Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

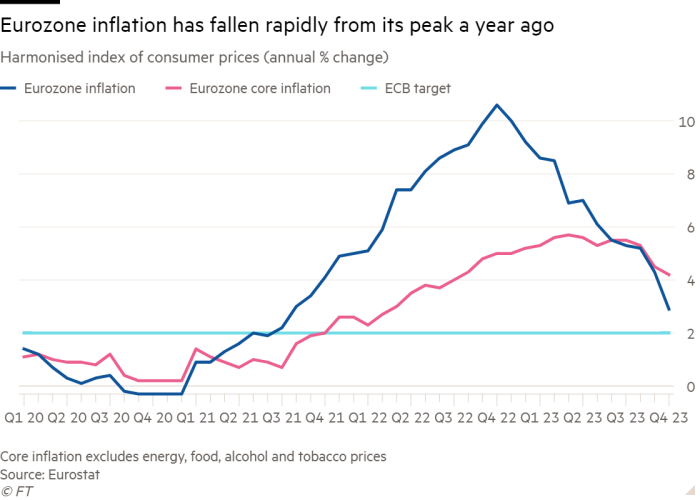

Eurozone inflation fell to 2.9 per cent in October, its lowest for greater than two years, bolstering expectations that the European Central Financial institution is not going to increase rates of interest additional.

The determine in contrast with 4.3 per cent in September and represented the area’s slowest annual development in shopper costs since July 2021.

It got here after the bloc’s financial system began to shrink within the third quarter and was primarily a results of falling vitality costs and a drop in meals inflation, in line with Eurostat, the EU statistics arm.

October’s 2.9 per cent charge additionally undershot economists’ expectations of three.1 per cent amid indicators that the world’s massive central banks now take into account that they’ve achieved sufficient to carry inflation all the way down to their 2 per cent targets.

“That is clearly the second that the three main central banks realise the primary a part of the job is finished on inflation and they’re now transferring into this case of preserving charges greater for longer, although nobody fairly is aware of how lengthy,” stated Carsten Brzeski, world head of macro analysis at Dutch financial institution ING.

The ECB held its benchmark deposit charge regular at 4 per cent final week, ending its unprecedented sequence of 10 consecutive will increase.

The US Federal Reserve is predicted to maintain rates of interest on maintain for the second consecutive time at its assembly on Wednesday. The Financial institution of England is taken into account prone to do the identical a day later. Figures on Tuesday confirmed that UK store inflation had eased to its lowest charge in additional than a yr as a consequence of falling meals costs.

Nevertheless, economists suppose the slide in inflation is prone to sluggish as the Israel-Hamas struggle pushes up vitality costs, and because the base impact of evaluating vitality costs with final yr’s excessive ranges diminishes.

“Trying forward, inflation is unlikely to maintain falling this rapidly,” stated Jack Allen-Reynolds, an economist at consultants Capital Economics. He added that “vitality inflation will in all probability choose up a bit of within the subsequent few months”.

Inflation inside the eurozone nonetheless covers a variety, from 7.8 per cent in Slovakia to minus 1.7 per cent in Belgium for the yr to October.

However the sharp slowdown in costs mirrored weaker exercise within the area’s financial system as a complete, which Eurostat stated shrank 0.1 per cent within the three months to September. That was beneath economists’ forecasts and got here after contractions in Germany, Eire and Austria offset development in Spain and France.

The eurozone financial system has barely grown previously yr as shoppers and companies have confronted rising borrowing prices, weaker world commerce and the most important surge in the price of residing for a era.

Figures launched on Monday additionally confirmed Germany’s place as one of many world’s weakest main economies after its gross home product shrank 0.1 per cent.

In contrast, the US financial system has quickly expanded, with annualised third-quarter development reported at 4.9 per cent final week.

“The eurozone financial system is about for a interval of financial stagnation, with development solely returning as soon as actual earnings development turns sufficiently constructive,” stated Rory Fennessy, an economist at consultants Oxford Economics. “Momentum going into the fourth quarter stays exceptionally weak, weighed down by tight monetary situations.”

Tuesday’s figures confirmed that core eurozone inflation, which excludes vitality and meals fell in keeping with expectations to 4.2 per cent, down from 4.5 per cent in September. This metric is intently watched by the ECB as a gauge of underlying worth pressures.

However ECB president Christine Lagarde warned final week that wage development was additionally “critically necessary to find out the inflation outlook”.

She careworn that particulars on the subsequent spherical of collective wage bargaining agreements with unions would solely come “method into 2024” — suggesting the financial institution would wait till then earlier than deciding if it may begin chopping borrowing prices.

“The ECB must see wage inflation slowing and this might take an extra six months,” stated Mark Wall, chief European economist at German lender Deutsche Financial institution.