A reader asks:

I maintain listening to in regards to the Magnificent 7 shares are carrying the inventory market this yr whereas the remainder of the shares are sucking wind. Does this even matter? I get that these shares may fall and convey the market down with them however ought to we be apprehensive about this degree of focus?

It’s true the Magnificent 7 shares — Amazon, Apple, Fb, Google, Microsoft, Nvidia and Tesla — are carrying the inventory market this yr.

The numbers are mind-boggling when you think about how huge these corporations are.

The typical market capitalization for these 7 corporations is $1.6 trillion. The typical return for the Magnificent 7 this yr is a achieve of 105%!1

The typical market cap of the remaining shares within the S&P 500 is round $57 billion with a median return in 2023 of simply 4%.

As of this writing, the S&P 500 itself is up near 19% on the yr after accounting for dividends.

Folks fear about this dynamic as a result of they fear about what occurs if and when these ginormous shares roll over. These 7 shares make up near 30% of the S&P 500 by market cap. Microsoft and Apple alone are almost 15% of the index.

It is a professional concern. If these shares crash for some cause, the market will fall as nicely. It’s additionally potential the opposite shares within the index will make up for a few of these losses.

You don’t have to return too far to see how this dynamic would play out.

In 2022, all of those shares bought rocked. Nvidia, Tesla, Fb and Amazon had been all down 50% or worse. The typical return for the Magnificent 7 in 2022 was -46%. Every of those 7 shares had been down much more than the S&P 500.

The S&P 500 was down simply 18% in whole final yr. Meaning different components of the market picked up the slack. My guess is that might occur once more however you may’t make sure of it.

Nevertheless, when you spend money on the inventory market you need to be taught to change into comfy with returns being concentrated in a handful of shares. This yr shouldn’t be regular by way of short-term efficiency however over the longer-term most shares stink whereas the most important and greatest names shoulder a lot of the load.

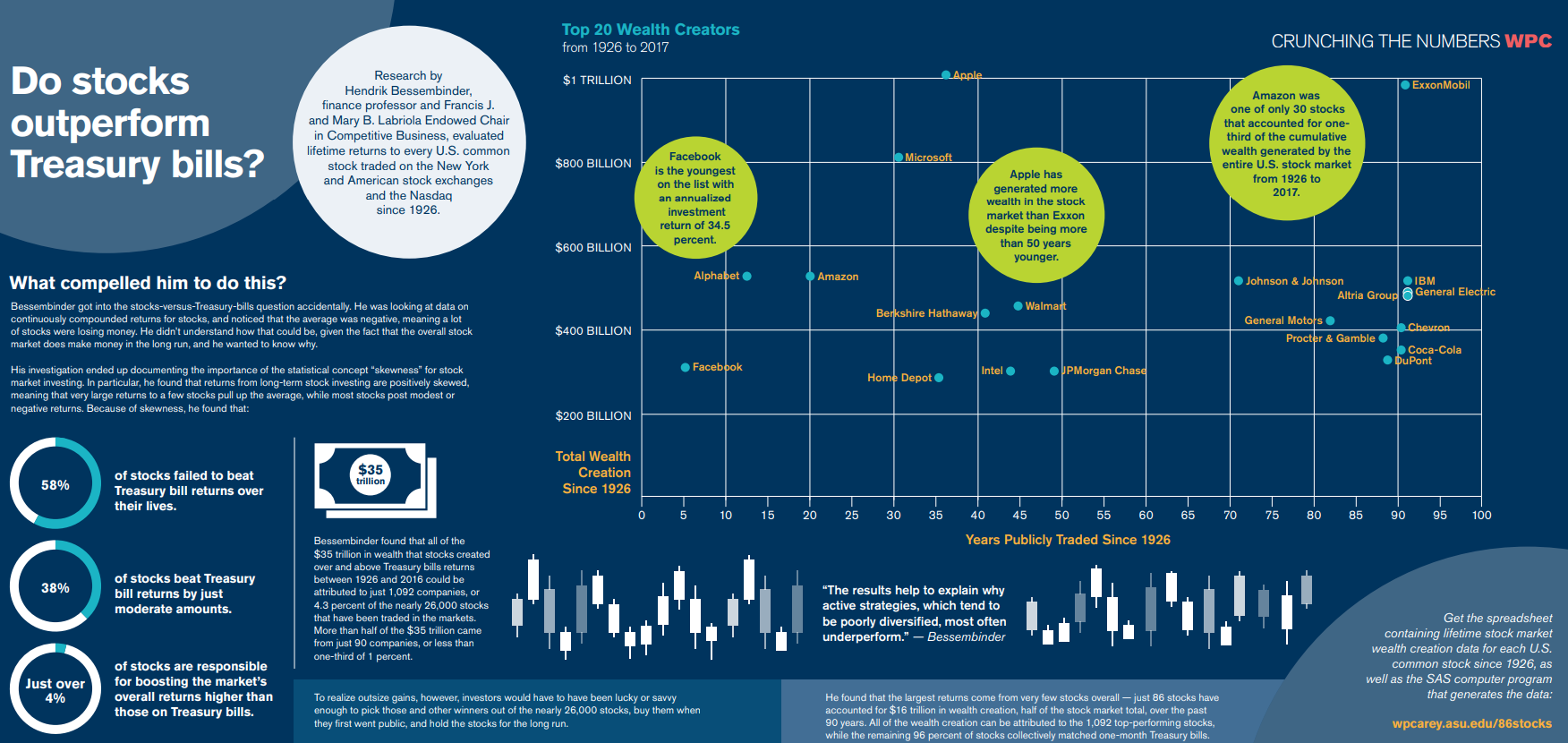

My favourite research on this was analysis finished by Hendrik Bessimbineder from Arizona State College:

Bessimbinder discovered simply 86 shares accounted for half of all wealth creation within the U.S. inventory market going again to 1926. The entire wealth creation in that point got here from simply 4% of shares. Almost 60% of shares did not beat T-bill returns over their lives. Near 40% of shares barely beat T-bills.

After all, that is almost 100 years of information. Loads of shares over this time had unbelievable returns over shorter time frames earlier than flaming out.2 My greatest takeaway from Bessimbinder’s work is it highlights the necessity for diversification since nobody is aware of the place the massive winners are going to come back from.

Apple was months away from going out of enterprise within the Nineteen Nineties earlier than securing a mortgage from Invoice Gates and Microsoft to remain afloat. Now it’s the most important firm within the U.S. inventory market.

In a brand new paper titled Underperformance of Concentrated Inventory Positions, Antti Petajisto from NYU took Bessimbinder’s inventory even additional by trying on the distribution of returns for shares utilizing shorter time frames.

This was the principle takeaway:

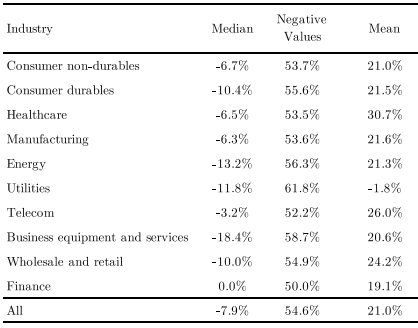

Since 1926, the median ten-year return on particular person U.S. shares relative to the broad fairness market is -7.9%, underperforming by 0.82% per yr. For shares which were among the many high 20% performers over the earlier 5 years, the median ten-year market-adjusted return falls to -17.8%, underperforming by 1.94% per yr. For the reason that finish of World Battle II, the median ten-year market-adjusted return of latest winners has been destructive for 93% of the time. The case for diversifying concentrated positions in particular person shares, significantly in latest market winners, is even stronger than most buyers understand.

Enable me to sum up these findings — choosing particular person shares is difficult.

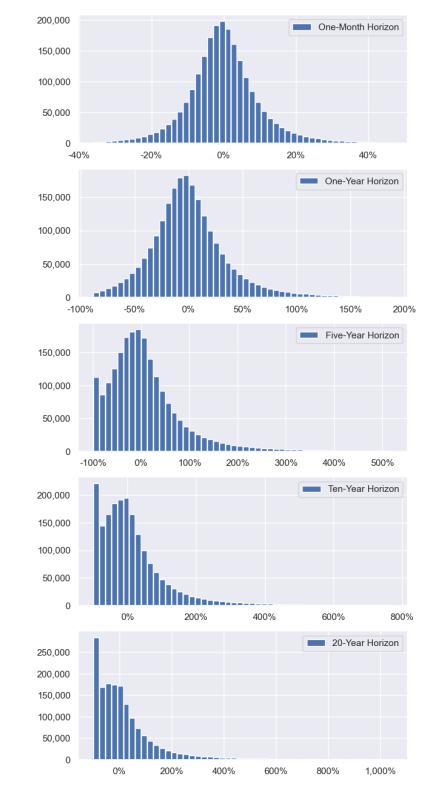

Petajisto created this neat chart that reveals the distribution of returns for particular person shares over one month, one yr, 5 years, ten years and twenty years:

Simply have a look at what number of shares present destructive returns the longer you prolong your time horizon. And when you look on the best aspect of the distribution only a handful of shares account for the most important gainers.

His analysis reveals 55% of all shares are losers over 10 yr time frames, on common. That is true throughout sectors too:

You possibly can decide a inventory in any sector and maintain it for ten years, and there’s a higher than 50% likelihood it would find yourself a loser.

The gorgeous factor in regards to the inventory market is the winners have greater than made up for the losers over time. Whereas the median inventory return is destructive, the typical is optimistic, which reveals simply how vital the positive factors could be from the winners.

So what does this inform us in regards to the Magnificent 7 shares?

Outsized positive factors are regular. It doesn’t really feel proper for a handful of shares to expertise the most important returns however that is the norm within the inventory market over the long term.

A few of these shares are going to underperform (ultimately). Curiously sufficient, underperformance will increase once you decide the highest 20% of shares over the earlier 5 years:

The relative underperformance over rolling ten-year durations will increase to 17.8% (or 1.94% per yr) when contemplating solely shares whose efficiency ranked within the high 20% over the prior 5 years.

These tech behemoths have already defied the legal guidelines of gravity so I wouldn’t wish to put myself able of guessing which of them are going to underperform within the coming years. However there’s a excessive probability of it occurring to a few of them.

Different shares will decide up the slack. Certain, among the Magnificient 7 shares will falter ultimately. They will’t maintain this up without end.

Microsoft is the one certainly one of these shares that was within the high 10 of the S&P 500 within the yr 2000. Others on the record embody corporations like Normal Electrical, Citigroup, Cisco and AIG. These shares all went on to underperform in an enormous method however the brand new giants stepped up and took their place.

I don’t know who the up-and-comers will probably be within the years forward however it would occur once more in some unspecified time in the future.

Focus could be a killer. Holding concentrated positions within the inventory market provides you the chance to outperform but in addition will increase your probabilities of underperforming by a large margin.

The issue with attempting to outperform by means of focus is the chances are stacked in opposition to you. For each Buffett, there are literally thousands of different buyers who tried and failed to carry concentrated positions. We by no means hear in regards to the losers.

Diversification not solely helps handle threat in a portfolio but in addition will increase your return within the inventory market by supplying you with extra alternative to personal the most important winners.

We spoke about this query on the newest version of Ask the Compound:

My colleague Alex Palumbo joined me once more this week to reply questions on what to do with marriage ceremony cash, the professionals and cons of getting your MBA, tax-deferred retirement accounts and learn how to observe your funds.

Additional Studying:

Focus within the Inventory Market

1To be honest the typical is skewed by Nvidia’s ~240% achieve in 2023. However the median return continues to be nearly 75% this yr for these 7 shares.

2This additionally doesn’t imply the most important shares are the one areas to spend money on. The S&P 600 Small Cap Index is up 10.4% per yr since inception in 1995. The S&P 400 Mid Cap Index is up 11.4% per yr. Most of the greatest shares began out small.