Knowledge Patterns (India) Ltd – Defence and Aerospace Digital Options

Knowledge Patterns (India) Restricted is likely one of the fastest-growing corporations within the Defence and Aerospace Electronics sector in India. It’s one among the many few vertically built-in defence and aerospace electronics options suppliers catering to the indigenously developed defence merchandise business with end-to-end capabilities and a big addressable market. Integrated as “Indus Teqsite Non-public Restricted” in 1998, at Bangalore, Karnataka as a Non-public Restricted Firm, the corporate’s title was modified to “Knowledge Patterns (India) [Private] Restricted” in August 2021. It was subsequently transformed right into a public restricted firm in December 2021. The corporate is targeted on in-house growth and manufacturing services led by innovation and design and growth efforts. It has provided merchandise catering to numerous platforms, viz., area, air, land and sea, together with merchandise for LCA-Tejas, LightUtility Helicopter, BrahMos missile.

Merchandise & Companies

Knowledge Patterns supply merchandise beneath the enterprise domains of Automated Take a look at Gear (ATE) and Rugged Army Electronics (RME). Main merchandise embody Avionic and Area Techniques, Radar and Digital Warfare merchandise, COTS Boards, RF & Microwave, Cockpit and Rugged shows, Communication Merchandise, Naval and Navigation Techniques and so forth.

Subsidiaries: As of FY23, the corporate doesn’t have any subsidiaries, joint ventures or affiliate corporations.

Key Rationale

- Orders from reputed defence organisations – Over greater than 3 many years, Knowledge Patterns has established itself to be one of many few corporations with product capabilities protecting all the spectrum of Defence and Aerospace platforms, encompassing area, air, land and sea. It has positioned itself to be one of many robust allies with many reputed purchasers in Defence sector. The foremost clients embody the Ministry of Defence (MoD), Defence Analysis and Improvement Organisation (DRDO), BrahMos Aerospace Non-public Restricted, Bharat Electronics Restricted (BEL), Bharat Heavy Electronics Restricted (BHEL), Hindustan Aeronautics Restricted (HAL), Digital Company of India Ltd (ECIL) and items operated by the Indian Area Analysis Organisation (ISRO).

- Growth plans – The corporate is effectively positioned to profit from the “Make In India” initiative by Authorities of India. It has began to take part in giant worth tenders like Make-1 and Make-2 classes with Ministry of Defence. The corporate has raised Rs.500 crores by QIP to develop merchandise in radars, EW, communications and satellites. Along with supplying subsystems, the corporate is stepping up its enterprise line to supply entire methods to MoD. The order ebook throughout Q2FY24 reached Rs.1000 crores, with an order influx of Rs.145 crores, which incorporates export order of about Rs.39 crores majorly from Europe, UK and South Korea.

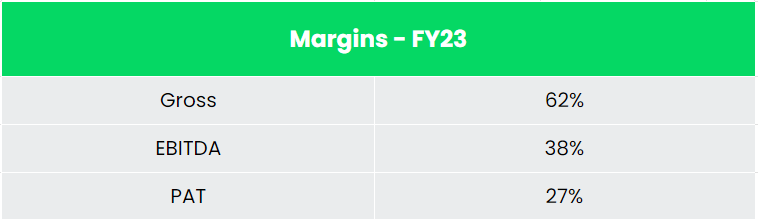

- Q2FY24 – Knowledge Patterns reported a income of Rs.108 crores marking a rise of 23% in comparison with the Rs. 88 crores income of Q2FY23. EBITDA stood at Rs. 41 crores in comparison with the Rs.30 crores of FY23, a surge by 37% YOY. The revenue after tax stood at Rs.34 crores which is a strong development of 62% as in comparison with the Rs.21 crores of identical interval within the earlier 12 months. The EBITDA and PAT margin have been 38% and 31% respectively.

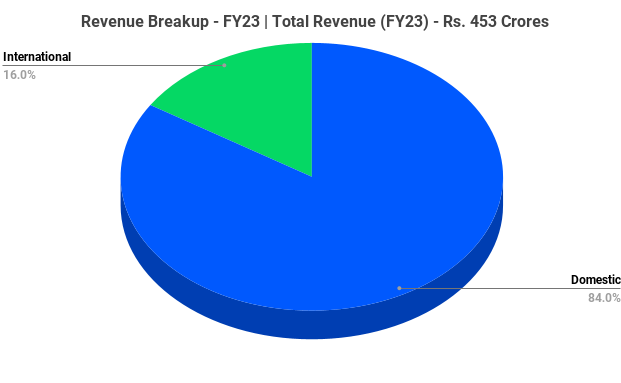

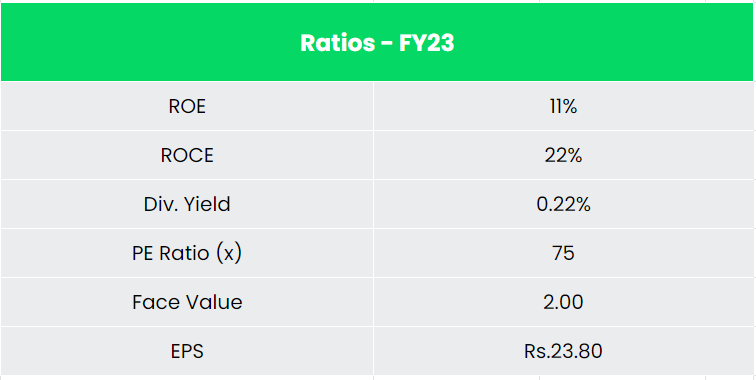

- Monetary efficiency – The corporate has generated a income and PAT CAGR of 52% and 151% over the interval of 5 years (FY18-23). Common 5-year ROE & ROCE is round 18% and 25% for FY18-23 interval. The corporate has robust steadiness sheet and monetary threat profile with zero debt excellent, indicating its prudent monetary administration.

Trade

India is likely one of the strongest army forces on this planet and maintain a strategic significance for the Indian Authorities. To modernise its armed forces and scale back reliance over exterior dependence for defence procurement, a number of initiatives have been taken by the federal government to encourage ‘Make in India’ actions by way of coverage help initiatives. Ministry of Defence has set a goal of attaining a turnover of INR 1.75 lakh crore in aerospace and defence Manufacturing by 2025, which incorporates exports of INR 35,000 crore. The federal government has additionally introduced 2 devoted Defence Industrial Corridors within the States of Tamil Nadu and Uttar Pradesh to behave as clusters of defence manufacturing that leverage current infrastructure, and human capital.

Development Drivers

Within the Union Funds 2023-24, the Capital Allocations pertaining to modernisation and infrastructure growth of the Defence Companies has been elevated to INR 1,62,600 crores representing an increase of 6.7% over FY22-23. The business bought INR 5.94 Lakh crores in Funds 2023-24, a leap of 13% over earlier 12 months. Beneath the Atmanirbhar Bharat or Self-Reliant India Initiative, 4 optimistic indigenization lists of 411 merchandise have been promulgated by Division of Army Affairs and Ministry of Defence to be manufactured domestically for the defence sector, as a substitute of being sourced by way of imports.

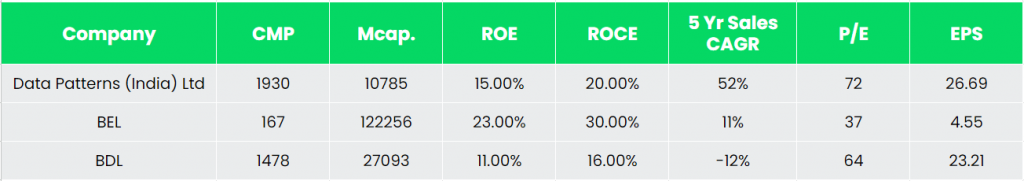

Rivals: Bharat Electronics Restricted (BEL), Bharat Dynamics Ltd (BDL) and so forth.

Peer Evaluation

Among the many above rivals, Knowledge Patters is producing a better income from the quantity of capital invested. The corporate has robust steadiness sheet and monetary threat resistance with zero debt within the capital construction.

Outlook

The Indian defence manufacturing business is a major sector for the economic system. The business is more likely to speed up with rising considerations of nationwide safety. We consider Knowledge Patterns is rising to be a powerful participant within the business with its vertically built-in manufacturing technique and marquee consumer base. Within the current years, the corporate has raised capital by IPO and QIPs, indicating its capital abundance to put money into area of interest initiatives and sustenance of current enterprise strains. The corporate is creating new merchandise to satisfy the necessities of defence forces making itself able to zero in new orders as any requirement arises. The corporate is aiming to place itself as an finish person system producer whereas additionally creating the sub methods vertical.

Valuation

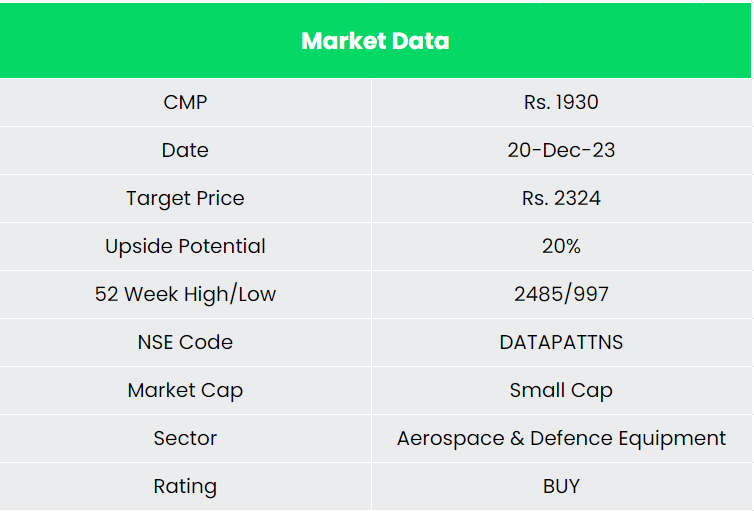

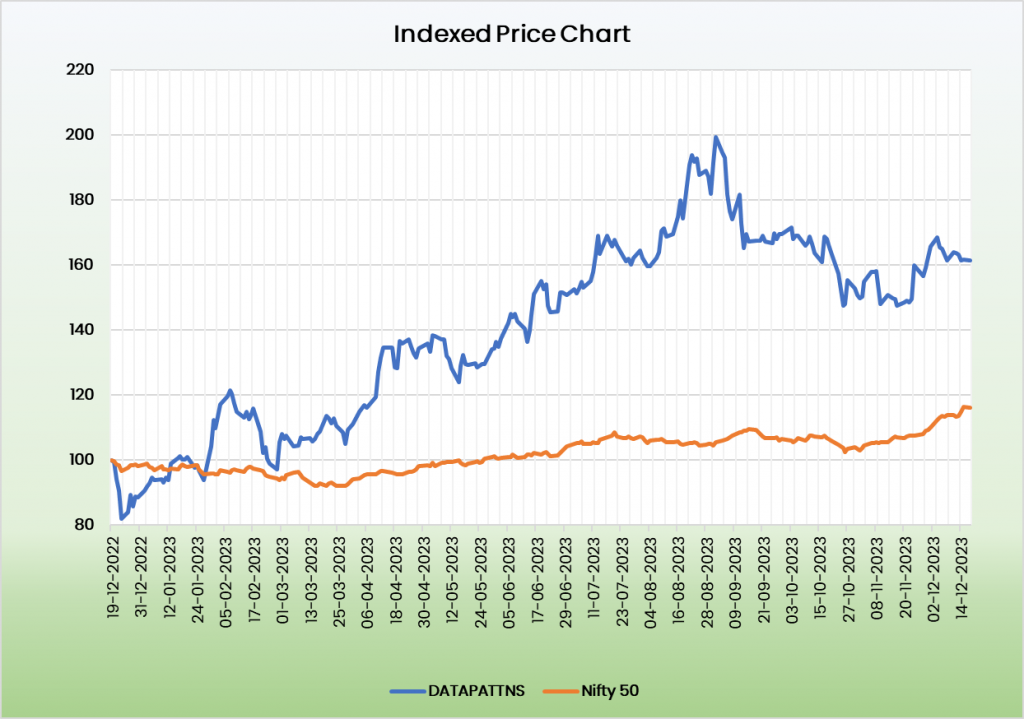

We consider Knowledge Patterns (India) Restricted is able for strong development within the coming years. It’s rising market share within the current enterprise and upcoming initiatives the corporate has in pipeline locations it able for a upside development potential. We suggest a BUY ranking within the inventory with the goal worth (TP) of Rs. 2324, 21x FY25E EPS.

Dangers

- Venture getting delayed – There’s chance of initiatives being deferred because of procedural delays, which could result in order deferment, an inherent threat of defence business.

- Regulatory threat – The business is extremely inclined to regulatory adjustments, and this may lead to ban/redundance of sure merchandise, affecting income.

Different articles you could like

Publish Views:

115