Missed Alternative in Brazilian Curiosity Charges sowed the seeds of discovering the fitting fund

Earlier this yr, certainly one of my associates, a doyenne of Currencies and Curiosity Fee buying and selling, informed me there was cash to be made in Brazilian Actual Native Authorities Bonds and rate of interest merchandise. In 2022, the Brazilian rate of interest rose from 9.25% to a cycle excessive of 13.75%. Inflation was hovering there as in the remainder of the world. Lots of merchants misplaced cash calling the highs within the price excessive cycle and threw within the towel. Losses multiplied. However by the flip of the yr, issues have been trying totally different. Inflation was coming down, the Central Financial institution had stopped elevating charges in Sao Paulo and had stopped sounding hawkish. Because the market had been wrongfooted in 2022, rates of interest appeared too excessive initially of 2023.

“Devesh, you must become involved in Brazilian native charges,” she pleaded. “This can be a nice commerce.”

“However how?” I responded with frustration. “No mutual fund or ETF permits a person investor primarily based out of the USA to spend money on native Brazilian Authorities bonds in Reais. There has by no means been a option to take part.”

She has at all times been liberal along with her market calls and is nearly at all times proper. However buying and selling Thailand vs. Malaysia or Aussie charges vs. Mexican charges will not be my forte. I twiddled my thumbs till I made up my mind to seek out a solution to the issue. I’ve sufficient background in these merchandise to grasp their complexity and the chance set.

My private profession historical past in EM confirmed alternatives and dangers.

Proper out of faculty, my first job was to commerce Latin American currencies and native rates of interest. From 1997 to 2000, I referred to as banks and brokers in Venezuela, Argentina, Colombia, Chile, Brazil, and Mexico to purchase and promote currencies and bonds for Merrill Lynch’s clients and for the financial institution’s personal capital. As soon as, we took down a whole Colombian bond public sale at 32% rates of interest. However I additionally noticed the Argentine and Venezuelan devaluation, and there may be nothing uglier than seeing cash evaporate. Debt devices in Rising Markets are fascinating as a result of there are such a lot of nations and so many merchandise.

Thrilling and academic it could be, however maybe it’s a blessing in disguise that easy fund merchandise don’t exist to invest on the long run path of those Rising Market (EM) debt belongings. At a financial institution, one might be a specialist. Not from residence. I stored on the lookout for an clever option to harness the chance set in Rising markets debt.

Does the reply lie in a Passive ETF?

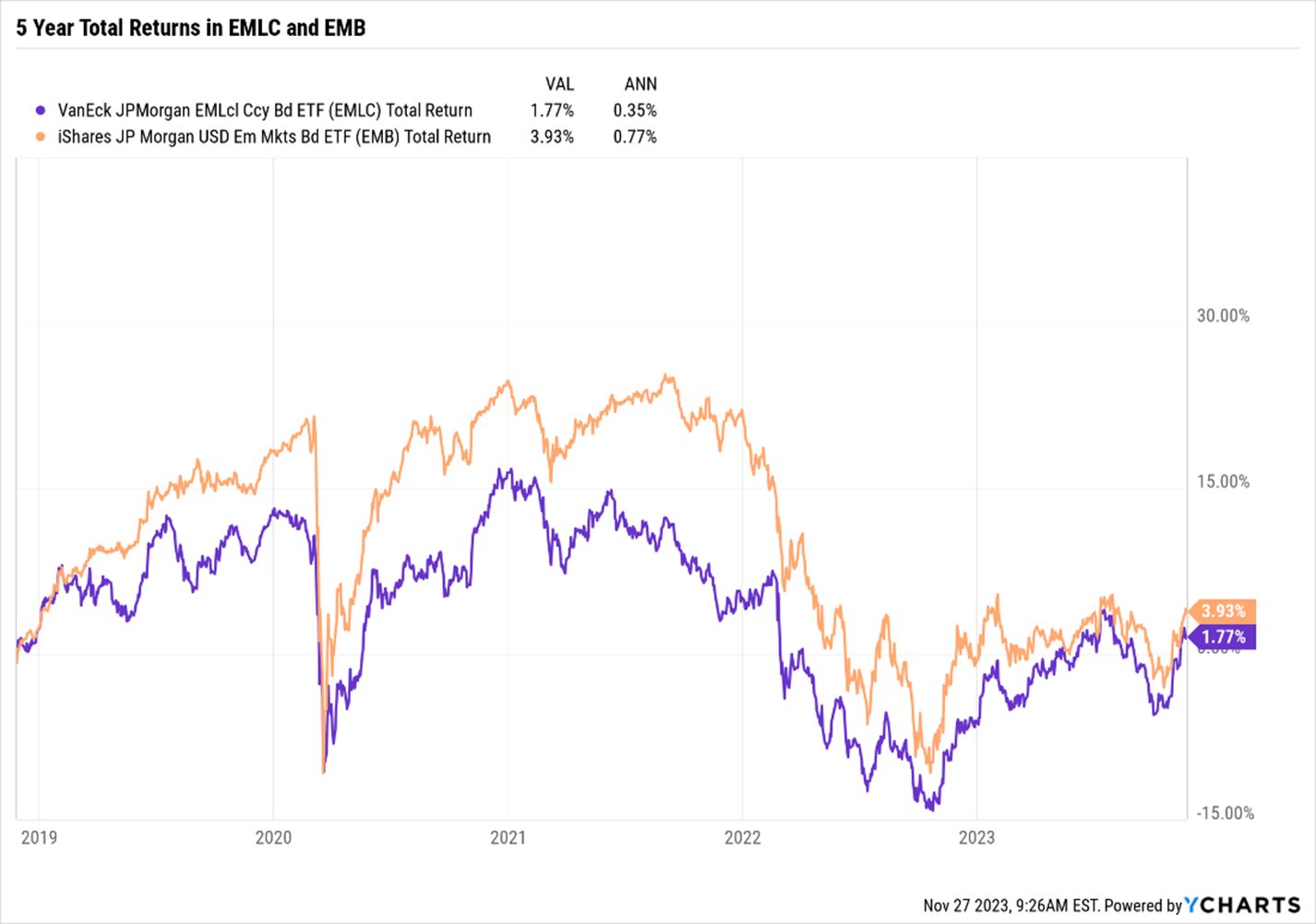

For native forex investments, the Van Eck JP Morgan EM Native Foreign money Bond ETF (EMLC) has nearly $3 Billion in AUM. For exhausting forex investments, The iShares JP Morgan USD EM Bond ETF (EMB) is the go-to car with nearly $14 Billion in Property. Sadly, neither of them conjures up regardless of the billions invested in them. The 5-year Whole Return for each are within the low single digits. There are various causes for the poor report, however I’m not on the lookout for losers to show round. I need to speak to winners who know the best way to become profitable.

PS: One wonders who these buyers are with $17 Billion in these sorry ETFs. And why do they proceed to be concerned in it?

The Energetic Selection: Artisan EMsights Capital Group Rising Market Debt Funds

I stored on the lookout for energetic funds that may match the shoe for EM debt and beat the pants out of the passive. With the assistance of the MFO Premium search engine, I discovered what I feel is an effective fund for the aim and the portfolio.

Michael Cirami is a fund supervisor of three EM Debt funds at Artisan Companions. I spoke to him in mid-November to grasp higher what he does and why his funds would possibly work for these looking for an adept supervisor in EM debt. I’d like so as to add that David Snowball has a companion piece that readers ought to learn. If a reader desires a larger appreciation of what the fund tries to perform, there’s a incredible interview by The Wall Road Transcript. I wished to take a barely totally different method. As an asset allocator, it issues much less whether or not the fund chooses or avoids Nigeria or Guyana. The essential factor for buyers in our seats is to grasp what this fund does and the way it suits into our total portfolio.

Michael Cirami is a fund supervisor of three EM Debt funds at Artisan Companions. I spoke to him in mid-November to grasp higher what he does and why his funds would possibly work for these looking for an adept supervisor in EM debt. I’d like so as to add that David Snowball has a companion piece that readers ought to learn. If a reader desires a larger appreciation of what the fund tries to perform, there’s a incredible interview by The Wall Road Transcript. I wished to take a barely totally different method. As an asset allocator, it issues much less whether or not the fund chooses or avoids Nigeria or Guyana. The essential factor for buyers in our seats is to grasp what this fund does and the way it suits into our total portfolio.

Can we begin with why the passive funding method doesn’t work effectively in EM Debt?

Passive ETFs typically comply with Benchmarks. In EM Debt, there are 4 benchmarks:

Benchmarks are riddled with issues: Nations which situation probably the most debt are likely to have the most important positions within the index. Simply because a rustic is extremely indebted doesn’t make them extra investment-worthy. Maybe, fairly the alternative. Benchmarks might assign very low weights to some nations or all collectively ignore different nations whereas nonetheless protecting defaulted nations within the benchmark. There are arbitrary guidelines on minimal measurement and maturities included within the index. Bonds within the benchmark even have a whole lot of threat to non-EM components: like US rates of interest of the Euro forex price. Lastly, the benchmark carries many bonds with low spreads to US treasuries which don’t provide engaging yields to debt buyers.

These are among the the reason why Passive ETFs haven’t carried out effectively in EM.

What do you try this’s totally different?

We’re benchmark agnostic. We begin with a clean piece of paper and decide one of the best investments in EM throughout sovereign exhausting forex bonds, native forex bonds, company bonds, and derivatives which permits us to hedge or add to FX threat, Credit score threat, or rate of interest threat. Our funding universe is round 130 nations. Moreover, we hedge out the US Rate of interest threat throughout all our investments (extra about this later).

We handle three totally different funding methods:

- Artisan World Unconstrained (“Unconstrained”)

- Artisan Rising Markets Debt Alternatives (“EMDO”)

- Artisan Rising Markets Native Alternatives (“Native”).

As of October 2023, the belongings underneath administration (AUM) are: Unconstrained $301 million, EMDO $82 million, and Native $412 million. We handle mutual funds, separate accounts, and European UCITS.

Solely World Unconstrained and EMDO can be found to US Mutual Fund buyers.

The EMDO fund is a protracted solely fund within the EM debt asset class. It’s 100% EM alpha and beta.

The World Unconstrained fund is a long-short fund throughout EM and Growing Markets (DM). This fund could be a combine 80% EM and 20% DM. As a result of it’s Lengthy Quick it carries much less beta threat than the EMDO fund. It additionally permits us to seize alpha on each side of the market as our analysts are centered on nation by nation and safety by safety analysis.

We consider that investing in mid-size nations like Brazil and Mexico would possibly arrange once in a while. However these are typically typically extra environment friendly. Our candy spot is within the extremely inefficient nations, tens of smaller nations, which may provide true diversification to a portfolio, and the place the probabilities of over and undervalued securities are highest.

How huge is your investible universe set for this asset class?

We consider the Sovereign Exhausting Foreign money market is about $1 Trillion {dollars}. Native forex bonds ex-China is about $2 Trillion, and maybe $3 Trillion if we embrace India. The dimensions of the asset class will not be related to what we do as we try to discover one of the best alternatives in EM.

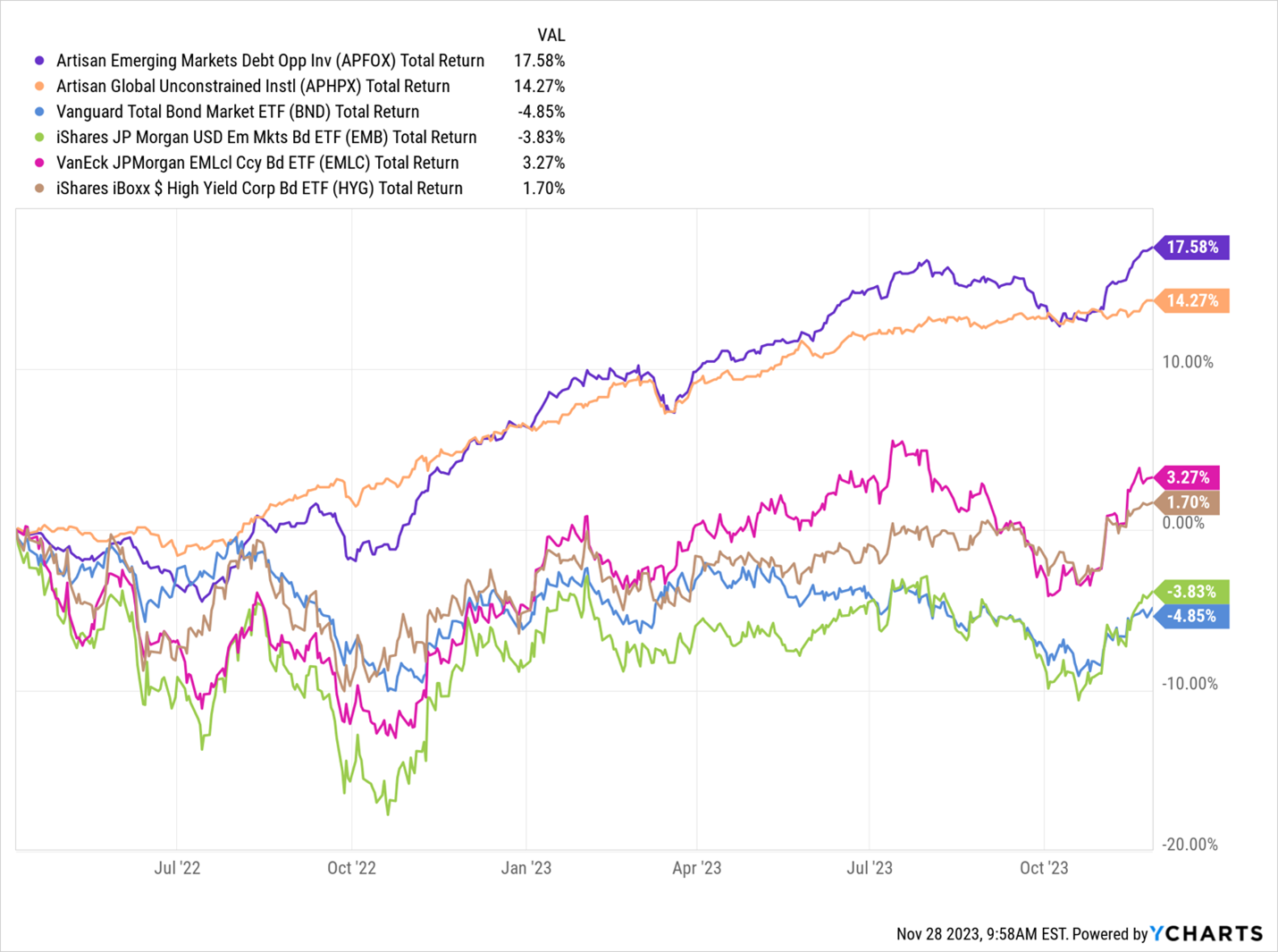

You began the funds in March and April 2022. Let’s check out the returns of the 2 funds and examine them with a couple of passive ETFs.

The EMDO and World Unconstrained have fared considerably higher in a hostile broader surroundings for bonds. Inform us one thing we should always study from this remark.

Over the past ten years, the EMBI (which is 90% in exhausting forex sovereigns and 10% in corporates) generated a complete return of 24%. A tough forex bond is priced on a ramification to US Treasuries. Over this era, about 44% of the return generated within the EMBI got here from US rates of interest. The passive is closely uncovered to the actions in US rates of interest and thus is a complicated barometer with EM-specific efficiency.

Take the instance of a brand new 10-year Turkish bond in US {Dollars}. It could be issued at a ramification of over 4% (400 foundation factors) to the US 10-year, which has a present rate of interest of 4.5%. The mixed yield or curiosity earned can be 4 + 4.5% = 8.5%.

The EMBI would spend money on a bond like this. So, a whole lot of the yield of the Turkish bond is coming from the extent of the US 10-year rates of interest. If US rates of interest threat, and US bonds fall, so will the Turkish bond, even when the basics would possibly enhance in Turkey on the margin.

In our funds, we hedge out our rate of interest threat. If we purchased the Turkish bond, we might brief the 10-year US Treasury bond towards it and largely, however not absolutely insulate ourselves from the long-dated US Bond market.

We’d then make investments the proceeds generated from the sale of the 10-year US Treasury into short-term US Cash market funds. This manner we cut back the period threat of all of the positions.

We will nonetheless earn the 4% unfold, and we might earn 5.25% from the present in a single day money price, or a complete of 9.25% now. We thus convert a hard and fast price bond portfolio to a floating price portfolio.

By selecting our nations primarily based on alternative set and never market cap weight, and by hedging period threat from our investments, our funds behave in a different way from the passive ETFs.

What returns will be anticipated for an investor prepared to spend money on the fund for 5-7 years?

We perceive that buyers anticipate to fulfill a sure hurdle price to step out of their consolation zone and spend money on EM debt.

There are two parts to our funds: Exhausting forex bonds and native bonds. Each have a large dispersion between nations.

First, Sovereign & Company exhausting forex bonds commerce from 300-400 bps over US Treasuries to as vast as 1000 bps. We predict a blended price is about 500 bps.

Second, native rates of interest could also be as little as 2% and as excessive as 9-10%. Moreover, there can be some FX actions on our investments. We see the Extra return to US Treasuries there to be between 300 to 500 bps.

Mixing the 2, we hope to earn an extra return over Treasuries with a ramification period of about 2.2 years. In an excellent yr, that would result in mid-teens in returns. In a poor yr, given the excessive yield, it is perhaps within the small single-digit adverse territory.

Returns are typically not going to be as excessive as Rising Market Equities.

In addition to the distinction in volatility between Bonds and Equities, is there a distinction in composition?

In comparison with EM Equities, EM Debt is much less unstable and likewise not as concentrated in Asia. Here’s a chart with High 10 nation exposures:

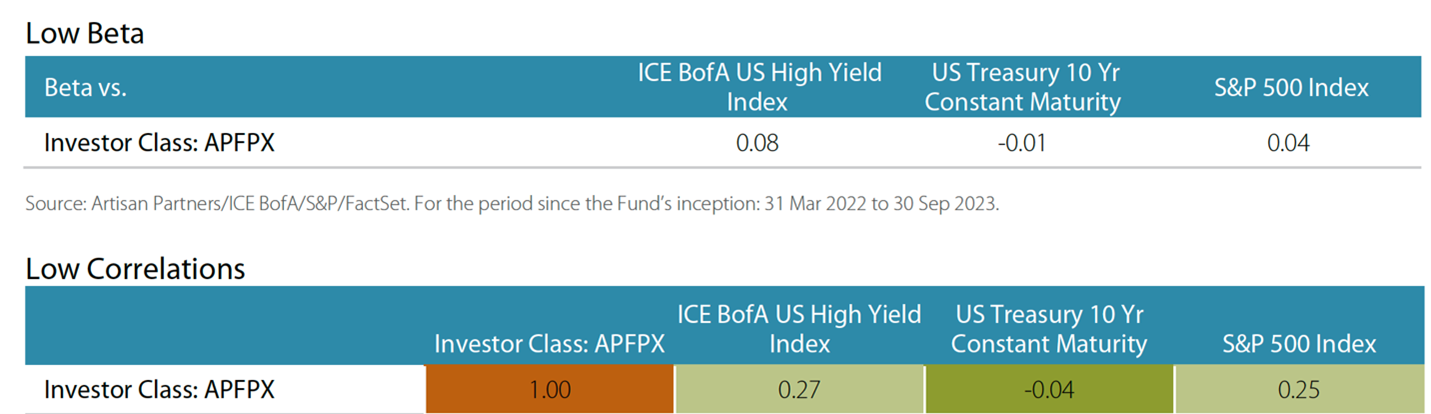

How correlated are the funds with different giant asset lessons?

The World Unconstrained fund has a low beta and low correlation to US belongings just like the HY Index, the 10-year Treasury, and the S&P 500 Index.

Relying on the prevailing portfolio construction of buyers, our EM debt funds could be a good diversifier. They could be a low period, low beta, low correlation, excessive Sharpe ratio asset to personal.

We consider that energetic administration wins by not dropping. We hope to guard the draw back and compound capital through the years.

Notice to reader: Since I used to be on the lookout for a option to allocate to native and sovereign debt positions in Rising Markets on a long-only foundation, I’m an investor in EMDO.

After I requested Michael the place he’s invested, he mentioned, “I’ve been a fixed-income investor in my profession. We are typically a bearish breed, however I’ve cash in each of the funds.”

How does he plan to cope with a big institutional investor deciding to tug the promote set off on the portfolio given the extremely illiquid and geographically various nature of the EM debt investments? Portfolio distribution in variety solely works in concept. I’m certain that’s not an choice.

We spend money on sovereign/company bonds and derivatives that span the liquidity spectrum. Many of those markets are extremely liquid. I’ve managed on this model for practically 20 years in all totally different market situations, and EM markets will be extra liquid than another conventional credit score markets. Having mentioned this, we might not have issue managing a big promote within the portfolio.

Conclusion

My journey began with the search for a public market fund that supplied clever publicity to EM Debt. The Artisan EMDO and Unconstrained appear to be the answer in the fitting course. There is perhaps different funds too, however I’d be watching each funds very carefully as a present investor. With Debt funds, there may be much less hyperbole. We’re by no means going to have actually nice years. The hope is to compound capital exterior of equities in a gentle and stable method. Michael Cirami and the group appear to have a deal with on that course of.