Rainbow Childrens Medicare Ltd. – Paediatric Hospitals

Rainbow Childrens Medicare Ltd (RCML) operates a sequence of paediatric hospitals with prenatal centres. The corporate was based in 1999 by Dr. Ramesh Kancharla in Hyderabad, with its concentrate on little one and ladies healthcare. The Rainbow Group has seven hospitals in Hyderabad, three in Bengaluru, two every in Delhi and Chennai, and one every in Vijayawada and Visakhapatnam. The Group additionally has three outpatient clinics in Hyderabad, Vijayawada and Visakhapatnam with a complete depend of sixteen hospitals. RCML operates underneath the model, “Rainbow Kids’s Hospital” and “Birthright by Rainbow”. RCML’s operational subsidiaries, Rainbow Specialty Hospitals Personal Restricted (RSHPL) operates a cardiac hospital in Hyderabad and Rosewalk Healthcare Personal Restricted (RWHPL) runs a boutique maternity hospital in Delhi. The Group has a complete capability of round 1,655 beds, of which round 1,230 have been operational as on FY23.

Merchandise & Providers:

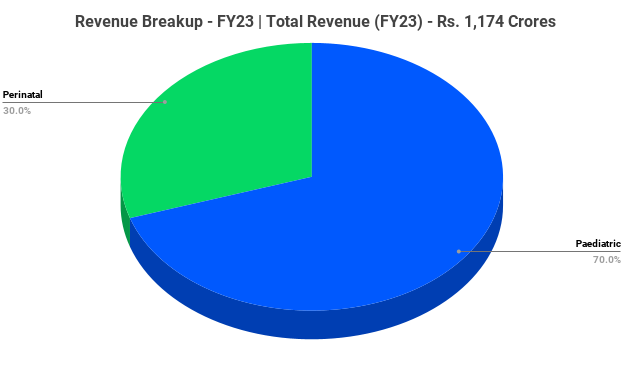

The corporate’s Paediatric companies phase working underneath the model “Rainbow Kids’s Hospital” consists of new child and paediatric intensive care, paediatric multi-specialty companies, paediatric quaternary care (together with organ transplantation); whereas the ladies care companies phase underneath “Birthright by Rainbow” provides perinatal care companies which incorporates regular and sophisticated obstetric care, multi-disciplinary fetal care, perinatal genetic and fertility care together with gynaecology companies.

Subsidiaries: As on FY23, the corporate had 6 subsidiaries.

Key Rationale:

- Hub and Spoke Mannequin – Rainbow Kids’s Hospital is constructed on robust fundamentals of multidisciplinary method in a baby centric atmosphere with a singular physician engagement mannequin, the place docs work solely on a fulltime, retainer foundation to supply 24/7 advisor led service, which is especially vital for kids’s emergency, neonatal, paediatric intensive care companies and to help paediatric retrieval companies. The corporate follows a hub-and-spoke working mannequin the place the hub hospital offers complete outpatient, inpatient care, with a concentrate on tertiary and quaternary companies whereas the spokes present 24/7 emergency care in paediatrics and obstetrics, giant outpatient companies and complete obstetrics, paediatric and degree 3 NICU (Neonatal Intensive Care Unit) companies. This mannequin is efficiently operational at Hyderabad and is gaining traction in Bengaluru. The endeavour is to duplicate this method in Chennai and throughout the Nationwide Capital Area. Subsequently Rainbow intends to increase into tier-2 cities of Southern India.

- Newest Updates – The corporate has appointed Mr. Sanjeev Sukumaran as Chief Working Officer (COO). He has over 25 years of expertise in strategic administration, enterprise advisory, gross sales and advertising and marketing, enterprise improvement, and shopper relationship administration throughout a various vary of sectors. In the course of the quarter, the corporate signed an settlement to lease for a brownfield ~80 beds spoke hospital at Sarjapur, Bengaluru. The hospital is strategically situated and can make an vital a part of the Rainbow community within the metropolis. This hospital is more likely to begin operations over the last quarter of the FY24. Additionally, a further block with an outpatient division and an IVF facility at Rainbow LB Nagar, Hyderabad to boost the affected person amenities on the present hospital and cater to the longer term progress at this spoke hospital.

- Q4FY23 – The corporate’s income elevated by 49% YoY to Rs.317 crore in Q4FY23. The EBITDA elevated by a whopping 104% YoY from Rs.48 crore in Q4FY22 to Rs.98 crore in Q4FY23 and the EBITDA margin has improved by 826 bps from 22.6% in Q4FY22 to 30.9% in Q4FY23. The Revenue after tax for the corporate has reported an enormous progress of 339% YoY from Rs.12 crore in Q4FY22 to Rs.54 crore in Q4FY23. The variety of working beds have improved from 1150 in Q4FY22 to 1232 in Q4FY23.

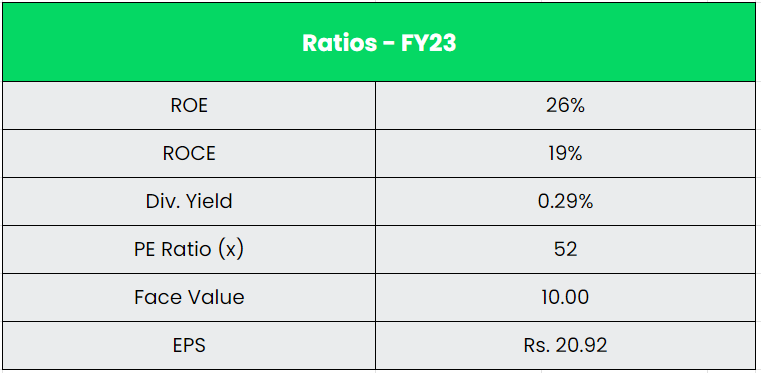

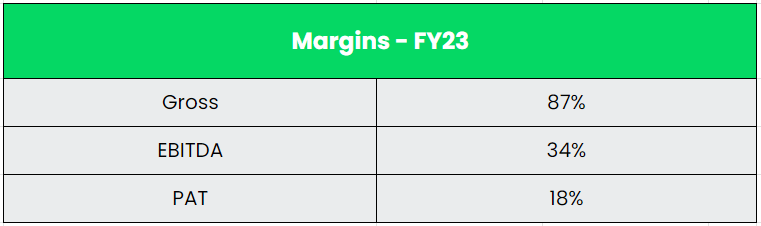

- Monetary Efficiency – The income and PAT CAGR have grown at 24% and 42% between FY18-23. The working cashflow of the corporate is persistently constructive and rising traditionally. The corporate generated round Rs.700 crore of cashflow from operations within the final 5 years. The EBITDA to OCF conversion has been robust for the corporate and it’s round 82% in FY23 from 73% in FY22. The corporate has zero debt in its stability sheet with solely lease liabilities of Rs.570 crore as on FY23.

Trade:

Owing to the nation’s general financial improvement and rising inhabitants, the Healthcare business has emerged as one of many largest contributors to the Indian economic system, each by way of income era and employment alternatives. The Indian Well being Care sector is predicted to develop to Rs.8,620 billion by FY26 with a CAGR of 12%. The growth of personal and public healthcare amenities, in addition to elevated information about childcare and early identification of illnesses, are anticipated to drive progress within the maternity and paediatric care market in India. In FY2020, the mixed market share of paediatric and maternity care in hospitals was roughly 33% of the overall hospital market, amounting to Rs.1,390 billion. Personal maternity care held a forty five% share of the overall maternity market, and it’s projected to increase at a compound annual progress price (CAGR) of 12% between FY2020-26, reaching a market dimension of Rs.330 billion. Equally, the non-public paediatric care market constituted 60% of the general paediatric market and is predicted to develop at a CAGR of 14% throughout FY2020-26, ultimately attaining a market dimension of Rs.1,340 billion.

Development Drivers:

- 100% FDI within the healthcare business has been authorised by the automated route for investments within the improvement of hospitals, healthcare amenities and the manufacture of medical merchandise.

- Within the Union Funds 2023-24, the federal government allotted Rs.89,155 crore (US$ 10.76 billion) to the Ministry of Well being and Household Welfare (MoHFW).

- A lot of socioeconomic causes have contributed to a rise within the common age of being pregnant within the nation. The age group of 25-29 years accounted for 32% of births in FY2010-15andmoving ahead, the age teams 25-29 years and 30-34 years are predicted to contribute a higher proportion of dwell births. This pattern in direction of delayed being pregnant could cause elevated problems, which can end in the next demand for maternity healthcare in India.

Rivals: Apollo Hospital, Narayana Hrudayalaya, KIMS, and many others.

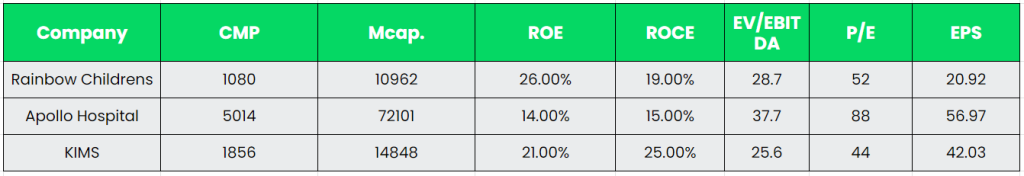

Peer Evaluation:

RCML is having a sequence of paediatric hospitals whereas, its friends are having tremendous speciality and multi-specialty hospitals. So, RCML have a distinct segment area within the hospital enterprise itself. By way of fundamentals, RCML is competing properly with its friends.

Outlook:

The corporate stays the one listed paediatric hospital chain. The corporate crossed an vital milestone of 1,000,000 outpatients throughout the group and efficiently accomplished 20 liver transplants and 5 kidney transplants with glorious outcomes. In the course of the 12 months, the Firm has efficiently inaugurated a brand new hospital with 100 beds within the Monetary District of Hyderabad, in addition to a 55-bed hospital in Sholinganallur (OMR), Chennai. The corporate has additionally received two bids to construct Greenfield hospitals in Gurgaon, Haryana, with a 300-bed facility in sector 44 and a 100-bed Spoke Hospital in sector 56. The Gurgaon hospital might be a excessive capex, multi-specialty hospital, totally different from their routine kids’s hospitals. The present ARPOB (common income per working mattress) for the hospital group is Rs.48,900, however the Gurgaon hospital may have the next ARPOB. The corporate is including roughly 400 beds within the subsequent two to 3 years, which can end in a 50-50% combine between mature and new hospital beds. The break-even timing for brand spanking new hospitals is one to at least one and a half years, relying on location and dimension. The corporate has guided for Rs.420 crores of EBITDA for the present monetary 12 months, with excessive teenagers progress in income.

Valuation:

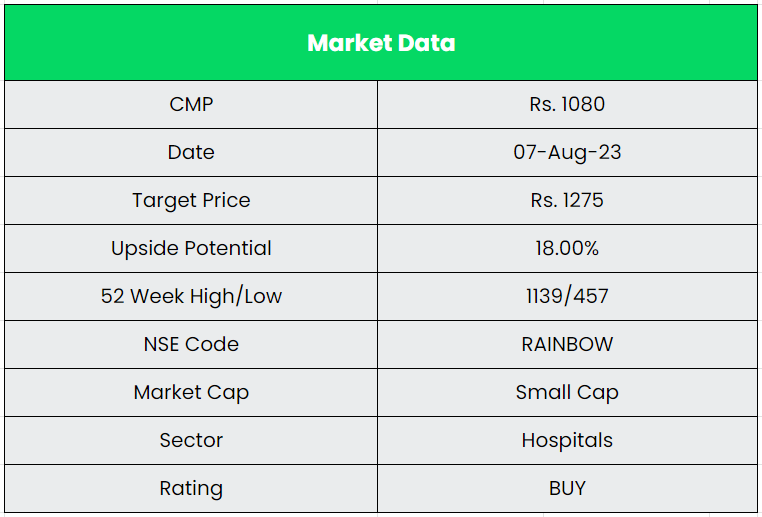

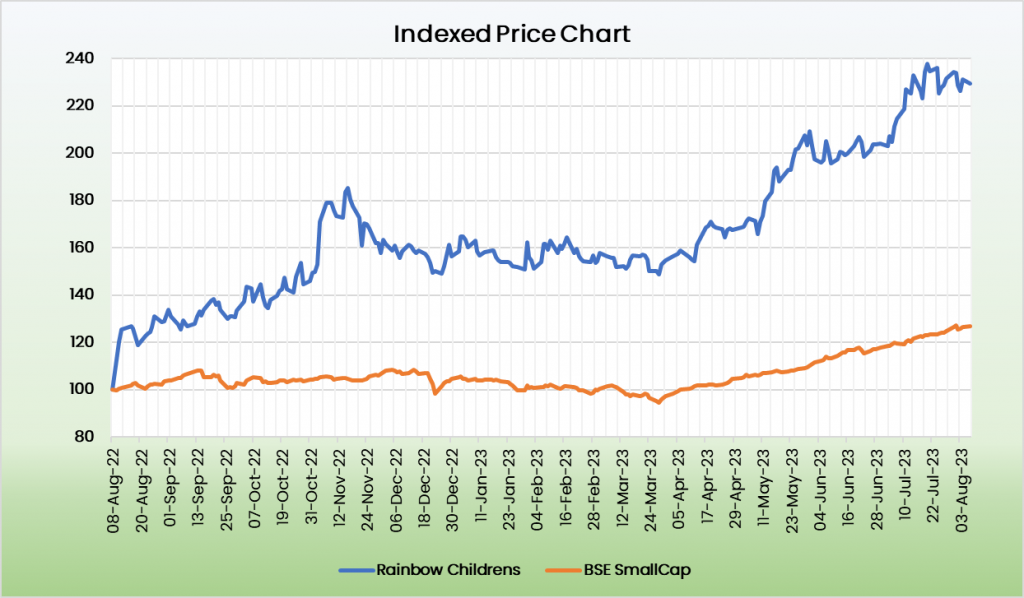

Rainbow’s asset-light, hub and spoke mannequin of growth has been the success story up to now. The corporate’s debt free place and powerful money conversion will drive the growth going ahead. We advocate a BUY ranking within the inventory with the goal value (TP) of Rs.1275, 23x FY25E EV/EBITDA.

Dangers:

- Attrition Danger – The corporate’sperformance and the execution of its enterprise methods rely considerably on its skill to draw, recruit and retain docs in specialties resembling paediatrics, obstetrics and gynaecology. Lack of ability to recruit or retain the professionals will influence the standard of the companies.

- Regulatory Danger – The corporate is required to adjust to a wide range of rules on the central, state and native ranges. These rules cowl a variety of areas, together with affected person care, privateness, security, and record-keeping. Non-compliance with these rules can result in fines, authorized motion, and injury to the hospital’s fame.

- Aggressive Danger – The Rainbow Group has income dependence on paediatrics and obstetrics specialities and faces excessive competitors from established hospitals in Chennai, Delhi and Bengaluru, the place it’s a current entrant with restricted model recognition, nonetheless the corporate has substantial scale-up plans in these cities which is predicted to enhance the model identification in these areas.

Different articles it’s possible you’ll like

Publish Views:

4,863