For the previous few years, we now have reported on the change in costs related to numerous vacation seasons. The Thanksgiving Value Index was the primary, a product of our want to trace not simply common worth developments, however these of products and providers linked to particular occasions.

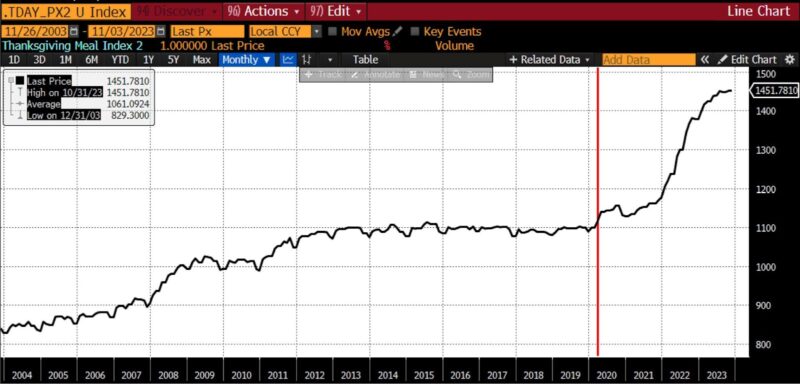

The constituents of the Thanksgiving Value Index embody the six CPI subcategories: turkey (and different poultry), sauces and gravies, bread (rolls and biscuits), canned fruit, greens, and pies and truffles. We additionally observe the worth of meals away from dwelling for comparability’s sake. With out additional ado, the worth adjustments are proven beneath, first as a ten yr chart, after which over the previous three years.

Thanksgiving Value Index constituents (crimson vertical line signifies begin of COVID financial coverage response), 10 years

| Oct | Oct | Oct | |

| 2020 to 2021 | 2021 to 2022 | 2022 to 2023 | |

| US CPI Different Poultry Together with Turkey | 1.68% | 16.89% | 7.25% |

| US CPI Bread | 2.29% | 14.78% | 6.27% |

| US CPI Biscuits, Rolls, and Muffins | 4.76% | 13.57% | 5.68% |

| US CPI Potatoes | 1.66% | 15.19% | 3.34% |

| US CPI Frozen Greens | -0.30% | 16.74% | 10.69% |

| US CPI Contemporary Greens | 1.69% | 8.28% | -2.22% |

| US CPI Canned Fruits | 2.87% | 18.68% | 3.09% |

| US CPI Sauces and Gravies | 1.76% | 14.57% | 7.48% |

| US CPI Meals Away from House | 12.04% | 8.59% | 5.37% |

The Inflation Discount Act however, the Thanksgiving Value Index rose 5.3 p.c between October 2022 and October 2023, from an index degree of 1378.96 to 1451.78. That’s considerably lower than the 17.8 p.c improve from October 2021 to 2022, however a steeper improve than each the 2020 to 2021 (3.37 p.c) and 2019 to 2020 (2.94 p.c) rises. The price of consuming at a restaurant rose virtually identically over the identical time interval (5.37 p.c).

The twenty-year development within the mixed index is proven beneath — once more with the beginning of the Fed’s COVID response indicated by a horizontal crimson bar. Since October 2019, our Thanksgiving Value Index has risen 32 p.c (1099.537 to 1451.781).

AIER Thanksgiving Value Index, 2013 – current

(Supply: Bloomberg Finance, LP)

The American Farm Bureau Federation calculates that Thanksgiving dinners will likely be about 4.5 p.c cheaper than final yr’s traditionally excessive costs, reaching the identical conclusions that we do utilizing a considerably totally different basket of products.

We additionally study a second set of costs, greatest described as “secondary” or “auxiliary” Thanksgiving bills. They embody prices that are usually incurred round Thanksgiving however don’t embody meals: transportation, grooming, and the like. Between 2022 and 2023, three of those costs took half within the total deflationary development: for gasoline, airline tickets, and intercity transportation (buses and trains), costs declined. But a handful of seasonally-engaged providers — haircuts, dry cleansing/laundry, and pet care — rose at almost twice the October year-over-year headline CPI price (3.2 p.c) from October 2022 to October 2023.

| Oct | Oct | Oct | |

| 2020 to 2021 | 2021 to 2022 | 2022 to 2023 | |

| AAA Gasoline (common, US) | 51.64% | 20.00% | -7.88% |

| US CPI Gasoline, Common Unleaded | 51.28% | 17.07% | -5.58% |

| US CPI Airline Fare | -4.63% | 42.89% | -13.20% |

| US CPI Different Intercity Transportation | 4.60% | 4.07% | 0.37% |

| US CPI Haircuts and Private Care Providers | 4.31% | 5.59% | 5.04% |

| US CPI Pet Providers Together with Veterinary | 3.93% | 10.67% | 7.29% |

| US CPI Laundry and Dry Cleansing | 6.92% | 7.19% | 6.15% |

In 2023, People are going through one other costly vacation season stemming largely from the financial interventions enacted in the course of the preliminary phases of the COVID pandemic. Disinflation is underway, however because the AIER Thanksgiving Value Index makes clear these results are taking impact each slowly and never pervasively. The uptrend in each the overall worth degree, and on this cultural touchstone as nicely, are the enduring legacy of the 2020 coverage decisions of the Federal Reserve.