I hope everybody had an opportunity to benefit from the holidays and spend time with household! I want you a nice and affluent new 12 months.

I used to be making ready for my typical overview of forecasts for the approaching 12 months and browse an attention-grabbing dialogue about allocation methods on the MFO Dialogue Board and redirected my efforts. The discussions centered round funding and withdrawal methods. On this article, I’ll create three base instances in comparison with the S&P500 utilizing Portfolio Visualizer in response to the feedback. I add context utilizing secular and enterprise cycles for the final ninety-five years. I look briefly at life expectations. I reviewed my very own funding system for setting allocations and closed with a overview of trending Lipper Classes utilizing the Mutual Fund Observer MultiScreen Device.

This text is split into the next sections:

SUMMARY OF COMMENTS ON MFO DISCUSSION BOARD

The dialogue on the MFO Dialogue Board about allocation methods largely in retirement is New Report: All Inventory Portfolio Beats Inventory and Bond Combine Over Time. I summarize among the ideas that had been within the Dialogue by Class and ranked by my choice:

- ALLOCATION TO STOCKS

- Glide path of proudly owning extra shares within the accumulation stage and being extra balanced within the retirement stage.

- Assured earnings (Pensions, Social Safety) permits one to take extra funding threat.

- Yields are excessive for allocations to bonds must be larger.

- Fairness valuations are excessive so allocations must be tilted to bonds.

- Warren Buffet’s allocation of 90% inventory (for the rich).

- Traders could also be higher off investing in half home and half worldwide shares than in a 60/40 stock-to-bond portfolio.

- WITHDRAWAL STRATEGY

- Beginning withdrawals conservatively after which ramping up later.

- Basing withdrawal on spending wants.

- Having larger allocations to shares and the next withdrawal price.

- MANAGING RISK

- Having sufficient saved for retirement and basing threat on financial savings.

- Sequence of return threat.

- Utilizing buffer belongings like money, a reverse mortgage or entire life coverage with money worth.

- Spend conservatively.

- Be versatile with spending throughout market fluctuations.

- Glide path of being conservative initially in retirement and rising allocations later in retirement.

- Annuitizing a part of a portfolio to create assured earnings.

- The chance of being too conservative.

LIFE EXPECTANCY

Key Level: Knowledge displaying returns for the previous century or extra is irrelevant when our investing time horizon is simply a fraction of that. We must always put together for max life expectancy quite than common life expectancy.

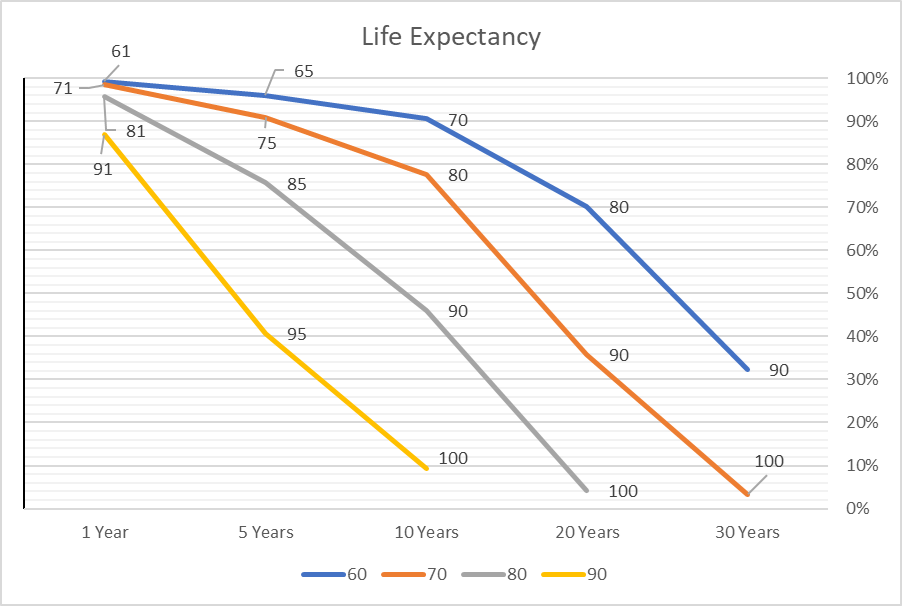

The life expectancy for ladies at delivery is about 79 years. Determine #3 reveals how life expectancy adjustments with age. There may be roughly a 32% likelihood {that a} 60 year-old-woman will stay to age 90. A girl who has lived to age 80 has roughly 45% of dwelling to age 90. We must always put together for max life expectancy quite than common life expectancy to be able to not outlive our financial savings.

Determine #3: Life Expectancy at Ages 60, 70, 80, and 90 (Labels = Age)

CREATING THREE BASE CASES FOR THE PAST 37 YEARS

Key Level: Handle Danger First – At all times keep a number of years of dwelling bills in secure investments. This together with assured earnings, quantity of financial savings, threat tolerance, and long-term market outlook are the primary inputs into setting an allocation technique in retirement. I exploit a Monetary Planner and advocate most individuals ought to begin utilizing one early within the accumulation stage.

All-Fairness Portfolio Beats Bonds In Retirement Plans, New Analysis Finds describes a research that discovered throughout a pattern of three dozen nations over 130 years was that a mixture of half home, half worldwide equities really beat blended portfolios in each cash made and capital preserved. My investing horizon is considerably lower than 130 years throughout which two world wars occurred so I don’t put any relevance into these research, legitimate as they might be.

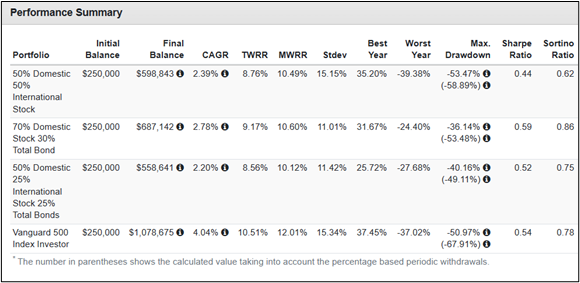

Portfolio Visualizer can be utilized to seek out the best-performing methods from 1985 to 2023. I created three methods for comparability with the S&P 500. The hyperlink to the Portfolio Visualizer Backtest is right here. The methods are 1) 100% US inventory (VFINX), 2) 50% US inventory (VFINX) and 50% Worldwide Inventory (VTRIX), 2) 70% US Inventory (VFINX) and 30% Bonds (VBMFX), and three) 50% US inventory (VFINX), 25% Worldwide Inventory (VTRIX), and 25% Bonds (VBMFX). I assumed a 6% annual withdrawal price.

The outcomes for the thirty-seven-year interval are that investing 100% within the S&P 500 had the very best return, but additionally a most drawdown of 68% together with a 6% withdrawal price. The second-best performing technique is the 70% US Inventory (VFINX) and 30% Bonds (VBMFX) portfolio which additionally had the very best Sortino Ratio or risk-adjusted return. The portfolios are rebalanced yearly.

Desk #1: Base Instances for Previous 37 Years Utilizing Portfolio Visualizer

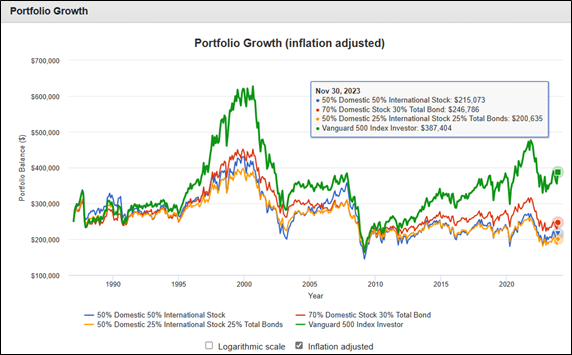

Determine #1 reveals the methods adjusted for inflation. All 4 methods held up effectively in opposition to inflation however solely the 100% SP500 technique beat inflation whereas 70% inventory/30% bond portfolio got here shut.

Determine #1: Base Instances Portfolio Progress for Previous 37 Years Utilizing Portfolio Visualizer

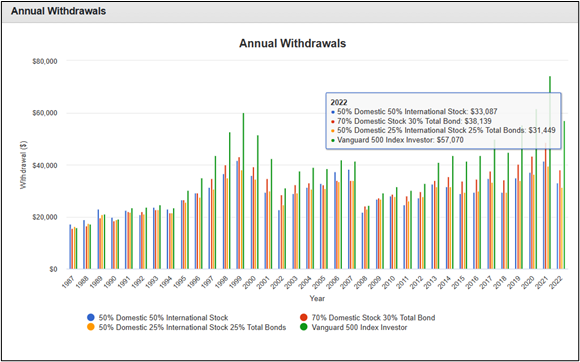

Determine #2 reveals annual withdrawals on a nominal foundation with out inflation changes. Total, the withdrawals would have saved up with inflation, however withdrawals in 2008 wouldn’t have saved up a gradual stream of inflation-adjusted returns. One various withdrawal technique can be to withdraw much less within the years with excessive returns and reinvest the surplus returns. A second method might be a bucket method the place you withdraw from safer investments within the dangerous occasions as a substitute of rebalancing yearly.

Determine #2: Nominal Annual Withdrawal for Previous 37 Years Utilizing Portfolio Visualizer

Whereas a technique of withdrawing 6% in the course of the previous 37 years would have labored comfortably, the previous decade has skilled unprecedented financial stimulus which has inflated many belongings. Valuations and inflation are main components in figuring out future returns. The utmost withdrawal price might rely upon spending wants and needs to cross alongside an inheritance, however the time-tested 4% withdrawal price is a reasonably secure assumption for historic market circumstances.

REVIEW OF 95 YEARS OF STOCK AND BOND PERFORMANCE

Key Level: Secular markets can suppress returns for many years. Shares and bonds normally transfer in reverse instructions decreasing sequence of return threat.

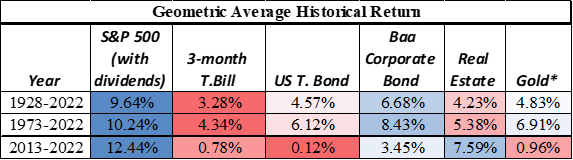

For this part, I depend on information supplied by Aswath Damodaran on the Stern College of Enterprise at New York College. Since 1928, shares have returned 9.6% in comparison with a good 6.7% for company bonds. Shares have returned 10.5% since 1987 used within the Portfolio Visualizer instance above.

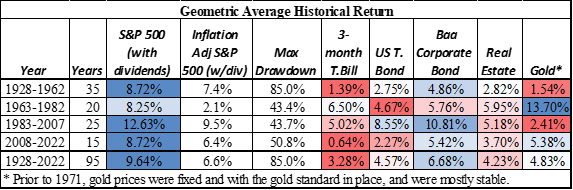

Desk #2: Historic Returns Supply: Aswath Damodaran on the Stern College of Enterprise at New York College

Desk #3 reveals secular returns. The time interval from 1928 to 1962 lined the Melancholy, World Battle II, and finish of the warfare over which period shares returned 8.7%. The following time interval, 1962 – 1982 was outlined by stagflation with sluggish development and excessive inflation from which shares solely returned 2.1% on an inflation-adjusted foundation. The Nice Moderation was from 1983 to the mid-2000s, and shares grew at 12.6% with comparatively low inflation. Throughout three of the time intervals, on common shares would have supported a 6% withdrawal price, nevertheless, inside every of those intervals, a sustained drawdown of greater than forty p.c posed critical dangers.

Desk #3: Historic Returns by Secular Markets

Supply: Writer Utilizing Knowledge from Aswath Damodaran on the Stern College of Enterprise at New York College; Inflation Adjusted Knowledge from DQYDJ; Drawdown from James Picerno at Looking for Alpha

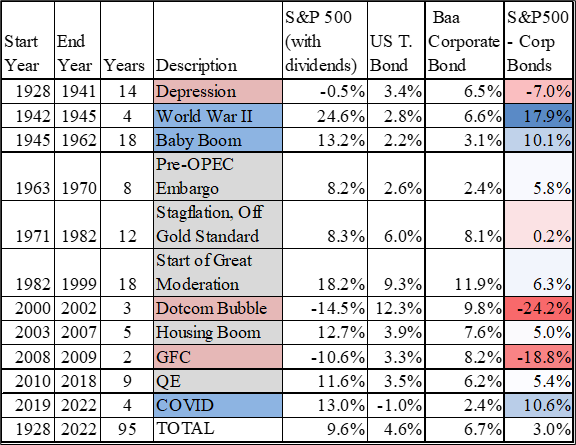

Desk #4 accommodates a extra detailed breakdown of time intervals. It reveals that there are three time intervals by which shares don’t outperform bonds and one by which they’re about the identical. One of many vital traits of bonds is that their worth usually strikes in the wrong way of shares. One can withdraw from shares after they outperform and draw from bonds after they outperform.

Desk #4: Historic Returns by Notable Market Circumstances

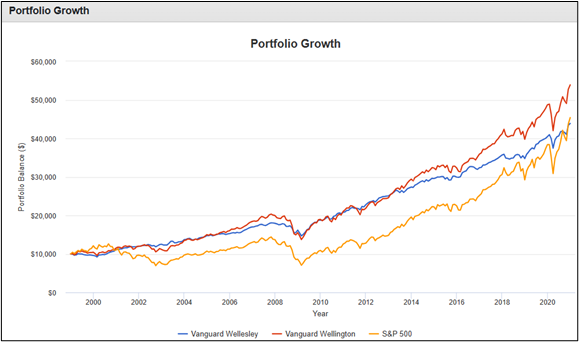

As an example the advantages of getting a balanced portfolio, from 1999 till 2020, the conservative Vanguard Wellesley (VWINX) and average Vanguard Wellington (VWELX) have overwhelmed the S&P 500. This illustrates the significance of beginning and ending factors – sequence of return threat. A excessive allocation of shares in 1999 may have impacted financial savings for the rest of retirement.

Determine #4: Instance 1998 – 2022 Vanguard Wellesley, Wellington, S&P 500

The approaching decade is prone to have inventory returns beneath historic tendencies. Valuations are presently reasonably excessive as I described final month. Practically 40% of revenues of the S&P 500 come from different nations, and tendencies of deglobalization will negatively impression some industries and have a tendency to extend inflation. Inhabitants development is slowing which suggests slower financial development. Excessive money owed and deficits recommend rates of interest will stay larger for longer. Unwinding Quantitative Easing will in all probability dampen asset costs. I favor a balanced portfolio that’s diversified globally and tilted towards high quality bonds.

CURRENT MARKET CONDITIONS AND 2024 OUTLOOK

Discuss of a smooth touchdown continues to be wishful considering with the yield curve nonetheless inverted. Few buyers acknowledged that excessive valuations had been wishful considering previous to the bursting of the know-how bubble in 1999 or acknowledged the hazard of “secure” tranches of subprime loans previous to the bursting of the housing bubble. Nonetheless, I wish to overview respectable outlooks for the approaching 12 months however put extra emphasis by myself nowcast within the subsequent part.

Vanguard launched its Financial And Market Outlook For 2024, “Vanguard anticipates that the US and different developed markets will grapple with gentle recessions in coming quarters and that central banks will minimize rates of interest, possible within the second half of 2024, amid development challenges and inflation falling towards the banks’ targets.” Additionally they count on larger actual rates of interest for longer.

Wells Fargo’s December 2023 Outlook features a gentle recession. “…the specifics on whether or not or not we really pull off the smooth touchdown or have a light recession is type of much less vital than the truth that it’s simply form of going to be a crummy 12 months.” Senior Economist Tim Quinlan provides that the buyer is holding up the financial system however circumstances are usually not as supportive.

Constancy’s 2024 Outlook is that now we have been in a late-cycle enterprise growth which is supported by a stronger client, bettering company earnings, and easing inflation. They’re seeing indicators of moderating development and might even see slowly rising delinquencies for auto loans and bank card funds. The Constancy fastened earnings managed account group has a base case that we might expertise some sort of gentle recession, or at the least a slowdown in development, over the approaching 12 months. The company bond market is just not pricing in a recession. They consider longer-term fastened earnings could also be an choice price contemplating.

From my perspective of the financial system, USA Details is an attention-grabbing supply of unbiased info. In 2021, the common middle-class household earned $59,600 and paid $18,800 in taxes. I believe you will need to have a look at median statistics extra so than simply averages. The median wage in 2022 was $46,367, down 7% from 2021 when accounting for inflation. Poverty elevated to 11.6% of the inhabitants in 2021. Over half of US renters and 22% of house owners spent greater than 30% of their earnings on housing in 2021. Meals insecurity affected 1 in 10 households, and 41 million folks acquired SNAP advantages every month of 2022, with a mean advantage of $230.39 per recipient. To which, I add that pandemic-era stimulus is expiring.

Based on the Related Press, “The USA skilled a dramatic 12% improve in homelessness to its highest reported degree as hovering rents and a decline in coronavirus pandemic help mixed to place housing out of attain for extra People.” The quantity 7 high article from USAFacts’ 10 most-read articles of 2023 is “What number of homeless individuals are within the US? What does the information miss?” The Division of Housing and City Growth (HUD) counted round 582,000 People experiencing homelessness in 2022.

MY ALLOCATION STRATEGY

I constructed my Funding Mannequin primarily based upon the rules mentioned within the following books: Nowcasting the Enterprise Cycle by James Picerno, Conquering the Divide by Cornehlsen and Carr, Investing with the Pattern by Gregory L. Morris, Forward of the Curve by Joseph H. Ellis, Possible Outcomes by Ed Easterling, The Period of Uncertainty by Francois Trahan and Katerine Krantz, The Analysis Pushed Investor by Timothy Hayes, Beating the Market 3 Months at a Time by Gerald Appel and Marvin Appel and Morris, and Enterprise Statistics for Aggressive Benefit with Excel, (2019) by Cynthia Fraser, amongst others. I used over 100 indicators most of which will be downloaded from the Federal Reserve Financial institution of St. Louis FRED Database which have a excessive correlation to the inventory market six months into the long run. I added different indicators that search for secular tendencies reminiscent of valuations and financial coverage.

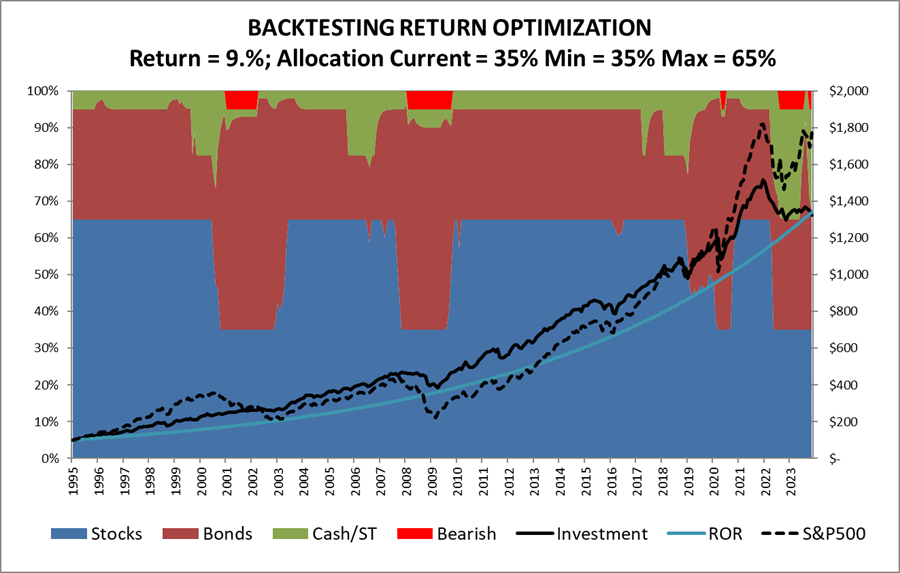

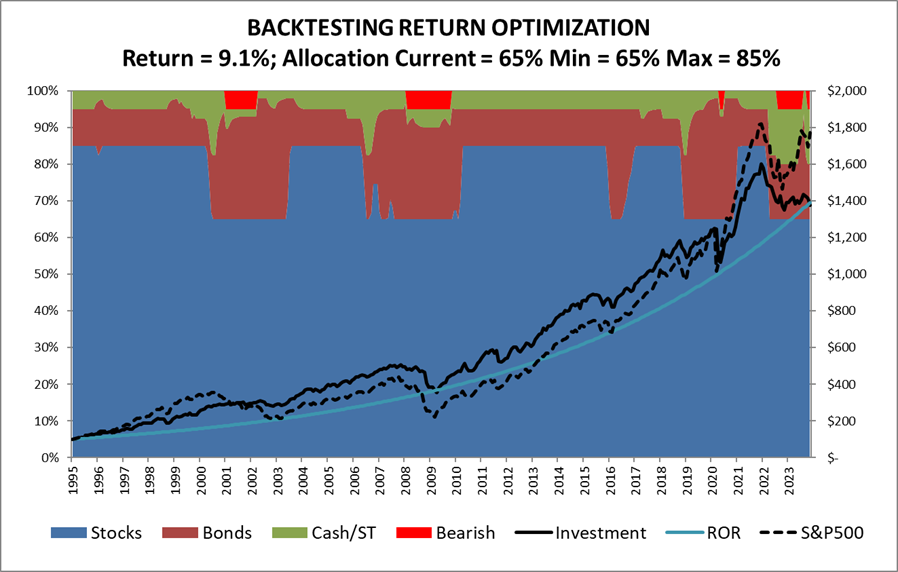

I constructed my Funding Mannequin proven in Determine #5 to optimize returns by various allocations to replicate financial, monetary, and market circumstances. The mannequin is meant to regulate slowly to market circumstances and never for use for frequent market timing. It really works most effectively with tax advantaged accounts. Minimal and Most allocations to inventory are variables. Utilizing a minimal allocation to inventory of 35% and a most of 65% ends in a mean annual return of 9.0% with a mean allocation to inventory of 58%. It beat the S&P 500 till 2020 when huge stimulus inflated asset values.

Determine #5: Writer’s Funding Mannequin, Inventory Allocation >= 35% <=65%

Growing the minimal allocation to inventory to 65% and most allocation to 80% doesn’t enhance returns considerably as a result of it doesn’t permit ample switching between asset courses to cut back allocations to shares when recession threat is excessive and to fastened earnings when yields are excessive.

Determine #6: Writer’s Funding Mannequin, Inventory Allocation >= 65% <=85%

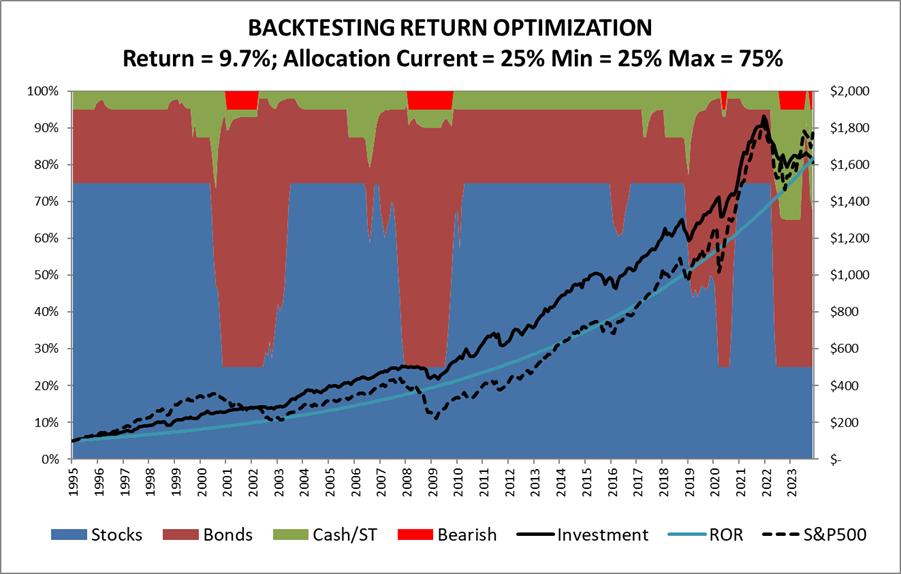

Following the rules of Warren Buffet’s mentor, Benjamin Graham, of by no means investing lower than 25% to shares nor greater than 75% will increase returns to the identical as an all-stock portfolio for the previous 37 years.

Determine #7: Writer’s Funding Mannequin, Inventory Allocation >= 25% <=75%

I constructed the core of the funding mannequin throughout 2015 to 2017. I used to be overly conservative throughout COVID as a result of I didn’t know the way effectively the mannequin would carry out. In hindsight, I’d have been higher off following it. I exploit a narrower allocation to shares than Benjamin Graham’s to bear in mind the psychological impression of the unknowns.

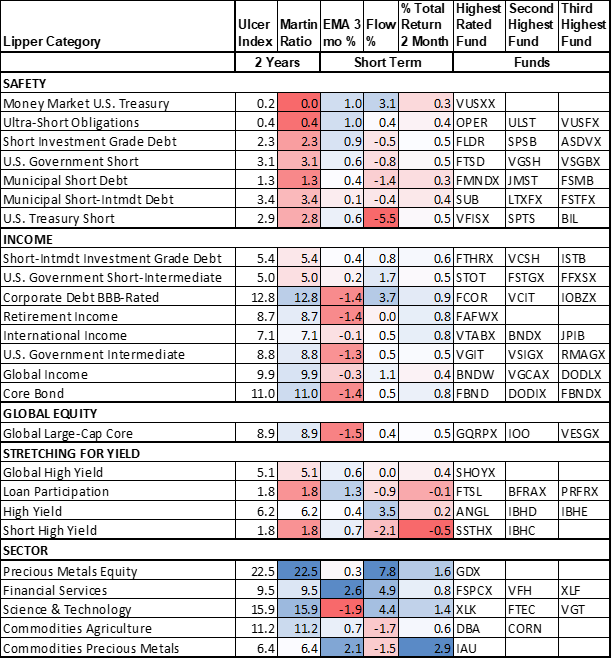

TRENDING LIPPER CATEGORIES AND FUNDS

Desk #5 accommodates the top-performing Lipper Classes for the 635 funds that I presently observe. I constructed a ranking system primarily based on momentum and cash move to measure what Lipper Classes and funds are trending with investor assist. The primary group of funds is short-term, high quality fastened earnings. The Ulcer Index measures the depth and period of drawdowns over the previous two years, whereas the Martin Ratio measures the risk-adjusted efficiency over the previous two years. The second group is the one which pursuits me probably the most and consists largely of fixed-income funds with intermediate durations. Discover that International and Worldwide funds are included.

Desk #5: Trending Lipper Classes – Ulcer & Martin Stats – Two Years

CLOSING THOUGHTS

With the evolution of tax legal guidelines and financial savings incentives, like many buyers, I personal conventional and Roth IRAs and tax-managed accounts for a two-income family. Pensions and Social Safety Advantages largely insulate us from market downturns. We observe the bucket method with two to 3 years of dwelling bills in Bucket #1 (tax-efficient municipal cash markets and bonds). I consider in each the Vanguard long-term technique and the Constancy Enterprise Cycle methods to investing and use each to handle accounts in Bucket #3 (extra threat in Roth IRAs the place taxes have been paid) for long-term investments. I exploit Bucket #2 to regulate to my view of the funding setting. My present allocation is simply over 40% to home and worldwide shares and over 40% to intermediate bond funds and ladders. The remaining is generally in ladders of short-term fixed-income and cash markets. As these mature, I’ll resolve whether or not I need to improve my allocation to shares or bonds with a choice for diversifying internationally.

With regard to the Dialogue within the first part, in my view, there are three teams that profit from larger allocations to shares: 1) these within the accumulation stage with a long-time horizon; 2) these with assured earnings to cowl bills; and three) the rich with sufficient in short-term financial savings that they’ll face up to extra volatility. For almost all of individuals, the bucket method, controlling spending, and variable withdrawal charges are applicable.

For many buyers, I counsel consulting with a Monetary Planner. Within the MFO June 2023 e-newsletter, Serving to a Pal Get Began with Monetary Planning, I described serving to a buddy choose a Monetary Planner. She interviewed one from each Constancy and Vanguard and is finalizing her choice. I assisted her in organising a self-directed low-risk, tax-efficient brokerage account investing largely in municipal bond funds of various durations. She has benefited effectively from falling charges.