CCL Merchandise (India) Ltd. – Immediate Espresso Exporter

Continental Espresso (CCL Merchandise India Ltd.) is a number one Indian espresso firm within the world espresso market efficiently working companies in Espresso Exports, Non-public Label Manufacturing, and the retail branded coffees. Established in 1994 on a modest scale with only one espresso mix, one manufacturing unit in Duggirala, Andhra Pradesh, and exporting to at least one nation, CCL has grown to turn out to be a pacesetter within the trade globally providing greater than 1000 best high quality espresso blends, manufactured throughout 4 state-of-the-art amenities (India, Vietnam & Switzerland) to clients throughout 100 nations. CCL espresso is custom-made to swimsuit completely different palates and cater to the various wants of consumers world wide resulting in them turning into producers for high gamers personal label manufacturers in India and globally. They’re the biggest immediate espresso producer in India and one of many largest immediate espresso producers on the earth. Virtually 1000 cups of CCL espresso are consumed each second throughout the globe.

Merchandise & Providers:

The corporate works underneath two kinds of enterprise i.e., B2B and B2C. They’ve numerous merchandise underneath these two sorts.

- B2B – Below B2B, the corporate operates as a contract producer and produce merchandise comparable to Spray Dried Espresso Powder, Spray Dried Espresso Granules, Freeze Dried Espresso, Freeze Concentrated Liquid Espresso, Roasted Espresso Beans, Roast and Floor Espresso, Premix Espresso and Tea.

- B2C – Below B2C, the corporate has its personal manufacturers of espresso powders comparable to Continental Xtra, Continental Speciale, Continental THIS, Continental Black Version/Premium, Continental Malgudi, and so on. Other than foraying into client section, Continental Espresso has additionally arrange an institutional division and merchandising division (Merchandising Machines).

Subsidiaries: As on FY23, the corporate had 5 subsidiaries.

Key Rationale:

- Getting into the B2C Portfolio – CCL is primarily a contract producer for world immediate espresso model retailers or personal label entrepreneurs and it has already established its longstanding presence within the worldwide markets. The vast majority of CCL’s clients have been with the corporate for >15-20 years, a lot of whom entered the enterprise solely after partnering with CCL, thus demonstrating the standard of their relationship with it. Going ahead, the administration plans to develop its personal Continental espresso manufacturers within the UK and different markets. Additionally, Administration iterated that coming into the B2C section within the export markets gained’t create any battle of curiosity with the present shoppers. Within the branded Home Enterprise (B2C), the corporate has launched a brand new product class (Plant based mostly protein) underneath the model “Continental Greenbird).

- Current Acquisitions – The corporate has entered into an Asset- Buy settlement with the Lofbergs Group for the acquisition of varied manufacturers within the UK which incorporates Percol, Plantation Wharf, Rocket Gasoline, Percol Fusion, The London Mix, and Perk Up for a consideration of £ 550,000. Presently, the income is near Rs.18-20 crores which the enterprise goals to speed up to Rs.100 crores portfolio in a 3-5 years timeline. The enterprise requires no extra funding right here as it’s already a operating enterprise.

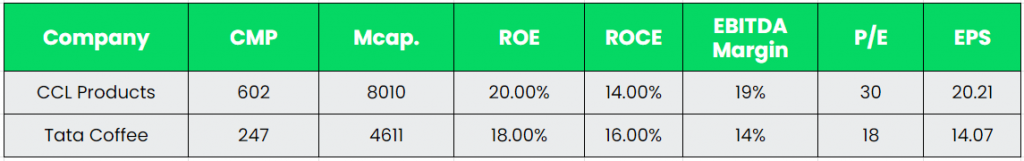

- Q1FY24 – CCL Merchandise reported a 28.6% YoY income development to Rs.655 crores in Q1FY24, on the again of sustaining its volume-driven development trajectory within the 18-20% vary with extra volumes pushed by the Vietnam plant. The EBITDA margins declined to 16.2% in Q1FY24 in comparison with 17.4% in Q1FY23 and 21.7% in Q4FY23. Excessive depreciation expenses and an uptick in curiosity prices (led by greater borrowings), resulted within the firm’s PAT falling brief to Rs.61 crores in Q1FY24 from Rs.85 crores in Q4FY23. In Q1FY24, CCL’s home enterprise stood at Rs.65 crores, out of which Rs.40 crores was branded enterprise (Continental Coffe, non-coffee merchandise).

- Monetary Efficiency – The ten 12 months income and revenue CAGR stands at 12% and 19% respectively. The steadiness sheet of the corporate is powerful with a debt-to-equity ratio of 0.6x. The 13,500 MT in Vietnam has been commercialized in Q4FY23 and the capability utilization will probably be elevated steadily. CCL plans to attain 50% capability utilization of the brand new capability in FY24. In complete, Vietnam’s present capability stands at 30,000 MT. Moreover, the corporate not too long ago introduced the addition of a 6,000 MT FDC (Freeze Dried Espresso) plant in Vietnam which is predicted to begin its operations in Q2FY25. Additionally, the brand new 16,500 MT SDC (Spray Dried Espresso) facility in Tirupati (AP) is predicted to be commercialized by the top of FY24.

Trade:

Espresso continues to thrive as one of the crucial consumed drinks globally. World espresso consumption is estimated to develop by 4.2% to 178.5 million baggage within the espresso yr 2022-23 (Oct’22-Sep’23). Worldwide Immediate Espresso market has been rising at low single digit. India turned the world’s fifth largest espresso exporter throughout 2021-22, with 6% of the worldwide output throughout FY22. Indian espresso is among the finest coffees on the earth resulting from its top quality and will get a excessive premium within the worldwide markets. Robusta is the majorly manufactured espresso with a share of 72% of the overall manufacturing. The trade supplies direct employment to greater than 2 million individuals in India. Since espresso is especially an export commodity for India, home demand and consumption don’t drastically affect the costs of espresso. The nation exports over 70% of its manufacturing. In 2021-22, the overall exports recorded a 42% rise to US$ 1.05 billion from the earlier yr. The export of immediate espresso elevated by 16.73 % to 35,810 tonnes in 2022 from 29,819 tonnes within the earlier yr.

Progress Drivers:

- Initiated by the Authorities of India, subsidies starting from US$ 2,500-US$ to three,500 per hectare have been offered to farmers to develop espresso in conventional areas.

- The altering existence, growing expenditure capacities and shifting dietary preferences of customers are additional offering a thrust to the market development. Because of the growing working inhabitants and hectic schedules, the consumption of Prepared-To-Drink tea and occasional merchandise has escalated considerably.

- Regardless of being a tea-drinking nation, espresso has been rising in recognition over the previous decade, fueled by the native cafe tradition scene.

Opponents: Tata Espresso.

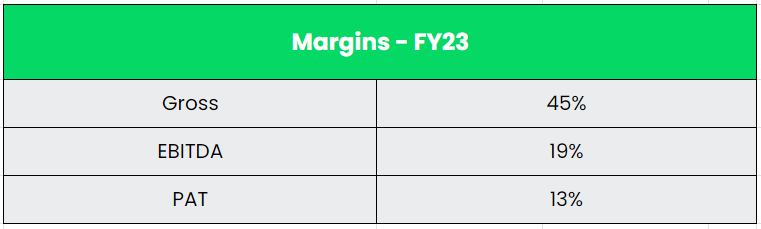

Peer Evaluation:

Tata Espresso is the direct competitors for the corporate and it’s the second largest producer of immediate espresso subsequent to CCL merchandise. The one distinction is that the CCL is a pure play producer and Tata espresso is greater than a producer. Tata possesses a danger of cultivating espresso plantations. By way of monetary efficiency, CCL merchandise is approach forward of Tata espresso.

Outlook:

The Administration has maintained its quantity development steering of 20% in FY24 and has additional guided for 18-20% CAGR quantity development for the subsequent three years. Presently, the corporate holds 8% of complete B2B market share in quantity (globally) and is assured to succeed in a market share of 15% within the subsequent 2-3 years. The administration has elevated the height FY25 debt steering to Rs.2,000 crores from Rs.1,200 crores on account of an anticipated improve within the working capital requirement in direction of the commissioning of the Vietnam and India facility. The corporate is totally booked (orders) within the freeze-dried espresso space for the subsequent 1 to 1.5 years, however they’re evaluating the spray-dried espresso space as they go alongside. CCL can be exploring the alternatives within the specialty espresso house as it’s a excessive margin house (premium class). Presently, it’s working with shoppers in small portions on this house. Within the Home section, the corporate goals to extend its outlet attain by 30-40% from catering to round 1,00,000 retailers to round 1,30,000-1,50,000 retailers this yr.

Valuation:

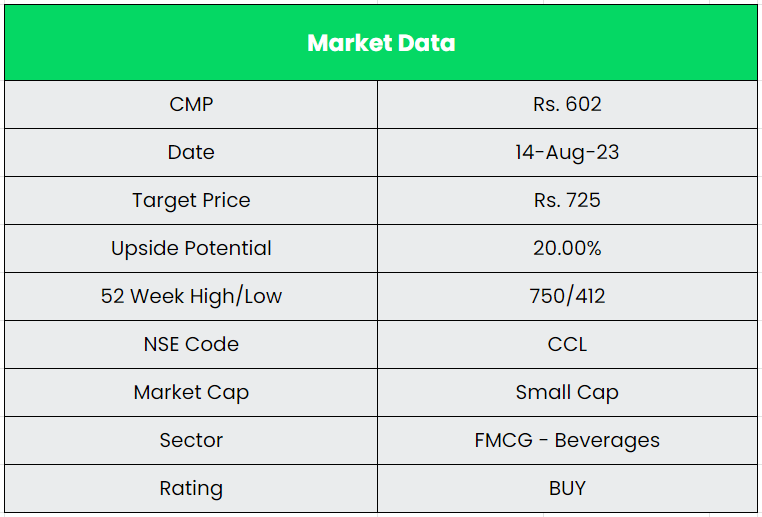

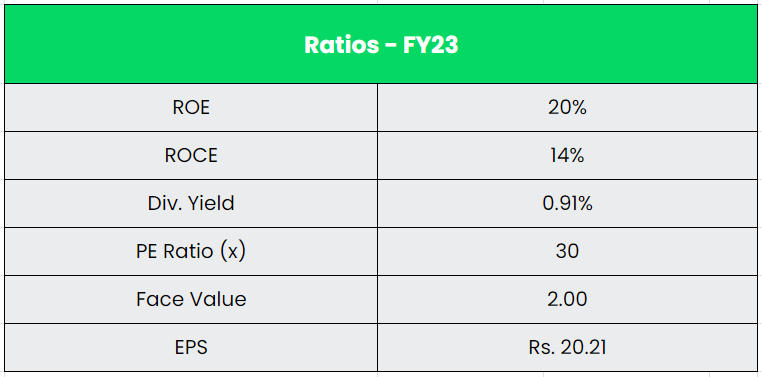

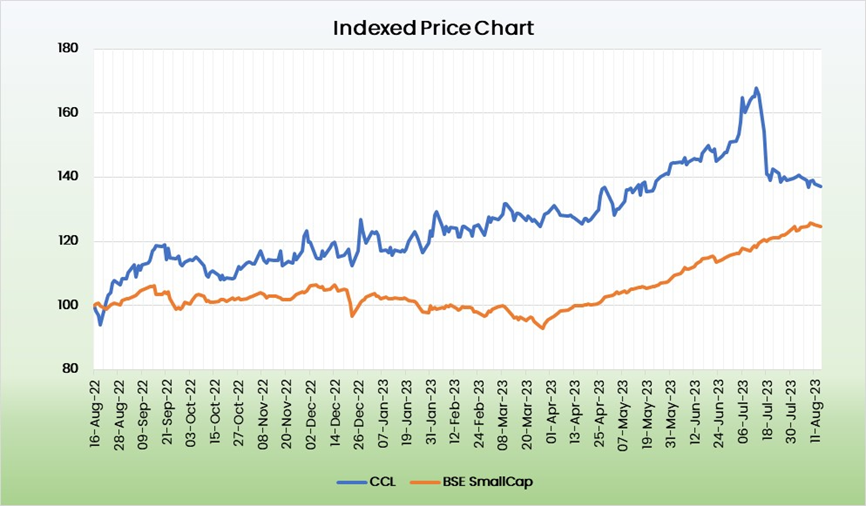

The corporate’s cost-efficient enterprise mannequin, capability growth, scaling up the excessive margin retail branded enterprise within the home & export markets and the latest acquisitions would be the key drivers within the close to time period. Nonetheless, rising in debt ranges must be a priority for the corporate. We advocate a BUY ranking within the inventory with the goal worth (TP) of Rs.725, 24x FY25E EPS.

Dangers:

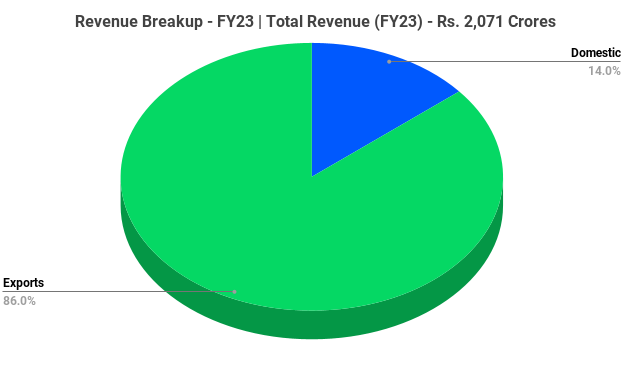

- Foreign exchange Danger – CCL derives 85%+ of its income by means of exports, thus being uncovered to foreign money fluctuations. Nonetheless, ~75% of its uncooked materials can be imported and therefore it creates a pure hedge for all transactions happening in US {dollars}.

- Regulatory Danger – CCL provides espresso to over 100 nations from India and Vietnam. Any unfavourable change in import or export responsibility charges in any nation or imposition of non-tariff boundaries might affect the competitiveness of provide from Vietnam and/or India.

- Credit score Danger – With a lot of the CCL’s enterprise being B2B in nature, the corporate is uncovered to credit score dangers. Nonetheless, a lot of the enterprise is repetitive and thru established clientele. The corporate doesn’t have document of any main dangerous money owed in its historical past.

Different articles chances are you’ll like

Publish Views:

4,551