Marico Ltd. – No.1 Coconut Oil Model

Marico Restricted is one in every of India’s main shopper items corporations working in world magnificence and wellness classes. The corporate nurtures main manufacturers throughout classes of hair care, skincare, edible oils, wholesome meals, male grooming, and material care. In India, Marico contact the lives of 1 out of each three Indians via its portfolio of manufacturers, corresponding to Parachute, Saffola, Saffola FITTIFY, Nihar Naturals, and so forth. Headquartered in Mumbai, the corporate has a presence in 50 nations throughout rising markets of Asia and Africa. It operates seven factories in India, situated at Puducherry, Perundurai, Jalgaon, Guwahati, Baddi and Sanand. Marico reaches 5.6 million shops, serviced via its expansive community of 900 distributors and seven,500 stockists. This community covers 59,000 villages in India and nearly each Indian city with a inhabitants of over 5,000.

Merchandise & Providers:

The corporate has a number of Manufacturers unfold throughout a number of segments in Home & Worldwide Markets.

- Home Manufacturers – Parachute and Nihar Naturals in Coconut Oil Section; Saffola in Tremendous-premium Refined edible oil Section; Parachute superior, Nihar naturals and Hair & Care in Worth added hair oil Section; Saffola oats, Coco Soul and Saffola FITTIFY Gourmand Vary in Wholesome meals; Livon Serums and Hair & Care in Premium Hair Nourishment Section; Set Moist, Beardo and Parachute in Male Grooming & Styling Section; Kaya Youth and Parachute superior in Pores and skin Care Section; Mediker, Veggie Clear in Hygiene Section.

- Worldwide Manufacturers – Parachute, HairCode, Nihar Naturals, Mediker SafeLife, Fiancee, caivil, Hercules, Black Stylish, Code 10, Ingwe, X-Males, Sedure, Hercules, Only for Child, Only for youngsters, Thuan Phat and Isoplus.

Subsidiaries: As on FY23, the corporate has 19 subsidiaries.

Key Rationale:

- Market Chief – Marico is the market chief within the branded coconut oil market in India with a market share of 62% as on June 2023 based mostly on the general volumes. The corporate additionally ranks number one place in different merchandise like Parachute Inflexible with 53% quantity market share and put up wash serums with 57% quantity market share. Worth sensible, Saffola Oats ranks number one place with 42% market share, Worth added hair oil phase with 28% market share and Hair gel/cream phase with 53% market share.

- Acquisition – The Firm has lately signed definitive agreements to amass upto 58% of the paid-up share capital of Satiya Nutraceuticals Non-public Restricted at a pre-money valuation of ~4x of its annualized income run-rate (ARR) of ~Rs.150 crore. Satiya Nutraceuticals Non-public Restricted owns “The Plant Repair – Plix”, a digital-first, clear label, plant-based diet model. With its portfolio of non-GMO, Vegan, Gluten-free and Cruelty-free choices, spanning throughout Weight Administration, Hair & Magnificence, Sleep and Life-style Diet classes, Plix has established itself as one of many main gamers within the on-line plant-based diet phase.

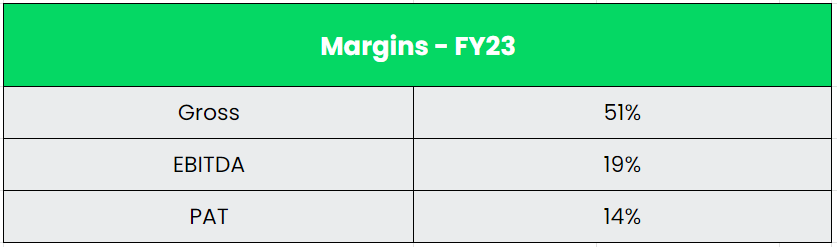

- Q1FY24 – Marico reported a consolidated income development of -3% YoY in Q1FY24 to Rs.2477 crore. Gross margin expanded by 494 bps YoY and 257 bps sequentially, owing to incrementally softer enter prices. EBITDA margin was at 23.2%, up 253 bps YoY. The India enterprise delivered a turnover of Rs.1,827 crore, down 5% on a YoY foundation. Within the home enterprise, Parachute Rigids posted a quantity decline of two%, adopted by Saffola Edible oils with a low double digit quantity development and Worth-added hair oils with Flat development. Meals continued its wholesome scale up with 24% worth development YoY, aided by regular development in core and newer franchises. The Worldwide enterprise continued its robust momentum and delivered fixed foreign money (cc) development of 9%, amidst macroeconomic and foreign money devaluation headwinds in a few of the geographies. Bangladesh, Vietnam, South Africa and MENA delivered round 9%, 5%, 37% and 15% development on cc phrases respectively.

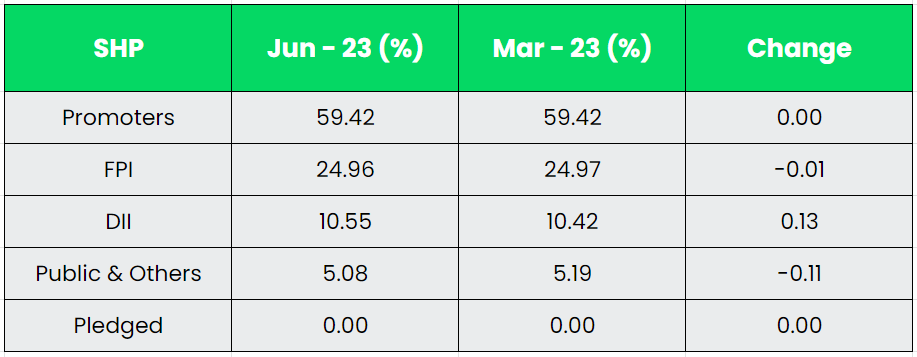

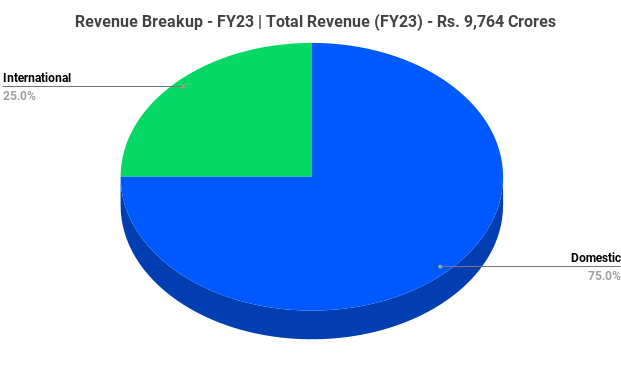

- Monetary Efficiency – The three 12 months income and revenue CAGR stands at 10% and seven% respectively between FY20-23. The share of worldwide enterprise has grown by 300 bps from 22% in FY19 to 25% in FY23. The corporate has a powerful steadiness sheet with a debt-to-equity ratio of simply 0.16x. The final 5-year accrued FCF (Free Money Movement) have crossed over Rs.5900 crore, depicting the money producing potential of the corporate.

Business:

India’s fast-moving shopper items (FMCG) trade grew 12.2 % in worth within the April-June quarter of 2023 pushed by larger consumption development, in accordance with information from NIQ India (previously NielsenIQ). The trade recorded a quantity development of seven.5 %, the very best within the final eight quarters. Worth development got here in at 4.4 %, which is the bottom in no less than 9 quarters. This comes after the FMCG trade noticed excessive inflation translating into price-led development for over two years. Whole income of FMCG market is anticipated to develop at a CAGR of 27.9% via 2021-27, reaching almost US$ 615.87 billion. In 2022, city phase contributed 65% whereas rural India contributed greater than 35% to the general annual FMCG gross sales. Good harvest, authorities spending anticipated to help rural demand restoration in FY24.

Development Drivers:

- India continues to be an immense development alternative because it nonetheless has one of many lowest per capita FMCG consumption on the planet with many sub-categories of FMCG having very low penetration ranges.

- The Authorities of India has permitted 100% FDI within the money and carry phase and in single-brand retail together with 51% FDI in multi-brand retail.

- Union finances 2023-24 focuses on reviving rural demand by boosting disposable revenue, allocation to farms and better fund allocation on rural infrastructure, connectivity, and mobility to create long-term jobs.

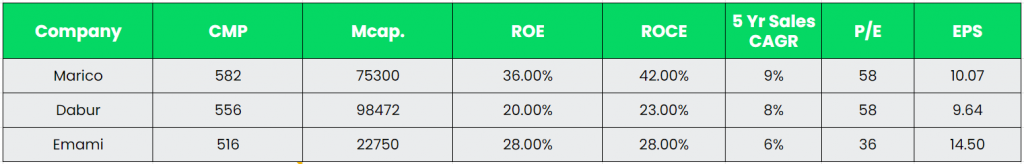

Rivals: Emami, Dabur, and so forth.

Peer Evaluation:

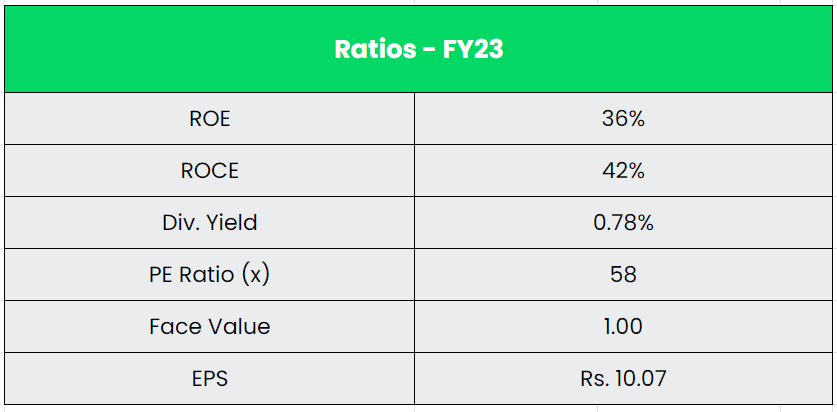

Whereas evaluating Marico with its listed friends when it comes to Gross sales CAGR, Marico is main from the entrance. Return ratios are additionally on par for Marico amongst its listed friends.

Outlook:

Through the quarter, the FMCG sector retained its optimistic sentiment from the earlier quarter, though clear inexperienced shoots in rural on a sequential foundation, as anticipated, weren’t seen. Development remained city led, whereas rural consolidated on a decrease base. Over the medium time period, the Administration aspires to ship 13-15% income development on the again of 8-10% home quantity development within the home enterprise and double-digit fixed foreign money development within the worldwide enterprise. On a consolidated foundation, the Administration anticipate a big enlargement in gross margin, starting from 250 to 300 foundation factors (bps). This optimistic outlook is underpinned by a number of components, together with beneficial tendencies in enter prices, the efficient implementation of value administration methods, and a extra advantageous product portfolio combine. Whereas the corporate stay dedicated to investing in model improvement to fortify the core and foster development in new franchises, it additionally expects to witness a considerable enhancement in working margin, an enchancment of over 150 bps, to attain working margins of round 20% in FY24.

Valuation:

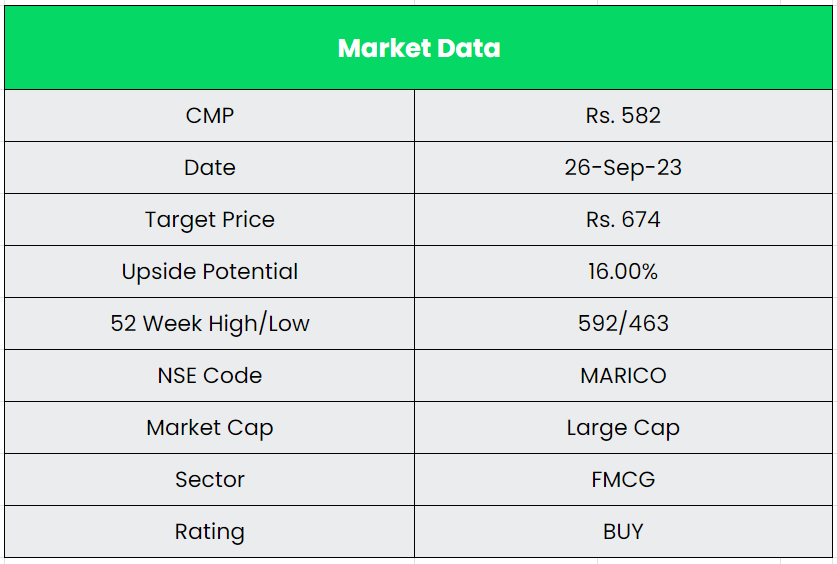

We consider Marico will keep and accumulate market share on account of inflation downtrend, gradual restoration within the rural quantity, improve in contribution from Meals and Premium private care phase via new launches and powerful worldwide enterprise. We advocate a BUY score within the inventory with the goal worth (TP) of Rs.674, 49x FY25E EPS.

Dangers:

- Aggressive Threat – Intense competitors has lowered the flexibility of gamers to cross on any improve in uncooked materials costs. Whereas Marico has pretty been capable of keep its place and pricing within the trade, aggressive depth will proceed to be excessive with new product launches from different massive gamers, particularly within the premium phase.

- Foreign exchange Threat – The corporate has vital operations in overseas markets and therefore is uncovered to foreign exchange threat. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

- Uncooked Materials Threat – The price of key uncooked supplies, copra, safflower, rice bran and liquid paraffin and polymers, account for greater than 50% of gross sales. Their costs depend upon geo-climatic circumstances, worldwide costs, and the home demand-supply state of affairs. Therefore, the working margin is partially inclined to fluctuations in uncooked materials costs.

Different articles it’s possible you’ll like

Submit Views:

2,605