The financial institution failures that occurred in March 2023 highlighted how unrealized losses on securities could make banks susceptible to a sudden lack of funding. This threat, which materialized following the fast rise in rates of interest that started in early 2022, underscores the significance of monitoring the vulnerabilities of the banking system. On this publish, as in earlier years, we offer an replace of 4 analytical fashions aimed toward capturing totally different facets of vulnerability of the U.S. banking system, with knowledge by way of the second quarter of 2023. As well as, we focus on modifications made to the methodology primarily based on the teachings from March 2023 and assess how the system-level vulnerability has advanced.

How Do We Measure Banking System Vulnerability?

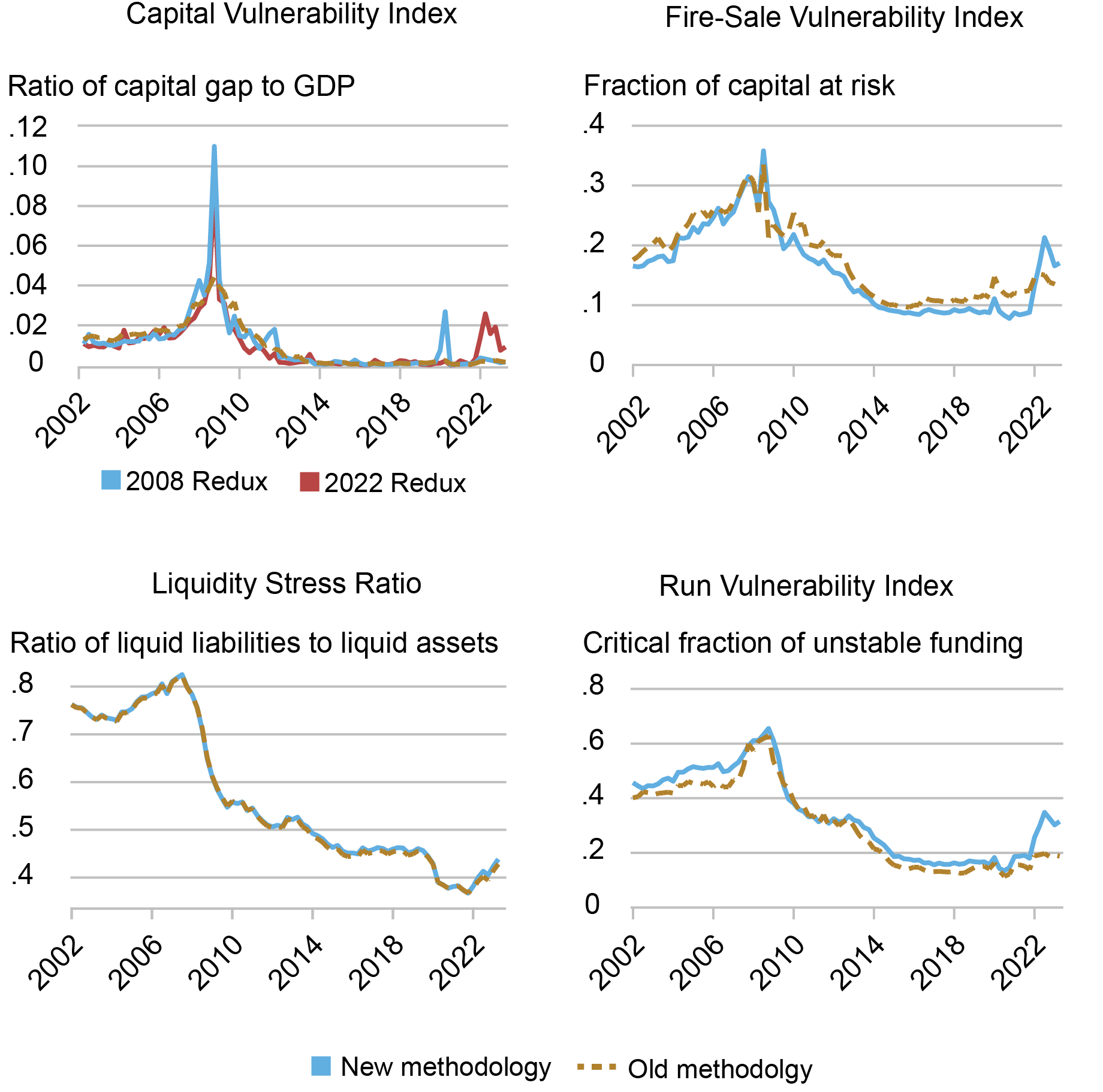

We take into account the next measures supposed to seize key dimensions of the vulnerability of the banking system, all primarily based on analytical frameworks developed by New York Fed employees or tailored from tutorial analysis and utilizing publicly obtainable regulatory knowledge on financial institution holding corporations. The 4 measures had been launched in a 2018 Liberty Avenue Economics publish and have been up to date yearly since then. The chart under reveals the 4 measures and compares the brand new methodology (strong traces) to the previous methodology (dashed traces).

Supply: Authors’ calculations, primarily based on FR Y-9C experiences.

Crucial change in methodology is that the measures now incorporate unrealized losses (or good points) on all securities. The aim of this transformation is to replicate extra carefully the financial worth of financial institution property in a stress situation. Nevertheless, this transformation implies that the measures deviate each from accounting requirements, the place held-to-maturity securities are valued at amortized price, and from regulatory requirements, the place unrealized good points or losses on available-for-sale securities usually are not included in regulatory capital apart from the very largest banks.

Capital Vulnerability Index

This index measures how well-capitalized the banks are projected to be after a extreme macroeconomic shock. It’s constructed utilizing the CLASS mannequin, a top-down stress-testing mannequin developed by New York Fed employees. The index measures the capital hole—that’s, the mixture quantity of capital wanted beneath a macroeconomic situation to deliver every financial institution’s Tier 1 frequent fairness capital to at the least 10 p.c of risk-weighted property—and scales the cap by GDP.

In earlier years, we calculated the Capital Vulnerability Index solely beneath a macroeconomic situation equal to the 2008 disaster (“2008 redux”). Nevertheless, the financial institution failures in March 2023 confirmed that banks are additionally susceptible to a fast rise in rates of interest that reduces the truthful worth of their securities holdings. We subsequently additionally calculate the Capital Vulnerability Index beneath a situation equal to the 2022 rise in rates of interest, the place unrealized good points and losses on securities are absolutely mirrored in banks’ capital ranges (“2022 redux”). In each eventualities, we made some changes to deal with the non-stationarity of essential macroeconomic variables, equivalent to rates of interest.

The Capital Vulnerability Index primarily based on the 2008 disaster is at the moment at traditionally low ranges, round 1.55 p.c of GDP (as proven within the upper-left panel of the chart above). Pushed primarily by mortgage provisions, the spike on the onset of the 2020 COVID-19 pandemic subsided as unemployment—and, in flip, anticipated credit score losses—returned to pre-pandemic ranges towards the tip of 2021. The Capital Vulnerability Index primarily based on the 2022 situation is at the moment nonetheless considerably elevated by current historic requirements. Such vulnerability originates from banks’ publicity to a sudden drop within the worth of securities following a hypothetical additional enhance in rates of interest.

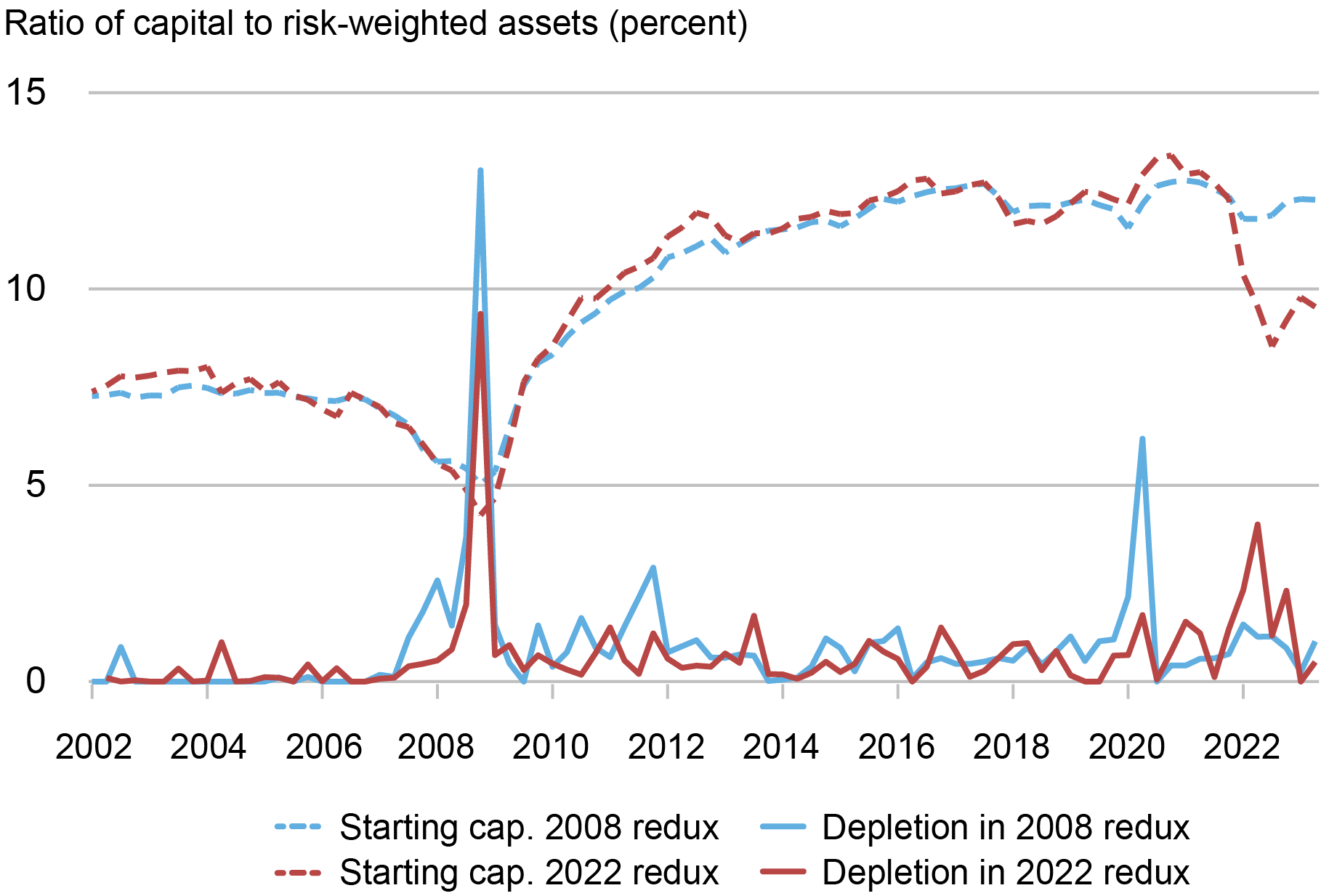

Though funding is assumed to be steady on this mannequin, the financial worth of banks’ securities portfolios decreased with the rise in charges. The next gradual enhance in web curiosity margins, largely pushed by the restricted pass-through of upper charges into deposit charges, may ultimately make up for the preliminary drop in securities’ values, however the doubtlessly fast losses may nonetheless expose banks to capital shortfalls. The chart under paperwork the decomposition of the Capital Vulnerability Index into its two important elements at any given time limit, specifically the beginning stage of capital and the capital depletion in the course of the projection interval. The chart confirms the sizable drop in capital ranges as soon as unrealized good points and losses are thought-about.

Decomposition of Capital Vulnerability Index

Supply: Authors’ calculations, primarily based on FR Y-9C experiences.

Fireplace-Sale Vulnerability Index

This index captures the vulnerability of banks to a hypothetical system-wide asset fireplace sale, calculating the spillover losses as a fraction of banks’ Tier 1 capital. It’s primarily based on the Journal of Finance article “Fireplace-Sale Spillovers and Systemic Danger.” Primarily based on the expertise of March 2023, the methodology now incorporates all unrealized losses (or good points) by measuring securities labeled as “held to maturity” (HTM) at their truthful worth as an alternative of the standard accounting technique of amortized price. As well as, unrealized losses on all securities are included in fairness. This alteration in measurement will increase leverage and subsequently fire-sale vulnerability in intervals of notable unrealized losses—for instance, because of rising rates of interest. We additionally differentiate the liquidity of property additional utilizing values from the Internet Steady Funding Ratio of Basel III.

Evaluating the fire-sale vulnerability index beneath the 2 methodologies reveals that probably the most notable variations are within the interval since 2016 (see the upper-right panel of the primary chart of this publish). Differentiating property’ liquidity dampens the rising pattern in fire-sale vulnerability since 2016 due to a concurrent shift towards extra liquid property on massive banks’ steadiness sheets. The extra pronounced change is the spike in fire-sale vulnerability since early 2022, which is way bigger as a result of the brand new methodology accounts for unrealized losses on all securities. Whereas fire-sale vulnerability has retraced a number of the spike seen in 2023, it stays elevated in comparison with the low ranges of the previous ten years.

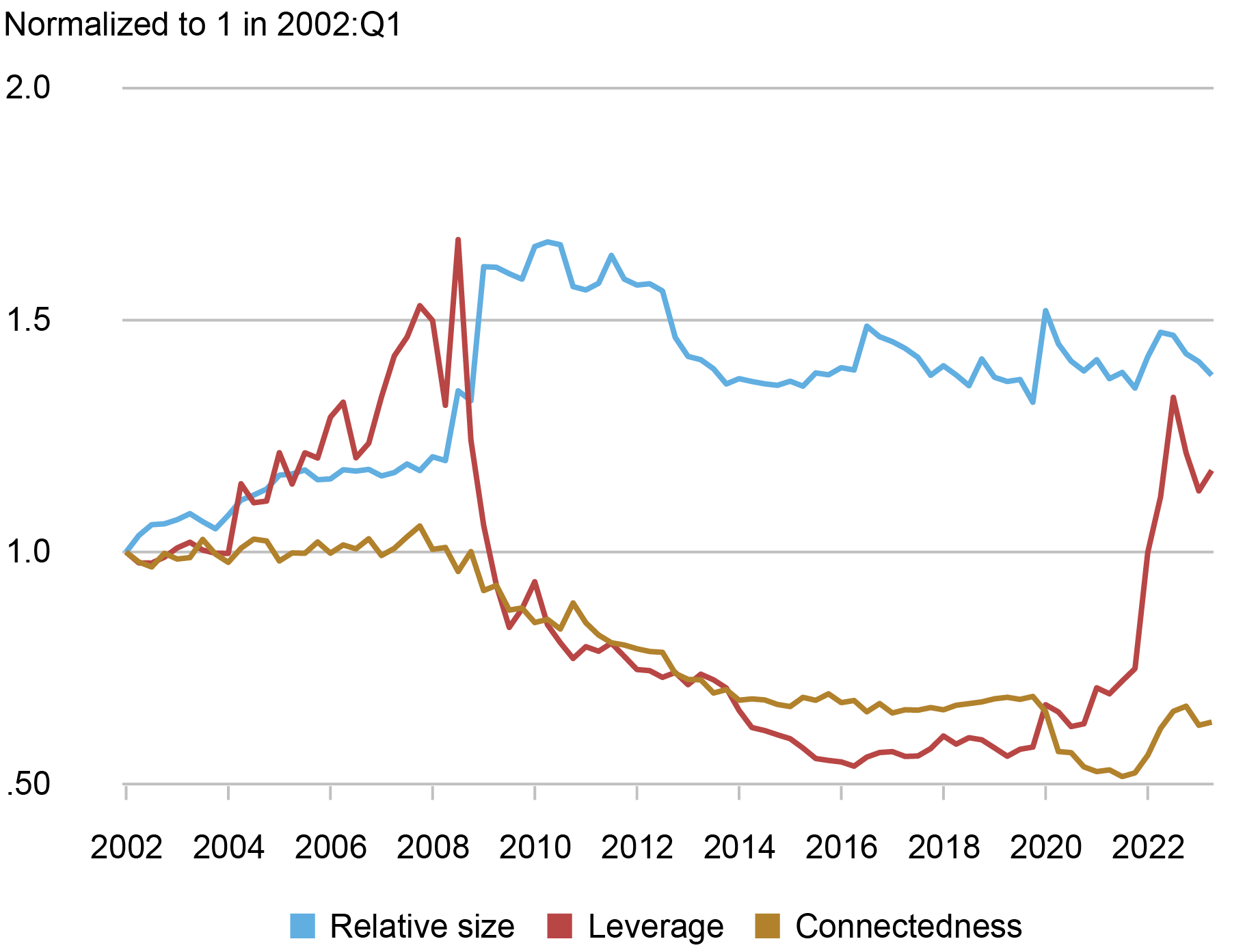

The chart under decomposes the index into the dimensions of the banking system, its leverage, and its “connectedness.” Whereas system measurement and connectedness have been contributing components, the spike within the index since early 2022 is generally because of a rise in leverage.

Decomposition of Fireplace-Sale Vulnerability Index

Supply: Authors’ calculations, primarily based on FR Y-9C experiences.

Liquidity Stress Ratio

This ratio measures the potential liquidity shortfall of banks beneath circumstances of liquidity stress, as captured by the mismatch between liability-side (and off-balance-sheet) liquidity outflows and asset-side liquidity inflows. For every particular person financial institution, it’s outlined because the ratio of runnability-adjusted liabilities plus off-balance-sheet exposures (with every legal responsibility and off-balance-sheet publicity class weighted by its anticipated outflow charge) to liquidity-adjusted property (with every asset class weighted by its anticipated market liquidity). The liquidity stress ratio grows when anticipated funding outflows enhance or property change into much less liquid. The combination ratio is computed as a size-weighted common of the person banks’ liquidity stress ratio.

Following the occasions of March 2023, the liquidity stress ratio is now calculated by utilizing the truthful worth somewhat than the amortized price for HTM securities, to account for unrealized losses or good points on these property. The combination ratios primarily based on the brand new and the previous methodologies exhibit some variations from 2016 onward, with the previous being considerably larger at instances of rising rates of interest, particularly throughout 2022 (see the bottom-left panel within the first chart of this publish).

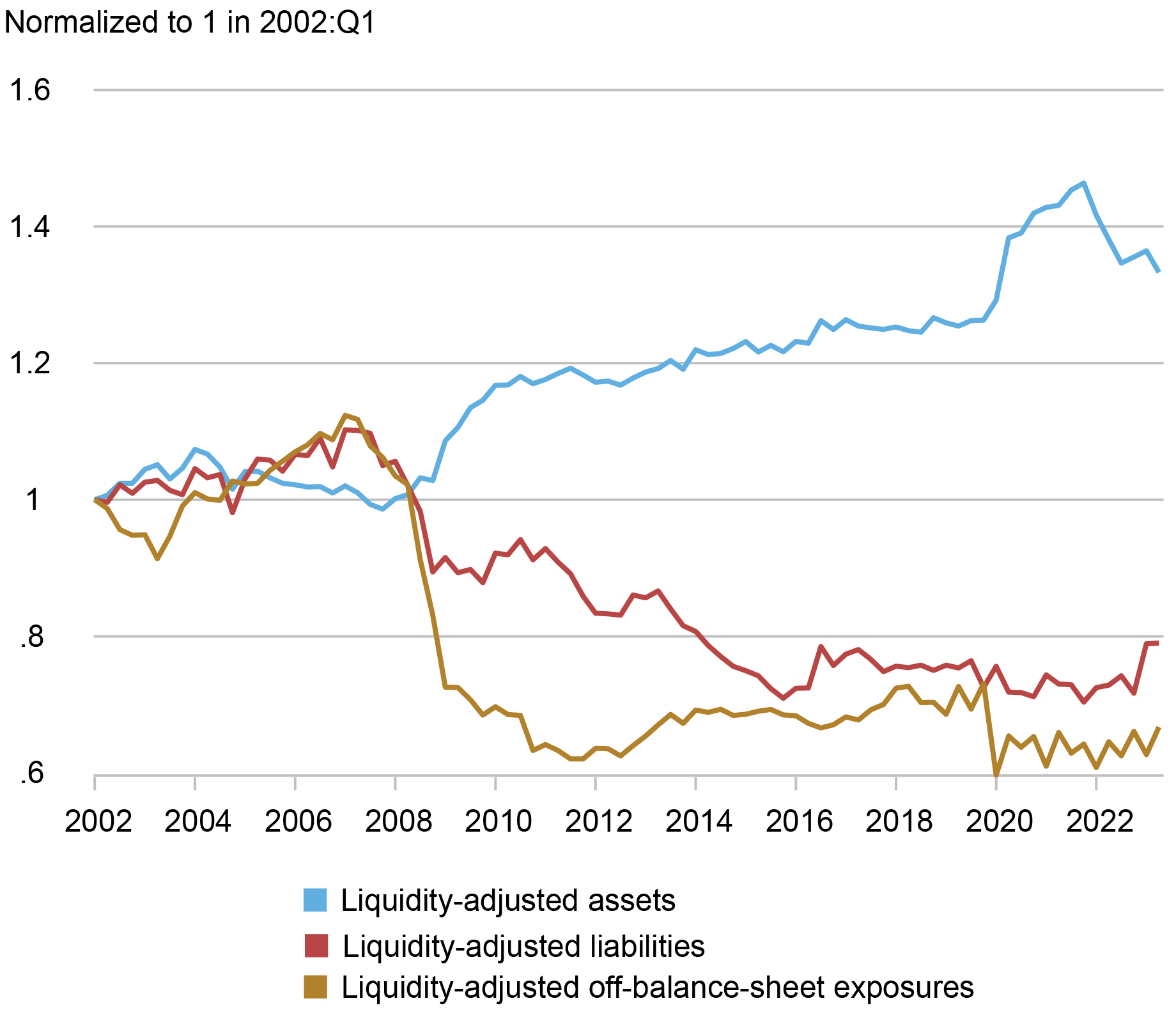

After a dip in 2020 and a flat path in 2021, the liquidity stress ratio rebounded in 2022 and early 2023 to nearly attain its pre-pandemic stage. Trying on the underlying elements of the ratio within the chart under, we see that the marked enhance within the ratio since early 2022 is pushed by a shift from liquid to less-liquid property and from steady to unstable funding.

Decomposition of Liquidity Stress Ratio

Supply: Authors’ calculations, primarily based on FR Y-9C experiences.

Run Vulnerability Index

This measure gauges a financial institution’s vulnerability to runs, measured because the crucial fraction of unstable funding the financial institution must retain in a stress situation to stop insolvency. Run vulnerability combines liquidity and solvency as a result of a financial institution can fail because of a sufficiently massive shock to property, a sufficiently massive lack of funding, or each. The combination index is computed as a size-weighted common of the person banks’ run vulnerability. The methodology now additionally makes use of truthful worth for all securities, which will increase leverage within the interval since early 2022, and it assumes a 1 p.c shock to all property because the stress situation.

Evaluating the run vulnerability index beneath the 2 methodologies reveals that probably the most notable distinction is within the interval since 2022, the place the index is significantly larger as a result of unrealized losses on securities rising leverage (see the lower-right panel of the primary chart of this publish).

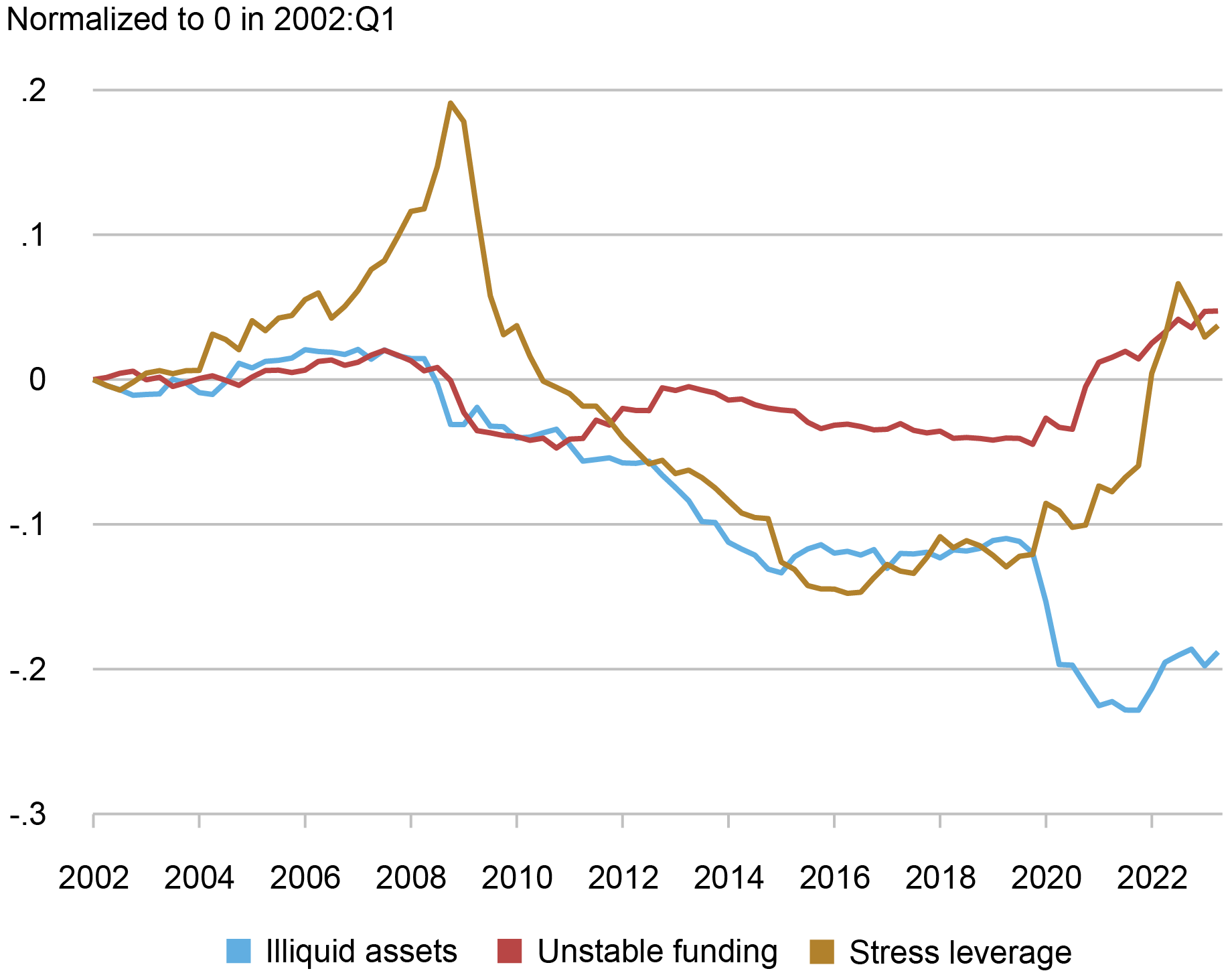

Contemplating the underlying elements of run vulnerability within the chart under, we see that the rise within the index since early 2022 is principally because of a rise in leverage, however that the opposite elements— unstable funding and illiquid property—have additionally elevated over this era.

Decomposition of Run Vulnerability Index

Supply: Authors’ calculations, primarily based on FR Y-9C experiences.

Ultimate Phrases

The March 2023 banking disaster highlighted the vulnerability of the banking sector to a sudden rise in rates of interest. Particularly, banks’ capability to restrict the pass-through of rate-hiking cycles into deposit charges permits them to learn from larger charges, however solely step by step. But, within the short-term, banks may undergo losses of their securities portfolio that may, in flip, induce funding dry-ups and considerably weakened efficient capital ranges. Our measures, tailored to this current shock, counsel a reasonable enhance in systemic vulnerability in comparison with the low ranges of the earlier ten years. Nevertheless, systemic vulnerability nonetheless stays under the excessive ranges previous the 2008 disaster, particularly as a result of the biggest banks are usually much less uncovered to capital shortfalls, fireplace gross sales, liquidity mismatches, and run threat in comparison with smaller establishments.

Matteo Crosignani is a monetary analysis advisor in Non-Financial institution Monetary Establishment Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Thomas M. Eisenbach is a monetary analysis advisor in Cash and Funds Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Fulvia Fringuellotti is a monetary analysis economist in Non-Financial institution Monetary Establishment Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

The right way to cite this publish:

Matteo Crosignani, Thomas Eisenbach, and Fulvia Fringuellotti, “Banking System Vulnerability: 2023 Replace,” Federal Reserve Financial institution of New York Liberty Avenue Economics, November 6, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/banking-system-vulnerability-2023-update/.

Disclaimer

The views expressed on this publish are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the writer(s).