Dean of quantitative investing and critic of public pension fund and endowment efficiency Richard Ennis despatched alongside a scrumptious article, Ought to CalPERS Fireplace Everybody and Simply Purchase Some ETFs, by Chief Funding Officer and analyst Meb Faber. Faber, who manages an over $1 billion fund, has little respect for CalPERS and Betteridge’s Legislation.

I hope Mr. Faber won’t take umbrage at my quoting liberally from his piece, since I think about he’s extra eager about having his concepts get wider publicity than driving visitors to his website. And as a matter of excellent order, CalPERS can’t fireplace everybody. It’s a giant well being insurer and in addition has a really giant operation holding tabs on employer funds to the fund and paying member advantages. However gutting the funding workplace is certainly a sound concept.

It’s noteworthy that one or Faber’s findings quantities to saying that CalPERS is overdiversified. In a current article on endowment efficiency, Ennis surmised {that a} main cause they underperformed public pension funds, regardless of being supposedly extra subtle, is overdiversification. From our 2021 dialogue of that paper:

Ennis’s evaluation paints an especially unflattering image. One strategy to summarize it’s that endowments’ workers and their exterior managers have added detrimental worth, or in finance-speak, detrimental alpha. Word that Ennis’ estimate is charitable since he doesn’t add in the price of the endowments’ funding workplaces, which run to 0.50% to 0.75% of property. And on prime of that, all of their machinations, um, workout routines in diversification, have achieved completely nothing. Their outcomes are functionally the identical as being totally invested in US equities. From his overview:

Endowments have underperformed by 2.5% per 12 months over the 13 years ended June 30, 2021. I estimate that endowments’ annual value of investing is roughly 2.6% of asset worth. Given the intense diversification of the composite, which contains greater than 100 giant endowment funds with a mean of greater than 100 funding managers every, there’s each cause to consider that value is the principal explanation for endowments’ poor efficiency. Throughout the newest 5–7 years, which I check with because the Fashionable Period, endowments have exhibited an efficient US fairness publicity of 97% of asset worth, with frictional money accounting for 3%. The overwhelming publicity to the US fairness market raises vital strategic questions associated to threat tolerance and diversification for trustees and fund managers.

Ennis’ findings that overdiversification was the seemingly offender for funding unhealthy outcomes is constant together with his 2020 public pension fund research that discovered that their funding applications generated detrimental alpha, as in destroyed worth, and CalPERS was one of many worst sinners. On this and different analyses, Ennis targeted on the opposite large efficiency drag, different investments (actual property, hedge funds, and personal fairness). From New Research Slams Public Pension Funds’ Different Investments as Drag on Efficiency, Identifies CalPERS as One of many Worst “Unfavorable Alphas”; Reveals Folly of CalPERS’ Determined Plan to Improve Personal Fairness and Debt and Go Greater Utilizing Leverage:

Ennis’ conclusions are damning. Each the pension funds and the endowments generated detrimental alpha, which means their funding applications destroyed worth in comparison with purely passive investing..

Academic endowments did even worse than public pension funds attributable to their increased dedication stage to “different” investments like non-public fairness and actual property. Ennis explains that these kinds of investments merely resulted in “overdiversification.” Since 2009, they’ve change into so extremely correlated with inventory and bond markets that they haven’t added worth to funding portfolios. From the article:

Different investments ceased to be diversifiers within the 2000s and have change into a big drag on institutional fund efficiency. Public pension funds underperformed passive funding by 1.0% a 12 months over a current decade…

For a decade [starting in 2009], inventory and bond indexes have captured the return-variability traits of other investments in composites of institutional funds, for all intents and functions. Different investments didn’t have a significant impact. The discovering that the correlation between funds with vital alts publicity and marketable securities benchmarks is close to excellent runs counter to the favored notion that the return properties of alts differ materially from these of shares and bonds. That, in spite of everything, is an oft-cited cause for incorporating different investments in institutional portfolios. As we see right here, nonetheless, alt returns merely mix into broad market returns within the context of ordinary portfolio evaluation within the latter decade.

….Ennis discovered the median value of the mismanagement by the 46 public pension funds as roughly 1% per 12 months. CalPERS is a standout within the “detrimental worth added” class, rating 43 out of 46, with a “detrimental alpha” of two.36%. This can be a significantly appalling scoring, since CalPERS has far and away the biggest and greatest paid funding workplace of any US public pension fund.

Again to the current publish. The explanation for the stage-setting with quant/fund efficiency maven Ennis’s work is that Faber, though he requires eliminating CalPERS’ funding workplace, he’s much less detrimental about CalPERS’ than Ennis, merely discovering them to be lackluster versus detrimental worth added. How can that be?

Faber is way too charitable to CalPERS. He appears at their outcomes since 1984. As unbelievable as it could appear, CalPERS had a vigilant board and extremely revered Chief Funding Officers although the early 2000, when Fred Buenrostro turned Chief Government Officer and was then later convicted and despatched to jail for taking bribes. CalPERS has by no means recovered. Its later CIOs had been gentle on investing expertise.

As well as, by going again to 1984, Faber picks up the interval when CalPERS began investing in “alts,” significantly non-public fairness (beginning in 1992). The so-called “classic years” of 1995 to 1999 produced stellar efficiency since there had been a leveraged buyout bust within the late 1980 by 1992 and funds that had been shopping for firms within the early Nineties bought nice bargains. That state of affairs had gone into reverse by 2006. Oxford professor Ludovic Phalippou has decided that personal fairness stopped outperforming public shares beginning then. An excessive amount of cash chasing too few offers! And keep in mind, non-public fairness, attributable to illiquidity and better threat (leverage) is meant to beat public shares, not merely match its returns, to justify investing in it.

Keep in mind additionally, as we now have identified commonly, that varied analysts settle for non-public fairness outcomes as reported. But non-public fairness is the one main funding technique that’s not topic to impartial third-party valuation of its property.

So even with giving CalPERS credit score it doesn’t deserve, he nonetheless deems CalPERS’ efficiency to be too poor to justify all of the wheel-spinning by its funding workers. Key factors from his publish:

“He was a U.S.-class easy politician, which is the one approach you’re going to outlive in that job. It has nothing to do with investing.”

That’s how Institutional Investor just lately described a former CIO of the California Public Workers’ Retirement System, also called CalPERS.

The outline is particularly attention-grabbing when contemplating that the “I” in “CIO” stands for “funding,” which raises an eyebrow at how the position may have “nothing to do with investing”….

The staggering waste of CalPERS market strategy

CalPERS’ said mission is to “Ship retirement and well being care advantages to members and their beneficiaries.”

Nowhere on this mission does it state the aim is to spend money on a great deal of non-public funds and pay the inflated salaries of numerous non-public fairness and hedge fund managers. However that’s precisely what CalPERS’ does.

The pension’s Funding Coverage doc – and we’re not making this up – is 118 pages lengthy.

Their checklist of investments and funds runs 286 pages lengthy. (Possibly they should learn the e book “The Index Card”.)

Their checklist of investments and funds runs 286 pages lengthy. (Possibly they should learn the e book “The Index Card”.)

Their construction is so sophisticated that for a very long time, CalPERS couldn’t even calculate the charges it pays on its non-public investments. On that word, by far the largest contributor to excessive charges is CalPERS’ non-public fairness allocation, which they plan on growing the allocation to. Is {that a} properly thought out concept or is it a Hail Mary go after years of underperformance…

Let’s study CalPERS’ historic returns towards some primary asset allocation methods.

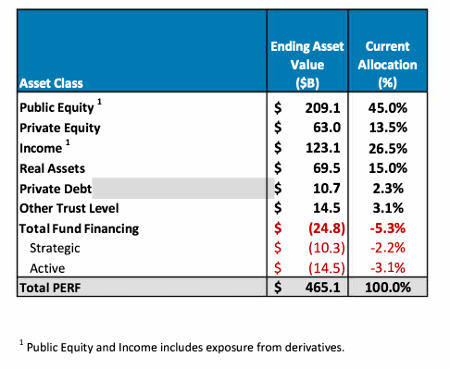

We’ll start with CalPERS’ present portfolio allocation:

Supply: CalPERS

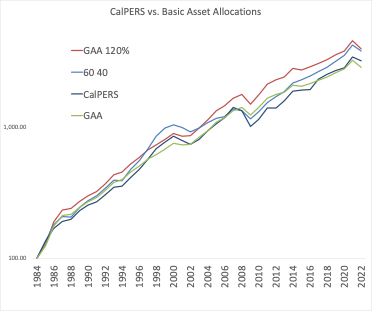

Now, that we all know what CalPERS is working with, let’s examine its returns towards three primary portfolios starting in 1985.

- The traditional 60/40 US shares and bonds benchmark.

- A worldwide asset allocation (GAA) portfolio from our e book International Asset Allocation (obtainable as a free eBook right here). The allocation approximates the allocation of the worldwide market portfolio of all the general public property on the planet.

- A GAA portfolio with slight leverage, since lots of the funds and techniques that CalPERS makes use of have embedded leverage.

Supply: CalPERS, International Monetary Knowledge, Cambria

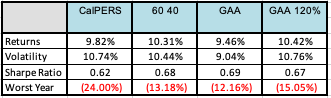

As you’ll be able to see from the desk, from 1985-2022 CalPERS fails to distinguish itself from our easy “do nothing” benchmarks.

To be clearer the returns are usually not unhealthy. They’re simply not good.

Think about the implications:

All of the money and time spent by funding committees debating the allocation…

All of the money and time spent on sourcing and allocating to personal funds…

All of the money and time spent on consultants…

All of the money and time spent on hiring new workers and CIOs…

All of the money and time spent on placing collectively countless stories to trace the hundreds of investments…

All of it – completely wasted.

CalPERS would have been higher off simply firing their complete workers and shopping for some ETFs. Ought to they name Steve Edmundson? It could actually make the document holding lots simpler!

Plus, they’d save a whole bunch of thousands and thousands a 12 months on working prices and exterior fund charges. Cumulatively through the years, the prices run properly into the billions.

Personally, I take the “I” a part of the acronym very severely and have supplied to handle the CalPERS pension at no cost.

“Hey pension funds scuffling with underperformance and main prices and headcount. I’ll handle your portfolio at no cost. Purchase some ETFs. Rebal yearly or so. Have an annual shareholder assembly over some pale ales. Possibly write a 12 months in assessment.”

I’ve utilized for the CIO position 3 times, however every time CalPERS has declined an interview.

Faber can be being variety in his characterization of the outcomes, even utilizing a time-frame that’s extraordinarily flattering to present CalPERS administration. When you take a look at the second desk, it exhibits CalPERS has the second worst returns, with volatility barely distinguishable from the technique that scored 60 foundation factors increased. A distinction like that provides up over time. So I might not deem the outcomes to be simply “not good”. They’re mildly unhealthy.

The remainder of the publish is equally readable and has enjoyable analyses. Faber then appears on the storied hedge fund Bridgewater:

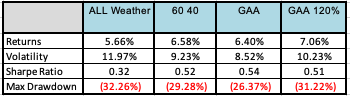

In 2014, we got down to clone Bridgewater’s All Climate” portfolio – an allocation that Bridgewater says has been stress-tested by two recessions, an actual property bubble, and a worldwide monetary disaster.

The clone, based mostly on a easy international market portfolio comprised of indexes, did a superb job of replicating Bridgewater’s providing when again examined. Extra importantly, working the clone would have required zero hedge fund administration prices and lockups, and wouldn’t have been weighed down by any tax inefficiency. To be truthful, this backrest has the advantage of hindsight and pays no charges or transaction prices.

The All Climate portfolio, with its deal with threat parity, exhibits that for those who’re constructing a portfolio you don’t essentially have to just accept pre-packaged asset courses….

So clearly the world’s largest hedge fund ought to be capable to stomp an allocation one may write on an index card?

As soon as once more, from 1998-2022 we discover {that a} primary 60/40 or international market portfolio does a greater job than the biggest hedge fund advanced on the planet.

Supply: Morningstar, International Monetary Knowledge, Cambria

One could reply, “OK Meb, All Climate is meant to be a purchase and maintain portfolio. They cost low charges. You need the good things, the actively managed Pure Alpha!”…

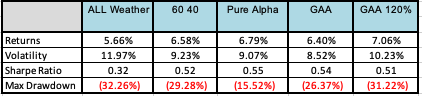

Let’s now deliver the Pure Alpha technique into the combination. Under, we’ll examine it with All Climate, the standard 60/40 portfolio, and the International Asset Allocation (GAA) portfolio from our e book and above. Lastly, the danger parity technique makes use of some leverage, so we additionally did a take a look at with GAA and leverage of 20%.

The replication technique again examined the portfolios’ respective performances between 1998 and 2022.

As soon as once more the returns of Pure Alpha had been practically an identical to the GAA and 60/40 portfolios, with efficiency differing by lower than 0.5%. And don’t miss that Pure Alpha really trailed the leveraged model of the GAA portfolio.

Once more, this isn’t unhealthy, it’s simply not good…..

Right here’s the issue. Many of those hedge fund and personal fairness methods value the tip investor 2 and 20, or 2% administration charges and 20% of efficiency. In order that 10% annual gross efficiency will get knocked down to six% in spite of everything of these charges.

So sure, maybe Bridgewater and different funds do generate some alpha, the issue is that they hold all of it for themselves.

Right here I’m going to quibble additional with Faber. He assumes that public pension funds (and presumably different institutional traders, like endowments) are within the enterprise of getting one of the best return attainable given their threat tolerance.

However that’s not what that type of investing is about. First, it’s about legal responsibility avoidance through following Large Advisor sanctified funding allocations, whether or not they add any worth or not, and going by a strategy of trying such as you’ve vetted investments in accordance with once more some type of seen-as-orthodox strategy.

Second, the wasted charges are a characteristic, not a bug. For universities, these large hedge, non-public fairness, and actual property funds have agency heads and different companions who’re extremely wanted donors. I’ve been instructed by non-public fairness fund salesmen that endowments particularly do just about no due diligence. It’s as if it’s towards membership guidelines to take action.

Equally, outstanding CalPERS beneficiaries contend that the explanation the enormous fund is so doggedly loyal to high-fee methods like non-public fairness is that it’s understood that the fund principals will grease the wheels of political incumbents. There’s no prepared strategy to show that, but it surely’s not loopy. One other motivation is workers corruption. Personal fairness staffers get permitted bribes within the type of going to fund annual conferences (that are actually the fund staffers promoting, not disclosing) at fund expense at lavish venues with prime tier leisure and meals. Many are allegedly afraid of getting a PE agency insist on their firing in the event that they advocate towards a fund supervisor their employer has invested in earlier than (from what we will inform, it’s a full city legend as as to if this has ever occurred, however that doesn’t imply the worry isn’t actual). One other unhealthy workers motivation for currying favor with non-public fairness companies is the naive perception the the non-public fairness supervisor may assist them get a job once they selected to go away.

So that is one more reminder that CalPERS isn’t serving to beneficiaries or California taxpayers. However you had most likely labored that out.