Jupiter Wagons Ltd – Main Producer of Railway Freight Vehicles

Included in 2006, Jupiter Wagons Ltd (JWL) is among the most built-in Railway Engineering Firm, catering to clientele unfold throughout Indian Railway (IR), personal wagon aggregators, business automobiles OEMs, Indian defence, and logistics firms. It’s a premier producer of railway wagons, passenger coach parts, alloy metal casting for rolling stack and monitor. On a standalone foundation, JWL has a capability to fabricate ~8,000 wagons yearly and is backward built-in with a foundry store to fabricate numerous parts of a typical wagon like couplers, bogies, draft gears, CRF part, and so on. It boasts one of many highest capability enhances and holds the excellence of being India’s largest producer of 25-ton wagons. The corporate has 6 state-of-the-art factories and a couple of places of work for manufacturing and testing and improvement.

Merchandise and Companies

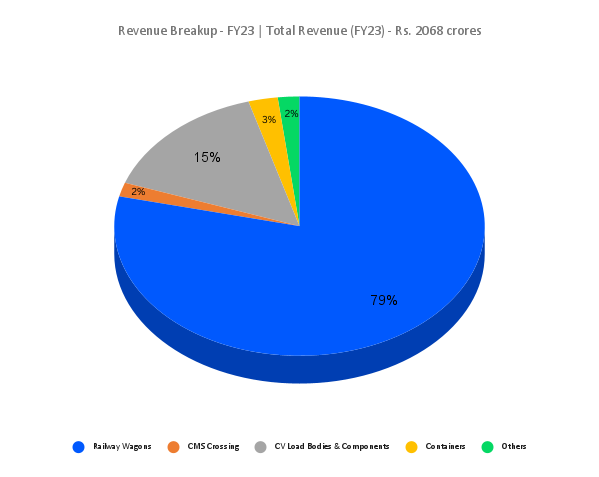

Jupiter Wagons is a complete options supplier in passenger coaches and freight wagons and equipment. The corporate’s wide selection of merchandise contains brake techniques, tippers, trailers for mining, infrastructure, and development, in addition to specialised automobiles equivalent to municipal disposers, refrigerated vans, defence automobiles, reconnaissance automobiles, RAF automobiles, water tankers, oil tankers, containers, business electrical automobiles and extra. It has two essential enterprise divisions: Rail mobility (encompassing wagons, monitor options, wagon equipment and passenger coach equipment) and Street & Multimodal mobility (encompassing Business Autos and Containers).

Subsidiaries: As of FY23, the corporate has two subsidiary firms and three affiliate and/or three way partnership firms.

Key Rationale

- Growth plans – The corporate is planning to extend the capability of its present foundry at Kolkata plant parallel to organising a brand new foundry at Jabalpur plant, rising the general capability from 2,500 metric tons to five,000 metric tons in combination at two places with an execution interval of 18 to 24 months. This may enhance the manufacturing from 700 wagons monthly to 1000 wagons monthly. Moreover, it’s including wheel set manufacturing capabilities to enhance backward integration. This may end in improved margins by attaining a discount in freight prices and improved manufacturing efficiencies. It has a capex plan of round Rs.700 crore by the top of subsequent monetary yr. The corporate just lately raised Rs.400 crore via Certified Institutional Placement (QIP).

- Latest acquisitions – The corporate acquired Stone India Restricted which is into the enterprise of brake techniques and prepare lighting alternators and a provider of engineering merchandise to IR. The corporate is planning to revamp the Stone India amenities with a capex of Rs.30 crore earmarked for facility modernisation with operations commencing by Q4FY24. It’s planning to begin the freight brake enterprise in Stone India and later step into manufacturing brakes for locomotives, Excessive-Attain Pantograph and numerous form of valves for the locomotive enterprise.

- Strong order e book – Jupiter Wagons has a wholesome order e book backed by unabated demand for wagons from IR and personal gamers. As of Q2FY24, it has an order e book of Rs.5952 crore, whereby Rs.5355 crore is being contributed from wagons. Moreover, the corporate has bagged an order for manufacture and provide of 4 rakes of Double Decker Vehicle Service Wagons value round Rs 100 crore and one other order from Ministry of Defence to fabricate and provide of 697 Boggie Open Army (BOM) wagons value Rs.473 crore.

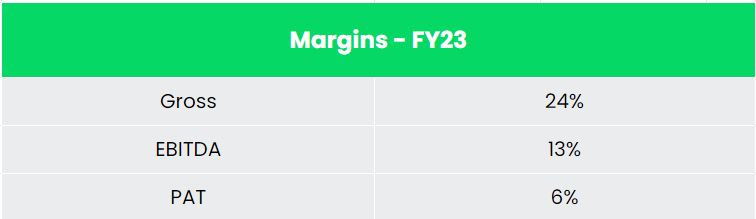

- Q2FY24 – Jupiter Wagons achieved triple digit progress in income, EBITDA, and web revenue in the course of the quarter. The momentum has been robust, notably within the wagon enterprise. In the course of the quarter, the corporate reported a consolidated complete income of Rs.879 crore versus corresponding Rs.417 crore of Q2FY23, a rise of 111%. EBITDA for the interval was Rs.121 crore marking an upside of 142% YoY in comparison with Rs.50 crore of Q2FY23. As in comparison with Q2FY23, web revenue in Q2FY24 elevated by 228% to Rs.82 crore. On account of the enriched product combine and economies of scale, the EBITDA margin improved by 180 foundation factors from 12% in Q2 FY2023 to 14% in Q2 FY2024.

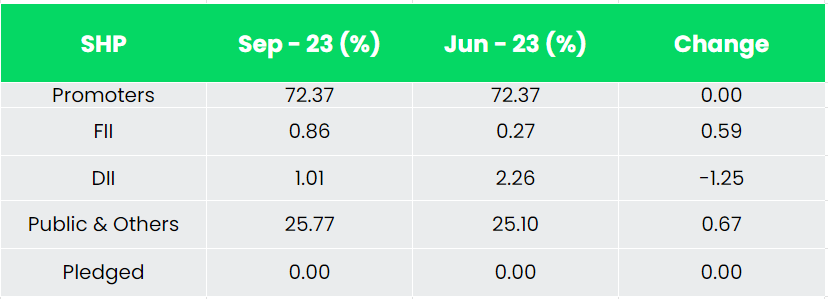

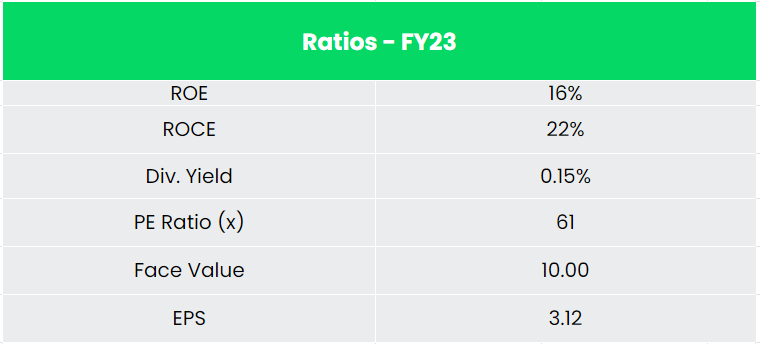

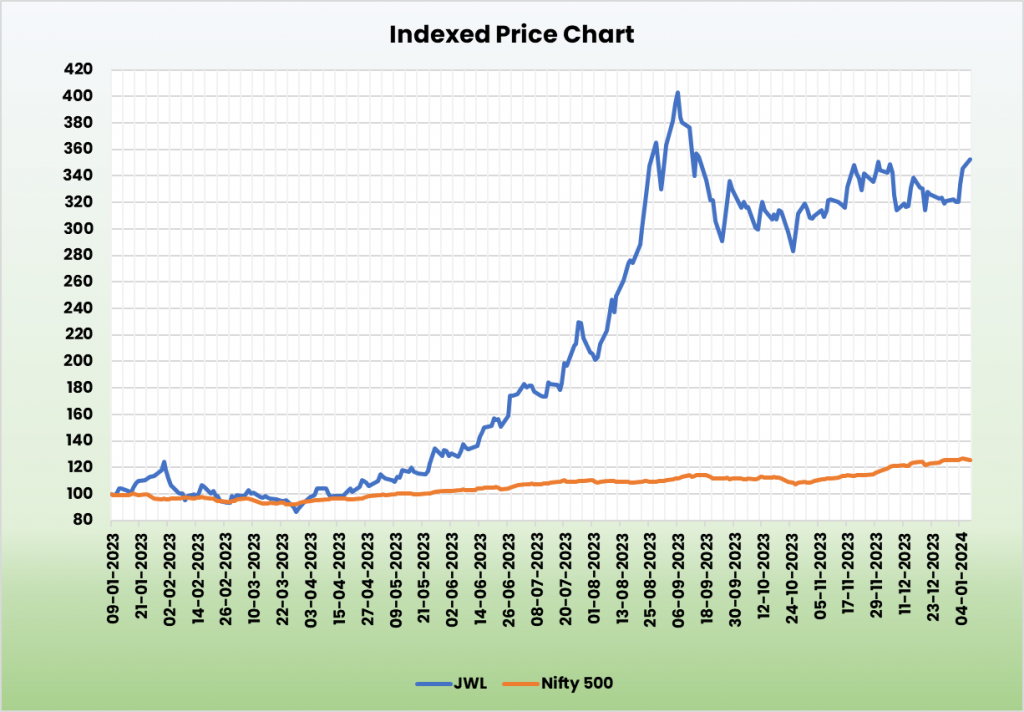

- Monetary Efficiency -The corporate has generated standalone income and PAT CAGR of 84% and 40% over the interval of 5 years (FY18-23). Common 3-year ROE & ROCE is round 13% and 18% for FY20-23 interval. The corporate has robust steadiness sheet with a strong debt-to-equity ratio of 0.35.

Business

Indian railways span hundreds of kilometres virtually overlaying your entire nation, making it the fourth largest on the earth after the US, China, and Russia. The railway community is taken into account cost-effective and superb for long-distance journey and motion of bulk commodities. Indian Railways’ income reached US$ 5.21 billion in Q3FY23. From April-January 2023, railway freight loading of 1243.46 MT was achieved towards final yr’s loading of 1159.08 MT which depicted an enchancment of seven%. 400 new era Vande Bharat trains are estimated to be manufactured in the course of the subsequent three years. Railway passenger site visitors is projected to achieve round 12 Bn per yr by 2031 and freight site visitors is predicted to cross 8,220 Mn tonne by 2031. India is projected to account for 40% of the full world share of rail exercise by 2050. With the appearance of initiatives equivalent to Vande Bharat, Devoted Freight Corridors (DFC), Metro Rail and Regional Speedy Transit System (RRTS), coupled with the federal government’s elevated concentrate on Indian Railways the trade and related firms are anticipated to attain strong progress.

Progress Drivers

Authorities has allowed 100% FDI within the railway sector. Below the Union Finances 2023-24, capital outlay of Rs. 2.40 lakh crore (US$ 29 billion) has been allotted to the Ministry of Railways, which is the best ever outlay. The Indian Railway launched the Nationwide Rail Plan, Imaginative and prescient 2024, to speed up implementation of important initiatives, equivalent to multitrack congested routes, obtain 100% electrification, improve the pace in strategic routes and remove all stage crossings on the GQ/GD route, by 2024.

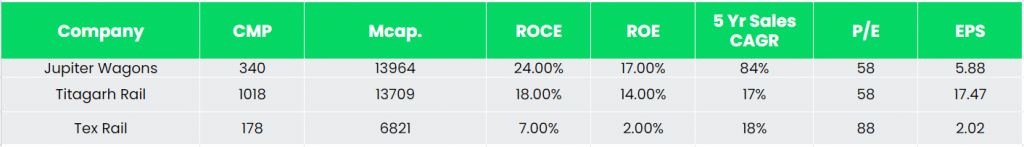

Rivals: Titagarh Rail, Texmaco Rail & Engineering Ltd and so on.

Peer Evaluation

Compared with its listed rivals, with a strong progress in income, JWL is forward when it comes to efficiency ratios, indicating the corporate’s monetary stability and its effectivity to generate earnings and returns from the invested capital.

Outlook

Fuelled by excessive demand for wagons and containers, strategic growth into worldwide markets, backed by stable order e book and promising partnerships, we consider Jupiter Wagons Ltd is in a trajectory of constant its present progress streak. The increase given by Indian Railways to develop its infrastructure and the “Make in India” initiative offers important increase to the railway sector and its related firms. We consider Jupiter Wagons is suitably positioned to capitalise on this and faucet the market share. The corporate has arrange the stage to enter the business electrical division beneath a separate entity shaped with GreenPower Motor Firm often known as Jupiter Electrical Mobility aiming to emerge as a number one participant in India’s business electrical car phase.

Valuation

We’re constructive on the longer term progress prospects of Jupiter Wagons Ltd given the thrust given by Indian Railways and personal sector on rail infrastructure, firm’s important market share coupled with capability growth in wagon enterprise and diversification of product portfolio. Therefore, we suggest a BUY score on the inventory with goal worth (TP) of Rs. 406 at 19xFY25EPS.

Dangers

- Dependence on Railways – IR being the main buyer for wagons, any antagonistic impression on price range allocation of Railways will impression the order move. The corporate has mitigated this danger partly by growing wagons for personal operators.

- Execution delay – Delay in well timed execution of the orders might impression income era. The corporate has laid out plans for capability enhancements. Any delays on this getting executed would possibly have an effect on the enterprise and turnarounds.

Different articles it’s possible you’ll like

Submit Views:

67