This text is an on-site model of our Disrupted Instances publication. Enroll right here to get the publication despatched straight to your inbox thrice every week

Right this moment’s high tales

-

The US struck two services in japanese Syria that it recognized as linked to Iran-backed militias, following assaults on American forces within the area in latest weeks. Full protection of the Israel-Hamas struggle.

-

JPMorgan chief Jamie Dimon will promote 1mn shares within the financial institution subsequent 12 months, the primary time he has diminished his stake since becoming a member of almost twenty years in the past, elevating questions on how lengthy Wall Avenue’s longest-serving boss intends to remain on. His rival at Morgan Stanley, James Gorman, is stepping down on the finish of the 12 months, to get replaced by Ted Choose, who at present runs funding banking and buying and selling.

-

The “core” private consumption expenditure index, an inflation measure carefully watched by the US Federal Reserve, fell to an annualised 3.7 per cent in September, the bottom in two years, easing strain on the central financial institution to boost charges subsequent week. The US financial system grew quicker than anticipated within the third quarter with a 4.9 per cent annualised GDP enhance, its quickest tempo in nearly two years.

For up-to-the-minute information updates, go to our dwell weblog

Good night.

Has Huge Oil within the US acquired its swagger again?

It’s tempting to consider so, in every week the place essentially the most important business consolidation in twenty years gathered tempo and the supermajors continued to get pleasure from a elevate from rising crude costs.

As we report right this moment, ExxonMobil, which fired the beginning gun on the present M&A race with its $60bn buy of Pioneer two weeks in the past, is nonetheless on the hunt for offers, or not less than these the place “one plus one equals three”.

Exxon additionally reported third-quarter earnings had risen to $9.1bn, up from $7.9bn within the earlier three months, because of the oil worth enhance and extra refining exercise, though just a little decrease than anticipated due to weaker margins in its chemical enterprise and diminished buying and selling.

On Monday, Chevron introduced a $53bn deal to purchase fellow US producer Hess, the most important transaction in its historical past, doubling down on its wager that demand for fossil fuels would stay sturdy for many years to return. Right this moment it reported third-quarter revenues of $6.5bn, down from $11.2bn final 12 months, however up from $6bn within the earlier three months.

This doubling down was attacked by former US vice-president and local weather campaigner Al Gore this week in an FT interview as he hit out on the “buddy-buddy” relationship between political leaders and the fossil gas business, which he mentioned was damaging prospects for international local weather motion.

Gore has additionally criticised the business’s “seize” of the UN local weather change negotiations. Huge Oil stays unapologetic: “We’re not promoting a product that’s evil,” Chevron chief Mike Wirth advised the FT this week as he laid out a “actual world” case for fossil fuels.

The backdrop to the business manoeuvring is the shift from fossil fuels to cleaner sources of power.

The Worldwide Vitality Company mentioned this week that demand for oil would fall by nearly half by 2050 if governments carried by way of on their inexperienced pledges and mentioned that the power disaster triggered by Russia’s full-scale invasion of Ukraine, rising tensions within the Center East and report temperatures highlighted the danger of continuous to depend on fossil fuels. The IEA additionally laid out the ramifications of governments failing to comply with by way of on their pledges, displaying oil demand would barely fall by 2050.

The FT editorial board mentioned latest tie ups are a part of the race to be final man standing, a wager that the IEA is fallacious, and proof that, as Saudi Arabia’s power minister mentioned this week, “hydrocarbons are right here to remain”.

What the latest megadeals actually present nevertheless is that we’re in a brand new age of uncertainty, writes power editor David Sheppard, who says that these betting the transactions sign strong demand development could wish to assume twice.

“You may in fact consider that the IEA have gotten this wildly fallacious,” he says, “or that governments will develop bored with addressing local weather change, if their populations deem it too sophisticated or costly. However inside the huge ranges and uncertainty of the IEA eventualities is a glimpse into what the seemingly path is for the oil sector. Buyers ought to be cautious about swaggering blindly in direction of it.”

Must know: UK and Europe financial system

UK prime minister Rishi Sunak is to place crime and power on the coronary heart of his subsequent legislative programme within the King’s Speech on November 7. Sunak mentioned nevertheless he would “not rush to control” AI as he introduced the creation of a security physique to guage and check new applied sciences.

The European Central Financial institution held its key rate of interest as anticipated on the all-time excessive of 4 per cent, ending its streak of 10 consecutive will increase.

EU leaders backed plans to make use of earnings from Russia’s frozen property to assist Ukraine. Western sanctions have immobilised $300bn belonging to Russia’s central financial institution because the full-scale invasion started. Russia right this moment raised rates of interest greater than anticipated to fifteen per cent, citing excessive inflation and the weak rouble.

In Turkey, charges had been raised for the fifth time in as many months to 35 per cent, with the specter of increased oil costs an extra concern in a rustic that imports the majority of its power. Its inventory market in the meantime tumbled after President Recep Tayyip Erdoğan stepped up his criticism of Israel and its allies at a time when Ankara is determined for western funding.

Must know: World financial system

China’s Communist social gathering beefed up its new monetary regulator which can act as de facto watchdog, planner and determination maker for the nation’s $61tn monetary sector, weakening establishments such because the Individuals’s Financial institution of China and the Securities Regulatory Fee.

Li Keqiang, the previous Chinese language premier who served beneath President Xi Jinping and was seen as a number one proponent of market-oriented reforms, has died aged 68, months after leaving workplace.

Zambia reached a debt aid deal on almost $4bn owed to personal bondholders, fuelling hopes that its long-running debt restructuring may be nearing an finish.

Must know: enterprise

NatWest admitted to “critical failings” in the way in which its non-public financial institution Coutts handled politician Nigel Farage when it closed his account, and promised “substantive adjustments” to its procedures. NatWest additionally reported decrease than anticipated third-quarter earnings and warned that advantages from increased rates of interest had been beginning to decline. Its shares tumbled.

The post-pandemic journey increase continues. British Airways proprietor IAG and Air France-KLM reported report earnings over the summer time whereas London’s Heathrow airport raised its passenger forecasts after an “extraordinary” peak season.

Cruise, the driverless automobile firm owned by Normal Motors, paused its operations after California regulators barred its autos from the state’s roads following an accident in San Francisco.

Ford reached a tentative cope with the United Auto Employees union that might increase wages 25 per cent over 4 years and doubtlessly finish a 40-day strike. About 29,000 staff at Stellantis and Normal Motors stay out.

The American south-east in the meantime is vying to turn out to be the new Detroit for the electrical car age. In Europe, Mercedes mentioned the “brutal” worth struggle in EVs had dented its earnings whereas in Japan, loads of hope is using on Toyota’s progress on solid-state batteries.

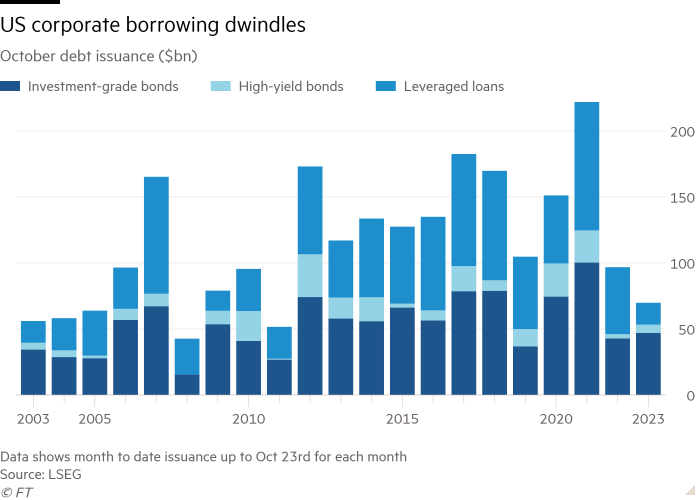

Bond market turmoil has pressured US firms to delay borrowing plans, making October the slowest month for debt issuance since 2011.

Science round-up

Report excessive sea floor temperatures and surprising marine heatwaves are threatening ocean biodiversity, affecting corals, seagrasses, fish and birds, in keeping with Copernicus, the European earth statement company.

The report readings additionally imply hurricanes are extra seemingly. Acapulco in Mexico was hit by a “nightmare” model — hurricane Otis — on Wednesday, catching authorities unprepared and resulting in warnings about flash floods and landslides.

The UN’s local weather science physique mentioned the possibilities of the world limiting the rise in international temperatures to 1.5C since pre-industrial occasions had decreased since its 2021 report.

Drugmakers Eisai and Eli Lilly introduced analysis that reveals the advantages to sufferers from utilizing pioneering new Alzheimer’s medicine very early within the improvement of the illness. Alzheimer’s is the commonest type of dementia however till just lately, many giant pharma firms had been reluctant to speculate closely to find therapies after a long time of failure.

Innovation editor John Thornhill says it’s time to get critical in regards to the risks of quantum computing as we strategy “Q-day” — the second a quantum laptop may crack the RSA cryptosystem, extensively utilized by tech firms, banks and governments on their knowledge.

Some excellent news

A Philippine noticed deer fawn, one of many world’s rarest animals, has taken its first steps at Chester Zoo. The brand new arrival, named Hercules, is a part of a conservation breeding programme between zoos in Europe, arrange on the request of the Philippine authorities to make sure the survival of the extremely endangered species.

One thing for the weekend

Attempt your hand on the vary of FT Weekend and day by day cryptic crosswords.

Interactive crosswords on the FT app

Subscribers can now resolve the FT’s Each day Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Really helpful newsletters

Working it — Uncover the large concepts shaping right this moment’s workplaces with a weekly publication from work & careers editor Isabel Berwick. Enroll right here

The Local weather Graphic: Defined — Understanding an important local weather knowledge of the week. Enroll right here

Thanks for studying Disrupted Instances. If this article has been forwarded to you, please join right here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thanks