Sovereign Gold Bond Scheme 2023-24 Collection 3 shall be obtainable for funding from 18th December to twenty second December 2023. Must you purchase it?

With the latest great returns of the primary Sovereign Gold Bond, many are interested in this product. RBI issued the primary Sovereign Gold Bond in November 2015. Therefore, 8 years accomplished in November 2023. The problem worth was Rs.2,684 per gram (per bond). The redemption worth set by RBI for this bond was Rs.6,132. Therefore, the return on funding is 10.88% (excluding 2.5% yearly curiosity). If we add the curiosity, then it’s round 12.5% !!

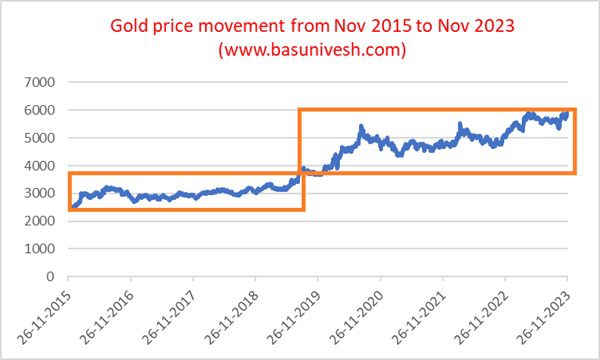

Whether or not the journey easy within the final 8 years for the gold?

Discover the flat and bumpy journey of the final 8 years of gold. From 2015 to 2019 it was one pattern and from 2019 onwards uptrend however inside the rangebound for the following 4 years. I wrote a publish by wanting on the previous 44 years of gold knowledge and the way a lot the risky gold worth motion is. Additionally, I’ve proven even in case you maintain the gold for 8 years (equal to the time horizon of Sovereign Gold Bond), then what could also be written potentialities? You’ll be able to seek advice from the identical at “Sovereign Gold Bond Returns – How A lot Can You Anticipate?“. Nonetheless, we’ve a agency perception that gold will at all times shine!!

This Gold Bonds scheme was launched in November 2015. The federal government launched this scheme to cut back the demand for bodily gold. Indians purchase round 300 tons of gold yearly. That is to be imported from outdoors nations. Allow us to see the silent options of this scheme.

The Bonds shall be issued within the type of Authorities of India Inventory in accordance with part 3 of the Authorities Securities Act, 2006. The traders shall be issued a Holding Certificates (Kind C). The Bonds shall be eligible for conversion into de-mat kind.

Sovereign Gold Bond Scheme 2023-24 Collection 3 – Options

Earlier than you run to purchase Sovereign Gold Bond Scheme 2023-24 Collection 3, learn my earlier posts on this regard.

After studying the above posts, in case you nonetheless really feel gold is price so that you can make investments, then go forward. Allow us to now talk about the options of this Sovereign Gold Bond Scheme 2023-24 Collection 3.

# Dates to subscribe

Sovereign Gold Bond Scheme 2023-24 Collection 3 shall be open for subscription from eighth December to twenty second December 2023.

# Who can make investments?

Resident Indian entities together with people (in his capability as such particular person, or on behalf of a minor youngster, or collectively with every other particular person.), HUFs, Trusts, Universities, and Charitable Establishments can put money into such bonds.

Therefore, NRIs aren’t allowed to take part within the Sovereign Gold Bond Scheme 2023-24 Collection 3.

# Tenure of the Bond

The tenor of the Bond shall be for 8 years with an exit choice from the fifth yr to be exercised on the curiosity fee dates.

Therefore, after the 5 years onward you’ll be able to redeem it on the sixth, seventh, or at maturity of the eighth yr. Earlier than that, you’ll be able to’t redeem.

RBI/depository shall inform the investor of the date of maturity of the Bond one month earlier than its maturity.

# Minimal and Most funding

It’s a must to buy a minimal of 1 gram of gold. The utmost quantity subscribed by an entity won’t be greater than 4 kgs per particular person per fiscal yr (April) for people and HUF and 20 kg for trusts and comparable entities notified by the federal government sometimes per fiscal yr (April – March).

Within the case of joint holding, the funding restrict of 4 kg shall be utilized to the primary applicant solely. The annual ceiling will embrace bonds subscribed beneath completely different tranches throughout preliminary issuance by the Authorities and people bought from the secondary market.

The ceiling on funding won’t embrace the holdings as collateral by banks and different Monetary Establishments.

#Curiosity Price

You’ll obtain a hard and fast rate of interest of two.50% each year payable semi-annually on the nominal worth. Such rate of interest is on the worth of cash you invested initially however not on the bond worth as on the date of curiosity payout.

Curiosity shall be credited on to your account which you shared whereas investing.

# Situation Worth

The worth of SGB shall be mounted in Indian Rupees based mostly on a easy common of closing worth of gold of 999 purity, revealed by the India Bullion and Jewellers Affiliation Restricted (IBJA) for the final three working days of the week previous the subscription interval. The problem worth of the SGBs shall be much less by Rs.50 per gram for the traders who subscribe on-line and pay by way of digital mode.

# Fee Choice

Fee shall be accepted in Indian Rupees by way of money as much as a most of Rs.20,000/- or Demand Drafts or Cheque or Digital banking. The place fee is made by way of cheque or demand draft, the identical shall be drawn in favor of receiving an workplace.

# Issuance Kind

The Gold bonds shall be issued as Authorities of India Inventory beneath the GS Act, 2006. The traders shall be issued a Holding Certificates for a similar. The Bonds are eligible for conversion into Demat kind.

# The place to purchase Sovereign Gold Bond Scheme 2023-24 Collection 3?

Bonds shall be offered by way of banks, Inventory Holding Company of India Restricted (SHCIL), designated Publish Places of work (as could also be notified), and acknowledged inventory exchanges viz., Nationwide Inventory Trade of India Restricted and Bombay Inventory Trade, both instantly or by way of brokers.

Click on HERE to search out out the record of banks to Sovereign Gold Bond Scheme 2023-24 Collection 3.

# Mortgage in opposition to Bonds

The Bonds could also be used as collateral for loans. The Mortgage to Worth ratio shall be relevant to strange gold loans mandated by the RBI sometimes. The lien on the Bonds shall be marked within the depository by the licensed banks. The mortgage in opposition to SGBs can be topic to the choice of the lending financial institution/establishment, and can’t be inferred as a matter of proper by the SGB holder.

# Liquidity of the Bond

As I identified above, after the fifth yr onwards you’ll be able to redeem the bond within the sixth or seventh yr. Nonetheless, the bond is accessible to promote within the secondary market (inventory alternate) on a date as notified by the RBI.

Therefore, you may have two choices. You’ll be able to redeem it within the sixth or seventh yr or promote it secondary market after the notification of RBI.

Do keep in mind that the redemption worth shall be in Indian Rupees based mostly on the earlier week’s (Monday-Friday) easy common of the closing worth of gold of 999 purity revealed by IBJA.

# Nomination

You’ll be able to nominate or change the nominee at any time limit by utilizing Kind D and Kind E. A person Non – resident Indian could get the safety transferred in his identify on account of his being a nominee of a deceased investor supplied that:

- The non-resident investor shall want to carry the safety until early redemption or until maturity, and

- the curiosity and maturity proceeds of the funding shall not be repatriable.

# Transferability

The Bonds shall be transferable by execution of an Instrument of switch as in Kind ‘F’, in accordance with the provisions of the Authorities Securities Act, 2006 (38 of 2006) and the Authorities Securities Laws, 2007, revealed partly 6, Part 4 of the Gazette of India dated December 1, 2007.

# Redemption

As I defined above, you may have the choice to redeem solely on the sixth, seventh, and eighth yr (computerized and finish of bond tenure). Therefore, there are two strategies one can redeem Sovereign Gold Bonds. Explaining each under.

a) On the maturity of the eighth yr-The investor shall be knowledgeable one month earlier than maturity relating to the following maturity of the bond. On the completion of the eighth yr, each curiosity and redemption proceeds shall be credited to the checking account supplied by the shopper on the time of shopping for the bond.

In case there are modifications in any particulars, comparable to account quantity, or e mail IDs, then the investor should inform the financial institution/SHCIL/PO promptly.

b) Redemption earlier than maturity – For those who plan to redeem earlier than maturity i.e. eighth yr, then you’ll be able to train this selection on the sixth or seventh yr.

It’s a must to method the involved financial institution/SHCIL places of work/Publish Workplace/agent 30 days earlier than the coupon fee date. Request for untimely redemption can solely be entertained if the investor approaches the involved financial institution/publish workplace not less than at some point earlier than the coupon fee date. The proceeds shall be credited to the shopper’s checking account supplied on the time of making use of for the bond.

# Taxation

There are three elements of taxation. Allow us to see one after the other.

1) Curiosity Earnings-The semi-annual curiosity revenue shall be taxable revenue for you. Therefore, For somebody within the 10%, 20%, or 30% tax bracket, the post-tax return involves 2.25%, 2%, and 1.75% respectively. This revenue you must present beneath the pinnacle of “Earnings from Different Sources” and should pay the tax accordingly (precisely like your Financial institution FDs).

2) Redemption of Bond-As I mentioned above, after the fifth yr onward you might be eligible to redeem it on the sixth,seventh, and eighth yr (final yr). Allow us to assume on the time of funding, the bond worth is Rs.2,500 and on the time of redemption, the bond worth is Rs.3,000. Then you’ll find yourself with a revenue of Rs.500. Such capital achieve arising resulting from redemption by a person is exempted from tax.

3) Promoting within the secondary market of the Inventory Trade-There may be yet another taxation which will come up. Allow us to assume you purchase in the present day the Sovereign Gold Bond Scheme 2023-24 Collection I and promote it on the inventory alternate after a yr or so. In such a scenario, any revenue or loss from such a transaction shall be thought of as a capital achieve.

Therefore, if these bonds are offered within the secondary market earlier than maturity, then there are two potentialities.

# Earlier than 3 years-For those who promote the bonds inside three years and if there may be any capital achieve, such capital achieve shall be taxed as per your tax slab.

# After 3 years – For those who promote the bonds after 3 years however earlier than maturity, then such capital achieve shall be taxed at 20% with indexation.

There isn’t a idea of TDS. Therefore, it’s the accountability of traders to pay the tax as per the principles talked about above.

# Whom to method in case of any points?

The issuing banks/SHCIL places of work/Publish Places of work/brokers by way of which these securities have been bought will present different buyer providers comparable to change of tackle, early redemption, nomination, grievance redressal, switch purposes, and so on.

Together with this, a devoted e-mail has been created by the Reserve Financial institution of India to obtain queries from members of the general public on Sovereign Gold Bonds. Buyers can mail their queries to this e mail id. Beneath is the e-mail id

RBI E mail ID in case of Sovereign Gold Bonds-[email protected]

Benefits Of Sovereign Gold Bond Scheme 2023-24 Collection 3

# After the GST entry, this Sovereign Gold Bond could also be advantageous over bodily Gold cash or bars. This product won’t come beneath GST taxation. Nonetheless, within the case of Gold cash and bars, earlier the VAT was at 1% to 1.2%, which is now raised to three%.

# For those who maintain it until maturity or redeem it as and when the bonds are eligible, then the achieve is tax-free.

# In case your foremost function is to put money into gold, then other than the bodily kind, investing in ETF or in Gold Funds, appears to be a greater choice. As a result of you do not want to fret about bodily safekeeping, no fund fees (like ETF or Gold Funds) and the Demat account shouldn’t be necessary.

# On this Sovereign Gold Bond Situation FY 2023-24, the extra profit other than the everyday bodily or paper gold funding is the annual curiosity fee on the cash you invested.

Therefore, there are two varieties of revenue potentialities. One is curiosity revenue from the funding and the second is worth appreciation (if we’re constructive on gold). Therefore, together with worth appreciation, you’ll obtain curiosity revenue additionally.

However do keep in mind that such curiosity revenue is taxable. Additionally, to keep away from tax, you must redeem it solely on the sixth, seventh, or eighth yr. For those who promote within the secondary market, then such achieve or loss shall be taxed as per capital tax achieve guidelines.

# There isn’t a TDS from the achieve. Therefore, you do not want to fret concerning the TDS half like Financial institution FDs.

# A sovereign assure of the Authorities of India will make you SAFE.

Disadvantages Of Sovereign Gold Bond Scheme 2023-24 Collection 3

# In case you are planning to put money into your bodily utilization after 8 years, then merely steer clear of this. As a result of Gold is an asset, which supplies you volatility just like the inventory market however the returns of your debt merchandise like Financial institution FDs or PPF.

# The important thing level to grasp can also be that the curiosity revenue of two.5% is on the preliminary bond buy quantity however not the yearly bond worth. Therefore, allow us to say you invested Rs.2,500, then they pay curiosity of two.5% on Rs.2,500 solely despite the fact that the worth of gold moved up and the worth of such funding is Rs.3,000.

# Liquidity is the most important concern. Your cash shall be locked for five years. Additionally, redemption is accessible solely annually after fifth yr.

In case you wish to liquidate in a secondary market, then it’s laborious to search out the proper worth, and capital achieve tax could break your funding.

# Sovereign assure of the Authorities of India could really feel you safe. Nonetheless, the redemption quantity is solely based mostly on the worth motion of the gold. Therefore, if there’s a fall within the gold worth, then you’ll get that discounted worth solely. The one assure here’s a 2.5% return in your invested quantity and NO DEFAULT RISK.

Sovereign Gold Bond Scheme 2023-24 Collection 3 – Must you purchase?

Above I’ve shared my earlier posts on gold. You observed that gold can also be a extremely risky asset like fairness. Nonetheless, many people discover it laborious to consider.

In case you are nonetheless keen on gold, then somewhat than exposing your self to gold an excessive amount of, ensure that to have a correct asset allocation amongst completely different asset courses like fairness, debt, actual property, and gold. Don’t be obsessive about anybody single asset class and above that we’re not sure of which asset class will carry out higher throughout OUR funding journey. Therefore, diversification must be your mantra.

Conclusion:- Put money into Sovereign Gold Bond Scheme 2023-24 Collection 3 in case your foremost function is to build up bodily gold after 8 years or so. Nonetheless, in case your function is to have publicity to gold in your funding portfolio, then higher to remain away. As they’re illiquid, it’s laborious so that you can promote whereas doing the rebalancing exercise. As an alternative, go for extremely tradable Gold ETFs or Gold Funds (The fee will improve extra in comparison with ETF and each ETF and Gold Funds are taxed otherwise) are higher choices.

Assume and make investments correctly somewhat than BLIND funding.