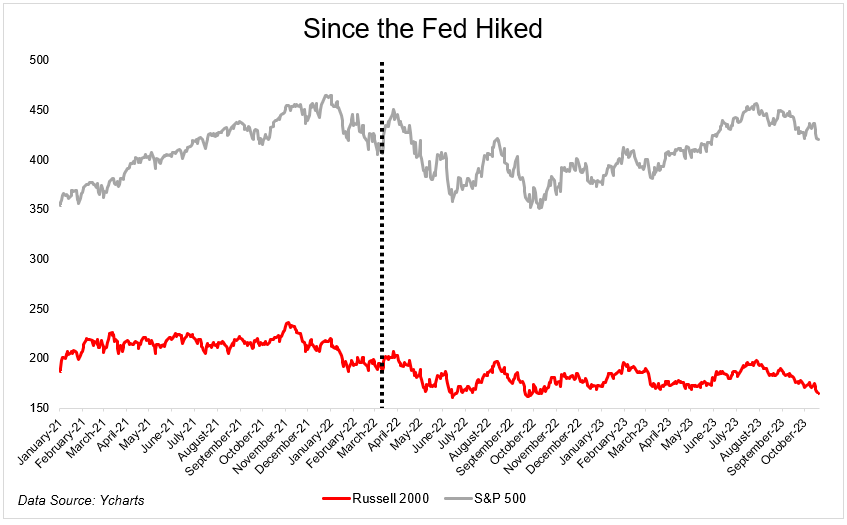

The S&P 500 is flat because the Fed began elevating charges in March 2022. It’s weathered the mountaineering cycle a lot better than smaller shares which might be extra delicate to tighter monetary circumstances. Over the identical time, the Russell 2000 is down 16%.

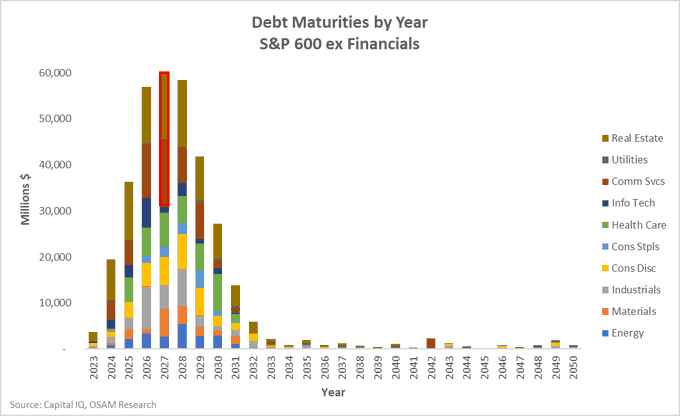

On final week’s What Are Your Ideas? I shared this chart from Financial institution of America evaluating long-term debt maturities of small versus large-cap indices. Absolutely this has been weighing on the Russell 2000.

Ehren Stanhope wrote an excellent thread that places the chart above into some much-needed context. Almost half of the debt within the Russell that’s maturing over the following few years is in two sectors; actual property and communication providers.

Everyone is aware of the story in actual property, not an enormous shock there. And within the different sector, based on Ehren, “the Comm Svcs half is usually pushed by 2 corporations, fallen angels Dish and Lumen Applied sciences (previously Centurylink) which have well-telegraphed points with their steadiness sheets for fairly a while.”

I don’t assume Ehren’s thread adjustments the truth that greater prices of capital have been a large headwind for smaller firms. However that is nonetheless an necessary reminder that we’ve got to remain vigilant within the face of seemingly goal information. Details may be deceptive. Knowledge may be wrapped in opinions and twisted into agendas.

Josh and I are going to speak about this and far more on tonight’s episode.