On the time of penning this submit, Nifty touched the mark of 20,780 – an all-time excessive. Ought to I make investments lump sum when market is ALL TIME HIGH or watch for fall?

Seek advice from my newest submit – “Prime 10 Greatest SIP Mutual Funds To Make investments In India In 2024“.

There’s a worry amongst traders particularly in case you are making an attempt to speculate your lump sum when the market touched an all-time excessive. Concern of MISSING or worry of LOSING each are excessive throughout such ranges. What do we’ve got to do? What steps to observe and what warning do we’ve got to take?

Ought to I make investments lump sum when market is ALL TIME HIGH?

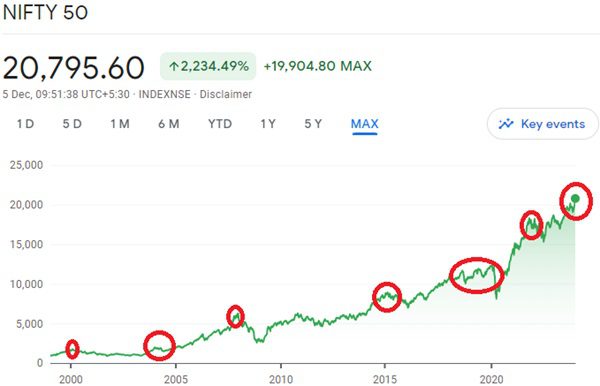

Allow us to attempt to look again on the historical past of the Nifty.

When you have a have a look at the above chart, you’ll discover that there are various such all-time excessive intervals up to now. Therefore, this isn’t new and this isn’t going to be an finish additionally. In such a scenario what needs to be our technique to speculate lump sum when market is ALL TIME HIGH?

# Establish your monetary purpose

Earlier than leaping to selecting an asset class, it’s of utmost significance to establish your monetary targets. They might be your child’s schooling, youngsters’ marriage, or retirement purpose. When you establish your monetary purpose, the following step is to establish the time horizon left to realize this purpose and the quantity required to realize this purpose.

Earlier than investing a single penny (whether or not month-to-month or lump sum), having readability about this is essential. After you have carried out this train, then the following step is knowing your RISK urge for food.

Sadly that is essentially the most tough and altering activity. All of it depends upon your previous monetary life, present monetary life, and the way you have a look at the danger. Danger-taking means adjustments based mostly on individual to individual, age, monetary standing, and sort of targets.

Should you can’t choose this, then higher to take the assistance of a mounted fee-only monetary planner who affords conflict-free recommendation (simply somebody is SEBI RIA doesn’t imply they provide conflict-free recommendation. Even when somebody planning to retain his purchasers endlessly for his revenue, then this additionally as per me is a conflicting relation). Therefore, be cautious whereas selecting a planner for this train for you.

# Asset Allocation

When you establish your monetary targets, time horizon, quantity required, and your danger urge for food the following step is to allocate your cash in direction of numerous asset lessons based mostly in your information and understanding of these belongings like Gold, Debt, Fairness (direct or by way of MF), or Actual Property.

Ideally, in case your targets are lower than 5 years, then by no means enter into the fairness market (whether or not direct shares or mutual funds). Nevertheless, in case your targets are round 6-10 years, then allocate round 40% to 50% in fairness and the remainder in debt (or different belongings with which you might be snug). Nevertheless, in case your targets are greater than 10 years, then chances are you’ll allocate round 60% in fairness and the remainder in your snug non-volatile belongings like debt.

Why asset allocation? As a result of no asset class is PERFECT for you. All belongings have their positives and negatives. Greater than that, we don’t know which asset class will carry out greatest sooner or later. Therefore, when we live in such an unsure world, it’s all the time higher to diversify our funding.

# If you’re already a goal-based investor

When you have already carried out this train of figuring out targets, danger evaluation, asset allocation, and doing the funding, then cross-check your present asset allocation. If there may be any deviation within the outlined asset allocation to the present, then fill the hole with this lump sum cash to align as per your targetted asset allocation.

Having a lump sum is a bonus as with out altering the prevailing asset lessons, you’ll be able to simply deliver it again to the advised asset allocation. In any other case, withdrawing the cash from a better allotted asset class means it’s a must to bear sure prices like tax (or typically exit load).

Therefore, do that train as a precedence and sleep calmly.

# Should you nonetheless have to speculate a lump sum in fairness

After doing the above train, for those who nonetheless must deploy a lump sum to deliver it to the advised asset allocation, then it’s a must to now consider the right way to make investments lump sum when market is ALL TIME HIGH?

Ideally, on this finance world, there isn’t any such normal or outlined reply to say that it is a FOOLPROOF technique to speculate lump sum when the market is all-time excessive. Nevertheless, to keep away from psychological trauma (in case the market falls drastically sooner or later), you’ll be able to observe the under technique.

- Do bear in mind that you’re coming into the fairness market on your medium-term and long-term targets however not for short-term targets. Therefore, even when there’s a market crash submit your entry (which NONE can predict), then mentally put together your self for this, and as I discussed you aren’t counting on this single asset class to realize your monetary purpose.

- If you’re bringing within the lump sum from fairness and shifting to fairness (perhaps for numerous causes like trimming your funds, cleansing your portfolio mess, or on account of extended underperformance of energetic funds), then in my opinion, no want to attend. Simply transfer as a lump sum. Primarily as a result of you aren’t coming into freshly to fairness. As a substitute, the motion is from fairness to fairness. Therefore, you’ll be able to put money into one go.

- Nevertheless, in case you are bringing within the lump sum freshly out of your different sources or the debt, then you could not observe the lump sum that goes to fairness.

- As I discussed above, there isn’t any such normal rule to say or outline what’s LUMP SUM. For few the month-to-month funding is Rs.5 lakh and for few lump sum means Rs.5 lakh (a giant quantity if somebody is doing a month-to-month funding of Rs.50,000).

- Therefore, outline how a lot BIG the quantity is in your OWN (with out taking a look at what the monetary world will preach to you with sure standardized guidelines). Should you can’t establish the identical, then take the assistance of your planner (in case you have any).

- Should you really feel the lump sum quantity you might be deploying to fairness is large, then stagger it for six months, 12 months, or 24 months (if the quantity is simply too large). Few observe weekly or as soon as in a 15-day technique too. Nevertheless, I often don’t recommend this. Primarily as a result of for a lot of traders, doing this isn’t a PRIMARY occupation. You need to take care of your occupation and household too. Therefore, don’t assume an excessive amount of. Additionally, don’t trouble an excessive amount of throughout this part about worry of lacking out, decrease publicity to fairness, or market downfall. Neither you might be conscious nor even the god additionally. Therefore, simply deploy it slowly into the fairness.

- Now the query is the right way to deploy this month-to-month. Can we do STP or maintain the cash within the financial institution and deploy it manually? Though it seems to be simple for few to maintain it within the financial institution and deploy it manually, in real-life eventualities it is vitally tough to do it strictly by managing your occupation or household. Therefore, you’ll be able to automate it by parking in the identical AMC liquid fund and organising the STP. I’m suggesting this seems to be simple for a lot of. I’m recommending this simply purely based mostly on the straightforward of deploying with none human intervention. You possibly can select the one which is snug for you. I’m neither a intermediary nor earn a single penny straight or not directly from any mutual fund firms by recommending any technique for you.

Is it a FOOLPROOF technique?

NO…As I discussed above, none are conscious of what could be the future. The one approach is by doing such a sort of deployment into fairness, you’ll not panic, you’ll not lose hope on fairness, and greater than that with correct asset allocation, you might be simply allocating a sure portion of your portfolio to fairness however not absolutely.

Whether or not you might be investing in a lump sum or month-to-month, this is not going to create draw back safety to your cash. As a substitute, a correct identification of your targets with the best asset allocation is a MUST.

Lastly, to conclude my factors, sharing with you the story of Mr.Bob, The World’s Unluckiest Investor. Get pleasure from studying !!