The depth, period, and frequency of flooding have elevated over the previous few many years. In response to the Federal Emergency Administration Company (FEMA), 99 p.c of U.S. counties have been impacted by a flooding occasion since 1999. Because the frequency of flood occasions continues to extend, the variety of individuals, buildings, and agriculture uncovered to flood threat is simply more likely to develop. As a earlier submit factors out, measuring the geographical accuracy of such threat is necessary and should affect financial institution lending. On this submit, we deal with the distribution of flood threat throughout the Federal Reserve’s Second District and study its impact on institution location choices over the past 20 years.

The place Is Flood Danger Concentrated within the Second District?

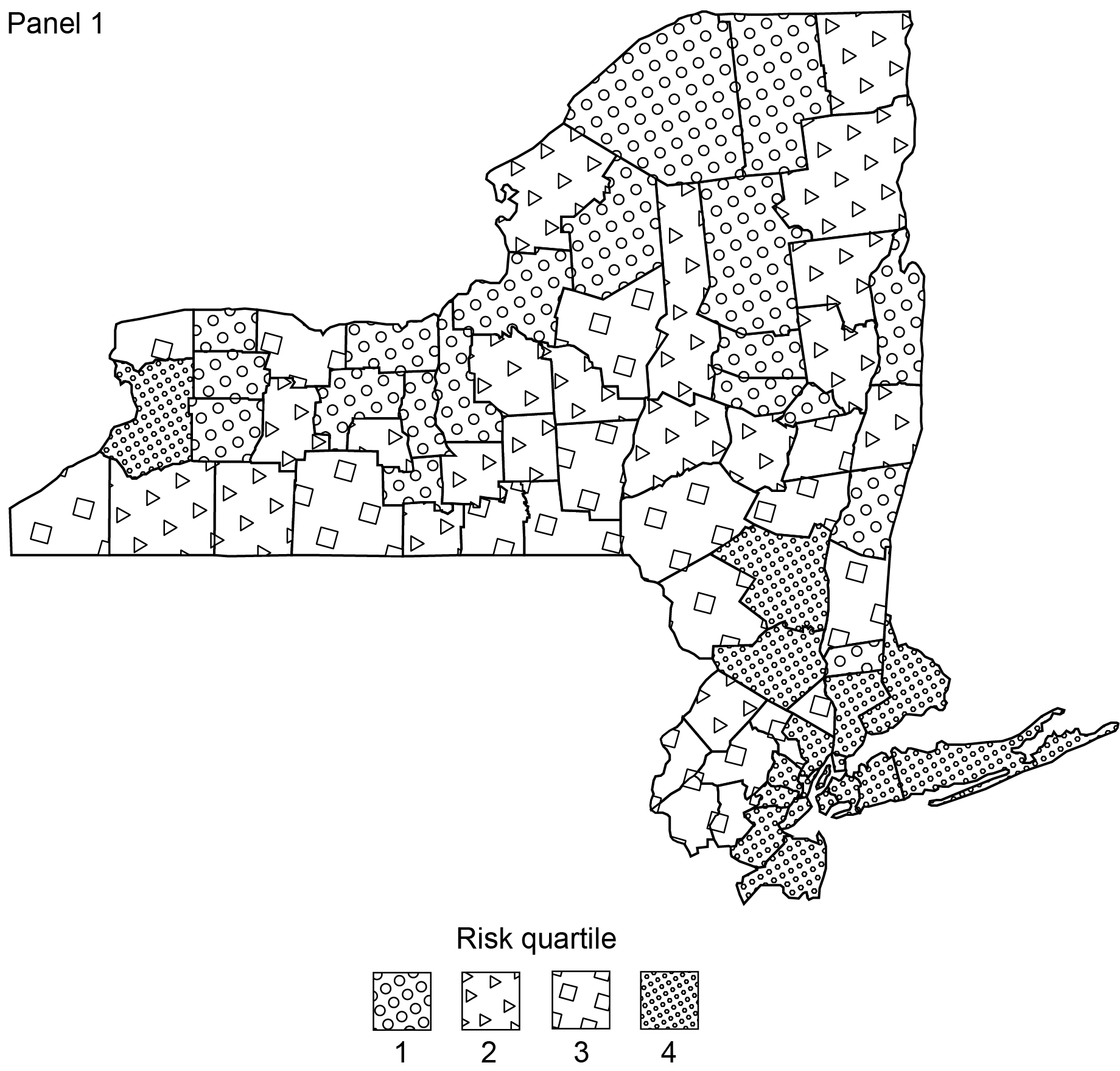

Coastal flooding happens when water inundates or covers usually dry coastal land, whereas riverine flooding happens when streams and rivers exceed their pure or constructed capability. We leverage county-level information on each coastal and riverine flood threat scores, offered by the FEMA Nationwide Danger Index (NRI), to construct an mixture flood threat rating for counties within the Second District as of March 2023. We type Second District counties into threat quartiles and plot their distributions in Panel 1 (Puerto Rico and the U.S. Virgin Islands are omitted as a result of inadequate information).

Flood Distribution within the Fed’s Second District

Supply: Federal Emergency Administration Company.

Be aware: Larger threat quartiles correspond to increased flood threat.

The counties with the best flood threat within the Second District additionally are typically probably the most populated; the correlation between flood threat rating and inhabitants is 0.78. All ten of probably the most populated counties within the Second District are additionally within the high quartile of flood threat rating and make up practically three-fourths of the overall inhabitants of New York State, in line with inhabitants information recorded in FEMA’s Hazus 6.0 launch. Geographically, the riskiest counties are concentrated within the Lengthy Island, South-Jap, and Metropolis Metro Areas of New York. The 2 exceptions lie in Fairfield County, positioned in Connecticut, and Erie County, dwelling of Buffalo and positioned within the North-Jap area. Mixed, high-risk counties account for over $3 trillion in constructing worth and $775 million in agricultural worth, primarily based on the authors’ calculations utilizing county-level FEMA NRI information.

Are New Corporations Avoiding Flood-Inclined Counties?

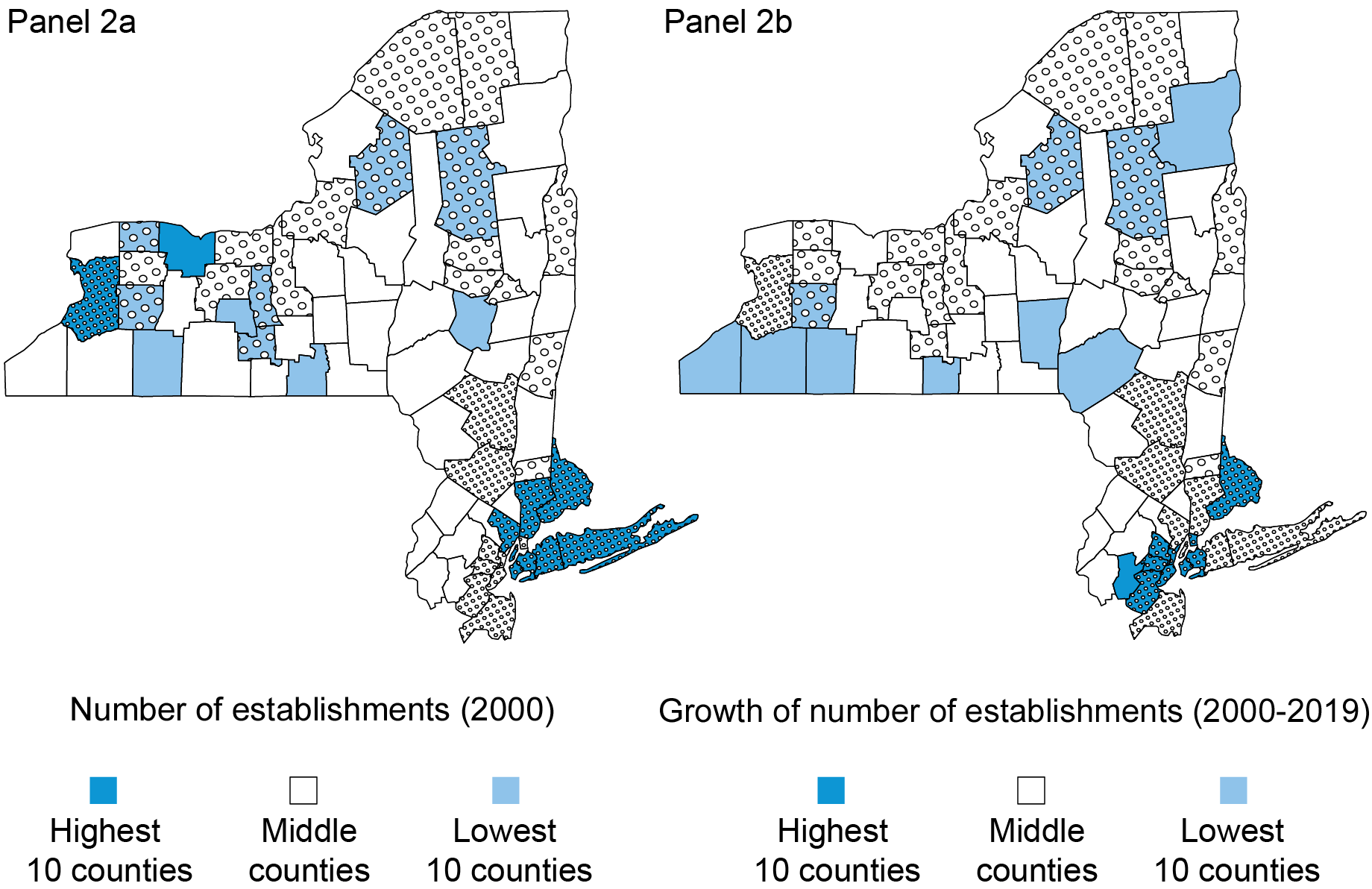

To know the evolution of firm location relative to flood threat, we use county-level information on institution places from the Nationwide Institution Time Sequence (NETS). An institution refers to an financial unit that engages in a enterprise exercise at a single bodily location. NETS experiences enterprise sector microdata, enabling us to look at county-level institution counts throughout time.

We start by plotting the distribution of the variety of institutions over the flood threat map, as introduced in Panel 2a under. We protect the patterns of the riskiest and most secure counties from Panel 1 for instance their distinction. Panel 2a highlights that again in 2000, institutions tended to be concentrated within the riskiest counties—the correlation between the variety of institutions and our flood threat rating is 0.71. This correlation seemingly displays the truth that inhabitants within the Second District is predominantly concentrated in counties with excessive publicity to flood threat; certainly, the correlation between the variety of institutions and inhabitants dimension is 0.83 throughout counties.

Focus and Progress of Institutions

Sources: Nationwide Institution Time Sequence (NETS); Federal Emergency Administration Company.

Notes: Panel 2b reveals the distribution of the ratio of institutions in 2019 to 2000 throughout all industries.

To get a way of the potential significance that flood threat could have performed in enterprise house owners’ geographical location choices throughout the Second District, we plot the distribution of the expansion of the variety of institutions between 2000 and 2019 in Panel 2b, overlaid with the flood threat map as of March 2023. We use flood threat information as of March 2023 as a result of historic information are unavailable.

Curiously, the counties with the highest progress charges within the variety of institutions have been not the counties with the bottom threat of flooding; on the contrary, the riskiest counties recorded the quickest tempo of firm progress. Equally, the counties with the lowest charges of firm progress have been not the riskiest counties however fairly comparatively protected counties. To manage for inhabitants dimension, we conduct the identical evaluation primarily based on the variety of institutions per particular person, yielding constant outcomes. Based mostly on these tendencies, flood threat doesn’t appear to have been the first determinant of enterprise location choices.

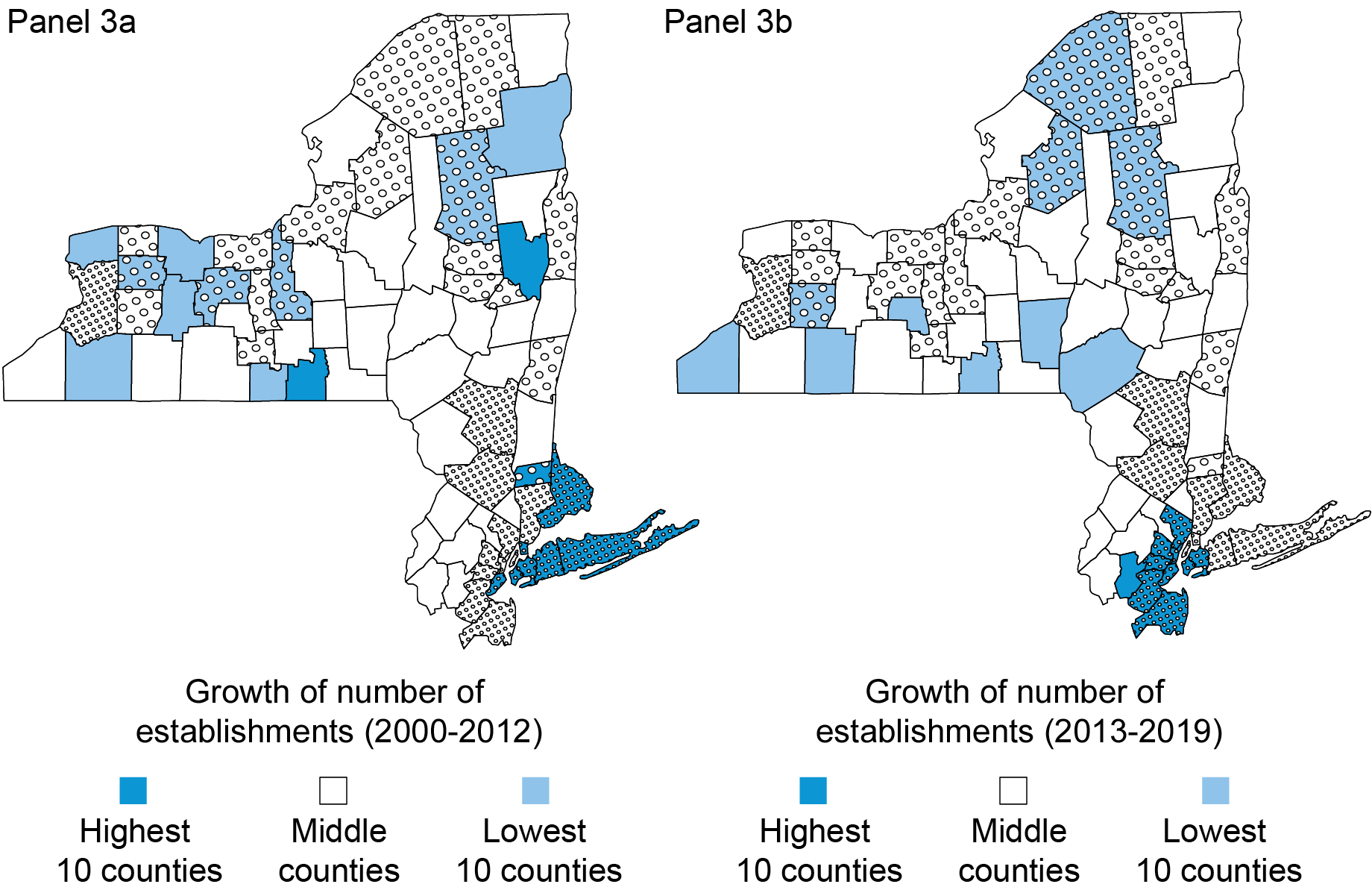

After all, it’s believable that the noticed lack of significance of flood threat in influencing institution location could also be pushed by the primary half of our pattern interval. In spite of everything, consideration to the danger of local weather change has elevated over time. To determine whether or not that is the case, we replicate Panel 2b in Panels 3a and 3b, however for the durations previous and following Hurricane Sandy (October 2012), some of the damaging hurricanes in america up to now, inflicting $50 billion in damages. Whereas there seems to be a change within the composition of excessive progress counties earlier than and after Hurricane Sandy, the shift is noticed primarily inside threat quartiles, fairly than throughout them, in keeping with Panel 2b.

Institution Progress Earlier than and After Hurricane Sandy

Sources: Nationwide Institution Time Sequence (NETS); Federal Emergency Administration Company.

Institutions’ Geographical Location by Trade

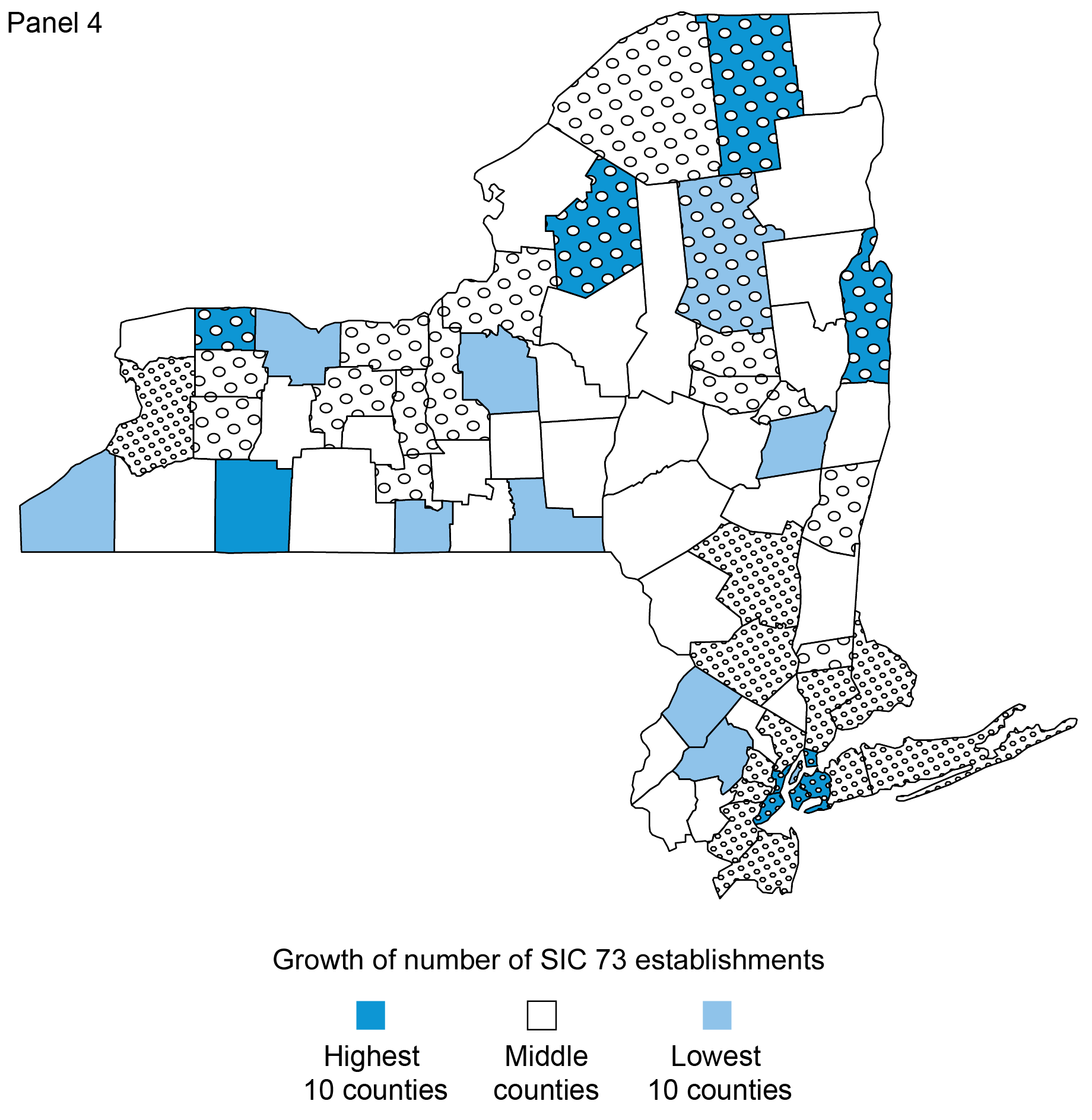

To additional perceive the potential significance of flood threat on institutions’ location choices, we examine progress charges over the past 20 years for institutions within the three most prevalent industries within the Second District primarily based on SIC2 code classification: Enterprise, Well being, and Engineering & Administration companies. Enterprise companies embody institutions primarily engaged in offering companies, on a contract or payment foundation, comparable to promoting, mailing, laptop programming, and assist provide companies. Well being Companies, in flip, consists of institutions primarily engaged in furnishing medical, surgical, and different well being companies. Lastly, Engineering & Administration institutions primarily have interaction in offering engineering, architectural, and surveying companies (for instance, accounting, analysis, and public relations companies).

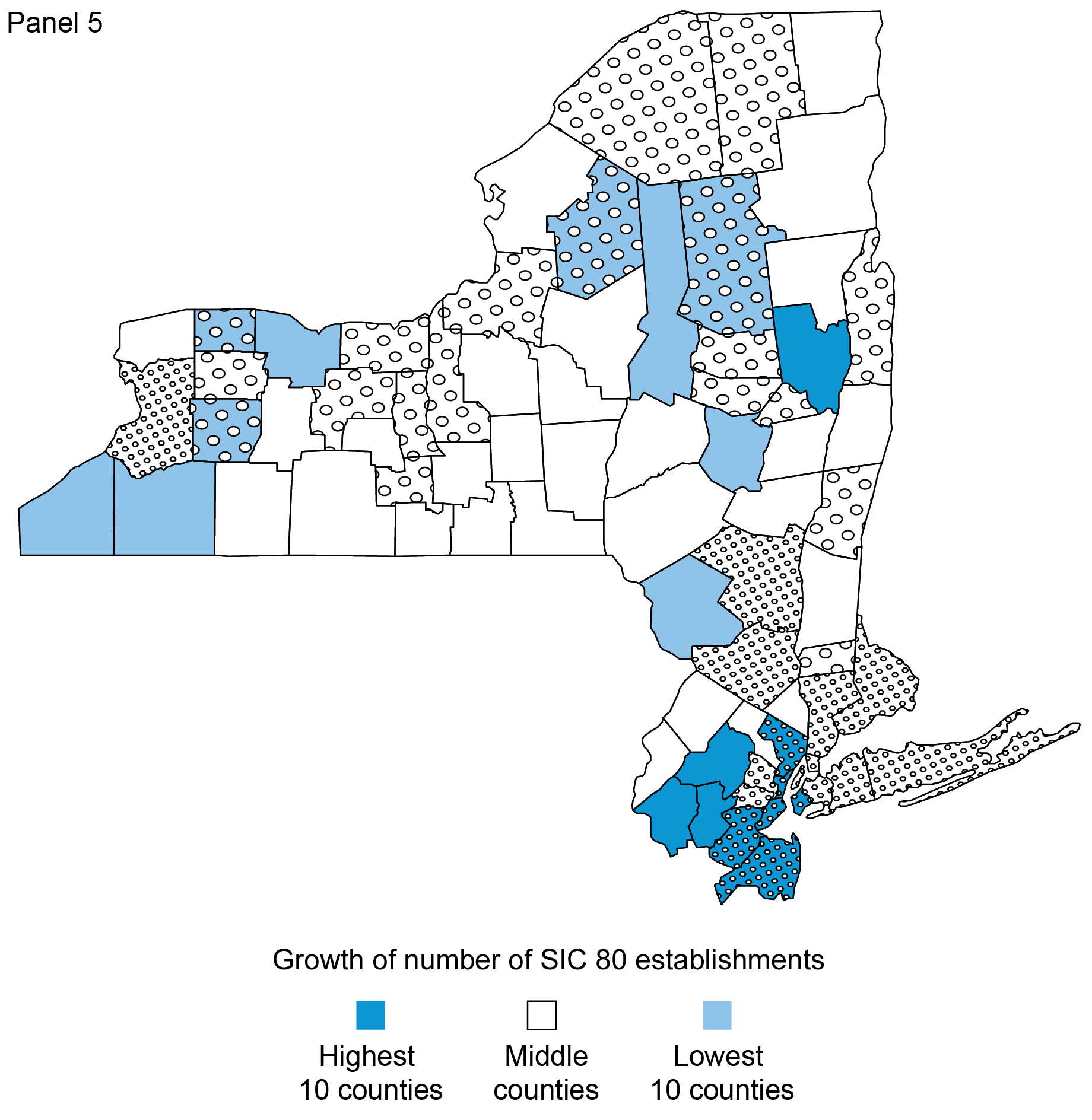

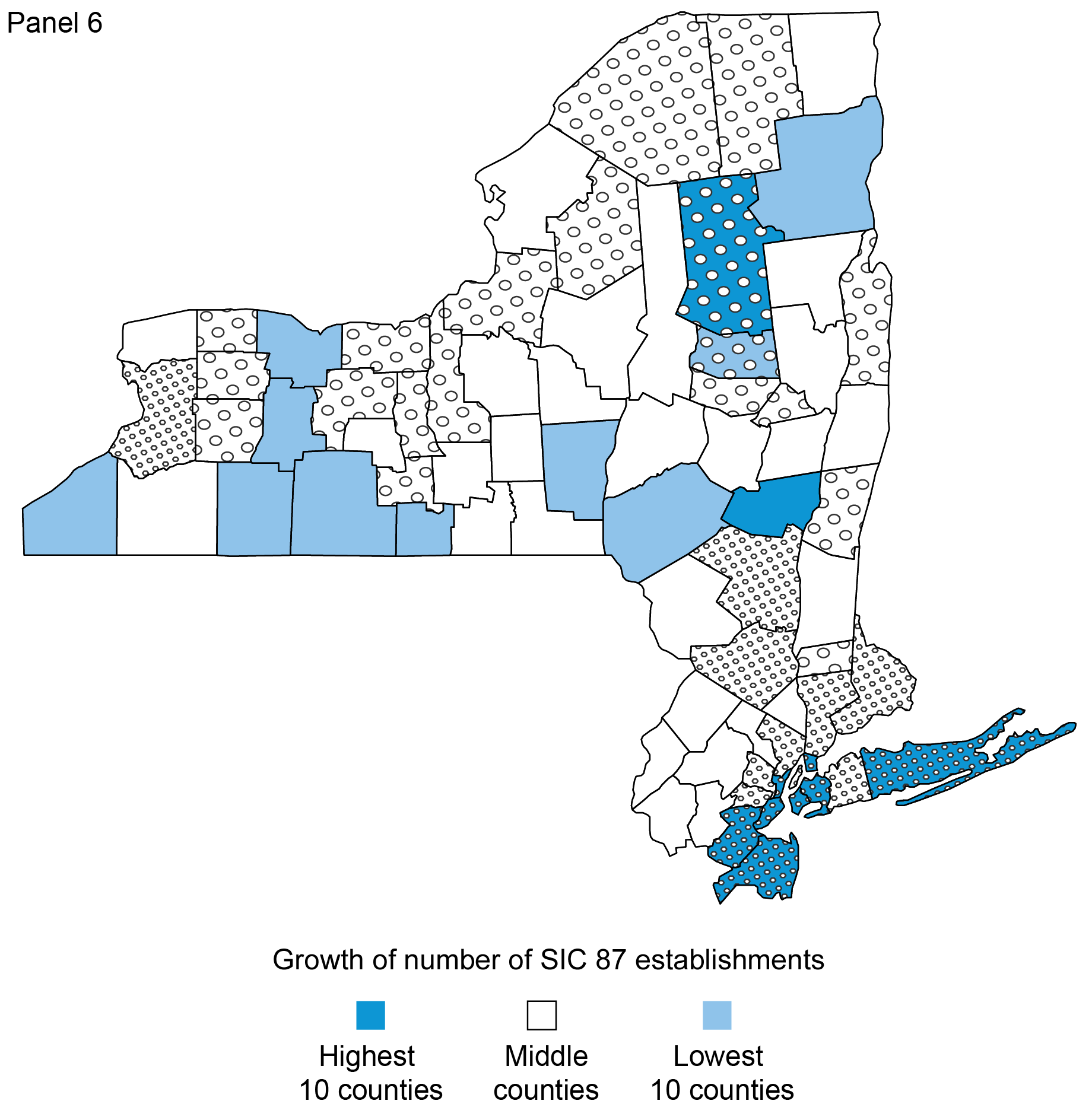

We plot the expansion of the variety of institutions for every of those industries in Panels 4-6. Curiously, Panel 4 reveals that 4 of the most secure counties ranked among the many high ten by way of Enterprise Service institution progress. Nevertheless, 5 of the highest ten progress charges on this class have been additionally claimed by counties within the riskiest quartile; and the highest three counties total are all positioned within the flood-prone New York Metropolis Metro area. Comparable patterns are noticed when analyzing progress charges for Well being Service institutions and Engineering & Administration Service institutions (see Panels 5 and 6). Total, these findings are in keeping with the proof noticed for all industries—we don’t discover proof of a migration of institutions from high-risk areas to low-risk areas.

Progress in Variety of Enterprise Service Institutions,

2000-19

Sources: Nationwide Institution Time Sequence (NETS); Federal Emergency Administration Company.

Progress in Variety of Well being Service Institutions,

2000-19

Sources: Nationwide Institution Time Sequence (NETS); Federal Emergency Administration Company.

Progress in Variety of Engineering & Administration Service Institutions, 2000-19

Sources: Nationwide Institution Time Sequence (NETS); Federal Emergency Administration Company.

Conclusion

On this weblog submit, we assess potential hyperlinks between institutions’ location choices and flood threat within the Second District. Our exploratory evaluation highlights that counties with higher publicity to flood threat additionally are typically the counties with the best focus of institutions. As well as, we don’t discover proof that flood threat is deterring the expansion of institutions within the Second District, suggesting that counties most uncovered to flood threat will proceed to play an necessary position within the area’s financial system. The subsequent submit within the Excessive Climate sequence additional explores the potential affect of local weather change dangers on financial exercise within the Second District, specializing in the affect of pure disasters on small enterprise house owners.

Oliver Zain Hannaoui is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Hyeyoon Jung is a monetary analysis economist in Local weather Danger Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

João A.C. Santos is the director of Monetary Intermediation Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Lee Seltzer is a monetary analysis economist in Local weather Danger Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

The right way to cite this submit:

Oliver Zain Hannaoui, Hyeyoon Jung, João A.C. Santos, and Lee Seltzer, “Flood Danger and Agency Location Selections within the Fed’s Second District,” Federal Reserve Financial institution of New York Liberty Road Economics, November 14, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/flood-risk-and-firm-location-decisions-in-the-feds-second-district/.

Disclaimer

The views expressed on this submit are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the writer(s).