By the tip of the Seventies inflation was uncontrolled.

The New York Instances wrote a front-page story the place they interviewed a bunch of regular individuals to see how inflation was impacting their lives.

By that time CPI was up a cumulative 73% within the decade or practically 7% per 12 months. Inflation had been raging on lengthy sufficient that it was lastly beginning to affect individuals’s habits:

In interviews throughout the nation, The New York Instances discovered that the “throwaway society” of the late 1960’s and early 1970’s is being changed, in lots of circumstances, by a brand new ethic of financial system. Persons are driving automobiles longer and carrying garments extra usually, planting their very own gardens and fixing their very own plumbing.

Many People use the identical phrases to explain this new perspective: “We purchase solely what we want, not what we wish.” However which means a few of the juice of life, from new stereos to journeys to the seaside, is getting squeezed dry by the strain of rising costs.

A kind of interviews was with a bread salesman named Terry McLamb from Raliegh, North Carolina. McLamb mentioned he, “feels powerless to enhance his residing circumstances.” Right here’s what they wrote on the time:

However many others are left with emotions of frustration and concern. Terry McLamb, the bread salesman, has seen his earnings rise from $9,000 to $15,000 a 12 months in 5 years, however says: “I used to be getting alongside higher on the decrease earnings. It’s all received to come back to a degree someplace, however I don’t know the place.”

Within the 5 years ending 1978, the buyer value index was up 47%. McLamb’s earnings rose 67% in that very same interval. His earnings outstripped inflation by 20% but he was depressing.

Clearly, inflation isn’t the one variable that may affect how somebody feels about their monetary prospects at any given second. However inflation can play head video games with you, particularly when it occurs in massive chunks.

Most individuals consider they deserve the upper wages that are likely to accompany greater inflation. Nobody seems like they deserve greater costs. Plus, individuals get used to greater wages faster than greater costs since you see the costs each time you spend cash.

It’s been over 40 years since we’ve handled sky-high inflation, so it is smart that individuals are thrown off by the worth will increase we’ve skilled these previous few years.

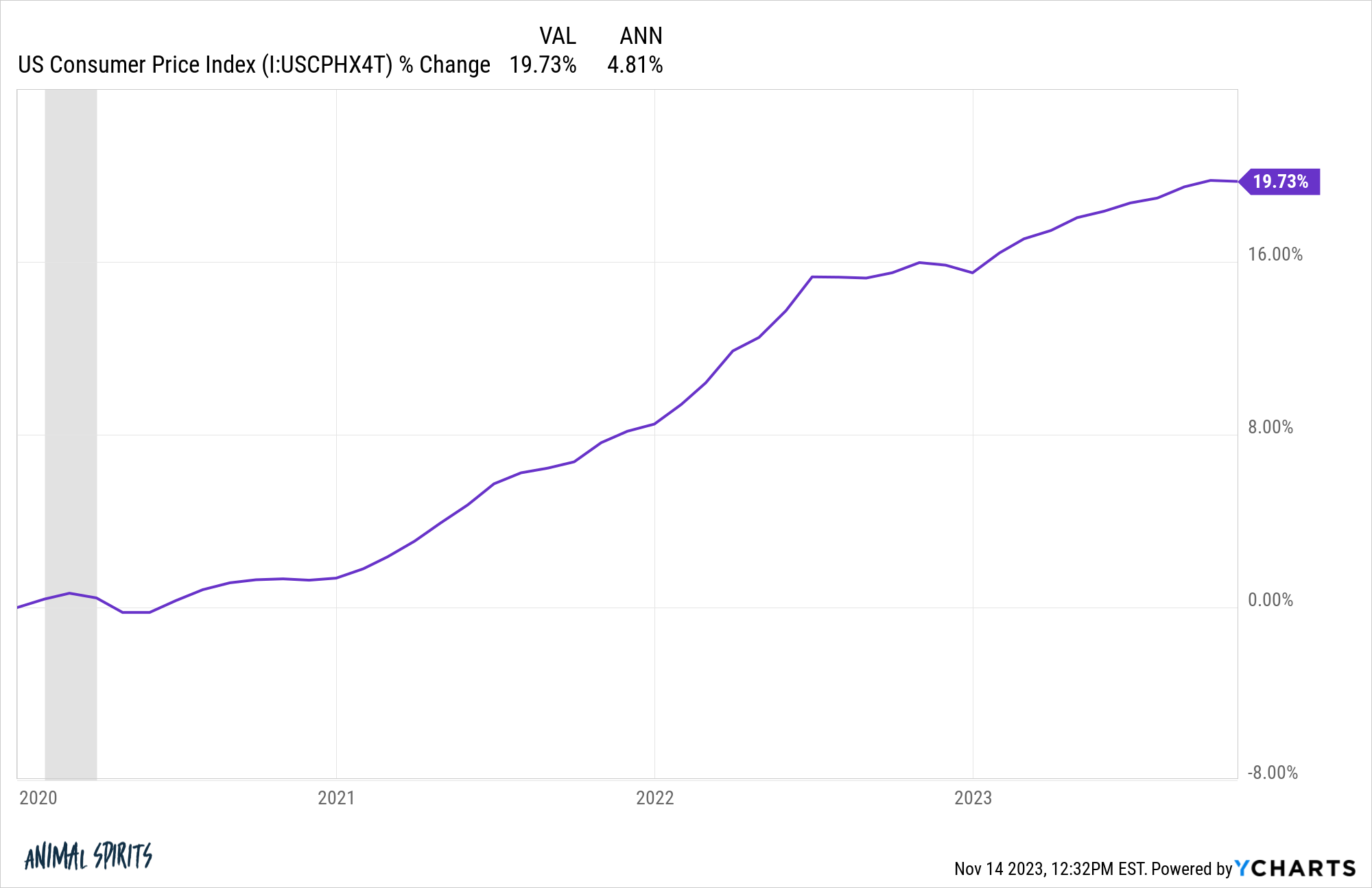

Cumulatively, U.S. CPI is up practically 20% because the begin of the pandemic:

The tempo of inflation has slowed however these greater costs at the moment are baked in.

Fed Governor Lisa Cook dinner lately acknowledged in a speech she thinks most individuals need costs again to pre-pandemic ranges:

“Most People should not simply on the lookout for disinflation. You and I as macroeconomists are on the lookout for disinflation. They’re on the lookout for deflation. They need these costs to be again the place they have been earlier than the pandemic,” Cook dinner mentioned.

“That’s my very own idea,” she concluded. “However I hear that lots. I don’t have to attend for articles about that, I hear that from my household, from a number of completely different individuals.”

I get it.

Individuals don’t take pleasure in financial volatility.

However that’s not how this works. That’s not how any of this works. You don’t get to maintain your greater wages whereas costs revert again to 2019 ranges. Deflation may sound interesting relating to costs, however that additionally means decrease wages, decrease financial development, and job loss.

Inflation isn’t factor, per se, however it’s the lesser of two evils.

One particular person’s spending is one other particular person’s earnings. Larger wages come from greater costs or vice versa.

So long as the financial system is rising, deflation is uncommon.

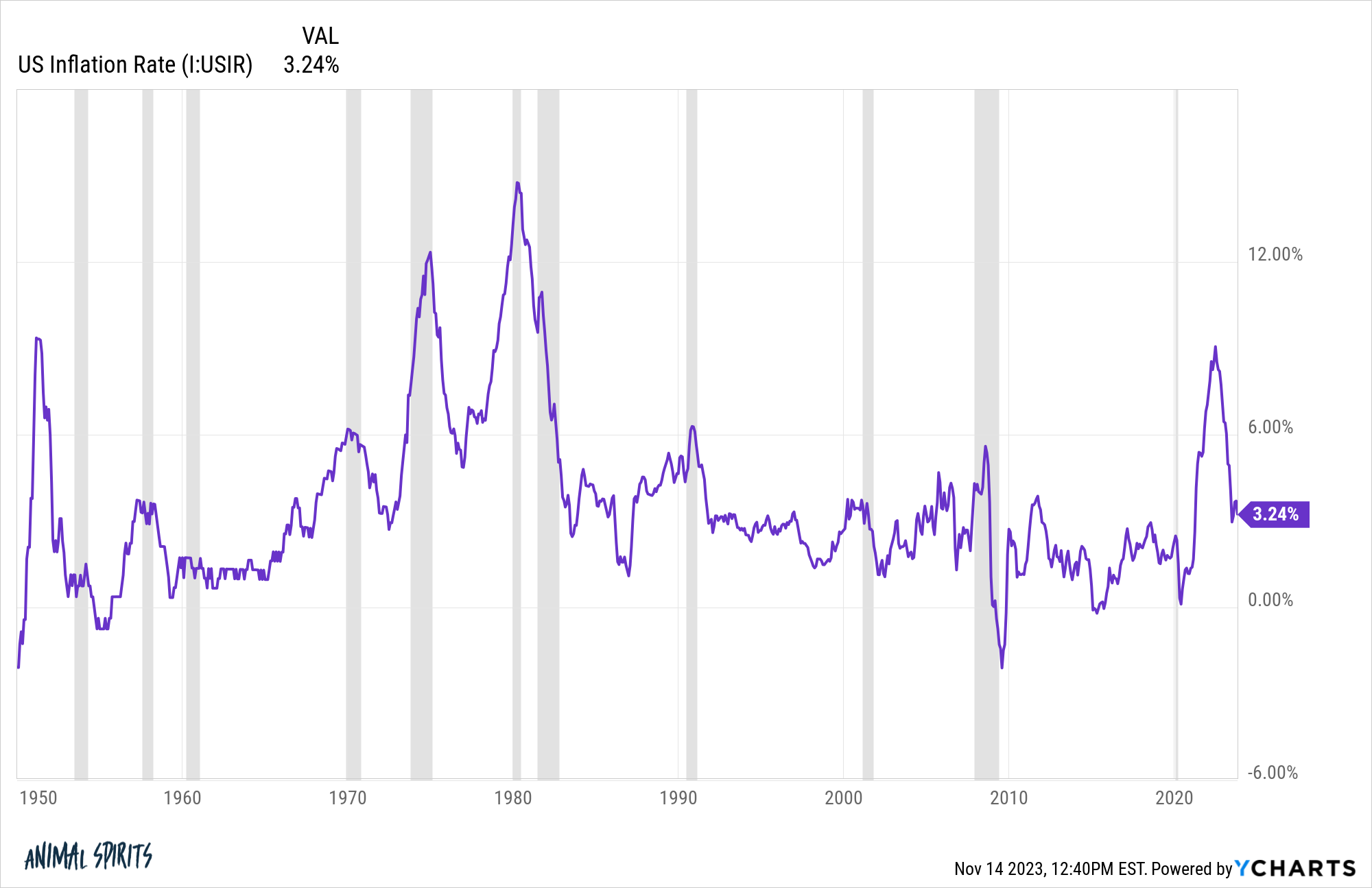

That is the annualized inflation charge within the U.S. going again to 1950:

Out of the practically 900 month-to-month inflation readings on this time-frame there have been simply 33 month-to-month deflationary numbers. So costs have declined lower than 4% of the time since 1950.

Deflation occurred within the Nineteen Fifties coming down from the post-WWII sugar excessive, throughout the Nice Monetary Disaster and briefly in 2015. That’s it. The remainder of the time, costs rose.

Have a look at what occurred following the Seventies inflationary spike. We by no means had deflation. Costs by no means fell within the Nineteen Eighties or Nineties. They saved transferring up, simply at a slower tempo.

The largest distinction between now and the Seventies is that individuals started altering their habits again then. That doesn’t appear to be the case for the American client but.

Matthew Klein wrote about our present spending habits at The Overshoot lately:

Spending on U.S.-made items and providers rose at a blistering 9% yearly charge in 2023Q3. Even after subtracting inflation, actual manufacturing rose at a 5% yearly charge. A few of that distinctive efficiency was doubtless a fluke, and must be discounted accordingly. However even earlier than the newest blowout quarter, complete spending has constantly been rising at a yearly charge of somewhat over 6% because the center of final summer season. Furthermore, inflation-adjusted spending by People–U.S. GDP excluding the affect of adjustments in inventories and the commerce steadiness–has constantly been rising barely quicker than 3% a 12 months in 2023Q1-Q3. By comparability, actual home demand was rising simply 0.8% a 12 months on common in 2022Q1-This fall, at the same time as complete nominal spending and incomes have been rising about 7% a 12 months.

In different phrases, whereas there was a big deceleration within the charge of value will increase from round 6% a 12 months to three% a 12 months, the expansion charge of the greenback worth of spending and incomes has slowed by a lot much less (from 7% a 12 months to six% a 12 months). To date, this has translated into a large acceleration within the development charge of People’ residing requirements.

That is most likely one of many greatest causes People are so irritated with greater costs — they maintain proper on paying them.

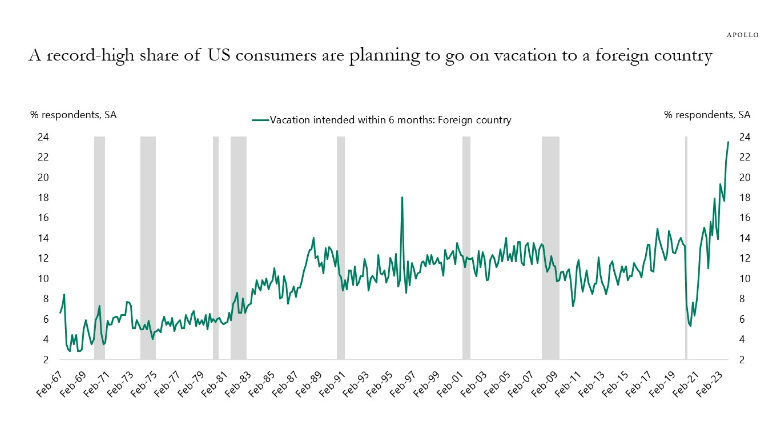

Torsten Slok at Apollo highlighted a survey this week that exhibits a document variety of customers plan on vacationing to a international nation inside the subsequent 6 months:

Cruise bookings are operating at a charge that’s 25-30% greater than pre-pandemic ranges. Cruise ships are operating out of stock.

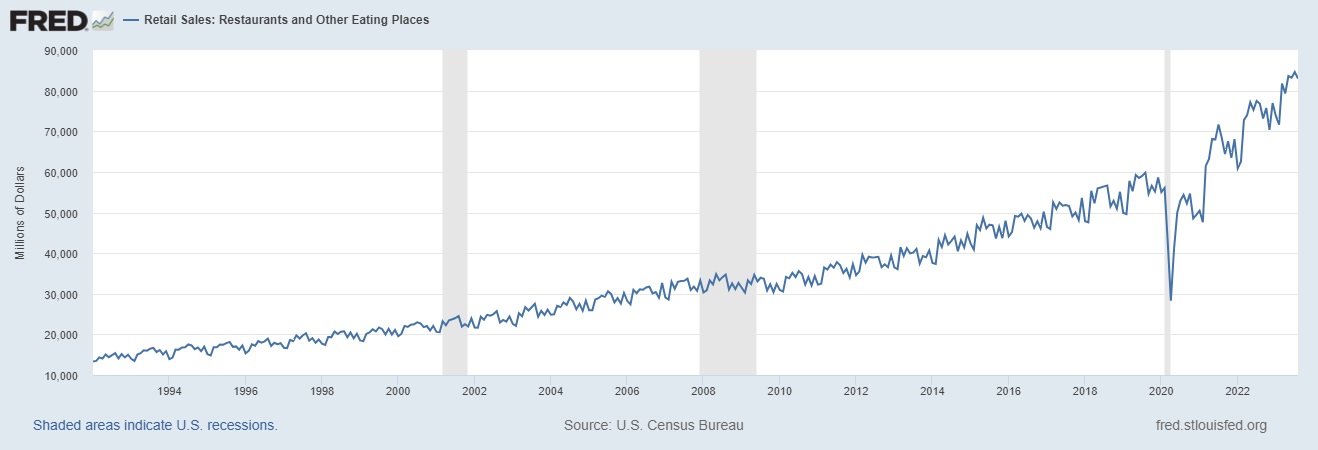

Have a look at the gross sales numbers for restaurant spending in America:

It’s manner greater than the pre-pandemic pattern.

The perfect-selling automobiles in America in 2022 have been the Ford F-150, Chevy Silverado and Dodge Ram.

Persons are nonetheless spending $50-60k on new vehicles, going out to eat, taking cruises and happening European holidays.1

This isn’t everybody and there are actually situations the place individuals are slicing again. However collectively, the largest affect inflation has had on client habits is all of us complain greater than we used to. Possibly that’s as a result of everyone seems to be spending extra too.

Fortunately, the speed of inflation is slowing. We’ll see if our charge of spending catches up finally.

Additional Studying:

Complacency within the U.S. Financial system

1This is likely to be a get off my garden second for me however I really feel like nobody I knew ever traveled to Europe once I was rising up. Now, it’s commonplace to listen to about European holidays.