Do employers have to supply medical insurance? Underneath the Inexpensive Care Act, you have to present medical insurance you probably have 50 or extra full-time equal workers. If this requirement doesn’t apply to you, you may resolve to determine a QSEHRA plan.

What’s a QSEHRA plan?

A Certified Small Employer Well being Reimbursement Association (QSEHRA) is a tax-free worker profit. QSEHRAs reimburse workers for individually-obtained medical insurance premiums and eligible medical bills. Employers fund QSEHRAs—as much as the contribution restrict—and might deduct their reimbursement bills from their taxes. Employers with fewer than 50 full-time equal workers can provide QSEHRAs.

The twenty first Century Cures Act established the small enterprise HRA in 2016. QSEHRA isn’t thought-about a conventional group medical insurance plan. Reasonably, this well being reimbursement association is a gaggle well being plan different small employers can pursue.

Employers who should not have to supply medical insurance to their workers can select to supply a standalone Certified Small Employer Well being Reimbursement Association. In case you present a QSEHRA plan, you can’t provide one other sort of medical insurance.

Workers don’t contribute to well being reimbursement preparations. And, eligible workers can not choose out of employer-provided QSEHRA plans.

Are you able to present QSEHRAs?

Providing standalone well being reimbursement preparations are helpful to each you and your workers.

Workers obtain assist paying for medical insurance premiums. And, you may deduct QSEHRA contributions out of your small enterprise taxes.

However earlier than you resolve to offer a Certified Small Employer Well being Reimbursement Association, test to make sure you’re eligible.

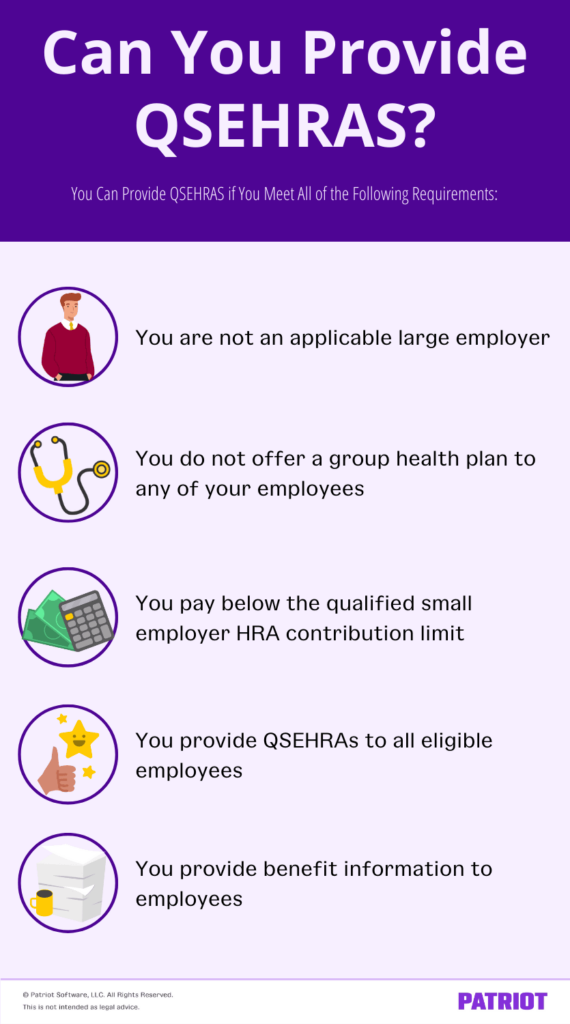

1. You aren’t an relevant massive employer

If you wish to present a QSEHRA, you have to meet small enterprise measurement requirements. You can’t present a small enterprise HRA in case you are an relevant massive employer (ALE).

Relevant massive employers are companies that make use of at the very least 50 full-time equal workers.

You can’t present a QSEHRA plan should you have been an ALE within the earlier calendar yr. In case your workforce will increase to greater than 50 full-time equal workers, you may proceed your QSEHRA plan till January 1 of the subsequent calendar yr.

2. You don’t provide a gaggle well being plan to any of your workers

Though small employers aren’t required to supply medical insurance to their workers, you may. However should you do provide group medical insurance, you can’t present QSEHRA plans.

For instance, it’s possible you’ll go for the Small Enterprise Well being Choices Program (SHOP) relatively than offering a QSEHRA plan. SHOP is an reasonably priced medical insurance choice that qualifying small companies can provide workers.

In case you provide group well being plans for a part of the yr, you can’t provide QSEHRA plans throughout these months.

3. You pay under the certified small employer HRA contribution restrict

Every year, the QSEHRA contribution restrict is topic to vary.

In 2024, the cost and reimbursement restrict for single protection is $6,150 per yr. The annual contribution restrict for household protection is $12,450.

It’s essential to fund your workers’ preparations by yourself. Don’t withhold cash from workers’ wages to fund the QSEHRA plan.

Remember that you do not want to pay the utmost quantity to your QSEHRA plan. Be sure you set a QSEHRA restrict. Your restrict may fluctuate relying on whether or not the worker elects single or household protection, in addition to what number of relations it covers.

4. You present QSEHRAs to all eligible workers

If you wish to set up a QSEHRA plan in your small enterprise, you have to provide it to all eligible workers. So, who isn’t an eligible worker?

You don’t want to supply well being reimbursement preparations to the next:

- Half-time workers who work lower than 35 hours per week

- Seasonal workers whose annual employment is lower than 9 months

- New workers who haven’t but accomplished 90 days of service

- Workers below the age of 25 at first of the plan yr

- Nonresident aliens with no earned earnings from sources throughout the U.S.

- Workers lined by a well being benefit-centric collective bargaining settlement

In case you personal an S company, 2% shareholder-employees will not be eligible for QSEHRAs.

Whenever you reimburse workers for his or her medical insurance premiums or medical bills, your contributions have to be equal and proportional. Once more, contributions must be equal to the variety of relations lined below the plan.

In response to the IRS, you may restrict the scope of your QSEHRA. It’s possible you’ll slender down which medical bills are eligible for reimbursement. However, you have to make this widespread amongst all eligible workers.

5. You present advantages data to workers

In case you set up a QSEHRA plan in your small enterprise, that you must notify your workforce. Distribute written notices to your eligible workers at the very least 90 days earlier than the QSEHRA goes into impact.

| Need a better method to distribute written notices? Add digital notices with Patriot’s on-line HR Software program add-on. Share necessary paperwork with workers, manage worker information, and extra. Plus, it integrates with our on-line payroll. Attempt each totally free immediately! |

What ought to your written QSEHRA notices say? In response to the IRS, every discover ought to embrace the next:

- The reimbursement quantity the worker is eligible to obtain

- An announcement that the worker wants to tell the Healthcare Market of the quantity of the profit in the event that they apply for advance funds of the premium tax credit score

- An announcement that the worker could be accountable for a person shared accountability cost if they don’t seem to be lined below minimal important protection for any month

- The date that the plan takes impact

Failing to offer a written QSEHRA discover may lead to penalties. You could be required to pay $50 per worker, as much as a most of $2,500, if you don’t present written notices.

What should you don’t qualify to offer a QSEHRA?

In case you don’t meet the above necessities, you can’t present a standalone QSEHRA. Nonetheless, nonqualifying employers of all sizes can provide a well being reimbursement association (HRA) along with group medical insurance protection.

This text has been up to date from its unique publication date of March 11, 2019.

This isn’t meant as authorized recommendation; for extra data, please click on right here.