial institution of New York Liberty Road Economics, November 20, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/banks-versus-hurricanes/.

Disclaimer

The views expressed on this put up are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the writer(s).