Firm Overview:

Rishabh Devices Ltd. (RIL) is a worldwide power effectivity resolution firm targeted on electrical automation, metering and measurement, precision engineered merchandise, with various purposes throughout industries together with energy, automotive and industrial sectors. It provides a variety {of electrical} measurement and course of optimization tools and is engaged in designing, creating, manufacturing, and sale of gadgets considerably beneath its personal model throughout a number of sectors. The corporate additionally offers sure manufacturing companies which embody mould design and manufacturing, EMI/EMC testing companies, Digital Manufacturing Providers, and software program options (e.g., MARC). Electrical automation merchandise embody power administration software program, transducers and isolators, paperless recorders (chartless) and knowledge loggers, temperature and humidity recorders, I/O converters and temperature controllers amongst others.

Objects of the Supply:

- Financing the associated fee in the direction of the Enlargement of Nashik Manufacturing Facility I – Rs.63 crore.

- Normal company functions.

Funding Rationale:

- Main Place: The Firm is a worldwide chief in manufacturing and provide of analog panel meters, and it’s one among the many main international corporations by way of manufacturing and provide of low voltage present transformers (Supply: F&S Report). Lumel is the most well-liked model in Poland for meters, controllers, and recorders and Lumel Alucast is without doubt one of the main non-ferrous stress casting gamers in Europe. The corporate has a product portfolio of over 145 product strains and 0.13 million inventory conserving models as of Could 31, 2023. Within the Fiscals 2023, 2022 and 2021, the corporate manufactured an mixture of 16.21 million models, 14.02 million models and 13.35 million models of merchandise throughout the product strains, respectively. Its panel devices are used not solely within the electrical swap boards that are used for distribution of electrical energy, but additionally for industrial purposes equivalent to multiload monitoring, cloud and connectivity, and power monitoring techniques.

- Consumer Base: Among the home and abroad clients, Siemens Restricted and Lucy Electrical India personal Restricted, have been with the corporate for over 5 years, whereas ABB India Restricted, Gama Electrical Buying and selling (LLC), Perel OY, Pronutec S.A. and Lucas-Nulle GmbH, have been with the corporate for over 8 years. The corporate has restricted buyer focus as, within the international electrical section, high 5 clients from Indian operations account for 15% of gross sales income and the highest 5 clients from abroad operations account for six% of gross sales income in Fiscal 2023. Additionally, within the aluminium excessive stress die casting enterprise, the highest 5 home clients account for 15% of gross sales income and the highest 5 abroad clients account for 50% of gross sales income within the complete gross sales of this section. Total, the highest 10 international clients accounted for under 32% of worldwide gross sales income in Fiscal 2023, respectively, and the highest 20 international clients accounted for under 43% of the worldwide gross sales income and the highest 30 international clients accounted for under 49% of the worldwide gross sales income within the Fiscal 2023.

- Monetary Monitor File: The corporate’s income has grown at a CAGR of 12% from Rs.401 crore in FY20 to Rs.570 crore in FY23. EBITDA has grown at an honest fee of 9% CAGR from Rs.60 crore in FY20 to Rs.77 crore in FY23. EBITDA margin has been hovering round 13-16% within the final 4 years. Although EBITDA development has been considerably common, the PAT of the corporate has grown at a CAGR of 16% for a similar interval on account of lower in taxation for the previous 2 years. Phase smart, Indian market derived 34% of the general income and abroad market derived the remainder 66%.

Key Dangers:

- Foreign exchange Threat – The corporate is uncovered to overseas alternate dangers, as main portion of its revenues are generated in foreign currency echange. Fluctuations in alternate charges may have an effect on its monetary efficiency.

- OFS – The IPO is a mixture of supply on the market (OFS) and Contemporary problem with OFS being 85% of the general problem measurement. Within the supply on the market (OFS), Promoter promoting shareholders named Asha Narendra Goliya, Rishabh Narendra Goliya and Narendra Rishabh Goliya (HUF) will offload as much as 24,17,500 fairness shares. Investor promoting shareholder named SACEF Holdings II will offload as much as 70,10,678 fairness shares.

Outlook:

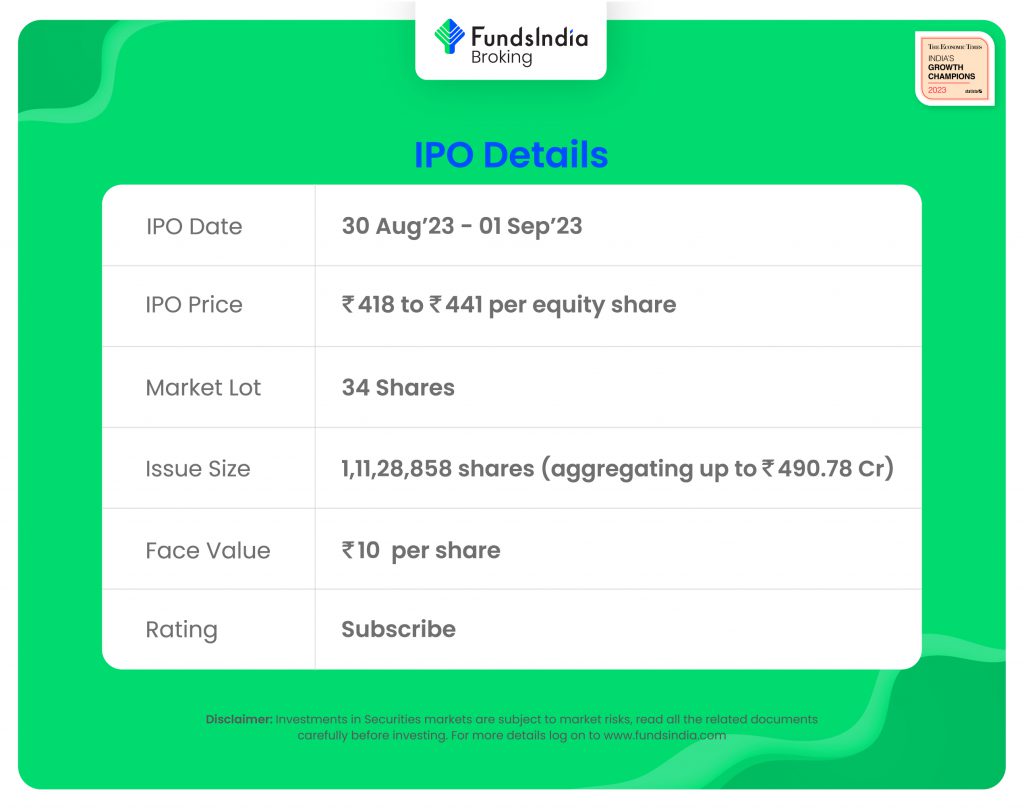

Rishabh Devices is a worldwide chief in power effectivity options and precision engineering merchandise. The numerous chunk of revenues from the abroad signifies that it has already created a distinct segment place within the international marketplace for its merchandise. In line with RHP, there aren’t any comparable listed corporations in India or globally that interact in a enterprise just like that of Rishabh Devices. On the larger worth band, the itemizing market cap can be round ~Rs.1675 crore and the corporate is demanding a P/E a number of of 33x based mostly on put up problem diluted FY23 EPS. Since, the corporate has a novel product portfolio and no listed friends, the difficulty appears to be totally priced in (Pretty valued). Based mostly on the above views, we offer a ‘Subscribe’ score for this IPO for a medium to long-term Holding.

In case you are new to FundsIndia, open your FREE funding account with us and luxuriate in lifelong research-backed funding steerage.

Different articles it’s possible you’ll like

Publish Views:

3,689