When you ship Types W-2 to your workers, you don’t have to fret concerning the annual kind till subsequent 12 months. Or, do you? In case you don’t know how one can fill out Type W-2, you might run into issues.

Your workers may come to you with questions on Type W-2. And, your workers might imagine you made a mistake if their W-2 Field 1 worth is decrease than what they imagine they earned.

Prepared to chop by means of the confusion? Learn on to discover ways to fill out Type W-2, field by field, and what all of it means.

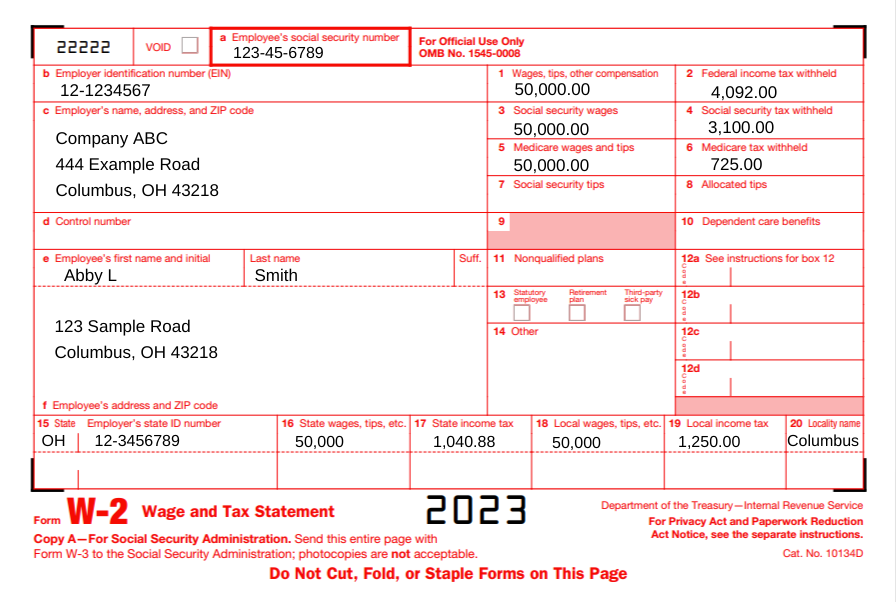

Instance Type W-2

Earlier than we dive into how one can fill out Type W-2, right here’s a easy pattern of a Type W-2 for an worker who earns $50,000 yearly.

fill out Type W-2

You might need your Type W-2 tasks all the way down to a science. Enter worker data; ship copies to workers; file the shape with the SSA and state, metropolis, or native tax division; and repeat the next 12 months.

Or, you simply may spend hours gathering worker data and making an attempt to decode the Wage and Tax Assertion.

Whether or not you full Types W-2 by yourself, use payroll software program, or have a tax preparer, you need to be semi-fluent in figuring out how one can fill out Type W-2.

As a generalization, Type W-2 packing containers present identification, taxable wages, taxes withheld, and advantages data.

Packing containers A-F are simple. They checklist figuring out details about your enterprise and worker. The numbered packing containers, Packing containers 1-20, can get just a little extra tough.

If you would like Type W-2 defined, dive into every field’s function beneath.

Field A: Worker’s Social Safety quantity

Field A exhibits your worker’s Social Safety quantity. Social Safety numbers are 9 digits which are formatted like XXX-XX-XXXX.

In case your worker utilized for a Social Safety card and has not acquired it, don’t depart the field clean. As a substitute, write “Utilized For” in Field A on the Social Safety Administration copy. When the worker receives their SS card, you have to challenge a corrected W-2.

Field B: Employer Identification Quantity (EIN)

Field B exhibits your Employer Identification Quantity. EINs are nine-digit numbers structured like XX-XXXXXXX.

The quantity you enter in Field B is identical on each worker’s Type W-2. The IRS and SSA establish your enterprise by means of your distinctive EIN.

Don’t use your private Social Safety quantity on Types W-2. In case you wouldn’t have an Employer Identification Quantity, apply for an EIN earlier than submitting Type W-2. Then, mark “Utilized For” in Field B.

Field C: Employer’s identify, deal with, and ZIP code

Field C additional identifies your enterprise by itemizing your organization’s identify and deal with. Use your enterprise’s authorized deal with, even when it’s totally different than the place your workers work.

Your workers could wonder if the deal with is wrong if it’s totally different than their work deal with. Confirm your authorized enterprise deal with and guarantee your worker it’s correct.

Field D: Management quantity

Field D may be clean, relying on whether or not your enterprise makes use of management numbers or not.

A management quantity identifies Types W-2 so you possibly can hold information of them internally. In case you don’t use management numbers, depart this field clean.

Packing containers E and F: Worker’s identify, deal with, and ZIP code

Field E exhibits the worker’s first identify, center preliminary, and final identify. Reference the worker’s SSN to enter their identify appropriately.

Enter the worker’s deal with in Field F.

Field 1: Wages, ideas, different compensation

Field 1 studies an worker’s wages, ideas, and different compensation. That is the quantity you paid the worker throughout the 12 months that’s topic to federal earnings tax.

Funds not topic to federal earnings tax embrace pre-tax retirement plan contributions, medical insurance premiums, and commuter advantages.

The wages you report in Field 1 may be greater or decrease than different wages on Type W-2. This isn’t essentially a mistake.

For instance, an worker’s Field 1 wages might be decrease than Field 3 wages. Some pre-tax advantages are exempt from federal earnings tax however not Social Safety tax.

Field 2: Federal earnings tax withheld

Field 2 exhibits how a lot federal earnings tax you withheld from an worker’s wages and remitted to the IRS.

Federal earnings tax withholding is predicated on the worker’s taxable wages and submitting standing.

In case your worker has a query about their refund quantity or why they owe taxes, instruct them to Field 2. The IRS compares what the worker paid all year long in federal earnings taxes to their whole legal responsibility.

Field 3: Social Safety wages

Field 3 exhibits an worker’s whole wages topic to Social Safety tax. Don’t embrace the quantity of pre-tax deductions which are exempt from Social Safety tax in Field 3.

The quantity in Field 3 shouldn’t be greater than the Social Safety wage base. For 2023, the wage base is $160,200.

In case you should report Social Safety ideas (Field 7), the entire of Packing containers 3 and seven should be lower than $160,200 for 2023.

Field 4: Social Safety tax withheld

Field 4 studies how a lot you withheld from an worker’s Social Safety wages and ideas.

The worker portion of Social Safety tax is 6.2% of their wages, as much as the SS wage base. Field 4 can’t be greater than $9,932.40 ($160,200 X 6.2%) for 2023.

Field 5: Medicare wages and ideas

Enter how a lot the worker earned in Medicare wages and ideas in Field 5.

An worker’s Field 5 worth is usually the identical as Field 4’s quantity. Nevertheless, there is no such thing as a Medicare wage base. If the worker earned above the Social Safety wage base, the quantity in Field 5 is greater than Field 3.

For instance, the worker earned $180,000. The worker’s Social Safety wages, (Field 3) ought to present $160,200 whereas Field 5, Medicare wages and ideas, shows $180,000.

Field 6: Medicare tax withheld

Field 6 shows how a lot you withheld from an worker’s wages for Medicare tax. The worker share of Medicare tax is 1.45% of their wages.

The quantity in Field 5 multiplied by the Medicare tax charge ought to equal Field 6. But when the worker earned above $200,000 (single), their tax legal responsibility must be higher.

In case you paid an worker above $200,000 (single), it is best to have additionally withheld the extra Medicare tax charge of 0.9% from their wages above $200,000.

Field 7: Social Safety ideas

In case your worker earned ideas and reported them, enter the quantity in Field 7. Additionally, embrace these tip quantities in Packing containers 1 and 5.

Once more, the entire of Packing containers 7 and three shouldn’t be greater than $160,200 for 2023.

Field 8: Allotted ideas

Report the information you allotted to your worker in Field 8, if relevant. Allotted ideas are quantities that you just designate to tipped workers. Not all employers need to allocate tricks to their workers.

Don’t embrace the quantity in Field 8 in Packing containers 1, 3, 5, or 7. Allotted ideas will not be included in taxable earnings on Type W-2. Workers should use Type 4137 to calculate taxes on allotted ideas.

Field 9: (Clean)

Go away Field 9 clean.

Field 10: Dependent care advantages

Did you give an worker dependent care advantages beneath a dependent care help program? In that case, embrace the entire quantity in Field 10.

Dependent care advantages beneath $5,000 are nontaxable. Advantages over $5,000 are taxable. In case you gave an worker greater than $5,000, report the surplus in Packing containers 1, 3, and 5.

Field 11: Nonqualified plans

Field 11 studies employer distributions from a nonqualified deferred compensation plan to an worker.

Embody the distribution quantities in Field 1, too.

Field 12: Codes

There are a number of W-2 Field 12 codes you might have to placed on an worker’s Type W-2. If relevant, add the codes and quantities in Field 12.

These codes and values could decrease the worker’s taxable wages.

Let’s say an worker elected to contribute $1,000 to a 401(ok) retirement plan. You’d write D | 1,000.00 in Field 12.

Field 13: Checkboxes

Field 13 mustn’t embrace values. As a substitute, mark the packing containers that apply. There are three packing containers inside Field 13:

- Statutory worker

- Retirement plan

- Third-party sick pay

For instance, if you happen to entered Field 12 code D to point out the worker’s retirement contributions, additionally examine the ‘Retirement plan’ field.

Field 14: Different

Report quantities and descriptions in Field 14 equivalent to car lease funds, state incapacity insurance coverage taxes withheld, and medical insurance premiums deducted.

Field 15: State | Employer’s state ID quantity

Like Field B, Field 15 identifies your enterprise’s employer ID quantity. However, Field 15 is state-specific. Mark your state utilizing the two-letter abbreviation. Then, embrace your state EIN.

Some states don’t require reporting. Go away Field 15 clean when you’ve got no reporting requirement together with your state.

Contact your state if you happen to wouldn’t have an employer’s state ID quantity and wish one.

Field 16: State wages, ideas, and many others.

Field 16 exhibits an worker’s wages which are topic to state earnings tax. If the worker works in a state with no state earnings tax, depart Field 16 clean.

An worker’s Field 16 quantity could differ from Field 1. This isn’t essentially a mistake. Some wages are exempt from federal earnings tax and never state earnings tax.

Field 17: State earnings tax

Report how a lot you withheld for state earnings tax in Field 17. In case you didn’t withhold state earnings tax, depart Field 17 clean.

Field 18: Native wages, ideas, and many others.

In case your worker’s wages are topic to native earnings tax, embrace their whole taxable wages in Field 18. Go away this field clean if the worker works in a locality with no earnings tax.

The quantity you checklist in Field 18 may differ from Packing containers 1 and 16.

Field 19: Native earnings tax

Report any native earnings tax withheld from the worker’s wages in Field 19. Go away this field clean whether it is inapplicable.

Field 20: Locality identify

Field 20 ought to present the identify of town or locality.

This text has been up to date from its authentic publication date of February 20, 2019.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.