The Nationwide Flood Insurance coverage Program (NFIP) flood maps, which designate areas prone to flooding, are up to date periodically by way of the Federal Emergency Administration Company (FEMA) and group efforts. Even so, many maps are a number of years previous. Because the earlier two posts within the Excessive Climate collection present, climate-related dangers range geographically. It’s due to this fact vital to provide correct maps of such dangers, like flooding. On this put up we use detailed knowledge on the flood danger confronted by particular person dwellings in addition to digitized FEMA flood maps to tease out the diploma to which flood maps within the Second District are inaccurate. Since inaccurate maps could go away households or banks uncovered to the chance of uninsured flood injury, understanding map inaccuracies is essential. We present that, when aggregated to the census tract degree, numerous maps don’t totally seize flood danger. Nevertheless, we’re additionally capable of present that updates do actually enhance map high quality.

Flood Map Updates

The NFIP was established within the late Nineteen Sixties following extreme riverine flooding within the U.S. heartland. As a part of the flood insurance coverage program, FEMA works with communities to create maps of areas in america that face heightened flood danger. Probably the most vital implications of those flood maps is the insurance coverage requirement for mortgage debtors. Mortgage candidates in areas which have not less than a 1 p.c likelihood of flooding every year should buy flood insurance coverage. This system in addition to the implications for the mortgage market are mentioned in earlier Liberty Road Economics posts (see right here and right here).

The prospect of a area flooding is just not static, nonetheless. On the one hand, the local weather continues to alter, and the dangers posed by a rising sea degree, hurricanes, and even summer time rains are continually evolving. However, many communities proactively handle flood dangers by way of the development of dams, floodways, or elevated dwellings to scale back the prospect of catastrophic injury. Consequently, FEMA periodically updates flood maps. These updates can see some beforehand “unmapped” areas obtain a flood danger designation whereas different areas could lose this categorization following native enhancements. Our knowledge signifies that, though the variety of parcels designated as uncovered to “flood danger” grows on common, greater than a 3rd of all adjustments contain some parcels of land receiving a decrease danger designation. Nevertheless, the difficult nature of modeling dangers—coupled with the need of group enter—signifies that maps could also be up to date occasionally and thus turn into outdated shortly. Regardless of current efforts to replace maps, many are nonetheless a long time previous.

Notes: This map depicts a FEMA South Centre, PA flood map as taken from FEMA’s mapping heart as of June 2023.. As could be seen from the purple spotlight, the map has been in place since 2008, with no amendments having occurred since then within the space depicted.

Outdated maps could lead to dangers that debtors or lenders are unaware of—see the above map that depicts a map that’s fifteen years previous. 1 / 4 of all maps had been fifteen years previous in 2022 and over half had been greater than 5 years previous. It’s doable that the flood zones depicted within the map have modified because the map was final up to date. As a consequence, some householders, who may need purchased insurance coverage had they been conscious of the dangers, will likely be in poor health ready and under-insured within the occasion a catastrophe strikes. Though understanding the diploma to which properties face unknown dangers has been difficult by the paucity of knowledge, we try to deal with this difficulty by capitalizing on new knowledge that has just lately turn into out there.

Flood Map Accuracy

FEMA’s course of for updating maps entails group enter in addition to doable amendments to the maps by particular person property homeowners prepared to contest maps utilizing their very own surveyors. Furthermore, its maps designate stark flooding boundaries—a location is both in or exterior of a flood zone. Third-party suppliers are in a position to make use of flood fashions and elevation mapping, in addition to satellite tv for pc imaging to assign extra granular danger measures to an space with out the necessity for group enter.

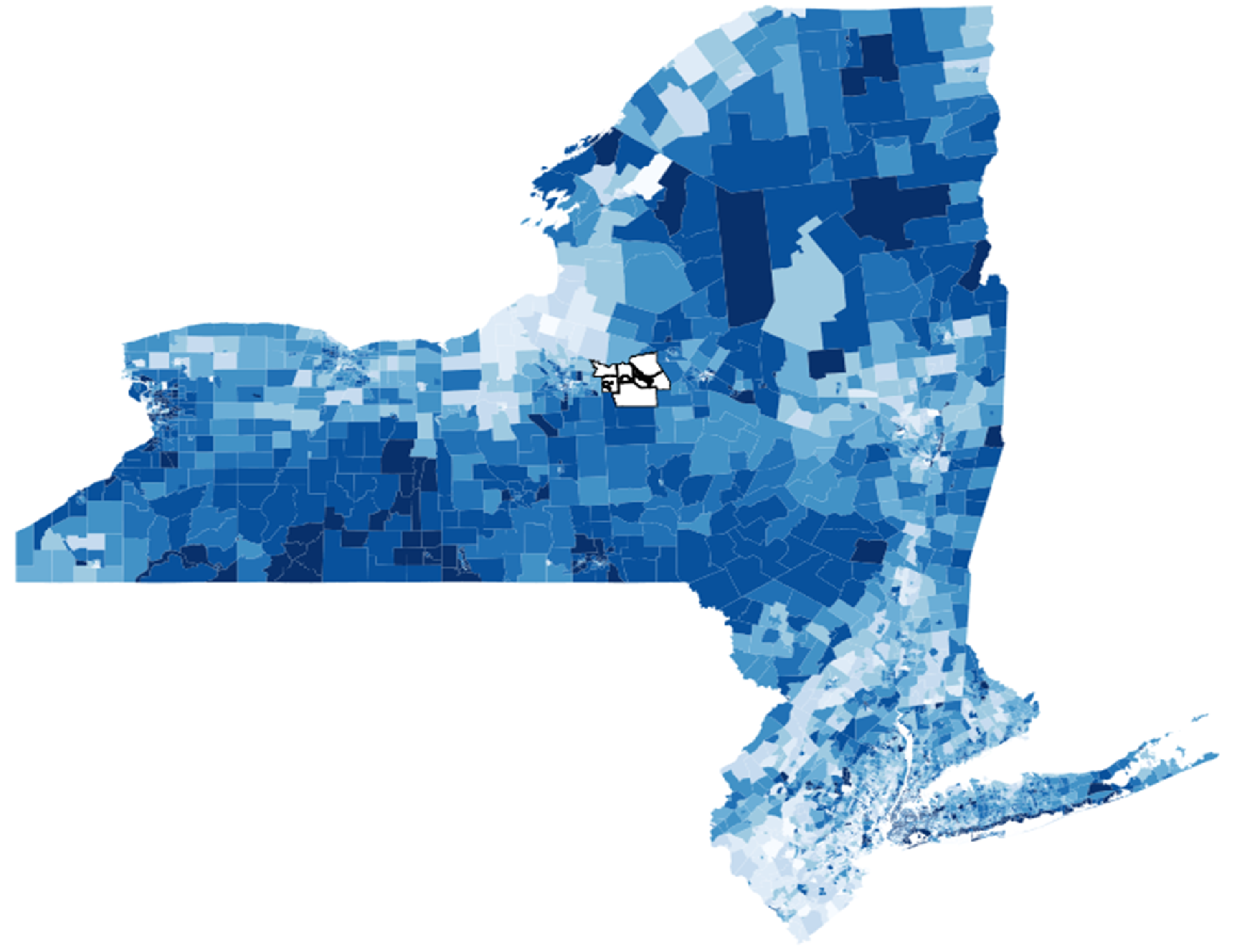

We use knowledge for 2021 on the flood danger confronted by particular person properties in america, as offered by CoreLogic, to establish the diploma to which some properties could also be inaccurately flood-mapped. Just lately, CoreLogic started estimating common annual flood injury for properties throughout america. We plot a property on the newest iteration of flood maps, which allows us to see whether or not the property has been assigned a 100-year, 500-year, or no flood danger standing. Subsequently, we evaluate the official danger designation with expectations from CoreLogic on the probability {that a} property would face greater than $1,000 in damages within the occasion of flooding (see an outline of CoreLogic’s methodology). We run this train for about fifteen million particular person properties within the Second District. We then combination the information to the census tract-level. A census tract with a better share of properties that may have obtained a flood zone designation utilizing the CoreLogic methodology, however should not have one underneath the FEMA map, is coloured a darker shade of blue within the map beneath.

Second District Census Tract with Doubtlessly Inaccurate Flood Maps

Be aware: This map depicts the Second District excluding Puerto Rico and the U.S. Virgin Islands. We present census tracts and shade these by the diploma to which they could be inaccurately flood-mapped. An inaccurately mapped property is one which faces important flood danger, however is just not designated as being in a flood zone. We then combination to the census tract degree, with darker shaded areas residence to a higher share of inaccurate properties. The utmost mirrored on the map is 60 p.c inaccurate, with lighter shaded areas displaying barely any inaccuracies.

Flood Map Updates

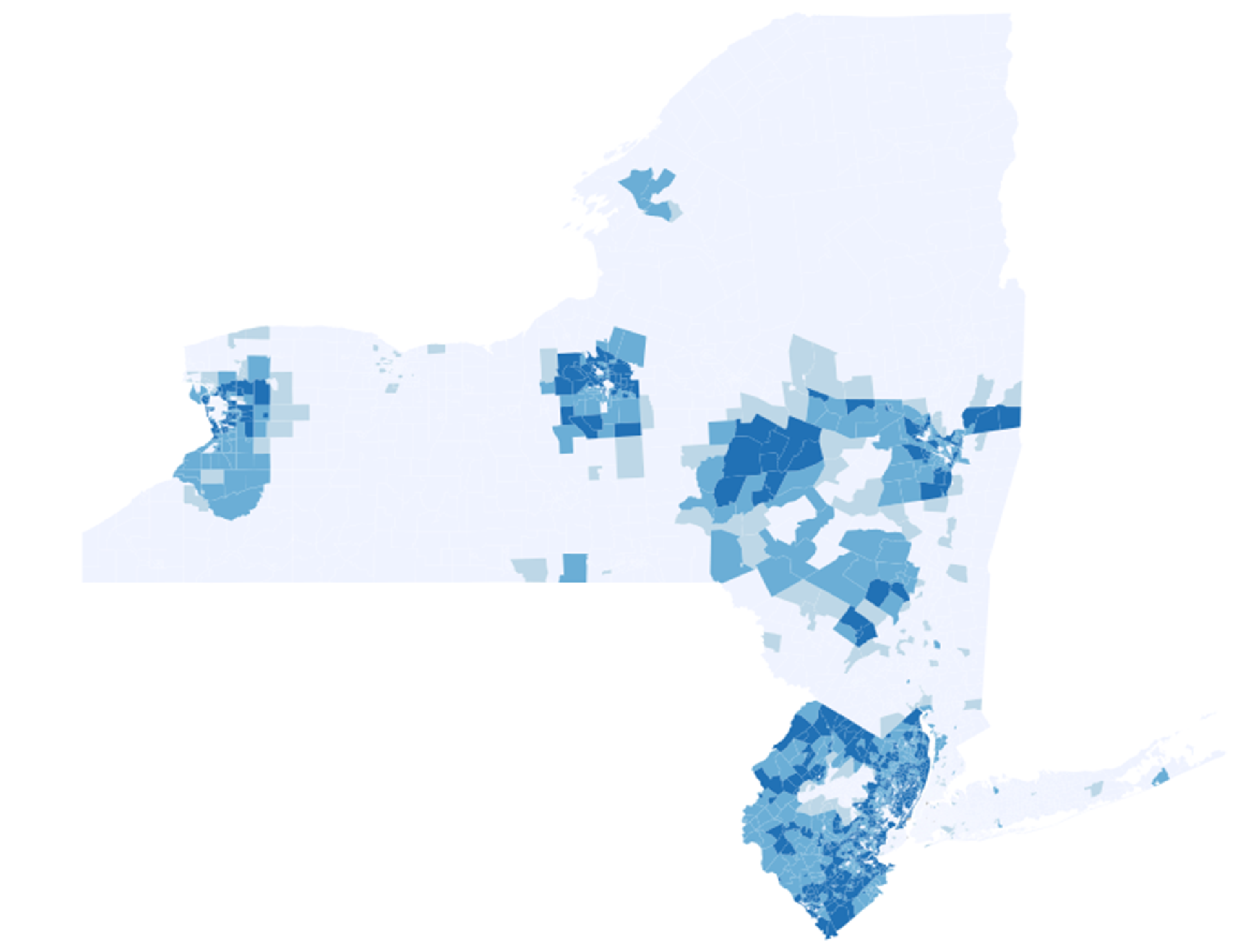

It’s reassuring to see that probably the most precisely mapped areas are the place maps have been up to date most just lately. Within the subsequent map, we once more plot the Second District, and spotlight these census tracts with important (optimistic) map adjustments. These are areas the place the flood zone designation has been expanded, based mostly on map adjustments between 2013 and 2022 in our historic map knowledge.

Second District, excluding Connecticut, Puerto Rico, and U.S. Virgin Islands

Notes: This map exhibits optimistic map updates. Blue shaded areas are people who noticed substantial progress of mapped areas between 2013 and 2022. The darkest shading signifies areas that weren’t flood-map coated in 2013 however are utterly coated in 2022. Lacking knowledge means we exclude CT on this illustration.

Probably the most shaded areas within the above map are these areas which have undergone important map adjustments—with areas in darkish blue turning into totally mapped, the place no map existed earlier than. The extra darkly shaded areas within the above map are these which are much less shaded within the second map above, implying a unfavorable correlation between map updates and map inaccuracies. The correlation coefficient is bigger than -0.5 and important, implying map updates scale back inaccuracies. This means that FEMA’s updating efforts are priceless in enhancing map high quality, regardless of the related prices to FEMA and communities. The end result holds true within the nation as an entire and never simply within the Second District. Thus, current map updates have decreased map inaccuracies.

Concluding Remarks

FEMA maps are sometimes inaccurate as a result of delay in updating maps to mirror adjustments within the flood dangers. This follows naturally from the truth that updating takes a very long time and requires expensive surveys, group enter, and injury assessments. Outdated maps are possible imperfect reflections of danger. A number of areas within the Second District could also be inaccurately mapped with penalties for the under-insurance of households. Nevertheless, map updates–once they happen–scale back the inaccuracies, that means FEMA’s updating efforts are each mandatory and priceless. The following put up within the Excessive Climate collection examines how these inaccuracies could affect financial institution lending within the Second District.

Kristian Blickle is a monetary analysis economist in Local weather Threat Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Katherine Engelman is a former knowledge scientist within the Information and Analytics Workplace within the Financial institution’s Know-how Group.

Theo Linnemann is an information scientist within the Information and Analytics Workplace within the Financial institution’s Know-how Group.

João A.C. Santos is the director of Monetary Intermediation Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

How one can cite this put up:

Kristian Blickle, Katherine Engelman, Theo Linnemann, and João A.C. Santos, “Potential Flood Map Inaccuracies within the Fed’s Second District,” Federal Reserve Financial institution of New York Liberty Road Economics, November 10, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/potential-flood-map-inaccuracies-in-the-feds-second-district/.

Disclaimer

The views expressed on this put up are these of the writer(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the writer(s).