The Fed isn’t performing as if its coronary heart is in taking regulation financial institution regulation critically. Not that that’s any shock.

Earlier this week, the Wall Avenue Journal described how banks are sidestepping the extra stringent capital necessities regulators plan to implement after Silicon Valley Financial institution and Signature Financial institution failed early this 12 months. SVB, as it’s typically known as, took the bone-headed motion of loading up on low rate of interest mortgages. The financial institution’s funding was skewed in direction of very giant deposits, after which by rich people, versus companies. Remember that fairly just a few enterprise capital funds who have been buyers in SVB required different investee corporations to financial institution at SVB, so the prospect of these corporations being unable to make payroll1 as a result of they’d lose their uninsured balances grew to become the rallying cry for Doing One thing.

The denouement was that each banks had all their deposits assured, and that the Fed created one more emergency facility, the Financial institution Time period Funding Facility, to offer reduction to similarly-situated gamers, as in doubtlessly numerous banks. This was a extra permissive means than the low cost window to permit banks to entry emergency funds, by advantage of not haircutting the collateral pledged for the mortgage. Do not forget that whereas SVB was an excessive case of wrong-footing the Fed’s rate of interest will increase, practically all banks are sitting on losses on loans and portfolio investments as a consequence of their worth taking place as rates of interest rise. There could possibly be an argument for regulatory forbearance, as in trying the opposite means and/or discovering methods to finesse the paper losses, on the belief that the central financial institution will relent within the not-too-distant future and people interest-rate-induced losses will show to be largely non permanent.

This long-winded intro is to determine that the disaster this spring, and the Fed’s combo of reduction however tighter capital guidelines was to resolve an issue created by the central financial institution itself, that of getting stored rates of interest too low for a lot too lengthy, after which reversing them although very aggressive charge improve. We’d heard in 2011 or 2012 from Fed-connected sources that the central financial institution realized its tremendous low rate of interest experiment had been a failure they usually wanted to unwind it. Bernanke talked the prospect of Fed tightening up in 2014, however misplaced his nerve out there revolt that got here to be known as the Taper Tantrum.

Congress and the Fed exacerbated this underlying downside, of an excessively-low-interest charge time bomb that will finally go off, with Congress voting via laxer guidelines in 2018 on the cutoff for being a big financial institution. However, the Fed remained the first regulator for SVB and even launched a report on why the financial institution failed and admitted it had develop into too palms off with the mid sized banks beneath the brand new regulation.

So now, in no way far previous the March upheaval, with new capital guidelines anticipated however not implement, the Fed going the opposite means, of being extra permissive. It’s permitting large banks to get reduction from present guidelines, whereas enriching some infamous unhealthy actor hedge funds and fewer unsavory personal fairness companies. From the Wall Avenue Journal:

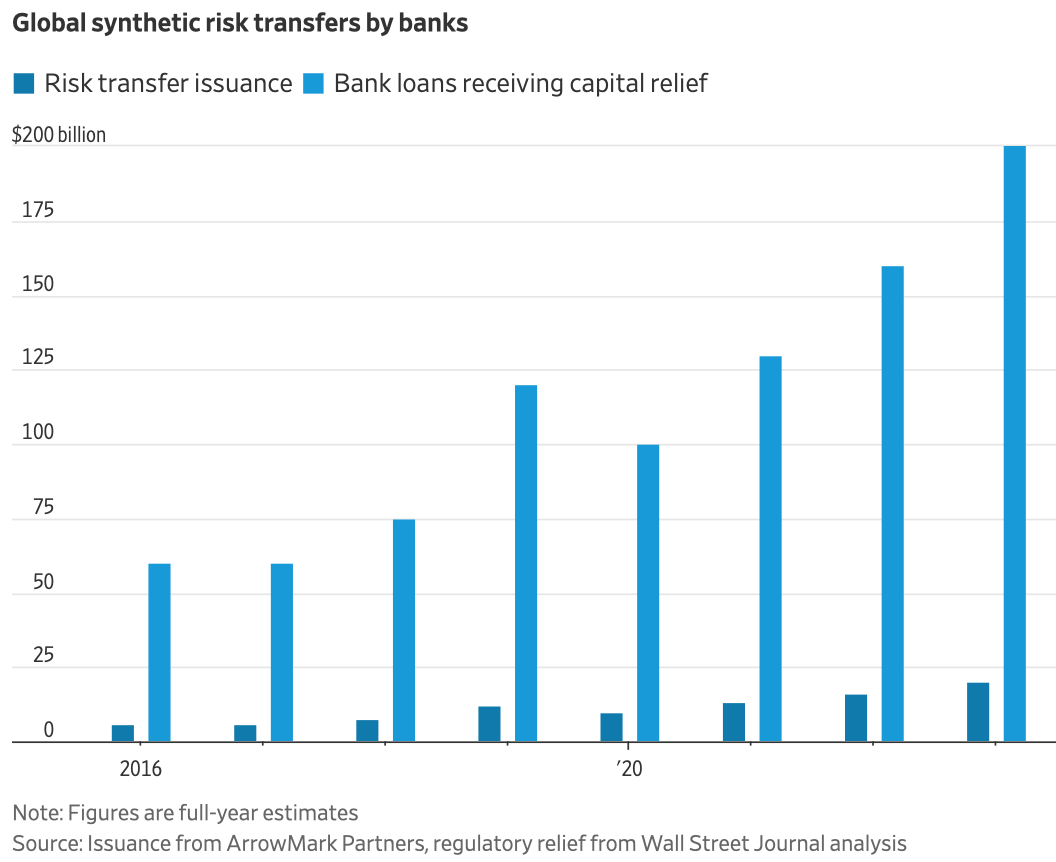

U.S. banks have discovered a brand new method to unload danger as they scramble to adapt to tighter laws and rising rates of interest.

JPMorgan Chase JPM 0.49percentincrease; inexperienced up pointing triangle, Morgan Stanley MS 0.61percentincrease; inexperienced up pointing triangle, U.S. Financial institution and others are promoting advanced debt devices to private-fund managers as a method to scale back regulatory capital expenses on the loans they make, individuals accustomed to the transactions stated.

These so-called artificial danger transfers are costly for banks however more cost effective than taking the total capital expenses on the underlying belongings. They’re profitable for the buyers, who can sometimes get returns of round 15% or extra…

U.S. banks have discovered a brand new method to unload danger as they scramble to adapt to tighter laws and rising rates of interest.

JPMorgan Chase, Morgan Stanley, U.S. Financial institution and others are promoting advanced debt devices to private-fund managers as a method to scale back regulatory capital expenses on the loans they make, individuals accustomed to the transactions stated.

These so-called artificial danger transfers are costly for banks however more cost effective than taking the total capital expenses on the underlying belongings. They’re profitable for the buyers, who can sometimes get returns of round 15% or extra, in accordance with the individuals accustomed to the transactions….

The offers perform considerably like an insurance coverage coverage, with the banks paying curiosity as a substitute of premiums. By reducing potential loss publicity, the transfers scale back the quantity of capital banks are required to carry towards their loans….

Banks began utilizing artificial danger transfers about 20 years in the past, however they have been hardly ever used within the U.S. after the 2008-09 monetary disaster. Complicated credit score transactions grew to become more durable to get previous U.S. financial institution regulators, partly as a result of comparable devices known as credit-default swaps amplified contagion when Lehman Brothers failed…

U.S. laws have been extra conservative. Round 2020, the Federal Reserve declined requests for capital reduction from U.S. banks that wished to make use of a kind of artificial danger switch generally utilized in Europe. The Fed decided they didn’t meet the letter of its guidelines….

The strain started to ease this 12 months when the Fed signaled a brand new stance. The regulator stated it could overview requests to approve the kind of danger switch on a case-by-case foundation…

However it’s not in any respect clear how stringent the Fed is being:

Fed steering on financial institution credit score danger transfers may double market dimension https://t.co/BjsVYox5lB

— Danger.Internet (@RiskDotNet) November 1, 2023

And if the central financial institution shouldn’t be doing such a scorching job of overseeing banks, how can it probably consider the counterparties which are taking over these dangers? In the event that they go bust or have liquidity issues, it’s the financial institution that winds up holding the bag. Do not forget that LTCW was perceived to be tremendous savvy and rock strong till it imploded, and world’s greatest insurer AIG was rated AAA till it began on its terminal slide.

Even worse, the gamers that the Wall Avenue Journal mentions first (as presumed market leaders) embrace hedge funds, which implies their exposures can change rapidly, and ones with questionable histories. Once more from the Journal:

Personal-credit fund managers, together with Ares Administration and Magnetar Capital, are lively consumers of the offers, in accordance with individuals accustomed to the matter. Corporations together with Blackstone’s hedge-fund unit and D.E. Shaw lately began a technique or raised a fund devoted to risk-transfer trades, among the individuals stated.

Ares was one of many companies concerned within the CalPERS pay-to-play scandal, which included the bribery of CalPERS CEO Fred Buenrostro. ProPublica gained a Pulitzer for its intensive reporting on Magnetar’s sleazy conduct within the runup to the disaster.

Nonetheless, it stays a sore level that ProPublica missed the actual story. As we described long-form in ECONNED, Magnetar was a structured credit score arbitrage specialist. Utilizing considerably artificial CDOs (the 20% of precise mortgages of their construction made them saleable to a a lot bigger group of buyers), Magnetar created credit score default swaps on the riskiest rated tranches of subprime bonds. Its massively leveraged construction generated monumental publicity that wound up within the palms of systemically vital, excessive leveraged banks. Its commerce additionally had the impact of driving demand to the worst subprime mortgages within the poisonous section that began in June 2005. Consultants estimated that from then to the ultimate demise of the subprime market, Magnetar drove the demand for 50% to 60% of subprime mortgage bonds. The explanation Magnetar didn’t get as wealthy and subsequently develop into as seen as John Paulson was that Magnetar gave up numerous its excellent subprime commerce on a foul wager, rumored to be on gold.

And these are the events the Fed is comfy backstopping financial institution danger? Severely?

____

1 Companies of any significant dimension will inevitably have greater than $250,000 on the financial institution. They obtain giant funds from clients. They need to have money within the financial institution to satisfy payrolls. From an accounting and software program standpoint, it’s far too cumbersome to attempt to handle these cash flows throughout a number of financial institution accounts.