Employers juggle many obligations, together with calculating and withholding payroll taxes and different deductions. However, what precisely does payroll taxes embody? And, how are you aware how a lot to withhold from staff’ wages? In case you’re questioning about understanding payroll taxes, by no means worry—your payroll taxes breakdown is right here.

What are payroll taxes?

How do payroll taxes work? Payroll taxes are a particular kind of employment tax. Not all employment taxes are payroll taxes. As an alternative, payroll taxes include the Federal Insurance coverage Contributions Act (FICA) tax. So, what’s FICA tax?

FICA tax is the mix of Social Safety and Medicare taxes. The federal government makes use of funds from the 2 taxes for various applications:

- Social Safety tax: Funds advantages for retirement, dependents of retired employees, and the disabled and their dependents.

- Medicare tax: Funds medical advantages for folks age 65 and older, the disabled, and people with qualifying well being situations.

Social Safety and Medicare tax have completely different tax charges. And, there’s an further Medicare tax for qualifying staff (we’ll get to that later).

What are payroll taxes levied on? Employers should withhold these taxes from their staff’ wages. However, don’t withhold the whole quantity of every tax from the worker. Employers share the accountability of paying FICA taxes with their staff. Present payroll tax on paystub on your staff.

Self-employed people will not be exempt from paying federal payroll taxes. As an alternative of paying FICA tax, they need to pay self-employment tax. The Self Employed Contributions Act (SECA) tax requires self-employed people to pay Social Safety and Medicare taxes. SECA doesn’t break up the tax between worker and employer. As an alternative, self-employed people should pay everything of the tax themselves.

Different taxes in payroll

Once more, not all employment taxes are payroll taxes. Individuals generally check with all taxes deducted in payroll as payroll taxes. However, there are numerous sorts of employment taxes.

Employment taxes embody:

- Federal earnings tax

- State earnings tax

- Native earnings tax

- Federal unemployment (FUTA) tax

- State unemployment (SUTA) tax

Workers don’t pay all employment taxes. And likewise, employers don’t pay all employment taxes.

Earnings taxes solely come out of the workers’ wages. Federal unemployment taxes are employer-only taxes. State unemployment taxes are sometimes employer-only, however some states require each employers and staff to contribute to the tax (e.g., Pennsylvania).

Payroll tax charges

Workers pay the identical quantity of FICA payroll tax as employers as a result of the whole quantity is break up evenly. Self-employed people should pay the whole quantity of each taxes. So, how a lot are payroll taxes for workers, employers, and self-employed employees?

Social Safety and Medicare tax charges

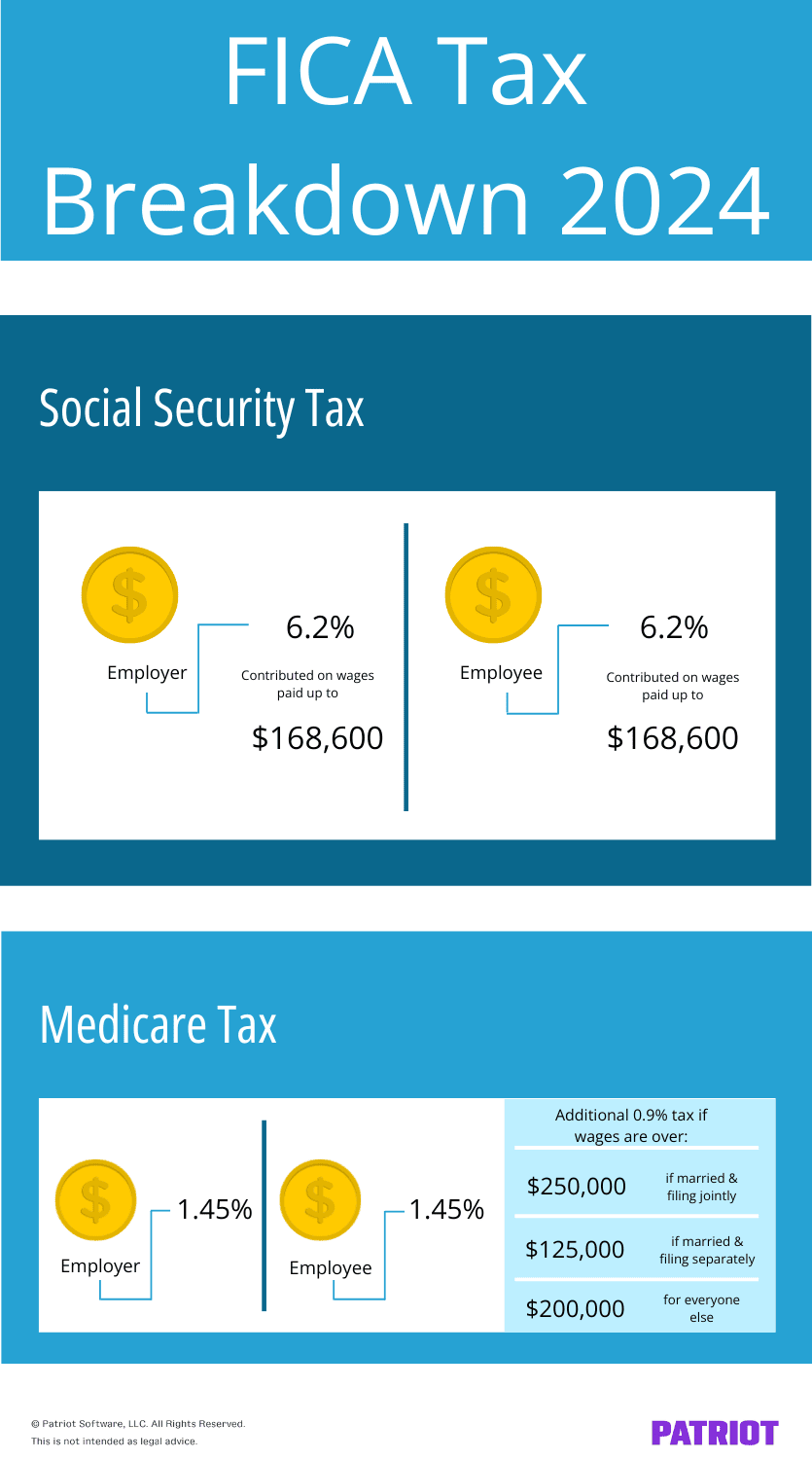

To understand how a lot FICA tax to pay or withhold, break it down into the 2 components of the tax: Social Safety and Medicare.

Social Safety tax has a better tax fee. It’s a flat 12.4% however solely applies as much as the Social Safety wage base, which usually adjustments annually. The 2024 Social Safety wage base is $168,600. Equally divide the whole share between you and your staff. Withhold 6.2% out of your staff’ wages and contribute 6.2% because the employer (12.4% / 2).

Medicare tax has a flat tax fee of two.9%. Like Social Safety tax, staff and employers equally share the whole tax. So, employers and staff every pay 1.45% (2.9% / 2). In contrast to Social Safety, there is no such thing as a wage base or cap to the wages topic to the Medicare tax. As an alternative, there’s an extra Medicare tax of 0.9% as soon as staff earn above a certain quantity.

Further Medicare taxes apply to staff based mostly on submitting standing:

- Married submitting collectively: $250,000

- Married submitting individually: $125,000

- Single: $200,000

Employers should withhold the extra Medicare tax after an worker earns above $200,000. Workers who earn above the brink should pay 2.35% for Medicare tax (1.45% + 0.9%). Employers proceed to pay 1.45% as a result of the extra Medicare tax fee solely applies to staff.

Self-employment tax fee

SECA tax is mainly the identical as FICA tax, besides one individual pays the whole quantity for every tax.

Social Safety tax is 12.4% and Medicare is 2.9% complete. So, the mixed fee for SECA tax is 15.3%.

Self-employment Social Safety taxes solely apply as much as the Social Safety wage base.

A self-employed particular person should additionally pay the complete 2.9% of Medicare tax. Self-employment wages are additionally topic to further Medicare tax (0.9%). If the extra Medicare tax applies, the whole tax fee is 3.8% (2.9% + 0.9%). There is no such thing as a most quantity of Medicare tax a person pays.

Payroll tax FAQs

Nonetheless have some questions on payroll taxes? Check out some continuously requested questions.

1. Is federal withholding tax a payroll tax?

Federal withholding is a tax calculated throughout payroll, however it’s not technically a payroll tax. As an alternative, federal withholding is an employment tax. One other title for federal withholding is federal earnings tax.

2. Can employers make staff pay the whole quantity of FICA tax?

No. Federal legislation requires employers to evenly break up FICA tax with their staff. Solely self-employed people pay everything of Social Safety and Medicare taxes.

3. What occurs if an worker meets the Social Safety wage base in the midst of a pay interval?

If an worker meets the Social Safety worker tax wage base in the midst of the pay interval, solely calculate the tax on wages as much as the quantity.

Say an worker receives biweekly paychecks and hits the wage base on the finish of the primary week of the pay interval. The worker’s complete paycheck is $6,000. Divide the gross pay by two and apply the Social Safety tax to the primary half of the gross wages ($6,000 / 2 = $3,000).

This text is up to date from its authentic publication date of October 20, 2015.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.