At this time’s Animal Spirits is delivered to you by Amplify ETFs:

See right here to be taught extra about Amplify’s free money circulation centered ETFs

Register right here for Episode 1 of The Smoke Present, on November fifteenth at 2PM Japanese

On right now’s present, we talk about:

Hear right here:

Suggestions:

Charts:

Tweets:

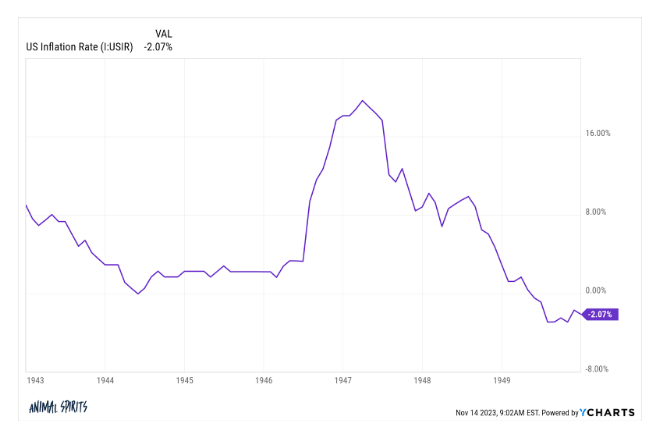

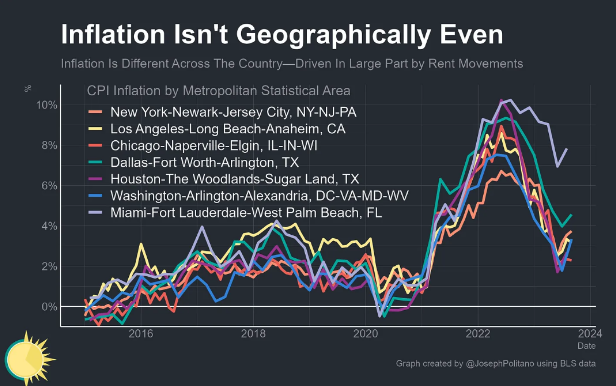

🧊THE OCTOBER CPI REPORT🧊

🧊Inflation slowed down once more

⛽ Gasoline costs are working in your pockets’s favor once more

😖Companies inflation is…choosing up once more?

⛰ The development is obvious(ish), a superb signal if you happen to’re nervous about charges pic.twitter.com/ku54FC3eUs— Callie Cox (@callieabost) November 14, 2023

WALLER: WHAT PEOPLE HAVE IN MIND NOW IS FOR PRICES TO RETURN TO EARLIER LEVELS, AND “THAT IS NOT GOING TO HAPPEN”

— *Walter Bloomberg (@DeItaone) November 7, 2023

the median voter needs double-digit deflation, a booming financial system, a decent labor market apart from low-level service employees, and rising house costs besides once they need to purchase and albeit, is that an excessive amount of to ask for?

— Ben Walsh (@BenDWalsh) November 14, 2023

MORGAN STANLEY: “We initiated our smooth touchdown name in March 2022, maintained that decision for 2023, and are rolling it ahead” for 2024. We see core PCE falling to 2.4% in 2024, with the Fed chopping charges starting in June.

“4 25bp cuts in 2024 and eight in 2025 ..” [Zentner] pic.twitter.com/xOVFAYmQ6I

— Carl Quintanilla (@carlquintanilla) November 12, 2023

BofA: Client spending moderated in October with complete card spending falling 0.2%.

Aggregated credit score and debit card spending per family fell 0.5% year-over-year pic.twitter.com/yzskIj2An1

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) November 9, 2023

NY Fed’s World Provide Chain Stress Index fell in October https://t.co/4uuIS9Jodm pic.twitter.com/RnhroGPzYu

— Sam Ro 📈 (@SamRo) November 6, 2023

2) The Sahm rule is: when the three-month transferring common of the nationwide unemployment price rises by 0.50 proportion factors or extra relative to its low throughout the earlier 12 months, we’re in a recession.

— Claudia Sahm (@Claudia_Sahm) November 3, 2023

For all of the discuss of a recession, job openings in “nearly each business” are above 2019 ranges. Each the layoff price and preliminary jobless claims are nonetheless low –Goldman pic.twitter.com/zQrzHe0fMT

— Gunjan Banerji (@GunjanJS) November 12, 2023

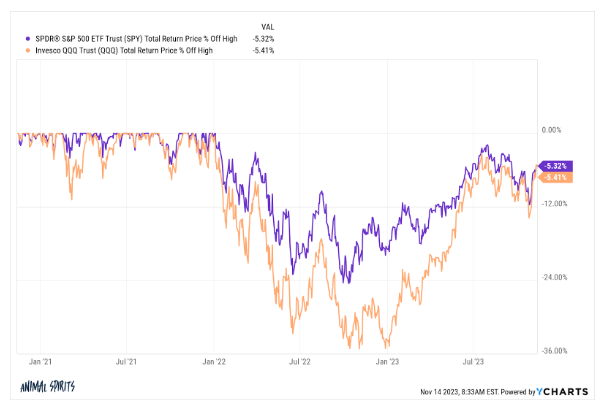

The S&P 500 has gone 467 buying and selling days with out making a brand new all-time excessive.

After the Nice Melancholy it went greater than 6,000… pic.twitter.com/98h4KhEUUK

— Bespoke (@bespokeinvest) November 12, 2023

We formally noticed an excellent uncommon Zweig Breadth Thrust right now. Because of @NDR_Research for the info.

This uncommon sign is just shares transferring from very oversold to overbought in lower than two weeks.

All it’s essential know is since WWII, the S&P 500 is larger a yr later each time. pic.twitter.com/4iAaf3nsSY

— Ryan Detrick, CMT (@RyanDetrick) November 3, 2023

Russell 3,000 names by cumulative quick PnL over the previous decade. Shorts made about $80 billion of greenback earnings on about 30% of names, and misplaced $900 billion complete throughout all names over 10 years. pic.twitter.com/KQ3snfsdCT

— Quantian (@quantian1) November 6, 2023

Small-caps now characterize lower than 4% of the entire US fairness market.

by way of Jefferies pic.twitter.com/XomHVD2lg6

— Every day Chartbook (@dailychartbook) November 10, 2023

Within the coming week, the Russell 2000 could have gone 500 buying and selling days, practically two full years, because it final closed at a 52-week excessive. That is the Third-longest streak within the index’s historical past. Be taught extra: https://t.co/2XJ9j5GtBl @jasongoepfert

— SentimenTrader (@sentimentrader) November 4, 2023

Russell 2000: “Least expensive our absolute valuation mannequin has been since Dec. ‘12.” $IWM $RUT

– Jefferies pic.twitter.com/EFkVaZD6rX

— Every day Chartbook (@dailychartbook) November 13, 2023

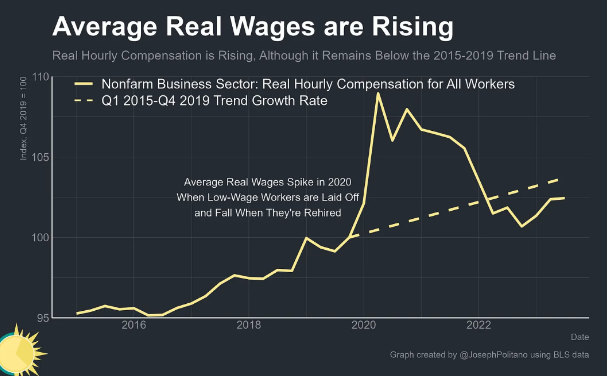

2020: nobody needs to work

2021: The Nice Resignation

2022: quiet quitting

2023: nobody needs to give up anymore

these are all bizarre methods for the media to explain the most popular labor market we have skilled in like 40 years

— Ben Carlson (@awealthofcs) November 6, 2023

Bitcoin’s market demand has outpaced its provide, a transparent signal of strong constructive momentum.

In simply sooner or later, a whopping 700,000 new BTC addresses joined the community. This enlargement is taken into account one of the crucial dependable indicators for value predictions.

With fewer BTC cash… pic.twitter.com/zAcgFc9LkS

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) November 6, 2023

The craziest factor about somebody bidding $3,000,000 simply now for one thing that’s really — lastly — completely nugatory is the proprietor wont even settle for it. pic.twitter.com/5wWd2HLoqN

— NFTstats.eth (@punk9059) November 11, 2023

(Bloomberg) – The common 30-year mortgage price plunged final week by probably the most in additional than a yr, serving to generate the most important advance in house buy functions since early June.@enterprise $XHB @LiveSquawk https://t.co/pGOdFIPkKP

— Carl Quintanilla (@carlquintanilla) November 8, 2023

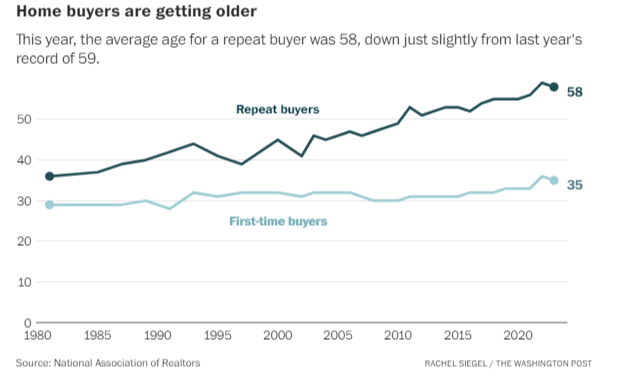

First-time patrons made up 32% of all house patrons, up from final yr’s historic low of 26%, however nonetheless beneath the typical of 38% since 1981. #NARHBS

— NAR Analysis (@NAR_Research) November 13, 2023

Truly, no. It bought for $875,000… in 1989! Seven instances the median house sale that yrhttps://t.co/G8WheWQ5cJ https://t.co/Tr6U7cCHiu

— Jeremy Horpedahl 🤷♂️ (@jmhorp) November 12, 2023

Expedia CEO on the buyer: “We’ve not seen actually something on the buyer aspect. We hold wanting…you’d must squint it actually onerous and look by sub subregion to attempt to and lower it by value level and lots of issues to actually see something noticeable”

— The Transcript (@TheTranscript_) November 5, 2023

Advert markets choosing up from the lows.

Information Corp CEO: “Particularly at Dow Jones, promoting was down 3%, which was a marked enchancment after a 14% decline within the prior quarter. Each digital and fringe reported enchancment in development strains”$NWSA

— The Transcript (@TheTranscript_) November 11, 2023

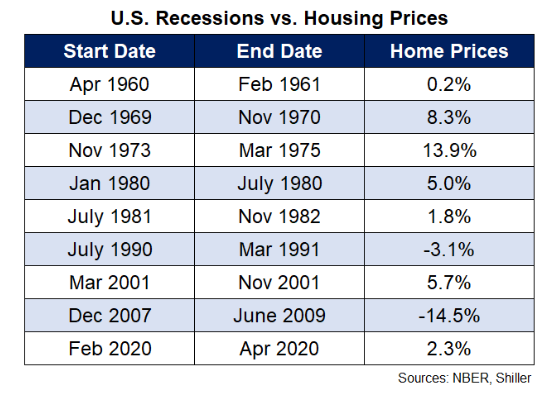

64% of Individuals would welcome a recession if it meant decrease mortgage charges, per USA At this time.

— unusual_whales (@unusual_whales) November 11, 2023

Who’s lacking their bank card funds?

Reply: Millennials**Millennial bank card delinquencies are actually larger than pre-pandemic**, NY Fed knowledge reveals.

Bank card delinquencies are rising significantly shortly for these with auto and scholar loanshttps://t.co/4vKXs5X9QC pic.twitter.com/j9o2gjUrSH

— Heather Lengthy (@byHeatherLong) November 7, 2023

Document-high share of US shoppers planning to go on trip to a international nation throughout the subsequent six months. ✈️

(By way of Apollo/Slok) $JETS $XAL pic.twitter.com/M9F4Qv0mjo

— Carl Quintanilla (@carlquintanilla) November 12, 2023

Paramount mentioned streaming subscribers will see much more value will increase transferring ahead — a development that is permeated all through all the media business. https://t.co/Sq9yxcDP52 pic.twitter.com/gdgB6VKnIl

— Yahoo Finance (@YahooFinance) November 5, 2023

‘THE MARVELS’ earns $21.3M within the movie’s home opening day, the bottom in MCU historical past.

Learn our overview: https://t.co/QKIzAqo1Dz pic.twitter.com/dtAZpULPD5

— DiscussingFilm (@DiscussingFilm) November 11, 2023

Contact us at animalspirits@thecompoundnews.com with any suggestions, suggestions, or questions.

Observe us on Fb, Instagram, and YouTube.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities includes the danger of loss. Nothing on this web site must be construed as, and will not be utilized in reference to, a proposal to promote, or a solicitation of a proposal to purchase or maintain, an curiosity in any safety or funding product.