That is the final article in a collection that describes what I discovered within the 12 months following retirement. After fifty years of working, army service, and getting two college levels, I took the primary 12 months as “Me Time”. I as soon as labored with an Australian who was fond of claiming that he had his $100 within the financial institution, that means that he was financially safe. I’ve reached the tip of the rainbow after many years of investing and monetary planning. I simply signed up for Social Safety, which, mixed with pensions, will cowl regular spending wants, plus I’ve my $100 within the financial institution.

This previous 12 months, I put my investing on autopilot with Constancy Wealth Administration and Vanguard Private Advisory Companies managing my long-term funding buckets. I’m shocked at how a lot aid I really feel placing these plans into motion and the way a lot time it has freed up. I’m able to look past the rainbow and create a map of the great life in retirement.

This text is split into the next sections:

REACHING THE RAINBOW

I had a rocky begin to my profession however was in a position to end sturdy with peak earnings in my later years. I started evaluating situations mid-career of retiring at 57, 59 ½, 62, and 65, not as a result of I needed to retire early, however in case I needed to. The advantages of working a number of years longer had been stunning. Brian J. O’Connor does a wonderful job in Dangerous Information: Early Retirement Can Create a Monetary Disaster, which summarizes the dangers of retiring early based mostly partly on a research by Allspring World Investments. He describes that somebody retiring at 62 is 3 times extra prone to run out of cash than somebody ready till age 65 to retire.

The 5 many years relating to private finance since I graduated from highschool have been characterised by the next:

- First Decade: Navy service, attending college, stagflation, working non permanent jobs.

- Second Decade: Globalization, layoffs, mergers & acquisitions, beginning an expert profession, marriage, MBA (between layoffs).

- Third Decade: Skilled improvement, Dotcom Bubble, shopping for a house, setting targets utilizing Vanguard’s retirement device.

- Fourth Decade: Working internationally, coming into administration positions, monetary disaster, constructing a house, utilizing the Constancy retirement device, starting DIY monetary planning, hiring fee-only monetary planner, utilizing Schwab robo-advisor, creating an funding mannequin.

- Fifth Decade: Peak incomes years, COVID, merger, retirement planning, retirement, most cancers, relocation, employed a monetary planner, writing articles for In search of Alpha and Mutual Fund Observer.

For sure, issues usually don’t go in accordance with plan. You might not have the ability to work so long as you wish to full your monetary plans. There are monetary pace bumps alongside the way in which. Finally, I labored till age 67, which is past the traditional retirement age for each my employer pension plan and social safety. Working longer means that you’re nonetheless including to financial savings as an alternative of drawing from them. The impression on Social Safety advantages is described later.

Setting Targets

Setting a aim to have a certain quantity saved by retirement at all times appeared somewhat esoteric to me as a result of there are such a lot of variables. Nevertheless, I’ve at all times saved a watch on the scale of the prize. Constancy’s guideline is that individuals ought to attempt to save a minimum of their wage by age 30, 3 times their wage by age 40, six occasions by 50, and eight occasions by age 60. The median wage within the 55 to 64 age group is about $76 thousand. That might indicate that the financial savings of a typical individual nearing retirement needs to be between $450 thousand and $600 thousand.

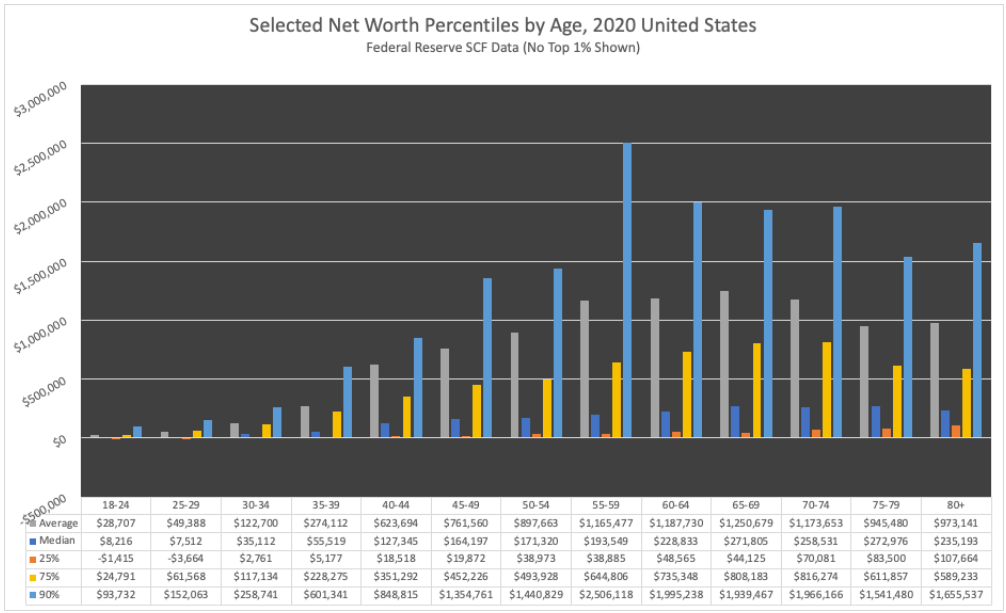

The Wealth Calculators supplied by DQYDJ estimate that to be within the high 50% for households within the 65 to 69 age group, one would want a internet price of $272 thousand, together with residence fairness. The Constancy Guideline is an attainable stretch aim. Having $1 million in internet price is within the high 20%, and to be within the high 10% requires a minimum of $1.9 million. This doesn’t embody pensions, annuities, and social safety. A Pension Current Worth Calculator from Monetary Algebra exhibits the current worth of a $4,000 month-to-month pension at 6% curiosity for 25 years has a gift worth of $624 thousand. It doesn’t take note of adjusting pensions for cost-of-living changes like Social Safety and a few pensions do. One other vital issue is whether or not the financial savings are in Conventional IRAs, the place taxes are owed on distributions.

Determine #1 exhibits estimated internet price, together with residence fairness by age group from DQYDJ.

Determine #1: Internet Value Percentiles by Age in america (2020)

Supply: DQYDJ based mostly on the Federal Reserve Survey of Client Funds (2019)

My important aim has been to avoid wasting the utmost allowable contribution to employer-sponsored financial savings plans, together with some discretionary financial savings targets. Financial savings and earnings targets have impacted my behaviors. I’d fairly drink a $0.35 cup of my favourite cup of espresso at residence fairly than a $5 latte, although I savor the lattes. Pamela Vachon conservatively estimates in Right here’s How A lot You’ll Save Making Espresso at Dwelling {that a} typical espresso drinker can save $736 by consuming their espresso at residence. This identical logic applies to many purchases. We lower our discretionary bills once I retired, and lately reassessed our spending to chop out one other $500 monthly, largely in monetary subscriptions. Our dwelling bills haven’t gone down, however our priorities have modified.

Lifetime Budgets

How a lot is required for retirement needs to be derived from a lifetime funds considering sources of earnings, bills, and together with the anticipated return from investments, and estimated inflation. Constancy has a retirement planning device that’s obtainable to account homeowners. Vanguard has one that’s obtainable if you happen to use their Private Advisory Companies. After all, there’s the DIY spreadsheet strategy that I additionally use. The price of dwelling can range dramatically by state, as proven by Robin Rothstein in Analyzing The Price Of Dwelling By State In 2023. John Csiszar estimates that typical 401k financial savings will final lower than seven years in some states: The Common 401(okay) Is Value $300K at Retirement Age — How Lengthy It Would Final in These 10 States.

Monetary Planners

I’m a powerful advocate of utilizing a monetary planner, though I reached this conclusion late in my profession. Social Safety, Medicare, and tax guidelines may be difficult. Monetary literacy is vital to assist us perceive the tradeoffs between danger and return. Monetary planners might help with these matters. What I’ve discovered is that it could take a monetary planner and tax accountant to advise on these matters. Rodney Brooks describes why you may want a tax accountant and a monetary planner in Ought to You Seek the advice of a CFP or CPA to Plan for Retirement? Sam Lipscomb describes why you may want an advisor who focuses on Social Safety in Monetary Advisors for Social Safety. I took the Do-It-Your self route, which has been time-consuming. Robert Powell describes sure advisors who focus on Medicare in How Monetary Advisers Can Assist Purchasers With Medicare. I exploit Alight, which is a retiree profit from my former employer, to determine one of the best Medicare plans.

Edelman Monetary Engines has monetary providers with charges based mostly on a share of property. There are additionally quite a lot of assets obtainable to seek out impartial monetary planners, reminiscent of FPA PlannerSearch and The Nationwide Affiliation of Private Monetary Advisors. I wrote Battle of the Titans for Portfolio Administration, evaluating Constancy to Vanguard. I’m utilizing each and can consider in a number of years if I’ve a powerful choice for one over the opposite.

Understanding Social Safety

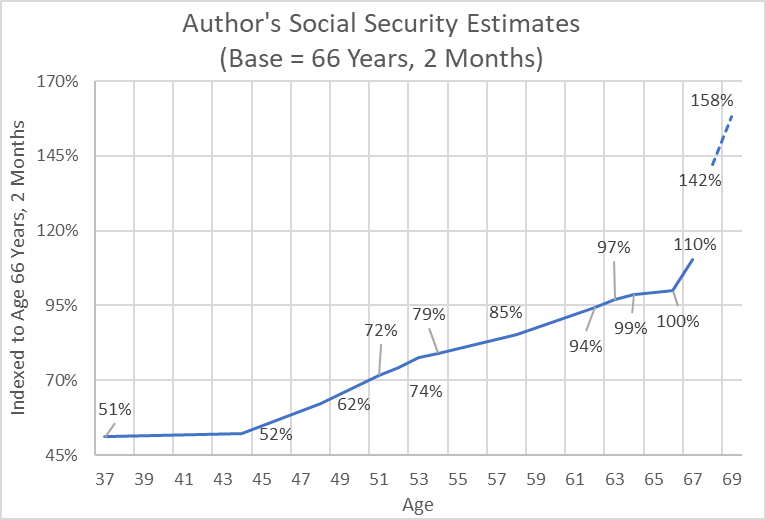

I’ve tracked my estimated Social Safety (SS) pension as a part of monetary planning. The bottom case in Determine #2 is the SS pension that I’d have drawn at full retirement (66 years and two months), proven as 100%. Your SS pension is based mostly on “the typical of the best 35 years of listed earnings divided by 12 (to alter the profit from an annual to a month-to-month measure)”. As we enter into our peak incomes years, our social safety advantages are prone to improve. This was significantly vital in my case.

Determine #2: Adjustments in Creator’s Estimated Social Safety Advantages

Working till age 67 displaced a 12 months with low earnings with a peak incomes 12 months. Somebody retiring early at age 62 can have roughly 32% decrease advantages than retiring at full retirement age, excluding the impression of earnings and inflation.

I evaluated totally different dates for beginning SS Advantages and utilized for the profit to start out early subsequent 12 months as an alternative of ready till age 70. One ought to take note of Spousal and Survivor Advantages when making these choices. Reaching the tip of the rainbow consists of leaving my spouse in the very best monetary situation in case I move away earlier than her.

CLOUDY DAYS

Our dad and mom and grandparents had been farmers and ranchers. They skilled crop failures, droughts, mud bowls, depressions, inflation, and world wars. I had a rocky begin in my profession because of not creating a transparent profession path early and to downturns within the enterprise cycle. These experiences developed a powerful want to at all times have a margin of security.

Individuals are usually shocked that pensions cowl lower than they anticipated or that financial savings don’t final so long as they anticipated. Some have had to decide on to proceed working or return to work. Then, there are unknowns, reminiscent of well being points that come up. The boogeymen that concern me are excessive Federal debt and funds deficits, geopolitical dangers, local weather change, underfunded pensions and Social Safety, stagflation/inflation, sequence of return danger, political polarization, and excessive crime charges.

As I used to be about to submit this text, I ran throughout yet one more pertinent supply by Chris Kissel at Cash Talks Information, 12 Arduous Truths About Retirement. These factors are nicely price understanding earlier than retiring.

- Medicare received’t be free

- Social Safety received’t go very far

- You’ll want you had saved extra

- Housing will stay your greatest expense

- Your goals could not match actuality

- You might spend greater than you count on

- Divorce shall be a severe risk

- You won’t work — even if you happen to deliberate to

- For those who’ve by no means volunteered earlier than, you received’t begin in retirement

- Retirement may be particularly lonely for single males

- Well being points will possible meet up with you

- You might be upset — at first

Now we have tried to handle these dangers by utilizing the bucket strategy, diversifying investments, increase pensions, working somewhat longer, delaying Social Safety advantages, and dwelling beneath our means. We elected pension choices with 100% survivor advantages. Delaying social safety till full retirement age elevated Spousal and Survivor Advantages. Rising monetary literacy and utilizing monetary planners reduces danger. Maintaining a healthy diet and staying energetic improves well-being.

Within the quick time period, authorities shutdowns and strikes will dampen an already slowing economic system. September and October are following seasonal tendencies for shares to dip. I’ve set a date in October to do a Roth Conversion whereas shares are hopefully decrease. I’m chubby money equivalents and short-term bond funds and ladders and underweight equities.

ASSESSING MY FIRST YEAR IN RETIREMENT

Earlier than I retired, I created an bold Bucket Record of issues to do within the 12 months following retirement. I fell far in need of finishing the listing. I achieved every thing on the listing, simply to not the extent that I needed. We did full our monetary planning and property targets, a significant xeriscape undertaking round the home, putting in a photo voltaic system, and organized for a kitchen transforming undertaking to start quickly. I’ve been devoted to the health club as deliberate. I additionally accomplished issues not on the listing, reminiscent of constructing raised mattress gardens and volunteering to take away snow for senior residents. My greatest remorse was losing an excessive amount of time following political drama, and never sufficient time studying high quality books.

My day begins with studying the information damaged down, specializing in ten classes that concern voters essentially the most in accordance with a latest ballot. I take a deeper dive into these topics. It shocked me that roughly twenty-five % of homeless individuals are really employed, however can’t afford housing. I examine what states and cities are doing to scale back homelessness. My spouse and I attended a fundraiser for an area group that helps present “sustainable housing, supportive providers, and schooling to households and people”. I visited their workplace to ask about alternatives to volunteer. I utilized to be a volunteer and count on to start out in November.

My targets have modified considerably. Turning over long-term funding buckets to monetary advisors shifted my pursuits to different targets. I’ve reassessed what stays on my listing and reprioritized it. The listing remains to be legitimate, and I’ll proceed to work on it.

THE GOOD LIFE IN RETIREMENT

I’ve lived abroad for 13 years, and touring overseas just isn’t a precedence. What appeals to me is to go to locations close by. This month, I went to a nationwide park to see the aspen leaves altering shade. I’m presently studying a historical past guide of Colorado, which enriches journey to close by locations.

My map of the great life in retirement just isn’t so totally different from what I envisioned a 12 months in the past. I had thought it out nicely. I’ve reprioritized my targets loosely as follows based mostly on the time that I count on to spend, a few of which overlap. I’m updating the main points for every of the classes.

- Household

- Well being/Fitness center

- Volunteering

- Studying high quality books

- Following present occasions and information

- Dwelling enhancements, upkeep

- Exploring Colorado and close by states,

- Nature trails and scenic drives

- Parks, museums, and tradition

- Social

- Retirement planning/investing/monetary literacy

- Visiting fascinating eating places/breweries/wineries

This bucket listing types my map of the great life in retirement.