Local weather change is anticipated to influence insurability within the area

Local weather projections for the Caribbean area foresee an upsurge in each the frequency and severity of climate occasions by 2050. Rising sea ranges are anticipated to exacerbate vulnerabilities for coastal properties, intensifying the dangers of flooding and erosion.

A brand new local weather report from Moody’s RMS examines how the perpetual menace of hurricanes might probably amplify in energy, posing substantial dangers to infrastructure and communities. Predicted modifications in rainfall patterns could result in elevated flood dangers throughout precipitation, in addition to extended dry spells and droughts.

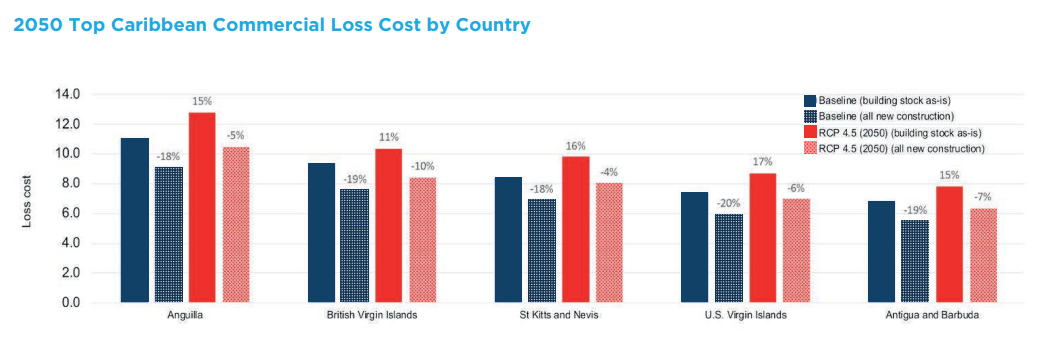

In assessing the potential influence, Caribbean nations going through increased dangers are anticipated to expertise a uniform improve in loss prices above 10%. For essentially the most weak areas, such because the US Virgin Islands, this improve could attain as excessive as 17%. Such fashions reveal that investing in constructing upgrades alone might considerably decrease loss prices in comparison with current danger values, underscoring the influence of investing in danger discount and resilience-building measures.

Waiting for the tip of the century, protecting measures geared in direction of mitigating danger within the constructed surroundings have the potential to mitigate essentially the most extreme will increase in loss prices, leading to solely marginal rises from present-day values. In distinction, the absence of motion might result in substantial escalation in potential loss prices, reaching as a lot as 27% in particular eventualities, together with a 19% improve for the British Virgin Islands.

The anticipated rise in future loss prices may inspire Caribbean nations to prioritize measures and modern methods that scale back danger and fortify resilience. Such modeling research assist governments, companies, property homeowners, and communities in evaluating and prioritizing danger discount methods. They reveal, in monetary phrases, the benefits of investing in measures to stop future losses and improve insurability.

Amidst the evolving impacts of local weather change within the Caribbean, the idea of an insurability threshold turns into more and more related. This threshold refers back to the level at which insurance coverage turns into both unavailable or excessively costly because of heightened dangers linked with particular occasions or circumstances. The importance of insurability turns into extra pronounced because the area faces potential loss value will increase starting from 10% to 17%, notably towards 2050.

The report additionally famous that numerous elements affect the provision and price of insurance coverage. Premiums not solely replicate the anticipated frequency and severity of dangers but additionally embody different parts, together with the bills related to underwriting and claims. Elements like the present world inflationary surroundings, resulting in elevated prices for repairs, supplies, and labor, contribute to the rising prices of claims. Furthermore, the provision of reinsurance capital is turning into dearer.

Sustaining non-public insurance coverage depends upon insurers’ capacity to gather satisfactory funds for his or her claims. Wanting forward, mapping out actions that assist in danger discount can compensate for the anticipated rise in hazards because of local weather change. Whether or not by elevated risk-sharing or stricter constructing codes, using danger modeling can help in devising plans for Caribbean danger trajectories, guaranteeing insurance coverage sustainability for the twenty first century.

What are your ideas on this story? Please be happy to share your feedback beneath.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!