Earlier than everybody began calling their merchandise “bespoke” options (a phrase that’s older than you might suppose), there was simply the spoke (a phrase that’s a lot older). The spoke was a “spike” linked to the hub of a wheel. It could be a ship’s wheel, a cartwheel, or a mill wheel, however the spoke was essential to the utilization of the wheel. Typically, the spokes have been all the identical. Their sameness has all the time been essential to the operation and steadiness of the wheel. On a bicycle, for instance, you don’t need completely different spokes connected to the hub. You want similarity.

Spokes have been distinctive to the mechanical world in how they operated. Spokes work along with the hub. They’re every comparatively weak, in comparison with the energy of the entire wheel. Spokes want a hub and a hub wants spokes. Even as we speak, many spokes should work collectively, tied to the hub, to perform the aim of the wheel.

In fact, in some unspecified time in the future, the entire bodily facet of the hub and spoke made for glorious enterprise metaphors, particularly when it got here to distribution, transport, buying, monetary processes, and knowledge.

Billing and funds are an space the place spoke and hub metaphors are exceptionally related however completely different. At this time’s digital hub works greatest when many several types of spokes work collectively effectively, together with completely different fee and knowledge sorts, differing product sorts, and even completely different buyer sorts. Actually, it’s the distinctive wants of the client which have now prompted insurers to wish bespoke fee and billing options created round a foundational billing and funds hub. The proper of basis — the proper of hub — can now match virtually all insurance coverage billing and fee methods.

Many methods. One hub.

Deloitte and Majesco hosted a roundtable with skilled billing and funds trade leaders to debate key market tendencies and subsequent methods and ways to raise billing and funds as an important a part of the client journey and expertise. For the complete protection of the Deloitte and Majesco roundtable, make sure to learn, Rethinking Billing and Funds within the Digital Age. It incorporates beneficial use instances that present simply how a revised technique suits particular person and enterprise prospects’ operational wants.

In our final billing and funds weblog, we mentioned buyer expertise and buyer loyalty associated to billing. In as we speak’s weblog, we’ll take a look at how firms can operationalize a billing and funds technique that can flip billing and funds right into a progress generator. Insurers start by implementing a multi-enterprise billing and fee hub — a step that’s extra essential and more easy than most insurers could know.

Operationalizing the Unified ‘Future State’ Technique

To operationalize the technique, insurers should:

- Pursue a deeper understanding of the client engagement mannequin – and by buyer segments, as not all prospects need to interact the identical means.

- Refine the underlying working mannequin to ship the required and personalised buyer expertise.

- Search buy-in from the distribution, customer support, and advertising groups.

- Align the group with an operationalization framework and significant KPIs that can information and govern the technique.

Sure capabilities are mission-critical. For instance, a funds hub is foundational to this alignment due to the differentiation and personalization it’ll ship and its centrality to customer-first experiences.

A funds hub is on the core of this unified transformation:

- A multi-enterprise fee hub is a high-impact enterprise transformation program providing vital monetary, buyer, and threat enchancment alternatives.

- Inbound and outbound funds are an costly perform inside operations. Cost transformation ought to embrace expense discount by decreasing the layers that separate the payor and finance, in flip decreasing transaction prices. Insurers proceed to face elevated bank card utilization prices and, so far (in contrast to banking), have been hesitant to cross the prices to the client. A contemporary fee functionality elevates vital alternatives for insurers.

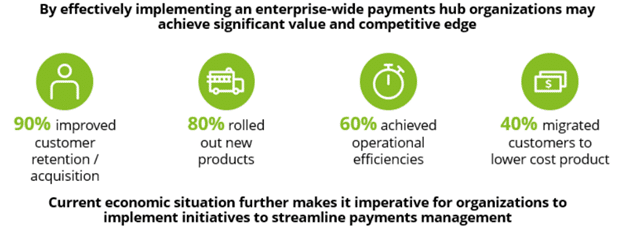

Determine 1: Advantages of implementing enterprise-wide funds hub

Billing and Funds Optimization Framework

Executives inside billing and funds are challenged to steadiness inside and exterior forces to ship worth to the enterprise. Among the best locations to start to realize that is the price of operations. Billing and funds are one of many areas the place price optimization and buyer expertise and loyalty will be addressed in tandem.

Leaders will begin by optimizing prices, as a result of fastened prices do have some degree of management, and each different space appears to be in a state of transition. Business worth chains, for instance, stay in flux whereas buyer wants proceed to evolve and supporting ecosystem individuals are re-thinking their billing and funds technique. All of that is additional impacted by elevated wants for safety and compliance.

Inner forces

- Particular person firms can keep away from shopping for, constructing, and sustaining duplicate methods to handle challenges associated to billing and gathering funds from their prospects.

- A standard resolution platform can drive down giant (usually hidden) classes of prices akin to operations, examine prices, card/interchange and downgrade charges, ACH errors and restore labor, reconciliation prices, fraud prices, intraday lending, wire charges, and many others. A centralized method can optimize the enterprise, improve revenues related to slower coverage activation or lapses, and improve buyer experiences given billing and fee is now on the frontline of buyer engagement.

Danger

- Suboptimal billing and fee controls and governance result in elevated exterior pressures on transparency and accountability of funds and changes. There’s a diminished tolerance for compliance failure and ensuing regulatory and fee card trade actions and fines.

- A fee hub can assist centralize controls and scale back regulatory burdens (e.g., PCI – DSS, and many others.) by participating related processing companions.

Buyer

- Buyer expertise expectations at the moment are set by firms like Amazon and Uber, whose billing and fee experiences are distinctive.

- It could improve buyer loyalty, thereby buyer retention.

- Funds are simple, swift, and versatile, enabling almost any customer-preferred technique of fee at any time the client needs to pay from anyplace and channel they want to use.

Market Agility

- Quickly undertake new progressive funds strategies (e.g. RTP®, Zelle, Venmo, ApplePay, BNPL)

- Embrace new hub applied sciences (FIS Trax, Kyriba, ACI, and many others.) for larger flexibility

Billing and Funds Optimization Rationalization:

Billing and fee strategies are among the spokes within the wheel which might be served by their attachment to the hub, enabling the including/swapping/eradicating of fee spokes as they shift or buyer wants change akin to the expansion of digital pockets firms versus bank card use. For insurers, fostering digital pockets funds could scale back bank card charges. Can insurers develop into adept at encouraging customers to make the most of cheaper strategies of fee? Completely. This is only one instance of how insurers can capitalize on tendencies and alternatives.

“Should you attempt to apply fixes to what you’ve as we speak, perhaps encompass it with some digital, you’re probably not altering the core of what it’s. You’re solely going to get to date.”

Roundtable Participant

Past simply the preliminary transformation, billing and funds re-design must account for fiscal and operational sustainability. A couple of particular design parts want further consideration:

- The flexibility to hint transactions throughout the worth chain. Traceability will likely be important to speedy responses associated to cyber crimes and the safety of buyer belongings and knowledge. Insurers will want a contractual flow-down language with companions, alliance relationships, and speedy response playbooks that assist such endeavors.

- Re-thinking what is taken into account to be the core of the enterprise, then shedding non-core companies.

- Lastly, collaborating in ecosystems and having companions is now non-negotiable. Insurers ought to have an evolving partnership matrix tailor-made to funds that can permit for staging, testing, and go-to-market capabilities of latest fee mechanisms and merchandise.

Because the technique strikes ahead and turns into operationalized, getting all components of the group invested within the design journey is important so they may fully perceive the client affect, the worth generated from an improved buyer expertise, and the related investments wanted to seize that worth.

Know-how Platform

Incorporating the billing and funds technique into the know-how platform design begins with three parallel parts, together with:

- Design consideration for course of and know-how elements with the client on the coronary heart of the design,

- Focused use instances at completely different ranges of element to allow buyer wants, and

- A modularized know-how structure that enables for flexibility and agility.

“Key elements and applied sciences throughout the total structure can drive down the general price and can help you actually assist progress, whether or not it’s new merchandise, it’s prospects, or it’s companions.”

Roundtable Participant

Course of and design issues:

- Architect for inbound simplicity. Allow seamless engagement throughout processes such because the claims course of and premium fee. Present a frictionless buyer pockets that eliminates guide paper-based processes (in the end limiting the entry of redundant knowledge a number of occasions).

- Handle the outbound complexity of insurance coverage funds. Prioritize the flexibility to handle insurance coverage funds, together with claims, and embrace a verified checklist of distributors to expedite fee and scale back fraud on behalf of consumers. (Hundreds of distributors exist within the claims house.)

- Present an optimum and easy-to-understand buyer expertise. Enhance buyer selection and buyer optionality, scale back friction, and ship the meant expertise along with your insured.

- Construct analytic capabilities to phase fee knowledge for straightforward understanding and reporting.

- Elevate key buyer KPIs that present perception for management and operational groups (profitability, high quality of service, sentiment, and retention evaluation).

“We have to take a look at cultural resolution making as it’s so important to any change. It’s inadequate to say that is what we’re altering. It must be the why and the why must be framed within the cultural nuances of your organization. And if you happen to can’t do this, spend time excited about it, determine it out, as a result of in the end, it’s going to scale back the cycle time for supply of that call, nevertheless it’s going to make the choice shared. It will likely be everybody’s resolution, not simply yours.”

Roundtable Participant

Particular insurance coverage design issues ought to embrace:

- An out of doors-in design with the client view (exterior) vs. a legacy enterprise view (inside)

- Buyer-centric with a consolidated view and course of throughout any product or line of enterprise for billing, funds, and repair

- Velocity to vary, pace to market, and pace to worth

- Add or get rid of resolution companions from a strong ecosystem to ship related, superior experiences

“When you’ve got an API built-in structure, it’ll can help you benefit from a few of these fashionable fee strategies and all that your prospects are on the lookout for.”

Roundtable Participant

Are your groups prepared to make use of billing and funds as a method for progress? Majesco has the #1, market-leading resolution Majesco Clever Billing for P&C and Majesco Clever Billing for L&AH with embedded analytics, together with generative AI to optimize operations and drive enterprise insights for the enterprise and prospects and a strong ecosystem of companions like One Inc. with OOTB integration that delivers fee choices demanded by prospects.

Transfer billing from the again workplace to the entrance workplace the place your prospects predict it with our next-gen options!

To get a brand new perspective on what’s at stake, make sure to learn the Majesco/Deloitte roundtable report, Rethinking Billing and Funds within the Digital Age. You’ll get an in depth take a look at what’s included in a Funds Hub Reference Structure, plus, you’ll discover instances and insights on how transformation will enhance buyer experiences whereas driving down prices.

At this time’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Ajay Radhakrishnan, Principal, Deloitte Consulting