The difficulty of world debt misery is a matter of nice concern, not only for the affected growing nations but additionally for developed nations and worldwide organizations. A latest United Nations Improvement Program report revealed that 54 growing economies are at the moment grappling with extreme debt issues. Amongst these nations, Ghana, Zambia, and Sri Lanka have discovered themselves in dire monetary straits. Sri Lanka’s authorities declared chapter in April 2022, quickly suspending exterior debt repayments till a consensual restructuring plan aligned with the Worldwide Financial Fund’s financial adjustment program may very well be established. Ghana defaulted in December 2022, whereas Zambia confronted monetary problem in repaying loans again in June 2020.

Frequent Challenges in Ghana, Zambia, and Sri Lanka

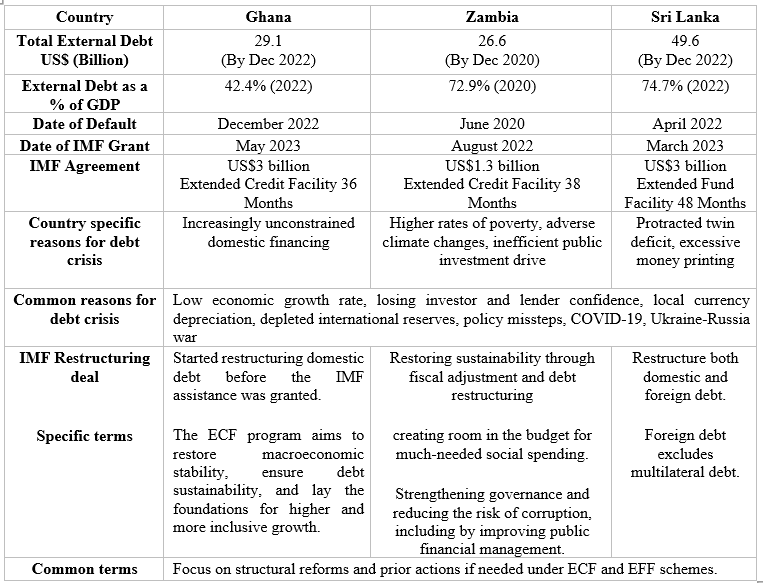

The debt crises in Ghana, Sri Lanka, and Zambia share a typical theme of coverage mismanagement that has given rise to structural imbalances of their respective economies. Whereas every of those nations confronted distinctive challenges – Sri Lanka with extreme cash printing and disruptive agricultural insurance policies, Ghana with impractical election guarantees, and Zambia with allowances for particular employment and local weather vulnerabilities – the underlying issues weren’t distinctive to those circumstances. These nations have grappled with inadequately structured tax methods, the middle-income entice, and the challenges of restructuring bilateral debt with China. The next desk summarizes the explanations for debt crises within the three nations.

Supply: Worldwide Financial Fund (2023), Central Financial institution Annual Report (2022), Exterior Useful resource Division of Sri Lanka (2023)

In Sri Lanka, coverage lapses and financial mismanagement led to a multifaceted catastrophe. Sick-timed tax reductions, rushed makes an attempt to undertake natural agriculture, depletion of official reserves whereas striving to keep up a flawless debt servicing document, delayed trade charge changes, and a failure to take heed to early warning indicators contributed to an financial disaster. As overseas trade reserves dwindled and financial progress charges declined, investor confidence plummeted.

Misappropriation of funds and impractical election guarantees within the type of tax cuts and subsidies in Ghana additionally speeded its financial downfall. The key tax reforms included the abolishment of VAT/NHIL on actual property, monetary companies, and import duties in addition to tax reductions on the nationwide electrification scheme levy, public lighting levy, and particular petroleum tax charge.

In Zambia, whereas the state of affairs was barely totally different, fiscal imbalances additionally created further debt pressures. Zambia reinstated allowances for chosen employment-related advantages and confronted financial shocks attributable to local weather vulnerabilities, which positioned rising stress on the home financial system.

The three nations confronted the identical penalties: servicing exterior debt obligations in foreign currency echange grew to become more and more troublesome, forcing these nations to depend on non-public credit score markets to acquire overseas trade for debt servicing and important imports. That in the end compounded their debt issues, resulting in sovereign defaults.

IMF Monetary Help

All three nations consulted the Worldwide Financial Fund (IMF) as a final resort to deal with their debt crises, and the IMF confirmed willingness to supply help beneath sure situations. As a consequence of their lower-middle-income standing, Ghana and Sri Lanka have been handled in a different way from Zambia, a low-income nation. Ghana and Sri Lanka needed to conform to restructure their home debt earlier than receiving monetary help, whereas Zambia had the chance to disregard home debt restructuring.

Ghana obtained a $3 billion Prolonged Credit score Facility (ECF), Sri Lanka a $3 billion Prolonged Fund Facility (EFF), and Zambia a $1.3 billion ECF. Zambia stood out as the one nation among the many three to learn from the Extremely Indebted Poor International locations (HIPC) initiative, which enabled the restructuring of money owed with senior collectors such because the World Financial institution and Asian Improvement Financial institution. This safeguarded Zambia’s improvement targets from being compromised by unsustainable debt and gave entry to extra sturdy types of debt aid.

This stark distinction marks the “middle-income entice” as a part of the continuing world debt disaster. The debt-distressed nations requiring further concessional financing are predominantly of middle-income standing, highlighting the necessity for higher mechanisms to handle debt misery past the standard measures.

The Position of China in Debt Restructuring Negotiations

China performs a pivotal function within the world dialog on the debt disaster, as proven within the three growing nations thought-about right here. China accounted for round 17.6 % of Zambia’s exterior debt. In Ghana, solely 3 % of exterior debt is owed to China; nonetheless, this debt is collateralized towards pure sources reminiscent of cocoa, bauxite, and oil. China is Sri Lanka’s largest bilateral creditor, to whom Sri Lanka owes round 45 % of its bilateral debt. As a result of China is such a serious bilateral creditor and faces its personal home debt pressures, this created further challenges when restructuring debt as a part of Sri Lanka’s IMF settlement.

Debt servicing funds comprise a big supply of China’s authorities income attributable to its standing as a serious world bilateral creditor by way of the Belt and Street Initiative. Therefore, China is cautious to not set a precedent for beneficiant and easy debt restructuring, as this will open the door to serial defaults on bilateral money owed, additional exacerbating financial pressures. Contemplating these points, as a strategic creditor with much less urge for food for losses, China sometimes prefers prolonged extensions on debt repayments and resists any reductions within the excellent principal.

This was the expertise of Zambia. In its eventual cope with the Export-Import Financial institution (Exim) of China, each side agreed to cut back the coupon on its $4 billion in acknowledged official claims to 1 % for the rest of Zambia’s IMF program. The settlement with China will see Zambia pay rates of interest as little as 1 % till 2037 and push out maturities on $6.3 billion in bilateral debt to 2043, representing a mean extension of greater than 12 years.

As for Sri Lanka, after President Ranil Wickremesinghe’s go to to China in mid-October, Sri Lanka confirmed that it has reached a cope with China, relating to $4.2 billion of debt. This can be a optimistic signal for receipt of the second IMF tranche. State Minister for Finance Shehan Semasinghe mentioned the settlement reached with the IMF and the staff-level settlement reached following the primary evaluate of Sri Lanka’s EFF association will assist settle arrears owed to multilateral collectors whereas expediting the debt restructuring course of.

This may increasingly give reassurances to Ghana, which is but to finalize a debt restructuring cope with China, because it goals for a versatile and cordial response from collectors with the help of the IMF. Nevertheless, the difficulties confronted by Ghana, Zambia, and Sri Lanka when restructuring their bilateral debt with China might push back different potential defaults within the growing world.

Classes Discovered

Growing nations that default earlier than initiating the debt restructuring course of present comparatively larger losses for buyers. The experiences of Ghana, Zambia, and Sri Lanka recommend that reaching out to the IMF earlier than a default is essential to stopping rejection by potential lenders.

This example ought to function a wake-up name for the World Financial institution, IMF, and different multilateral organizations to evolve mechanisms that tackle this unprecedented debt disaster and promote higher initiatives for financial improvement. With out efficient debt restructuring, aid, or forgiveness, middle-income debtor nations danger falling right into a debt entice the place financial insurance policies focus solely on servicing unproductive debt repayments to collectors and propping up an unfair world monetary system.

Many growing economies labeled as middle-income nations are disadvantaged of concessional financing alternatives and extra beneficiant debt aid mechanisms, such because the HIPC, offered by worldwide organizations. This should sign to multilateral organizations that mechanisms should evolve to help debt-distressed middle-income nations, who at the moment dominate world debt misery. Multilateral organizations should help these economies individually to cut back their debt ranges, somewhat than holding them again on account of arbitrary revenue categorization and a “one-size-fits-all” strategy.

Extended debt restructuring processes attributable to delays from main collectors have elevated debt burdens over time. Well timed discussions are important for safeguarding a debt-ridden nation’s monetary stability and mitigating potential financial repercussions from extended debt restructuring. The challenges related to IMF insurance policies necessitate entry to various sources of concessional finance to handle the chance prices of debt. It’s crucial to navigate these turbulent waters and be sure that nations should not held hostage by debt however somewhat empowered to construct a brighter financial future.

This text relies on an explainer titled: “Borrowing Properly: Gaining Insights from Debt Restructuring in Ghana, Sri Lanka and Zambia” printed by Lakshman Kadirgamar Institute of Worldwide Relations and Strategic Research.