In 2019, the state of California put in place the CalSavers Retirement Financial savings Program, with the objective of enabling California residents to save lots of for retirement.

Proper now, nearly half of all private-sector workers within the U.S. are employed by small companies. Of that group, solely about 10% have a retirement financial savings plan at work. Regardless of this, the advantages of providing a retirement program are wide-ranging for a small enterprise, serving to enhance worker efficiency and retention.

On this article, we’ll break down a number of the most often requested questions concerning CalSavers.

What’s CalSavers, and the way does it influence me?

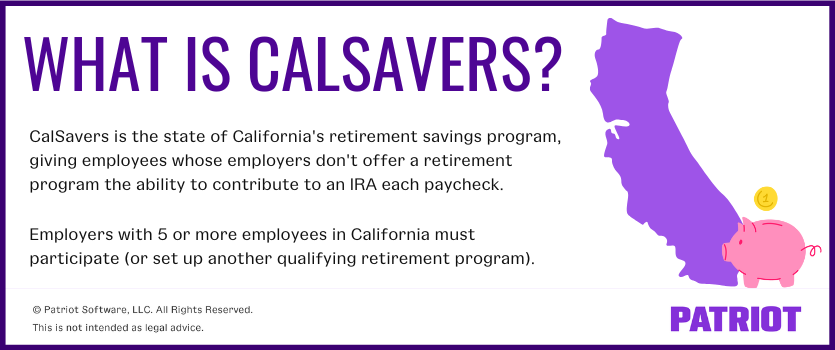

CalSavers is the state of California’s retirement financial savings program. It provides workers whose employers don’t provide a retirement program the flexibility to contribute to an Particular person Retirement Account (IRA) with every paycheck. CalSavers is overseen by a state board and administered by private-sector monetary service corporations.

So, how does the CalSavers mandate influence you? In response to the CalSavers web site, employers who meet the next standards should take part in this system or arrange one other qualifying retirement program like a 401(okay):

- Employer has 5 or extra W-2 workers in California

- Not less than one worker is eighteen years or older

- Employer doesn’t provide a separate, certified retirement plan

Staff at companies that meet this standards are mechanically enrolled in this system until they select to decide out. Staff of smaller companies (i.e., fewer than 5 workers) may open a CalSavers account, however they want to take action on their very own via the self-enrollment course of.

How does CalSavers work?

CalSavers is an computerized enrollment Roth IRA program. Worker contributions to the packages are mechanically deducted from every paycheck after taxes are taken out, so workers wouldn’t have to pay revenue taxes on this cash when withdrawing it for retirement. This system is totally voluntary for workers, they usually can decide out at any time.

If an worker doesn’t select their very own share of paycheck to be deducted, they are going to be entered into the usual financial savings fee for CalSavers: 5% of their gross pay. There may be additionally a function that mechanically will increase an worker’s financial savings fee by 1% every year till it reaches 8%.

Funds contributed to CalSavers develop tax-free, and contributors can withdraw their contributions at any time. Nevertheless, if a participant takes cash out of their CalSavers Roth IRA earlier than the age of 59½ by requesting a nonqualified distribution, the IRS costs a ten% penalty on the earnings portion of their distribution.

Additionally, at any time, contributors have the choice of transferring their account stability into a conventional IRA.

CalSavers penalty

Employers who fail to conform should pay a penalty of $250 per eligible worker if noncompliance extends 90 days or extra after receiving discover of non-compliance; $500 per eligible worker if non-compliance extends 180 days or extra after the discover.

Which workers can take part in CalSavers?

Any resident of California who is eighteen years or older and has a job is eligible to take part in CalSavers. Eligible employees are auto-enrolled by their employers however have a 30-day window to vary their contribution fee, funding possibility, or to opt-out earlier than any payroll contributions start. Savers could make modifications to their accounts or opt-out at any time. Accounts are owned by every particular person participant and are moveable from job to job.

Taking part employers are required to add their new workers into the portal inside 30 days of their rent date. Self-employed people and enterprise house owners are additionally eligible and might use the self-enrollment course of to open accounts.

Are there any CalSavers program alternate options?

If your small business has 5 or extra workers and isn’t sponsoring a plan but, there are a number of different choices of plans to supply. You possibly can arrange a:

- 401(okay) plan (together with a number of employer plans or pooled employer plans)

- 401(a) – Certified Plan (together with profit-sharing plans and outlined profit plans)

- 403(a) – Certified Annuity Plan or 403(b) Tax-Sheltered Annuity Plan

- 408(okay) – Simplified Worker Pension (SEP) plans

- 408(p) – Financial savings Incentive Match Plan for Staff of Small Employers (SIMPLE) IRA Plan

- Payroll deduction IRAs with computerized enrollment

Whereas CalSavers may be the proper choice for a lot of employers within the state, different companies could possibly be higher served by establishing their very own employer-sponsored retirement plan, corresponding to a 401(okay), to fulfill CalSavers necessities whereas additionally bettering their workers’ monetary safety.

A 401(okay) plan provides each conventional and Roth choices in addition to increased contribution limits and profit-sharing. Due to this, 401(okay) plans are a chance for enterprise house owners and workers to save lots of extra for retirement. Importantly, employer contributions to a 401(okay) are deductible on the employer’s federal revenue tax return as much as a sure restrict, that means employers may profit financially from providing workers a 401(okay).

It’s vital to contemplate all out there choices and analysis which plan is greatest for your small business.

How can Patriot & Vestwell assist?

Patriot and Vestwell have partnered to supply reasonably priced retirement plans for small companies in California and throughout the US. Vestwell’s digital retirement platform straight integrates with Patriot’s payroll software program, making it simpler so that you can provide and administer a company-sponsored 401(okay). By combining expertise with best-in-class retirement plans, Vestwell has created customized packages for Patriot prospects which are extremely reasonably priced and simple to arrange and use.

Should you’re a California employer serious about organising a 401(okay) account for your small business as an alternative of facilitating CalSavers, you’ll be able to contact Vestwell to find out if you’re eligible to obtain as much as $16,500 in tax credit, which may also help cancel out administration prices.

? Be taught extra right here.

This text has been up to date from its authentic publication date of June 8, 2022.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.