A fast stroll by way of of find out how to enhance the chances of success and the magnitude of return with a current low value name purchase in Caterpillar (CAT).

POWR Choices employs a fusion method to commerce thought technology. It combines basic, technical and volatility evaluation to establish potential trades which have the chances of their favor.

All of it begins with the POWR Scores. StockNews does the heavy-lifting for you by combining 118 various factors to search out the shares with the best chance of success (A and B rated) for bullish name buys. It additionally identifies the shares with the most important probability of failure (D and F rated) for bearish put buys.

Let’s take a stroll by way of the method utilizing our most up-to-date commerce in Caterpillar name choices.

Basic Evaluation

Caterpillar (CAT) was a Sturdy Purchase (A-Rated) inventory within the POWR Scores. Additionally ranked close to the very prime at quantity 8 out of 78 within the Sturdy Purchase (A-Rated) Industrial Equipment Trade.

Present Worth/Gross sales (P/S) ratio was additionally nearing a three-year low at simply 1.65x. The final time it was at such a cheap a number of was October 2022-which preceded a powerful rally in CAT inventory value.

Technical Evaluation

CAT inventory reached oversold readings on a technical foundation. 9-day RSI was underneath 20 and on the lowest ranges of the previous yr. MACD at the same unfavourable excessive as nicely. Bollinger P.c B turned unfavourable. Shares had been buying and selling at a giant low cost to the 20-day transferring common. Earlier occasions all these indicators aligned in a similar way marked important lows in Caterpillar. CAT additionally held main help on the $225 space.

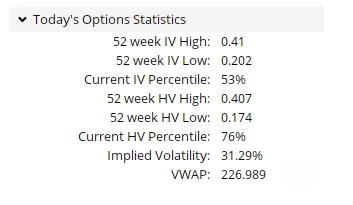

Implied Volatility Evaluation

Implied volatility (IV) was buying and selling at simply the 53rd percentile put up earnings, even after the sharp drop in CAT inventory. This implies choice costs had been just about common. Pricing was even cheaper, nonetheless, when in comparison with the historic volatility (HV) of 76%. Plus, it is very important do not forget that the VIX, an general measure of implied volatility for S&P 500 shares typically, was buying and selling at simply off the current highs.

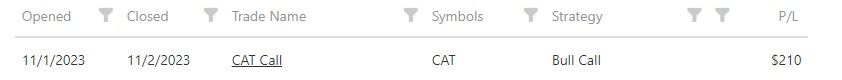

POWR Choices purchased the bullish CAT February $260 name choices on 11/1 simply after the market opened. Paid $4.10 to get in-or $410 per name.

Closed them out only a day in a while 11/2 for a fast one-day achieve of $210 as CAT inventory rallied properly. Shares did certainly bounce off the $225 help line. 9-day went again above 30. Bollinger P.c B regained constructive territory and MACD improved as nicely.

This equates to simply over a 50% achieve in in the future on the preliminary value of the decision of $410. Commerce outcomes proven under.

So, whereas CAT inventory did rally 4.5% from $225 to $235, our February $260 calls gained greater than 50%-or higher than 10x the quantity the inventory rose.

The price of buying and selling CAT inventory versus CAT choices would have been a lot higher, too. 100 shares of Caterpillar inventory would require an preliminary outlay of about $22,500 (100 shares occasions $225 inventory value). Even totally margined the inventory would have tied up nicely over $10,000.

The acquisition of the decision choice, which controls 100 shares of CAT inventory, value solely $410 up front-or solely about 2% of the inventory buy.

This highlights the facility of options-and the facility of the POWR Choices method.

Definitely, not all trades will work out this shortly or this nicely. Utilizing the POWR rankings together with the POWR Choices fusion method can put the chances in your favor.

On the finish of the day, buying and selling is all about chances and never certainties.

POWR Choices

What To Do Subsequent?

In the event you’re searching for the very best choices trades for as we speak’s market, you need to try our newest presentation Methods to Commerce Choices with the POWR Scores. Right here we present you find out how to persistently discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to be taught extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Methods to Commerce Choices with the POWR Scores

All of the Finest!

Tim Biggam

Editor, POWR Choices E-newsletter

CAT shares closed at $240.75 on Friday, up $1.63 (+0.68%). Yr-to-date, CAT has gained 2.55%, versus a 14.93% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices publication. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up No Catcalls On These One Day Marvel CAT Calls appeared first on StockNews.com