Over the previous few years, the U.S. economic system has skilled unusually excessive inflation and an unprecedented tempo of financial coverage tightening. Whereas inflation has fallen not too long ago, it stays above goal, and the economic system continues to broaden at a strong tempo. Does the resilience of the U.S. economic system suggest that financial coverage has been ineffectual? Or does it mirror that coverage acts with “lengthy and variable lags” and so we haven’t but noticed the complete impact of the financial tightening that has already taken place? Utilizing a Bayesian vector autoregressive (BVAR) mannequin, we present that financial exercise has, certainly, been considerably stronger than would have been anticipated contemplating the speedy coverage tightening. Nonetheless, the mannequin expects a big slowdown in 2024-25, though short-term rates of interest are forecasted to fall.

Excessive Inflation and Excessive Development?

To check the habits of the U.S. economic system over the previous few years, we use a big BVAR mannequin that options thirty-five macroeconomic and monetary time sequence, 5 lags of previous knowledge, and is estimated over the pattern starting from the second quarter of 1973 by way of the tip of 2019. For additional particulars see this paper. To reply our query of curiosity we’ll depend on so-called “conditional forecasts.” In unfastened phrases, a conditional forecast is the perfect guess of a future worth of a variable when one has information in regards to the future worth or values of another set of variables.

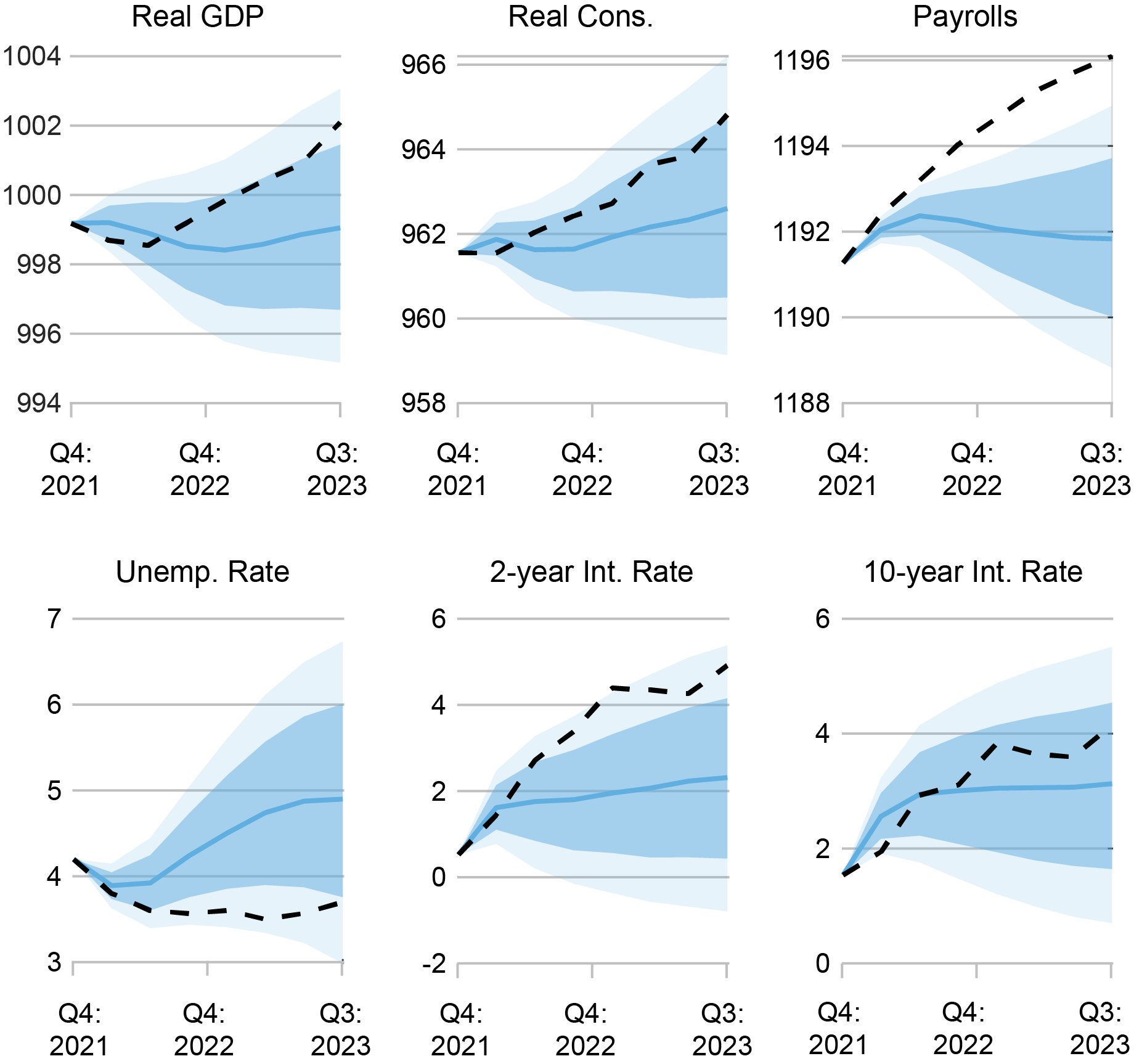

In our first train, we feed the mannequin all of the historic data obtainable as much as the fourth quarter of 2021 and the trail of worth inflation in 2022 and the primary three quarters of 2023. We’re asking the mannequin: if you happen to solely knew the trail of inflation since 2021, what would you are expecting for different financial and monetary sequence comparable to actual GDP development, the unemployment fee, or rates of interest over these seven quarters? The chart under exhibits the conditional forecast (blue line) and shaded areas denoting the related pointwise posterior protection intervals (darkish shading 68 p.c and light-weight shading 90 p.c). The dashed traces characterize the trail of the realized knowledge.

2021:This fall Forecasts Conditional on the Path of Inflation

Sources: Bureau of Financial Evaluation; Bureau of Labor Statistics; Board of Governors of the Federal Reserve System; authors’ calculations.

Notes: The chart exhibits the conditional forecast (blue line) and shaded areas denoting the related pointwise posterior protection intervals (darkish shading 68 p.c and light-weight shading 90 p.c). Dashed traces characterize the trail of the realized knowledge. The highest row experiences outcomes for the logarithm of actual gross home product (Actual GDP), actual private consumption expenditures (Actual Cons.), and nonfarm payrolls (Payrolls). The underside row experiences outcomes for the civilian unemployment fee (Unemp. Fee), the two-year nominal rate of interest (2-12 months Int. Fee), and the ten-year nominal rate of interest (10-12 months Int. Fee).

The chart signifies that the mannequin would have anticipated a modest enhance in short-term rates of interest and a recession, with the extent of actual GDP falling and the unemployment fee rising to about 5 p.c. Intuitively, this displays the truth that the unusually excessive inflation noticed since 2021 would sometimes set off tighter financial coverage, which might in flip result in a recession. Nonetheless, the rise within the two-year yield predicted by the mannequin is considerably decrease than the realized path: the rise in rates of interest that did happen was over and above what would have been foreseen simply primarily based on the trail of inflation.

Excessive Inflation and Curiosity Charges and Excessive Development?

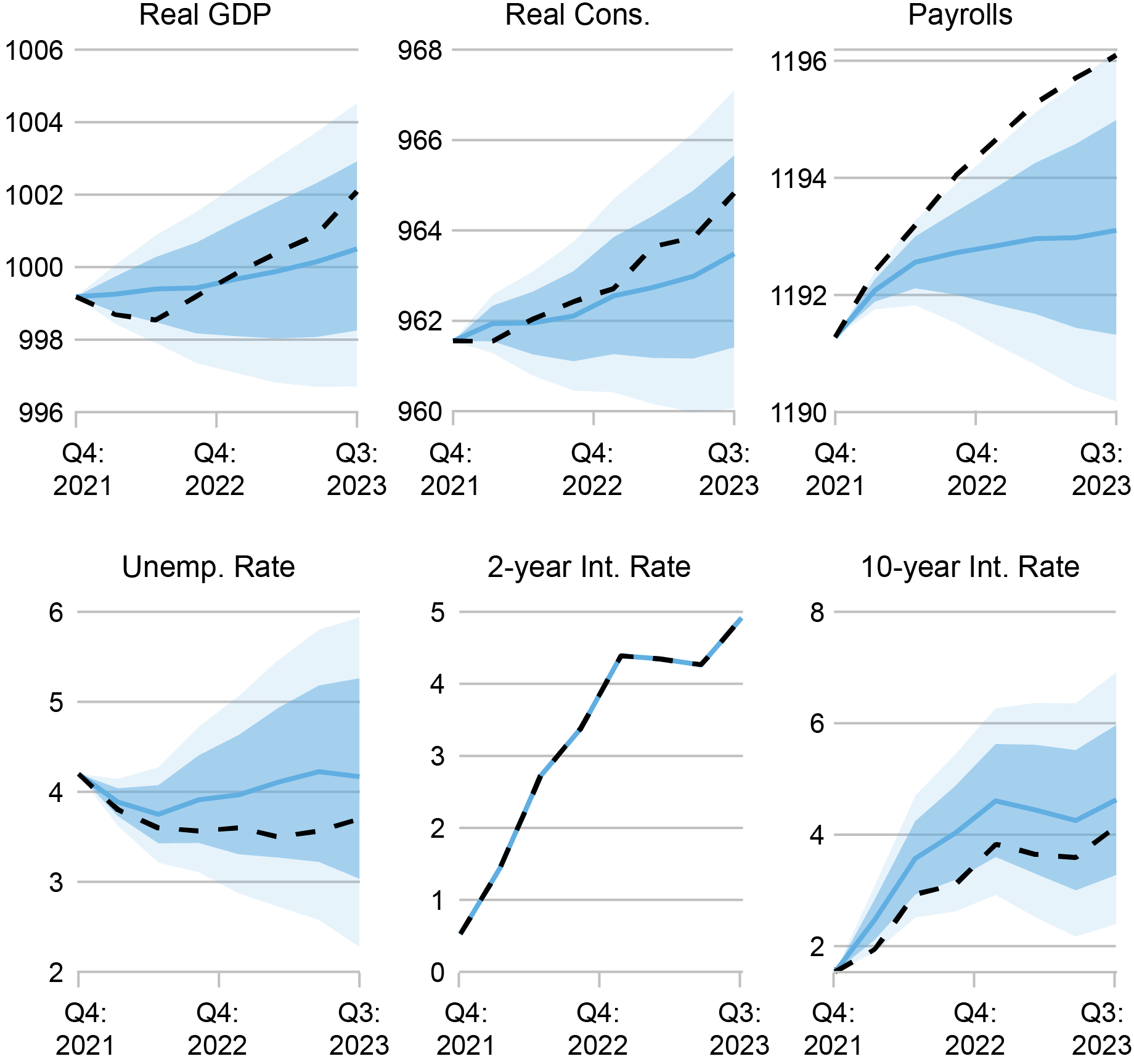

As we noticed within the earlier chart, short-term rates of interest rose to a lot increased ranges than the mannequin would have anticipated primarily based solely on the trail of inflation since 2021. As a second train, we ask the mannequin what the conditional forecast could be if, along with inflation since 2021, we additionally feed the mannequin the longer term path of two-year nominal rates of interest. This informs the mannequin on the speedy rise in short-term rates of interest since late 2021. The chart under presents the outcomes from this train. Since we use the longer term path of the two-year rate of interest in forming the forecast, the dashed and strong traces are the identical.

2021:This fall Forecasts Conditional on the Path of Inflation and Two-12 months Yields

Sources: Bureau of Financial Evaluation; Bureau of Labor Statistics; Board of Governors of the Federal Reserve System; authors’ calculations.

Notes: The chart exhibits the conditional forecast (blue line) and shaded areas denoting the related pointwise posterior protection intervals (darkish shading 68 p.c and light-weight shading 90 p.c). The dashed traces characterize the trail of the realized knowledge. The highest row experiences outcomes for the logarithm of actual gross home product (Actual GDP), actual private consumption expenditures (Actual Cons.), and nonfarm payrolls (Payrolls). The underside row experiences outcomes for the civilian unemployment fee (Unemp. Fee), the 2-year nominal rate of interest (2-12 months Int. Fee), and the 10-year nominal rate of interest (10-12 months Int. Fee).

In distinction to the earlier train, when conditioning on the upper path of rates of interest in addition to inflation, the mannequin forecasts solely anemic development however not an outright decline in exercise. One interpretation is that the upper path of rates of interest—relative to the forecasted path, conditioning on inflation—displays, partly, a scientific financial coverage response to increased financial exercise. Nonetheless, the mannequin remains to be shocked on the upside by the realized exercise knowledge. As proven within the chart, consumption and labor market exercise are meaningfully stronger than could be anticipated. Within the heart panel within the high row, we observe that realized actual consumption has skirted the 68 p.c protection interval, whereas within the backside left and high proper panels the unemployment fee has completed the identical and payrolls have comfortably exceeded the intervals.

These outcomes point out that, conditional on the steep enhance briefly charges and elevated inflation over the previous two years, we might have anticipated to see persistently slower actual exercise by now, even contemplating the lags with which financial coverage has acted up to now. That is according to the notion that the economic system skilled constructive demand shocks over this era, which offset the standard impact of tighter coverage.

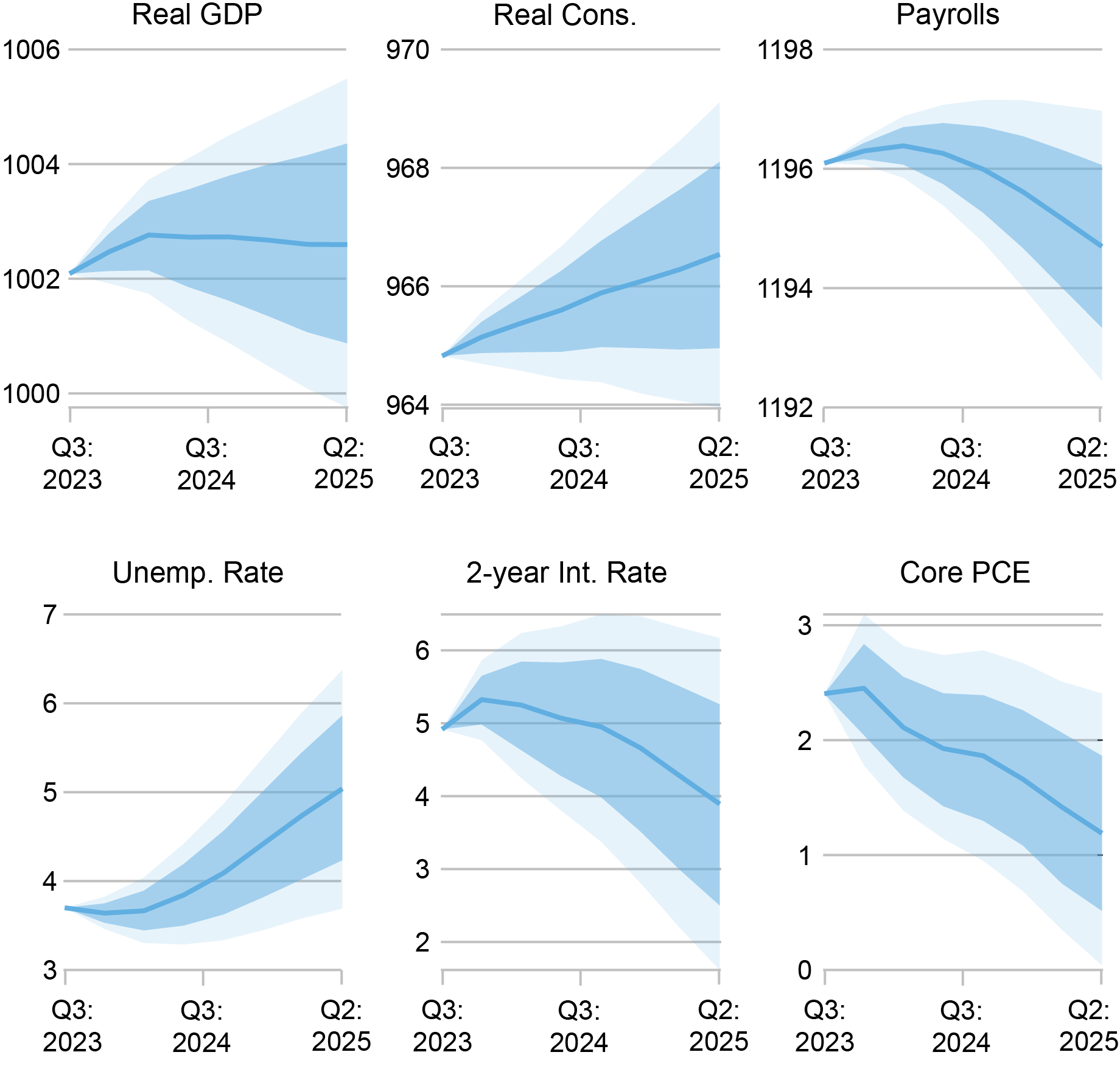

Present Forecast

Do these outcomes suggest that with out a vital additional tightening of coverage, we might anticipate exercise and inflation to stay elevated? Within the chart under, we report the present forecast primarily based on the information obtainable as much as the third quarter of 2023. The forecast includes a decline of greater than 100 foundation factors within the two-year rate of interest over the subsequent two years. Nonetheless, the forecast includes a slowdown in exercise and inflation according to habits noticed in previous slowdowns and NBER-defined U.S. recessions. Particularly, we observe a persistent decline within the degree of actual GDP (high left panel) beginning in early 2024 along with a rising unemployment fee and a fall in payroll employment (backside left and high proper panels). Trying on the underlying element (not proven within the chart), the decline in financial exercise is led by actual funding. Lastly, within the chart under we additionally present the forecasted path for core PCE inflation (backside proper panel). Concomitant with the projected slowdown in actual exercise, the forecasted path of inflation continues its pre-existing decline and, actually, falls under the goal fee of two p.c in 2024 and 2025.

Present BVAR Forecast

Sources: Bureau of Financial Evaluation; Bureau of Labor Statistics; Board of Governors of the Federal Reserve System; authors’ calculations.

Notes: The chart exhibits the forecast (blue line) and shaded areas denoting the related pointwise posterior protection intervals (darkish shading 68 p.c and light-weight shading 90 p.c). The highest row experiences outcomes for the logarithm of actual gross home product (Actual GDP), actual private consumption expenditures (Actual Cons.), and nonfarm payrolls (Payrolls). The underside row experiences outcomes for the civilian unemployment fee (Unemp. Fee), the 2-year nominal rate of interest (2-12 months Int. Fee), and core PCE inflation (Core PCE).

Conclusion

Taken collectively, the outcomes from the three forecasting workouts recommend that financial exercise in 2022-23 was stronger than anticipated conditional on the trail of rates of interest and inflation. However this doesn’t suggest that extra tightening is required to gradual actual exercise and cut back inflation. Whereas the lagged results of financial tightening have been counteracted by constructive demand shocks in 2023-24, the mannequin nonetheless expects a slowdown in 2024-25.

One limitation of our evaluation is that the BVAR is a reduced-form mannequin, which signifies that we can’t conduct a real counterfactual evaluation. Stated otherwise, we will’t reply questions comparable to: what would have occurred if financial coverage—and solely financial coverage—had been totally different since 2021? In our accompanying put up, we’ll take an alternate strategy that permits us to research these kinds of questions additional.

Richard Ok. Crump is a monetary analysis advisor in Macrofinance Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Marco Del Negro is an financial analysis advisor in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Keshav Dogra is a senior economist and financial analysis advisor in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Pranay Gundam is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Donggyu Lee is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Ramya Nallamotu is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Brian Pacula is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Learn how to cite this put up:

Richard Crump, Marco Del Negro, Keshav Dogra, Pranay Gundam, Donggyu Lee, Ramya Nallamotu, and Brian Pacula, “A Bayesian VAR Mannequin Perspective on the Lagged Impact of Financial Coverage,” Federal Reserve Financial institution of New York Liberty Avenue Economics, November 21, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/a-bayesian-var-model-perspective-on-the-lagged-effect-of-monetary-policy/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).