The market has been buzzing with anticipation for laptop chip designer Arm Holdings’ preliminary public providing, or IPO, that occurred yesterday, 9/14/23. Quite a bit occurs when an organization decides to go public and lists its shares on exchanges just like the NYSE (New York Inventory Alternate) or the Nasdaq. There’s an immense quantity of background work main as much as itemizing day, however that’s not what’s necessary to me. The place I discover actual worth is watching an IPO’s value motion after its launch.

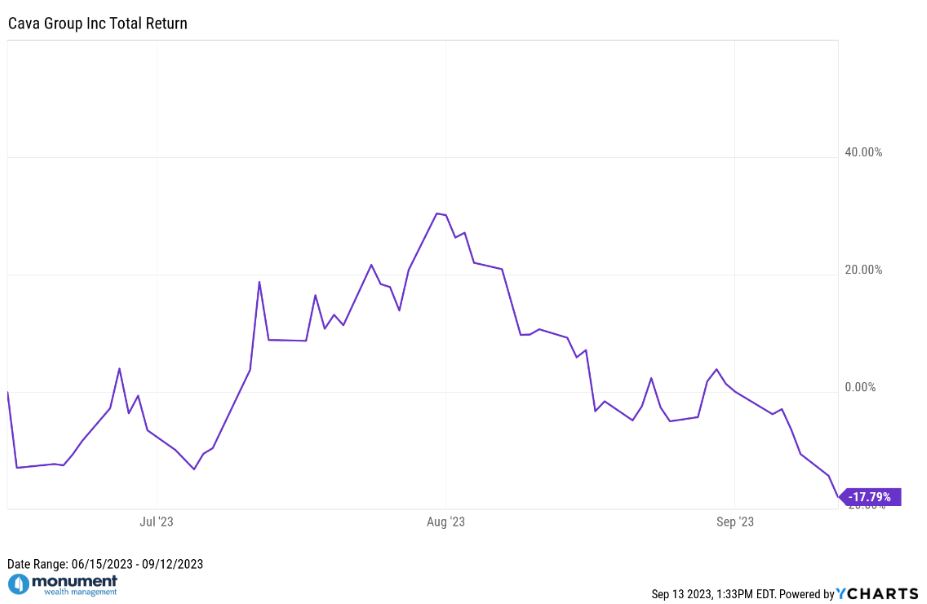

A superb instance is $CAVA. Again in June, I posted on LinkedIn that Mediterranean restaurant chain Cava (ticker: $CAVA) went public and was up as a lot as +117% throughout its first buying and selling day. For quite a lot of causes, traders piled in to get a bit of its potential future development though Cava was nonetheless a comparatively younger and unprofitable firm.

Quick ahead about 3 months to its shut on 9/12/2023, and Cava has roughly a -17.8% whole return because it went public. Speak about volatility – each to the upside and the draw back. Traders who have been chasing the potential outsized positive aspects from this “sizzling” IPO, might’ve simply been burned after the preliminary hype pale and there wasn’t sufficient investor demand to assist the elevated value. With out sufficient purchaser demand, the inventory value drifted decrease beneath its preliminary commerce value. That means, even these traders who obtained in immediately and skilled the rocket ship +117% enhance, could be down in the present day in the event that they nonetheless are holding onto $CAVA.

Admittedly, 3 months is a really brief time interval, and the e book isn’t closed on Cava as an organization or inventory. However the sort of value motion, whereas arguably ridiculous, isn’t irregular for IPOs. This wasn’t the primary IPO to have insanely sturdy efficiency in its first buying and selling day, adopted by promoting stress that pushed the worth decrease over time. Not each IPO will undergo this course of, however I’m assured that $CAVA gained’t be the final.

I can see why so many traders grow to be enamored with IPOs and different extremely speculative investments that seemingly provide the chance to get-rich-quick. These are residence run swings and in case you hit one, there isn’t a higher feeling on this planet. Nevertheless, with residence run swings, comes elevated chance of strikeouts, and people may be detrimental to your monetary plan’s long-term success. Don’t take residence run swings in case you aren’t financially secure sufficient to deal with a strikeout.

All too typically I see traders making the error of being overly obsessive about doable residence runs. They sound nice in principle however, in my expertise, not often work out. For most individuals, their allocation shouldn’t be dominated by residence run hitters, however as an alternative be stuffed with doubles hitters. In the event you’re a baseball fan, I’m speaking about investments with a great slugging share. Investments that might produce strong (however probably not huge) positive aspects whereas additionally hopefully providing decrease volatility than these extremely speculative investments that typically have gigantic positive aspects.

My favourite baseball participant to at the present time is Joe Mauer. He performed his entire profession as a catcher for his hometown crew the Minnesota Twins. He had a profession batting common of .306 and 923 runs-batted-in (RBIs) over his 15-year profession, however he solely hit a complete of 143 residence runs, or about 12/ per yr whereas he performed. Francisco Alvarez, a rookie catcher for the New York Mets, has 23 residence runs in simply his first 109 main league video games this season, however he additionally has a batting common of .216.

Even with out being referred to as a house run hitter, Joe Mauer was a celebrity. He had the very best batting common within the majors 3 out of 4 years by the 2006 to 2009 seasons and was the American League MVP in 2009. His success was largely resulting from his potential to keep away from strikeouts and constantly get hits – particularly when it mattered most to his crew.

So, who would you slightly have in your crew? The regular, form of boring participant with a greater likelihood of getting successful? Or the younger unknown upstart who’s extra more likely to crush residence runs but additionally extra more likely to strike out? Which participant you select says one thing about your danger tolerance. For me, if it isn’t already apparent, I’d take Joe Mauer’s manufacturing virtually each time as a result of I worth consistency, and usually I don’t want residence runs.

My little league coach instructed me way back, “Base hits win ball video games; not residence runs.” I’d argue the identical is true for investing. You don’t want insanely excessive returns (residence runs) to have a profitable funding technique or monetary plan. For most individuals, all they want is benchmark or index-like returns year-over-year (constant base hits) to assist them obtain their objectives. Stated otherwise, don’t swing for the fences if all you want is a single.